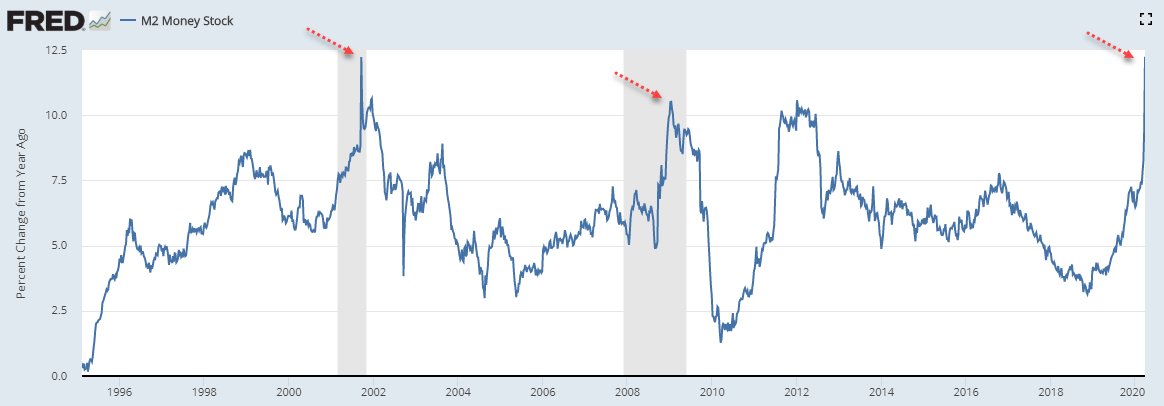

Broad M2 growth has surged to the highest level in several decades.

Before rushing to inflation, we should consider a few things.

First, broad M2 growth can spike in the middle of recessions.

Before rushing to inflation, we should consider a few things.

First, broad M2 growth can spike in the middle of recessions.

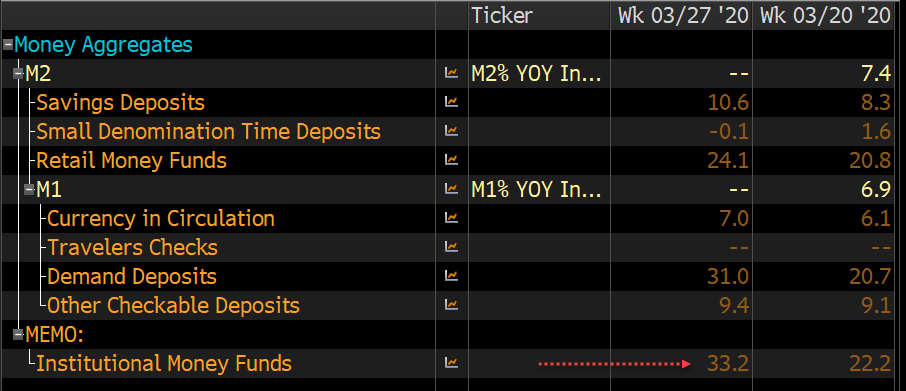

Also, a big factor driving the increase in broad money growth is retail money funds which are up 24% Y/Y.

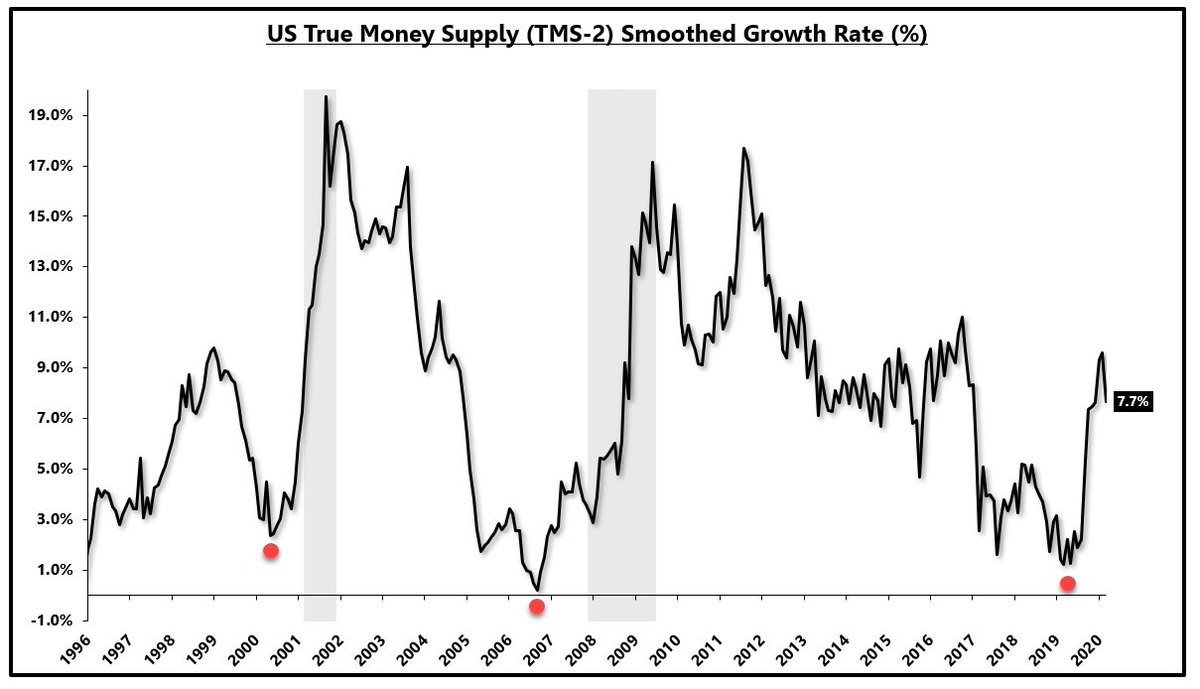

Austrians have a more refined version of money supply growth which excludes several categories in broad M2 growth including MMF and time deposits.

When excluding these categories, "True Money Growth" or TMS-2 is increasing far less.

When excluding these categories, "True Money Growth" or TMS-2 is increasing far less.

If we use the 2-year rate of growth emphasized by Friedman and Dr. Lacy Hunt, the rate of growth is even less and consistent with past recessionary periods.

Why do Austrians exclude these categories?

"because they do not represent a final medium of exchange (in the case of traveler& #39;s checks or MMMFs, they are ultimately redeemed for cash or checking deposits)"

"because they do not represent a final medium of exchange (in the case of traveler& #39;s checks or MMMFs, they are ultimately redeemed for cash or checking deposits)"

Read on Twitter

Read on Twitter