How might Covid-19 impact the housing market in Northern Ireland? Some thoughts on how this may play out over the coming weeks and months: (1/x) https://www.businessfirstonline.co.uk/our-guest-bloggers/how-might-coronavirus-impact-the-property-market/">https://www.businessfirstonline.co.uk/our-guest...

Context is key. House prices in N.Ireland fell by 57% following 2007/08 crash compared to 18% across the UK. As it stands local house prices remain 38% *below* peak levels whereas UK house prices are 18% *above*. Any reduction in prices may impact GB to a greater extent. (2/x)

The goal is not to get back to anything near 2008 unsustainable levels but the evidence suggests local house prices are undervalued relative to the UK. Since 1970, N.Ireland& #39;s housing market has typically been 20% more affordable than UK. It& #39;s currently about 40%. (3/x)

Covid-19 has 2 main impacts on the property market; Practicalities of buying and economic uncertainty/outlook.

Social distancing restrictions means buyers can& #39;t view properties, people can& #39;t meet to sign documentation, removal companies aren& #39;t operating.... (4/x)

Social distancing restrictions means buyers can& #39;t view properties, people can& #39;t meet to sign documentation, removal companies aren& #39;t operating.... (4/x)

..and estate agents & surveyors can& #39;t physically value properties. Technology will permit some elements to continue (virtual viewings etc) but it& #39;s inevitable that the market will significantly slow in the short term. But by how much and for how long? (5/x)

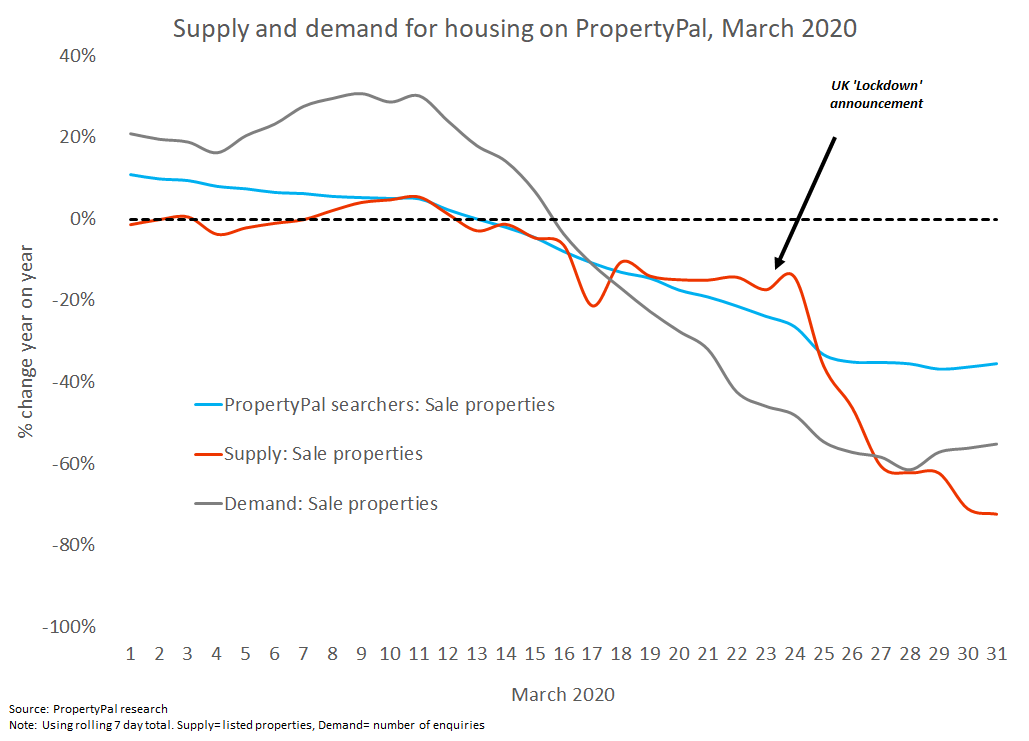

Over the last 2 weeks, the flow of properties coming to the market and the demand has fallen by over 60% on PropertyPal compared to last year. We forecast Q2 transactions will fall by 70% but by more so in the coming weeks. (6/x)

In terms of prices it is difficult to tell the direct impact yet. But a house is only valued what a buyer is willing to pay or what a seller is willing to sell for- IF they aren& #39;t forced to sell. The economic stress of 2007/08 led to a surge of forced sellers. (7/x)

Without a surge of forced sellers, the extent of any price reduction is more limited. The government& #39;s announcements including mortgage holidays, deferred rates (domestic and non) and VAT bills and available low cost borrowing will support households and businesses... (8/x)

...the Job Retention Scheme and similar measures for self-employed are aimed at protecting jobs and income levels for the next couple of months. There& #39;s also increasing calls for & #39;helicopter money& #39;- direct cash payments to individuals. This can& #39;t be ruled out yet. (9/x)

The critical point is if these measures are sufficient to prevent a long-term spike in unemployment, then the scope for reductions in house prices is more limited. Sellers will opt out & wait before going to the market. Plus lenders are facing huge capacity constraints. (10/x)

Practical difficulties of buying, fewer mortgage approvals & registration of transactions (plus the Land registry is closed so no deals can fully complete for now) will mean there will be very little evidence to base price movements on. There may be gaps in official stats. (11/x)

But a flow of available discounted rental properties will exert downward pressure on house prices- such has already been the case in London/Dublin as formerly AirBnB properties have flooded the market. (12/x)

Optimistic scenario- the housing market largely pauses and there aren& #39;t long term structural impacts on the economy. V-shaped recovery

Pessimistic scenario- unemployment spikes, wages fall and several businesses are forced to close permanently. U-shaped recovery (or a W). (13/x)

Pessimistic scenario- unemployment spikes, wages fall and several businesses are forced to close permanently. U-shaped recovery (or a W). (13/x)

The UK stock market is pricing in a 12% fall in house prices. Savills say 5%-10% short term & both Capital Economics and Knight Frank say 3%.

PropertyPal& #39;s modelling is 3-5% in short term before stronger growth in the rebound period giving negligible growth over 12 months. ENDS

PropertyPal& #39;s modelling is 3-5% in short term before stronger growth in the rebound period giving negligible growth over 12 months. ENDS

Read on Twitter

Read on Twitter