Had the privilege of being on @LBC with @NickFerrariLBC. Here are 3 things I to say about @hmtreasury CBILS scheme:

1) Badly designed

2) Assumes banks like lending to business

3) Relying on firms to take out more debt will make them less resilient

1/11 https://neweconomics.org/2020/04/supporting-smes-during-the-coronavirus-crisis">https://neweconomics.org/2020/04/s...

1) Badly designed

2) Assumes banks like lending to business

3) Relying on firms to take out more debt will make them less resilient

1/11 https://neweconomics.org/2020/04/supporting-smes-during-the-coronavirus-crisis">https://neweconomics.org/2020/04/s...

To recap, as @MikeCherryFSB head of the federation for small businesses @fsb_policy put it, the #CBILS was the government& #39;s promise to offer interest free, fee free, government backed support from banks.

But last week it became clear the programme was failing, BIG TIME...

2/11

But last week it became clear the programme was failing, BIG TIME...

2/11

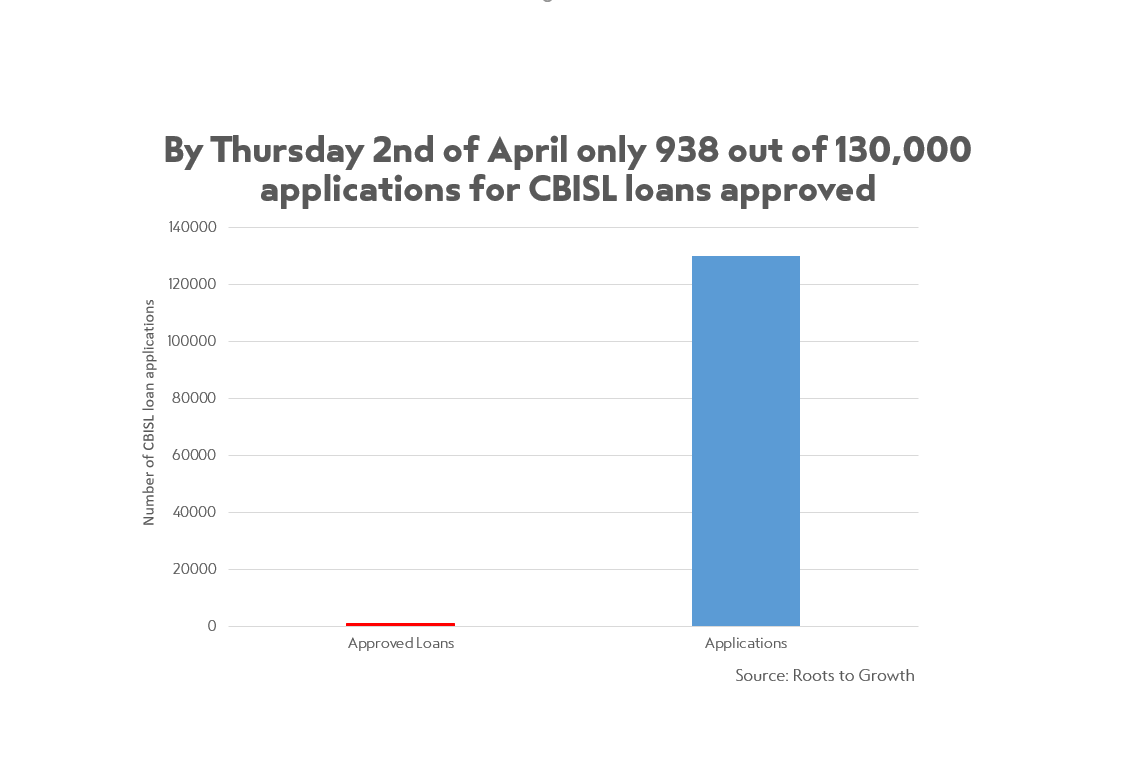

By last Thursday 2nd of April on 938 out 130,000 CBISL loans had been approved. In face of the biggest economic collapse on record, that is only 0.7% businesses were getting liquidity they applied for...

3/11

3/11

Some reports of the following problems:

-Banks asking for personal guarantees

-Interest rates of b/w 7% and 30%

-Loans take too long to process

-Not all businesses are eligible

-Must cut staff to be eligible

-Viable business plans but losses from last year = ineligible

4/11

-Banks asking for personal guarantees

-Interest rates of b/w 7% and 30%

-Loans take too long to process

-Not all businesses are eligible

-Must cut staff to be eligible

-Viable business plans but losses from last year = ineligible

4/11

Problem 1: A particular problem w/ the design of the CIBSL was that banks were supposed to lend on normal commercial terms if they could. Turns out that normal commercial terms aren& #39;t always that great, Covid or not...

5/11

5/11

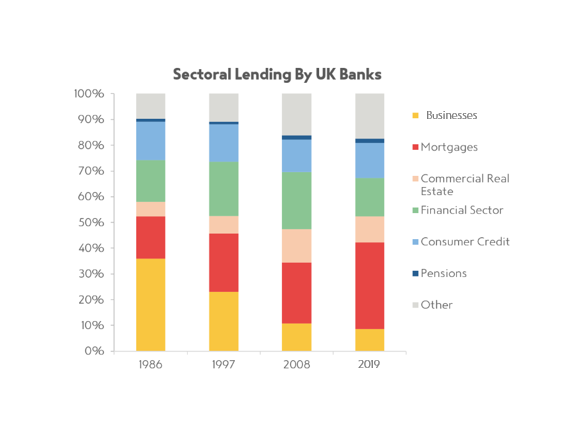

Problem 2: Leading to 2nd problem, the entire CIBSL is based on the premise that banks either like lending to businesses or they are good at it. But since the 1980s, bank lending to business has dropped from 35% of total bank lending in 1986, to 22% 1997, 10% 2008, 8% 2019

6/11

6/11

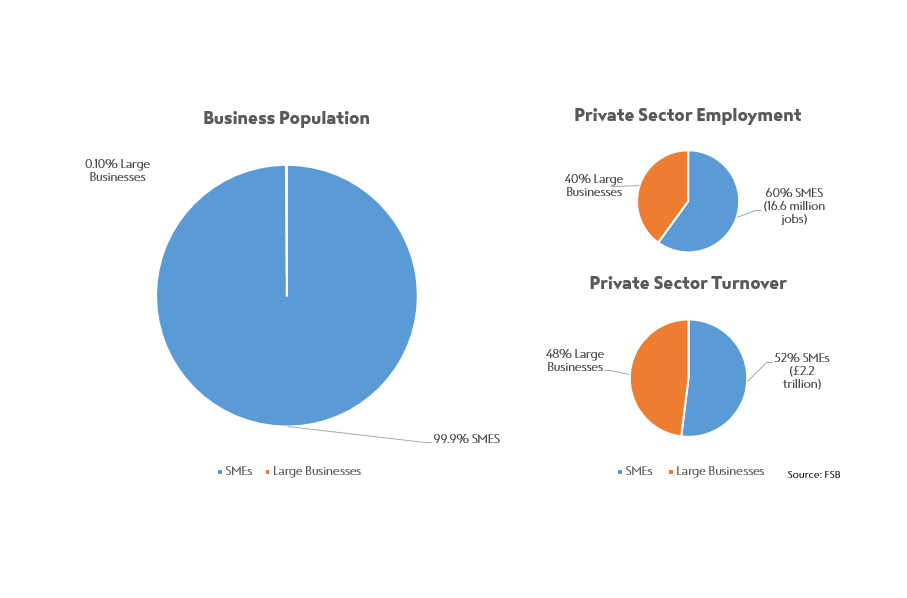

Of this lending, only between 2-3% goes to SMEs...SMEs that account for up to 99.9% of all UK companies, 60% of private sector employment, and 50% of private sector turnover.

7/11

7/11

Problem 3: The programme& #39;s design is essentially a knee jerk reaction based on the monetary stimulus playbook of 2008. But this isn& #39;t 2008, its not yet a global FC, and firms don& #39;t need a demand stimulus - they need life support. They need cash/profits, not loans.

8/11

8/11

Expecting businesses to take out loans when short-term revenue is low and future profits is uncertain = big risk. What was a viable business before Covid? Growth was really sluggish last year, a variety of different sectors etc were impacted by Brexit/political uncertainty.

9/11

9/11

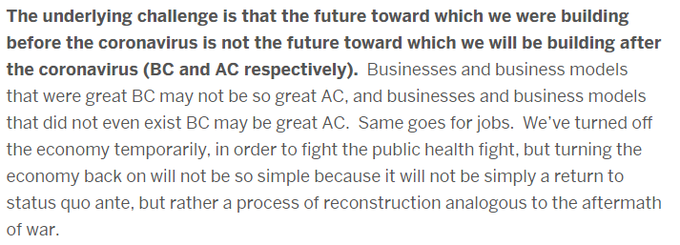

Another interesting point to consider by @PMehrling, is that the firms that were viable before Corona, might not be so viable after...maybe those that weren& #39;t viable before will seem more so post Corona  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Man shrugging" aria-label="Emoji: Man shrugging">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Man shrugging" aria-label="Emoji: Man shrugging">

10/11

10/11

The solution is not easy (ideas for another longer thread). The Chancellor has since made good changes to CIBSL, but prob 2 & 3 remain. RE prob 1, banks still decide eligibility- and what interest rate to charge (which gov only covers 1st year). Expect more probs to come.

11/11

11/11

Read on Twitter

Read on Twitter

10/11" title="Another interesting point to consider by @PMehrling, is that the firms that were viable before Corona, might not be so viable after...maybe those that weren& #39;t viable before will seem more so post Corona https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Man shrugging" aria-label="Emoji: Man shrugging"> 10/11" class="img-responsive" style="max-width:100%;"/>

10/11" title="Another interesting point to consider by @PMehrling, is that the firms that were viable before Corona, might not be so viable after...maybe those that weren& #39;t viable before will seem more so post Corona https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Man shrugging" aria-label="Emoji: Man shrugging"> 10/11" class="img-responsive" style="max-width:100%;"/>