1/ Many investors get stuck on the theory, but if you want to get rich, it usually needs to be all about the practical.

Let& #39;s touch on the theory of mark to market when it comes to private vs public real estate.

Whether private RE went down in value or not isn& #39;t important here.

Let& #39;s touch on the theory of mark to market when it comes to private vs public real estate.

Whether private RE went down in value or not isn& #39;t important here.

2/ What is important?

For many wealthy investors, they don’t want their real estate moving every day (while some who are skilled & seasoned for volatility obviously do).

They don’t want to panic, nor others around them to do so. Illiquidity helps these investors a lot.

For many wealthy investors, they don’t want their real estate moving every day (while some who are skilled & seasoned for volatility obviously do).

They don’t want to panic, nor others around them to do so. Illiquidity helps these investors a lot.

3/ I’ve talked with several wealthy European families who are very active in German & Scandinavian direct real estate over the years.

They refuse to invest in stocks for decades (they have no exposure... zero), due to the liquidity available & investors& #39; ability to force sell.

They refuse to invest in stocks for decades (they have no exposure... zero), due to the liquidity available & investors& #39; ability to force sell.

4/ Some FinTwit investors, especially the ones from the US & UK — where stock market investing, trading & speculation is far more of a norm — would think of them as extremely silly.

But how can you call someone who accumulated 10s of millions in capital gains & assets silly?

But how can you call someone who accumulated 10s of millions in capital gains & assets silly?

5/ Most of these wealthy investors are old school. They always say they don’t want red & green days in their life. They prefer illiquid real estate for a reason.

Now, I don’t doubt volatility is an advantage, as Buffett stated. But only for the few who can take advantage of it.

Now, I don’t doubt volatility is an advantage, as Buffett stated. But only for the few who can take advantage of it.

6/ During one of the Berkshire questioning sessions, Buffett stated him & Munger like cash flowing real estate but

a) felt like they don& #39;t have an edge in the field; and

b) the sector didn& #39;t give enough opportunities for their size of capital since it had very low volatility.

a) felt like they don& #39;t have an edge in the field; and

b) the sector didn& #39;t give enough opportunities for their size of capital since it had very low volatility.

7/ So for the same reason someone needs low vol assets, someone else might not.

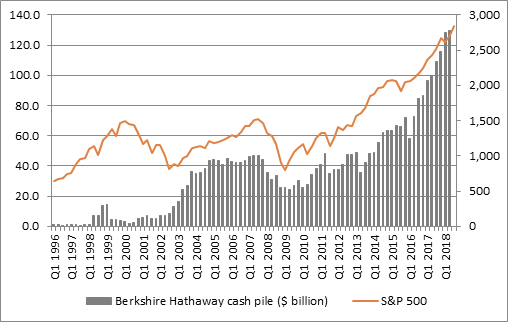

While seasoned veteran investors, like Buffett & Munger, can take advantage of market crashes we are witnessing in recent weeks (BRK cash pile is there for a reason)...

While seasoned veteran investors, like Buffett & Munger, can take advantage of market crashes we are witnessing in recent weeks (BRK cash pile is there for a reason)...

8/ ...most investors cannot perform under those conditions. They froze in crashes like 2001 & 2008.

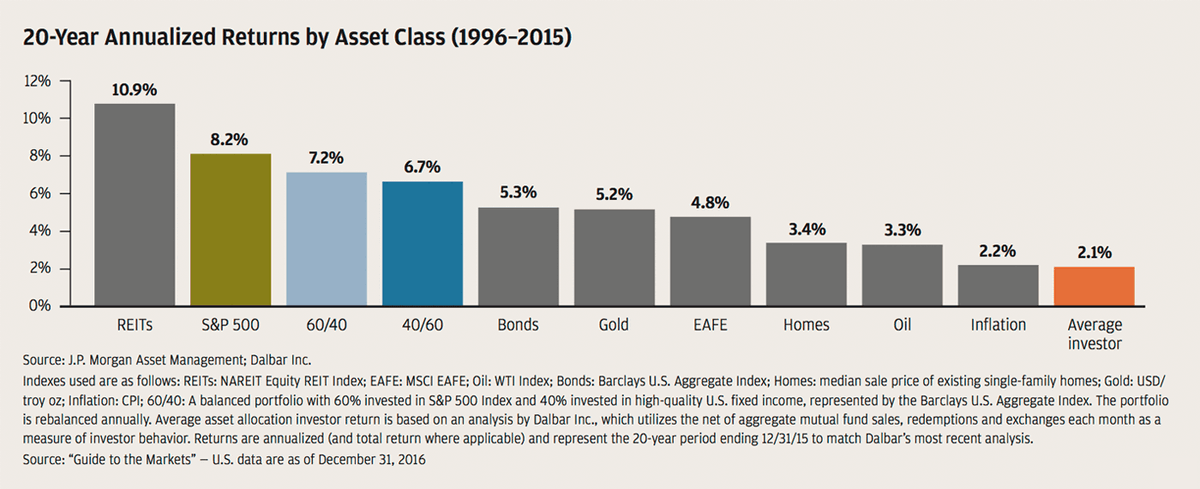

@jpmorgan shows that an average investor underperforms every public security return.

Why?

It& #39;s clear as daylight. The reason is these investors panic sell at the bottom...

@jpmorgan shows that an average investor underperforms every public security return.

Why?

It& #39;s clear as daylight. The reason is these investors panic sell at the bottom...

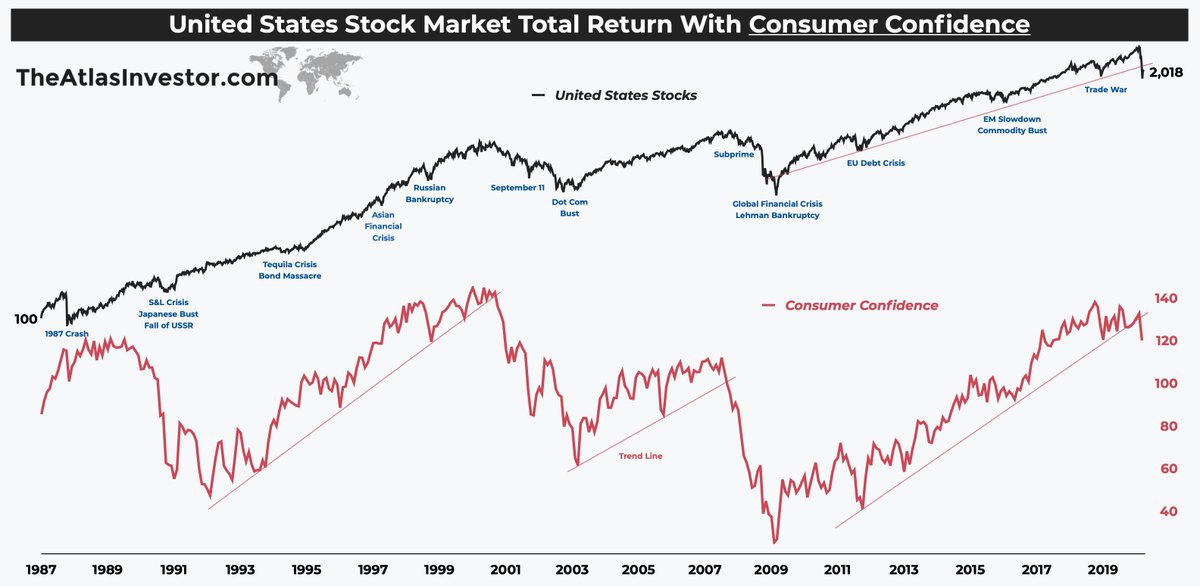

9/ ...and buy back in near peaks.

In my opinion, consumer confidence clearly shows when the public is optimistic...

And you can bet your bottom dollar that is when they are actually coming back into the market, unfortunately.

Obviously, volatility doesn& #39;t help them.

In my opinion, consumer confidence clearly shows when the public is optimistic...

And you can bet your bottom dollar that is when they are actually coming back into the market, unfortunately.

Obviously, volatility doesn& #39;t help them.

10/ There are a lot of stock market participants around the world with huge amounts of brokerage accounts according to statistics.

But one thing we know, there aren& #39;t a lot of rich people around the world.

So clearly, not many are taking advantage of that volatility, are they?

But one thing we know, there aren& #39;t a lot of rich people around the world.

So clearly, not many are taking advantage of that volatility, are they?

Read on Twitter

Read on Twitter