Unpopular opinion (from seasoned entrepreneur): #Covid19 is not an opportunity for startups & scale-ups to demand special gov financial support! As professional risk takers, we should humbly queue at the very end of gov’s (safety) lines and align with economy wide measures. 1/n

Disclaimer: this goes against my personal interests and many of my entrepreneurial friends and fellow (angel) investors, but we are not the priority now! (As board member of @fintechbe) it even goes against majority vote in a non-profit uniting one of these fragile ecosystems.

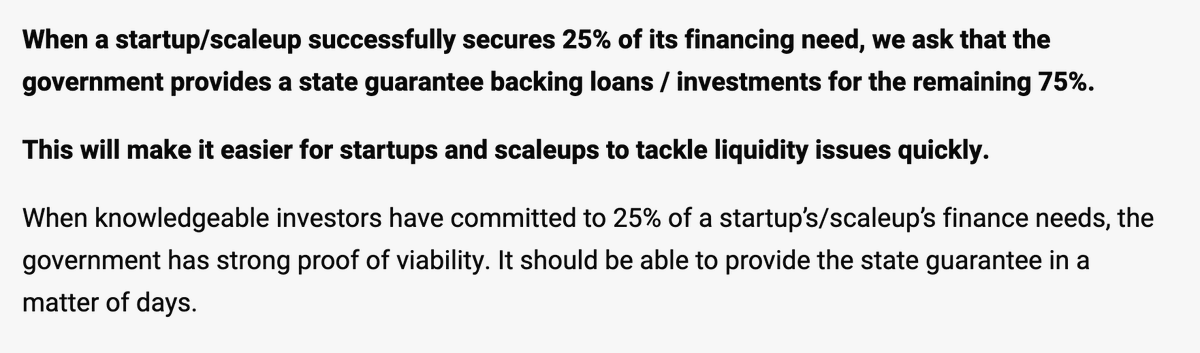

1/ Despite a popular call for Belgian gov to fix liquidity issues of privately owned startups & scale-ups by lending (or is it investing?) THREE TIMES (3X) the amount private investors commit to put into a ‘startup/scale-up’ during this #Coronacrisis: https://supportourstartups.be/about/ ">https://supportourstartups.be/about/&qu...

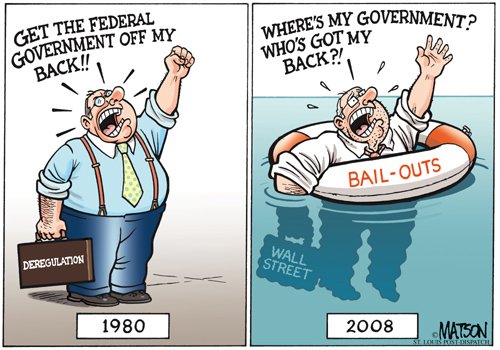

2/ Startup entrepreneurs and their ‘risk capital’ investors now risk a self-serving reputation for defending the virtues of capitalism when times are good, but calling for “socialist bail outs” when wind turns & their planned turnover gets delayed (like for most other businesses)

3/ For context: In Belgium any half-baked startup which convinces private investors to strengthen their capital base, already DOUBLES (2X) that investment with gov backed loans or convertibles from regional authorities (Flanders, Wallonia, Brussels).

4/ Continue justifiably use of welcomed Keynesian support measures for ‘regular’ economy of which we continue to be part. Use the (partial) unemployment + delayed payments for tax, VAT & social security. Plenty of credit schemes provided by banks under BE & EU warranty schemes.

5/ Private angel investors in Belgium already recover up to 60% of their risky investment in a startup via generous tax deductions. This seems an excellent timing on how to loosen/widen application field for this type of investment in innovation.

6/ I actively advocated for these support measures and clear rules which apply to all as they are intended to fuel innovation by incentivising > 278 Billion EUR* sleeping on Belgian savings accounts (*December 2019).

7/ It& #39;s thus relatively easy to score angel investments, but with requested 3X gov booster, I truly fear wide spread abuse towards non-viable ventures! Friends, family and fools will be activated to create expensive lifelines for lost causes and self delusional success pledgers.

8/ We should all continue to compete for the many subsidy programs at regional, national and European level. These gov grants (EU model to support innovation) already get vetted by an experienced panel of experts and are less prone to fraud than a generalised 3X top up scheme!

9/ Now is the time to team up with true VCs (putting their money where their mouth is). If you can& #39;t convince VCs about your longer term success, why would gov (less knowledgeable about your business) safely bail you out, without getting capital gain tax/returns on risky bets?

10/ Consider partnering/selling to an industrial partner with deeper pockets, who delayed digital transformation for too long and needs your promising platform to shorten their troubled innovation cycle (probably at lower/readjusted ‘crisis’ valuation)?

11/ Start-ups & scale-ups remain “risky business” and should never forget their high failure rates. Cash has always been king in crossing our “death valley”. Upon hiring I take pride in informing each team member about our highly uncertain nature and unguaranteed outcome..

12/ Investors in ‘venture capital’ are fully aware of our improbable success odds too. Hence the high returns upon successful exit(s) and painful dilution punishments in subsequent rounds for not delivering projected & #39;hockey stick& #39; revenues. No startup ever flattened that curve!

13/ We’re optimistic dream sellers by nature. Our ventures come in 2 types or stages: Lean Startups (using customer revenues for slow/safe organic growth) and Venture Backed (accelerating risky growth to captures market share ahead of profitability). Can& #39;t have it all!

14/ The lean startup type will survive (under the assumption their customers survive) if they manage to keep delivering more perceived value than the cost of their product/service.

15/ Venture backed startup/scale-up will survive if their investors turn out to be professionals who integrated all risk factors in their investment decision or if they align cost/revenues in the short term to cross their death valley.

16/ Stop moaning, start selling. If that is not possible, consider selling your impressive digital transformation skills in “service/consulting mode” to bridge these tough times (you’ll get paid to learn more about your customer’s industry).

17/ Belgium has reputably high taxes (also high quality of life), but no capital gain tax.. I do see/feel justifiably support (even for such 3X risk bearing by gov as a "lender of last resort") but with more balanced conditions than suggested in present call by startup founders:

17.A/ Emergency liquidity receivers of ‘bridge loans’ and their investors also need to accept their future capital gains to be taxed accordingly.. (did I already mention unpopular?)

17.B/ Only as part of a clear policy & overview with efficient government measures (EU aligned?) to support the ENTIRE economy (not just patches or empathy for risky startups). Limit support for those sustainable industries we democratically decide are worth keeping for future..

17.C/ Where governments give priority (and thus link their support) to employment! Could be in form of conditional loans corresponding to 90%* of salary cost & limited to an upper wage limit (to make it less expensive than massive unemployment, while lowering depression risk).

17.D/ If there& #39;s an unfortunate EU race to the bottom (with unjustifiable ‘state support’?) while Member States would subvention their national startup/scale-up ecosystem to ‘artificially’ extend lost potential in becoming profitable & #39;maybe later& #39; in an unknown/reshaped economy..

18/ Calc/Excel/Sheet is your new best friend. Now is the time to excel at cash planning by looking your worst-case scenario in the eye. Be honest and realistic to yourself. Then move on with alternative/adjusted cash flows, liquidity options and available gov support measures.

19/ To anybody spending money: PLEASE start/keep buying from local stores, artists, contractors, startups, scale-ups, suppliers & their webshops. You& #39;re directly injecting cash to support a nearby business, which will contribute (by tax paying) to rebuilding our next economy.

20/ For reasons above my co-founded Belgian startups: http://casius.be"> http://casius.be (PropTech), http://data.be"> http://data.be (FinTech) & http://lex.be"> http://lex.be (LegalTech) will not be signing this special treatment demand from a large group of befriended startups (who I wish all the best)!

21/ All the best, take care & stay safe! I’m grateful my co-founders @wavyx & @ErikDeHerdt largely agreed to these points & concerns too!

I hope to have a few understanding entrepreneurial friends left after this tweet storm.

Honest hard message for horrific hard times?

21/21

I hope to have a few understanding entrepreneurial friends left after this tweet storm.

Honest hard message for horrific hard times?

21/21

. @threadreaderapp please unroll yesterday& #39;s twitstorm so I can cross post & feed it to DeepL for translation into French/Dutch.. Lazy web FTW :)

Read on Twitter

Read on Twitter