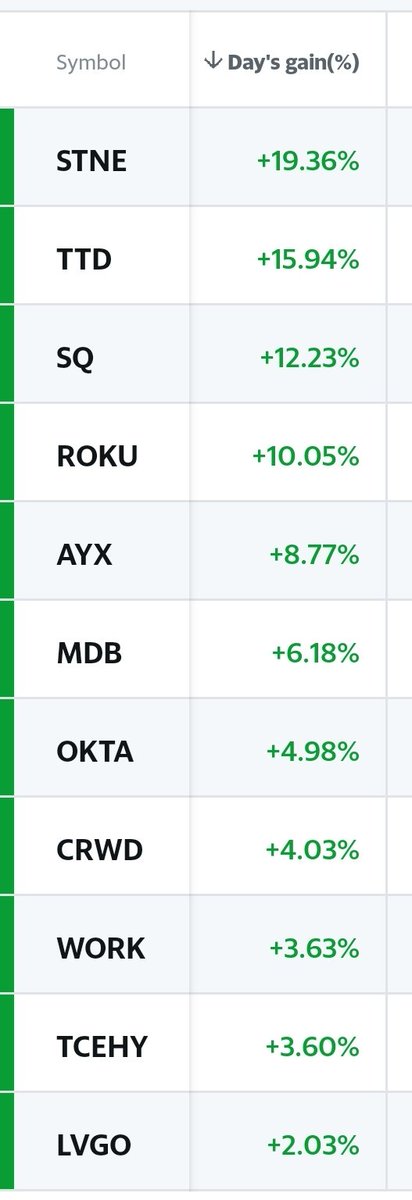

A little bounce back today...

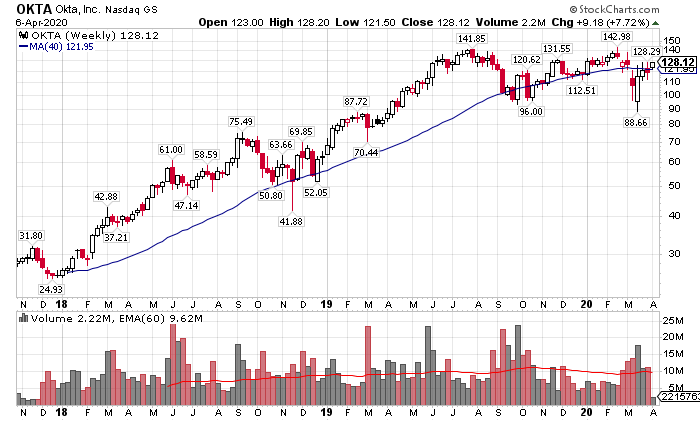

$STNE $TTD $SQ $ROKU $AYX $MDB $OKTA $CRWD $TCEHY $WORK $LVGO

Overall, 7 now in the black while 4 still in the red: $MDB $ROKU $SQ $STNE

6 of the 7 "in the black" were purchased in 2020, several within past few weeks.

$STNE $TTD $SQ $ROKU $AYX $MDB $OKTA $CRWD $TCEHY $WORK $LVGO

Overall, 7 now in the black while 4 still in the red: $MDB $ROKU $SQ $STNE

6 of the 7 "in the black" were purchased in 2020, several within past few weeks.

$STNE - $22.24, +24.80% but still 52% off of 52-week highs set on march 3rd. I debated dumping shares 2 weeks ago on the V-shaped bounce but didn& #39;t. The thought will cross my mind here if we get a multi-day bounce that fails to go above $28.22

$SQ - $50.42, +15.32% but still 42% off 52-week highs set on Feb 20th. It made a higher low, unlike $STNE which made a lower low but resistance is above at moving averages. Holding #long

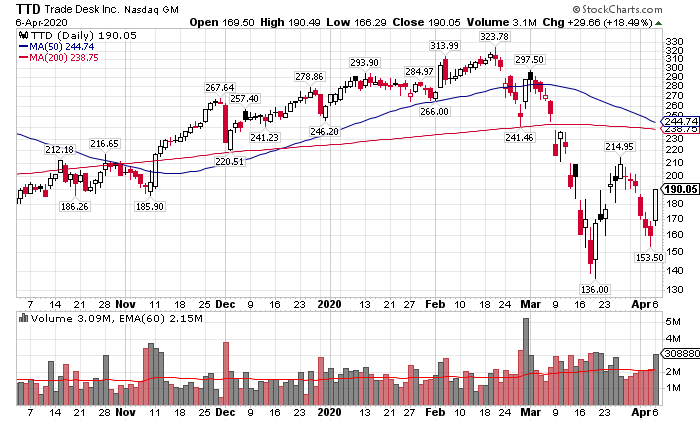

$TTD - $190.05, +18.49% but 41% off 52-week highs set on Feb 20th. Will be interesting to see how all these stocks react at next earnings, likely near 50d & 200d ma& #39;s

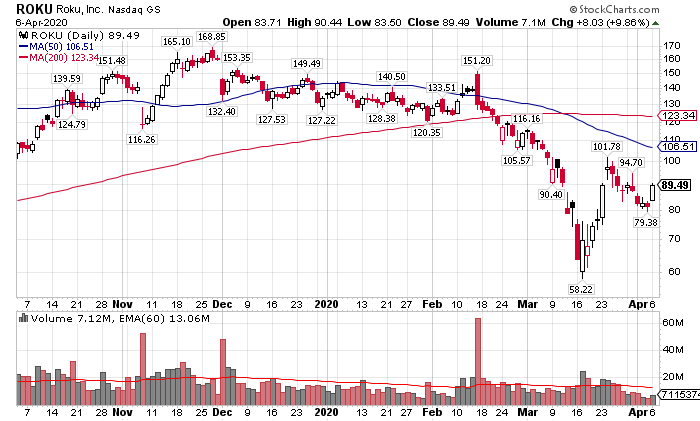

$ROKU - $89.39, +9.86% but 49% off 52-week high set last September 9th at $176.55. Let& #39;s see if it can trade above $102 and challenge that 50d moving average.

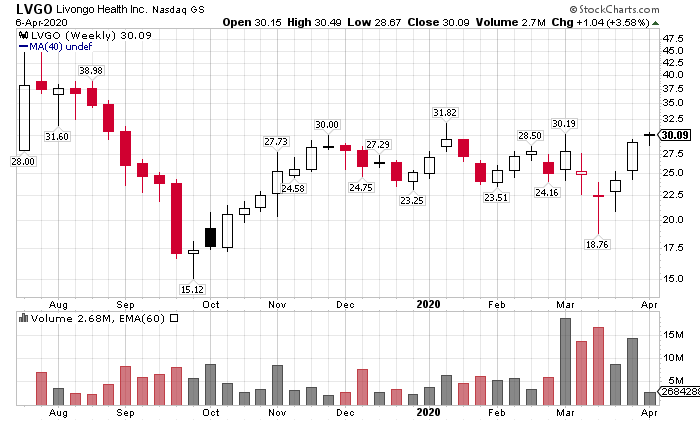

$LVGO - $30.09, +3.58% but 34% off 52-week high, which was set back near IPO. The stock has a 93 relative strength rating in this market. It has gassed out 3 times when it has touched or closed above $30 (Nov, Jan & Mar). I believe this one will be a leader when market is ready.

Read on Twitter

Read on Twitter