ECB: how to spend it.

A (long) thread on the implementation of ECB& #39;s asset purchases in 2020. Spoiler: maximum flexibility, virtually no limits. (1/n)

A (long) thread on the implementation of ECB& #39;s asset purchases in 2020. Spoiler: maximum flexibility, virtually no limits. (1/n)

First, some important caveats. The PEPP is very different from other asset purchases: the Executive Board alone is in charge, with "the power to set the appropriate pace and composition" monthly purchases, and previous limits won& #39;t apply. A game-changer. (2/n)

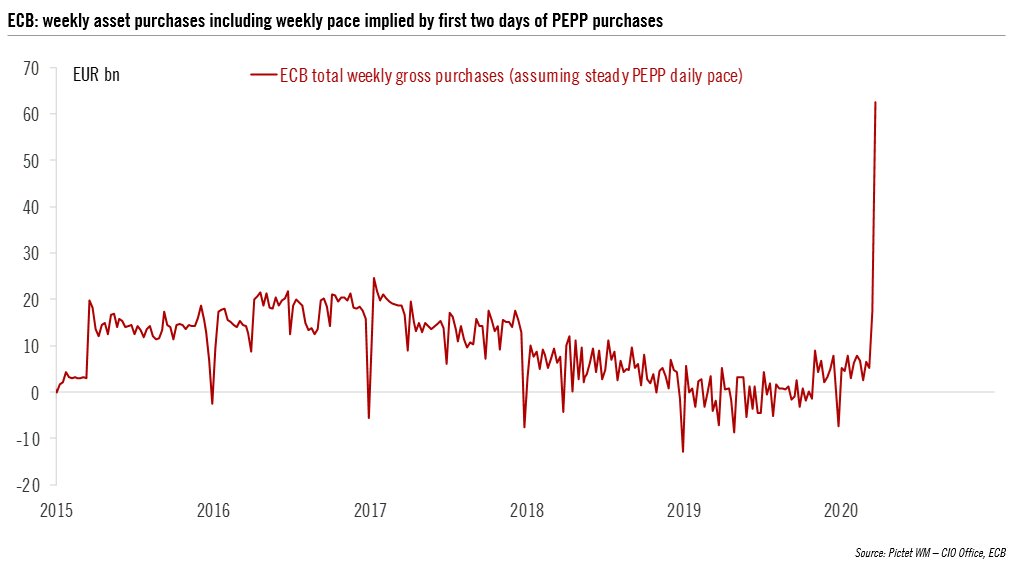

This means that PEPP may be reported separately and differently. Today we’ll get the monthly report for March, including 4 trading days for PEPP. We& #39;ll see how much granularity we get, but it should confirm that the ECB has been front-loading its interventions massively. (3/n)

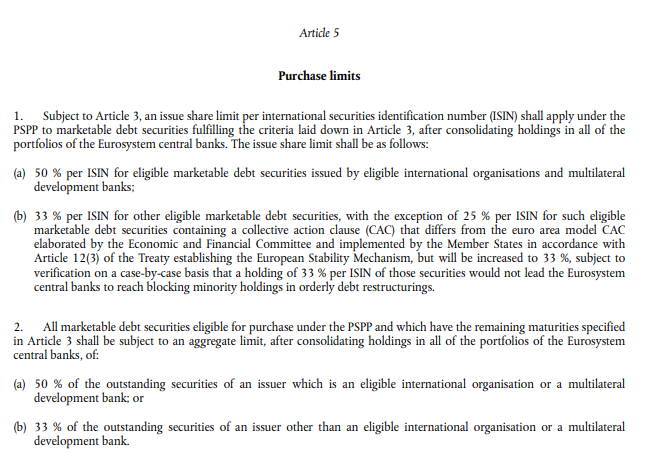

Now, the elephant in the room - limits. The PEPP legal act is clear: previous limits (Art. 5 of PSPP act below) "should not apply to PEPP holdings". I don& #39;t understand why the ECB hasn& #39;t stated it clearly... because they could be "new" limits? Either way, no turning back. (4/n)

Still think limits should be raised, including for APP. Legal risks look contained because the programmes are proportional (and PEPP is limited in time) while APP reinvestments should help mitigate deviations from capital keys over the (very) long-term. (5/n)

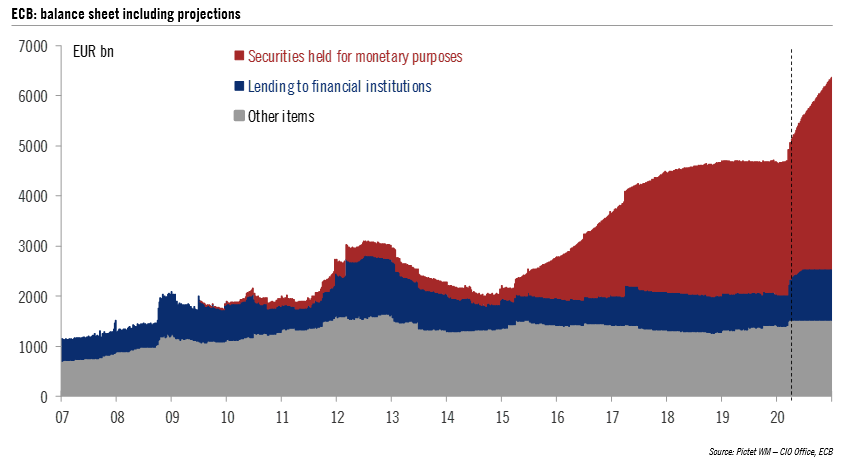

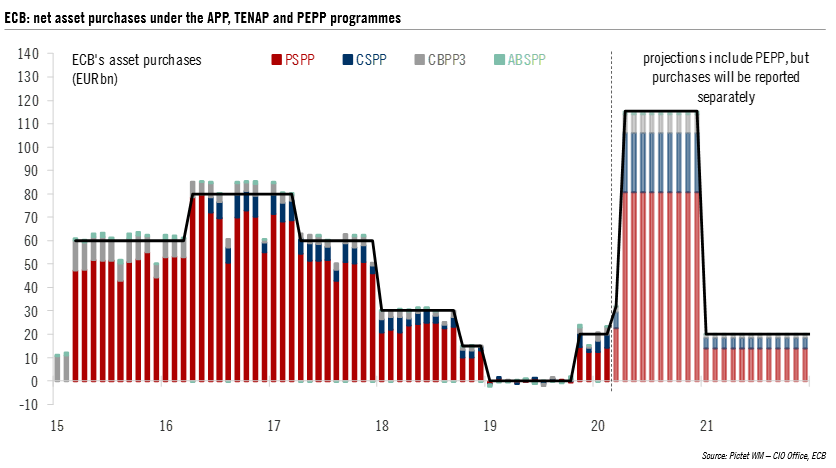

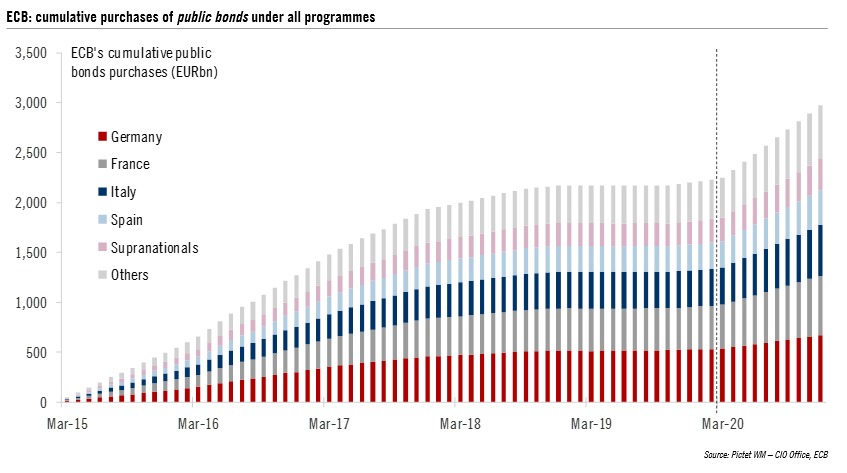

Now the big numbers. ECB asset purchases should total €115bn on average between April and December (APP+TENAP+PEPP). The total for 2020 is projected to be €1110bn, above the 2016 record of €900bn. The ECB& #39;s balance sheet should exceed €6.3 trillion by year-end. (6/n)

Across markets, we project 70% in public bonds (€81bn per month, of which 10% in Supranationals), 22% in corporate including CP (€25bn), and the rest in CBPP3 & ABSPP, roughly in line with recent patterns. Risks tilted towards larger PSPP purchases, at least initially. (7/n)

As regards sovereign bonds (€73bn monthly average), we expect deviations from capital keys to the tune of 15% in favour of Italy, Spain, France, Austria, Belgium (and Greece in PEPP). Could be larger, but the flip side will be larger deviations (lower) in other countries. (8/n)

Indeed, bond scarcity remains an issue in many smaller countries, and liquidity conditions will play a role. Meanwhile debt issuance will be an key driver of purchases, including Bills in the PEPP. (9/n)

For now, we assume monthly net purchases of central government debt of €11bn in Germany, €15bn in France, €14bn in Italy, €10bn in Spain. The equivalent amounts in nominal terms, which are used to compute issuer limits, would be about 15-20% lower. (10/n)

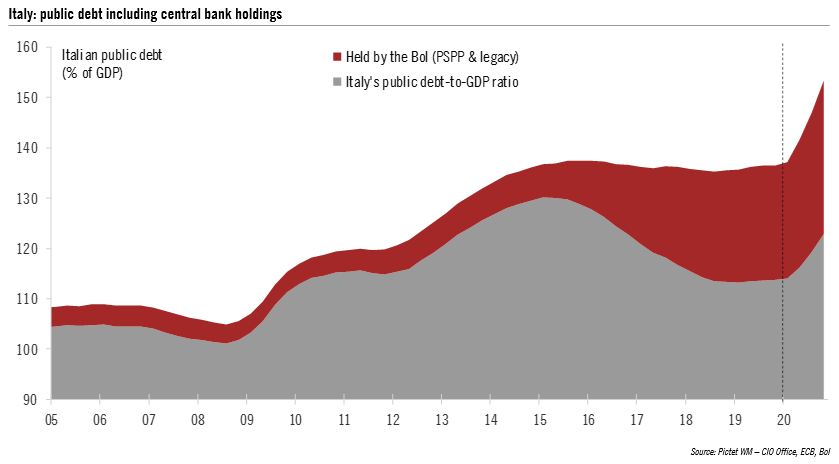

The Bank of Italy would buy about €130bn in CG debt in 2020, slightly higher than in 2016, and hold €520bn by year-end (incl. legacy holdings). Assuming that public debt rises above 150%, the central bank would hold 20% of total public debt by the end-2020 (30% of GDP). (11/n)

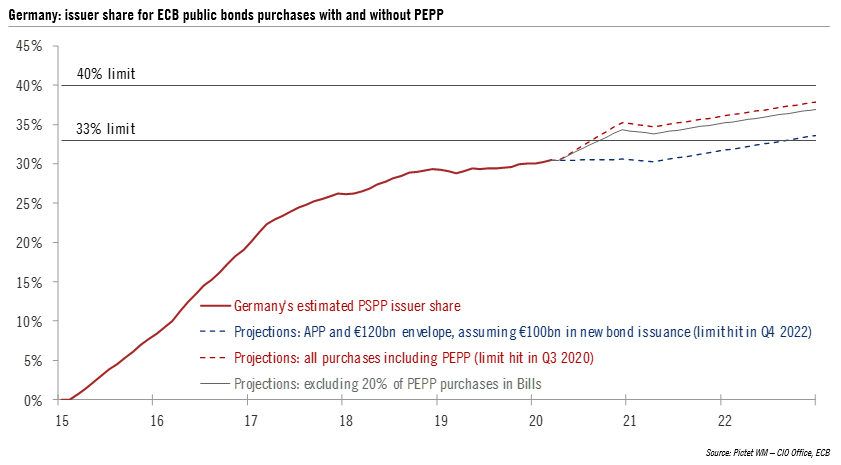

ISIN and issuer limits will continue to apply to APP holdings. But, using full flexibility (deviations and larger share of agency/regional debt) and accounting for extra German bond issuance (~€100bn in 2020), the limits should not be hit until late 2022 in Germany. (12/n)

Even if we include PEPP holdings, the Bundesbank can keep the German issuer share below 40% for the foreseeable future by skewing purchases towards agency, regional debt and Bills. The hope would be that PEPP ends in December, back to square one, no hard decision made. (13/n)

I think it would be a mistake not to make a clear decision on limits once and for all, if only because this is not the end of the story. The ECB is fully committed to doing more, and indeed asset purchases may have to be increased/extended into 2021, for two main reasons. (14/n)

First, the inflation outlook will deteriorate. Second, the & #39;temporary& #39; features of the PEPP (no reinvestment and shorter maturities) imply that holdings may start shrinking in 2021 already. If the ECB is serious about stock effects - it is-, then it can& #39;t be tolerated. (15/n)

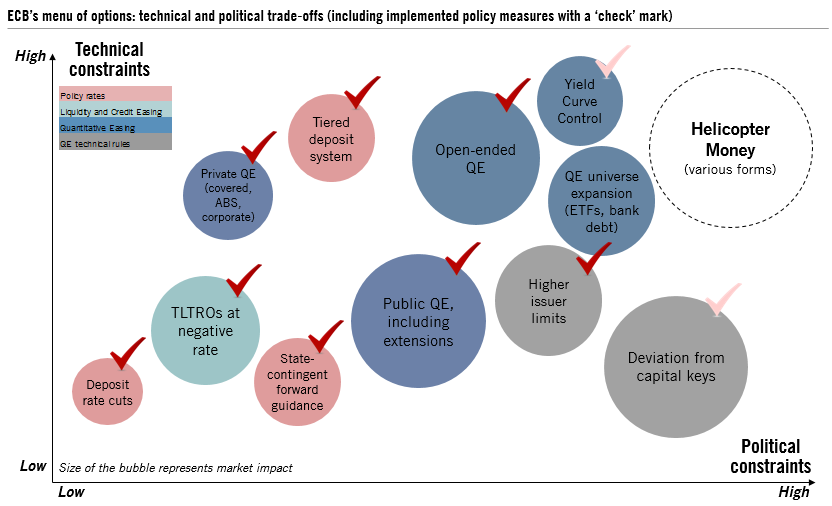

What else could the ECB do?

-raise Supranationals share to >10% (and 50% limit)

-raise private debt share

-expand eligible universe to ETFs or senior bank debt

-raise issuer limits to 40% or 50% across the board

My bubble chart is just like me though, a bit exhausted. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚁" title="Helicopter" aria-label="Emoji: Helicopter">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚁" title="Helicopter" aria-label="Emoji: Helicopter">

/END

-raise Supranationals share to >10% (and 50% limit)

-raise private debt share

-expand eligible universe to ETFs or senior bank debt

-raise issuer limits to 40% or 50% across the board

My bubble chart is just like me though, a bit exhausted.

/END

Read on Twitter

Read on Twitter

/END" title="What else could the ECB do?-raise Supranationals share to >10% (and 50% limit)-raise private debt share-expand eligible universe to ETFs or senior bank debt-raise issuer limits to 40% or 50% across the boardMy bubble chart is just like me though, a bit exhausted. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚁" title="Helicopter" aria-label="Emoji: Helicopter">/END" class="img-responsive" style="max-width:100%;"/>

/END" title="What else could the ECB do?-raise Supranationals share to >10% (and 50% limit)-raise private debt share-expand eligible universe to ETFs or senior bank debt-raise issuer limits to 40% or 50% across the boardMy bubble chart is just like me though, a bit exhausted. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚁" title="Helicopter" aria-label="Emoji: Helicopter">/END" class="img-responsive" style="max-width:100%;"/>