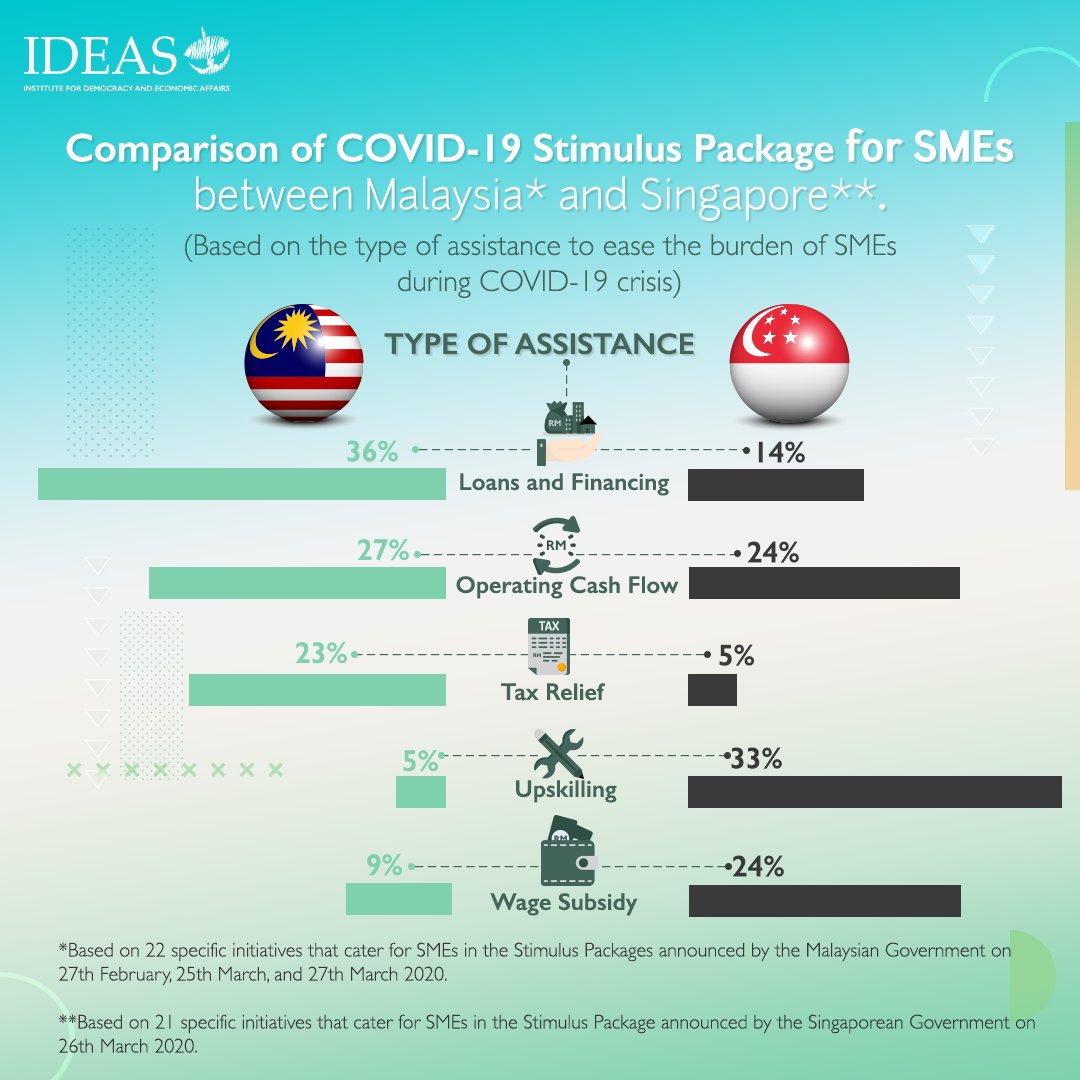

Do you know that more than half of Malaysian workers are working for Small and Medium Enterprises (SMEs)? During this COVID-19 crisis, they will be hurting the most. Let& #39;s see and compare what the stimulus package has prepared for our SMEs so far.

This is a thread.

This is a thread.

The infographic above shows the comparison between Malaysia& #39;s and Singapore& #39;s stimulus packages.

Our researchers have categorized the type of assistance into 5 categories:

1. Loans and Financing

2. Operating Cash Flow

3. Tax Relief

4. Upskilling

5. Wage Subsidy

1. Loans and Financing

2. Operating Cash Flow

3. Tax Relief

4. Upskilling

5. Wage Subsidy

1. Loans and Financing

An initiative provided by the government or the central bank to allow SMEs to borrow money with a low-interest rate and high guarantees.

An initiative provided by the government or the central bank to allow SMEs to borrow money with a low-interest rate and high guarantees.

2. Operating Cash Flow

An initiative provided by the government or the central bank to allow SMEs to defer their loan repayments, discounting their rents and bills, or monthly commitments.

An initiative provided by the government or the central bank to allow SMEs to defer their loan repayments, discounting their rents and bills, or monthly commitments.

3. Tax Relief

An initiative provided by the government or the central bank to exempt, defer, or reduce their taxes.

4. Upskilling

An initiative provided by the government to support, enhance, or train the SMEs to increase their capacity and productivity.

An initiative provided by the government or the central bank to exempt, defer, or reduce their taxes.

4. Upskilling

An initiative provided by the government to support, enhance, or train the SMEs to increase their capacity and productivity.

5. Wage Subsidy

An initiative provides by the government to fully or partially subsidise the salaries paid to the workers.

An initiative provides by the government to fully or partially subsidise the salaries paid to the workers.

These percentages are based on the total number of initiatives catered explicitly for SMEs (Malaysia has 22 specific initiatives for SMEs based on the previous stimulus packages announced whereas Singapore has 21 specific initiatives for SMEs).

It should also be noted that the Malaysian government will be announcing a new round of stimulus package for SMEs later today.

#COVID19Malaysia #StimulusPackage

#COVID19Malaysia #StimulusPackage

Read on Twitter

Read on Twitter