A report published by Mckinsey highlights the outperformance of Indian chemical companies. It also talks abt the trends shaping the Chemical Industry and ways in which India can reduce its chemical trade deficit by focusing on various segments of exports and imports.

Extracts:

Extracts:

1/n

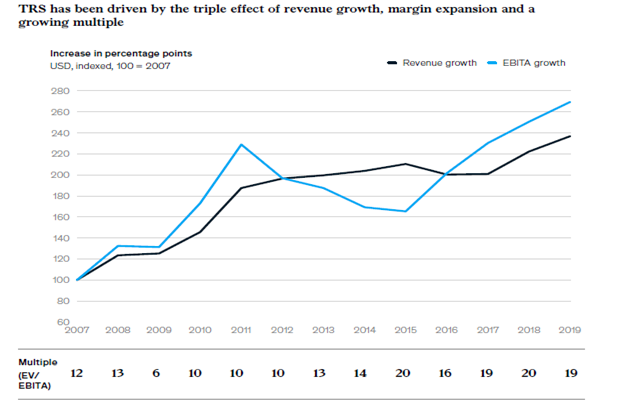

Indian chemical sector has been a global outperformer in terms of total returns to shareholders (TRS). Untill 2014, TRS was function of only topline growth. Over last 5 yrs, the triple effect of margin expansion, increase in multiples and continued rev. growth has raised TRS

Indian chemical sector has been a global outperformer in terms of total returns to shareholders (TRS). Untill 2014, TRS was function of only topline growth. Over last 5 yrs, the triple effect of margin expansion, increase in multiples and continued rev. growth has raised TRS

2/n

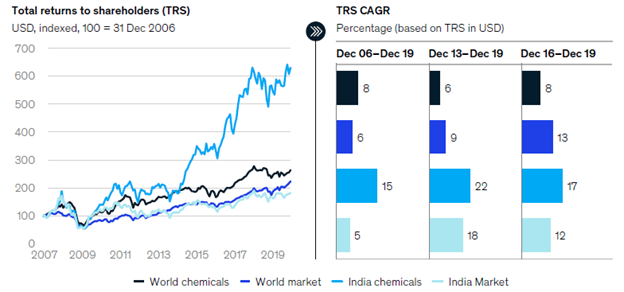

Between 2006 and 2019, the CAGR in TRS for Indian chemical companies was 15 percent against 8% for global chemical industry. Even between 2016 and 2019, when the Indian economy faced headwinds, the chemical industry maintained a returns CAGR of 17 percent

Between 2006 and 2019, the CAGR in TRS for Indian chemical companies was 15 percent against 8% for global chemical industry. Even between 2016 and 2019, when the Indian economy faced headwinds, the chemical industry maintained a returns CAGR of 17 percent

3/n

Global trends shaping the sector:

Trade wars between major world economies like US, Europe & China, Stringent pollution control norms in China and worldwide consolidation in chemical industry can provide new opportunities to Indian manufacturers.

Global trends shaping the sector:

Trade wars between major world economies like US, Europe & China, Stringent pollution control norms in China and worldwide consolidation in chemical industry can provide new opportunities to Indian manufacturers.

4/n

It& #39;s knwn fact that China has stricter pollution norms which has led to closure of few chemical factories. Creating new capacities in China is difficult due to capital intensive nature of industry. Also, greater monitoring & regulations has made bank loans elusive & expensive

It& #39;s knwn fact that China has stricter pollution norms which has led to closure of few chemical factories. Creating new capacities in China is difficult due to capital intensive nature of industry. Also, greater monitoring & regulations has made bank loans elusive & expensive

5/n

These developments have caused uncertainties 4 international players which source chemicals from china. Imposition of trade tariffs by US has also added to the uncertainity. Hence they will supplement their supplies from elsewhere (Can this accelerate post Covid 19?).

These developments have caused uncertainties 4 international players which source chemicals from china. Imposition of trade tariffs by US has also added to the uncertainity. Hence they will supplement their supplies from elsewhere (Can this accelerate post Covid 19?).

6/n

Investible opportunites in India:

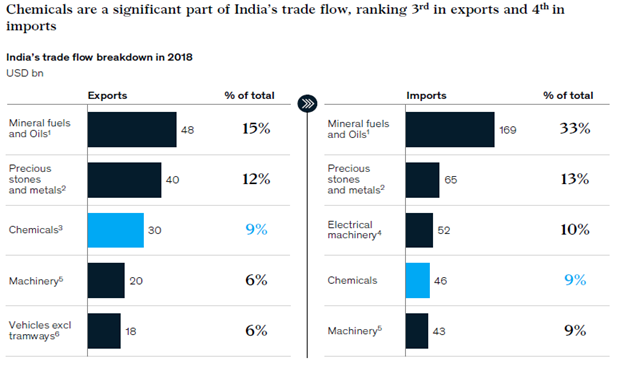

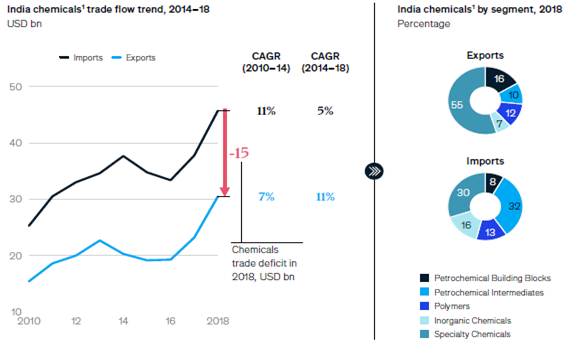

India’s share in global chemicals trade by value is 3%. The industry’s import–export rankings have been consistently high for the past 5 yrs. Chemical exports grew at 11% from 2014 to 2018, while imports also grew in this period, at 5%.

Investible opportunites in India:

India’s share in global chemicals trade by value is 3%. The industry’s import–export rankings have been consistently high for the past 5 yrs. Chemical exports grew at 11% from 2014 to 2018, while imports also grew in this period, at 5%.

7/n

Despite the faster growth in exports than imports, India still imports more than it exports, resulting in a chemical trade deficit of USD 15 bn. This deficit can be decreased in two ways.

Despite the faster growth in exports than imports, India still imports more than it exports, resulting in a chemical trade deficit of USD 15 bn. This deficit can be decreased in two ways.

8/n

One way is to reduce imports of petrochemical intermediates by manufacturing in-house. These petro intermediates can act as import substitutes for downstream specialty chemicals. Second way is to rampup specialty chemicals exports.

One way is to reduce imports of petrochemical intermediates by manufacturing in-house. These petro intermediates can act as import substitutes for downstream specialty chemicals. Second way is to rampup specialty chemicals exports.

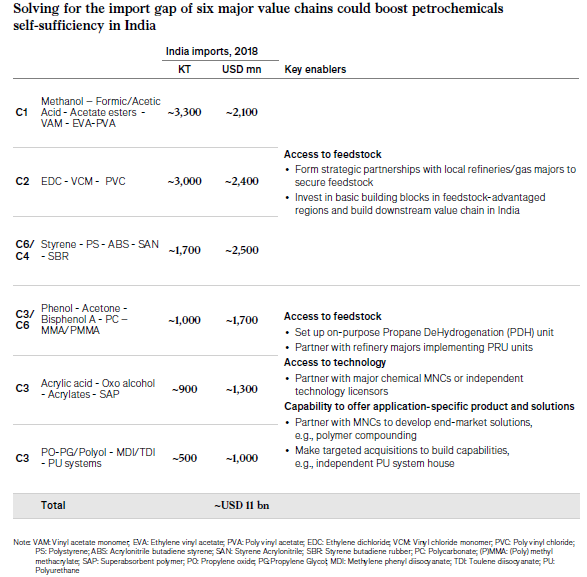

9/n Opportunity 1: Reducing imports of petrochemicals (PC)

PC is the largest category of chemical import by value. These PCs are vital for the industry as they act as primary feedstock for specialty chemicals. Among wide variety of PCs imported in India, ....

PC is the largest category of chemical import by value. These PCs are vital for the industry as they act as primary feedstock for specialty chemicals. Among wide variety of PCs imported in India, ....

10/n

....77% ($11bn) of the import gap can be filled from 6 major value chains in petrochemical intermediates that feed into a wide range of end-use sectors, from agriculture, automotive, construction, and electricals and electronics, to paints, consumer care, and food and feed

....77% ($11bn) of the import gap can be filled from 6 major value chains in petrochemical intermediates that feed into a wide range of end-use sectors, from agriculture, automotive, construction, and electricals and electronics, to paints, consumer care, and food and feed

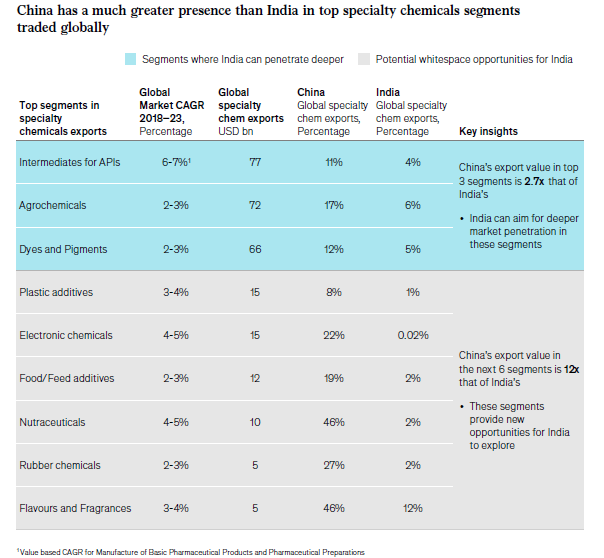

11/n Opportunity 2: Growing exports of sp. chemicals

India caters to just 3 percent of the total export value of specialty chemicals worldwide, compared with 13 percent for China, 11 percent for Germany and 5 percent for Japan

India caters to just 3 percent of the total export value of specialty chemicals worldwide, compared with 13 percent for China, 11 percent for Germany and 5 percent for Japan

12/n

Comp. like Aarti Ind, VinatiOrganics, SRF, Atul & Navin Fluorine– all of them derive significant rev. from exports of Sp Chem – has given CAGR of over 25% in last 3 yrs.

Within the vast segment of Sp Chems, there r 9 sub-segments which form bulk of the exports worldwide

Comp. like Aarti Ind, VinatiOrganics, SRF, Atul & Navin Fluorine– all of them derive significant rev. from exports of Sp Chem – has given CAGR of over 25% in last 3 yrs.

Within the vast segment of Sp Chems, there r 9 sub-segments which form bulk of the exports worldwide

13/n

China is leader in all these segments. India has strong base in top 3 subsegments of specialty chemicals – agrochemicals, dye & pigments and intermediates for APIs.

For the remaining 6 segments, India has an export value of $ 1.3 bn against $ 15 bn for China.

China is leader in all these segments. India has strong base in top 3 subsegments of specialty chemicals – agrochemicals, dye & pigments and intermediates for APIs.

For the remaining 6 segments, India has an export value of $ 1.3 bn against $ 15 bn for China.

14/n The report also talks about the intances where large companies are using digital & analytical (DnA) capabilities for building efficient systems which helps in margin expansion. Chemical companies globally are seeing DnA applications yield an EBITDA impact of 3 to 5 %age

pts

pts

I think the next step is to look for cos which have identified these trends early and have increased their capacities in the past few years. @unseenvalue sir has named many such companies in the past. @varinder_bansal sir has also shared his research https://tinyurl.com/qpn8hn4 ">https://tinyurl.com/qpn8hn4&q...

Link to the report. Thankyou sir for sharing it. https://twitter.com/pankajbaid17/status/1236673650192834560?s=20">https://twitter.com/pankajbai...

Tagging seniors for wider reach.

@abhymurarka @unseenvalue @Maaachaaa69 @utsav1711 @Gautampolisetty @jitenkparmar

@abhymurarka @unseenvalue @Maaachaaa69 @utsav1711 @Gautampolisetty @jitenkparmar

Read on Twitter

Read on Twitter