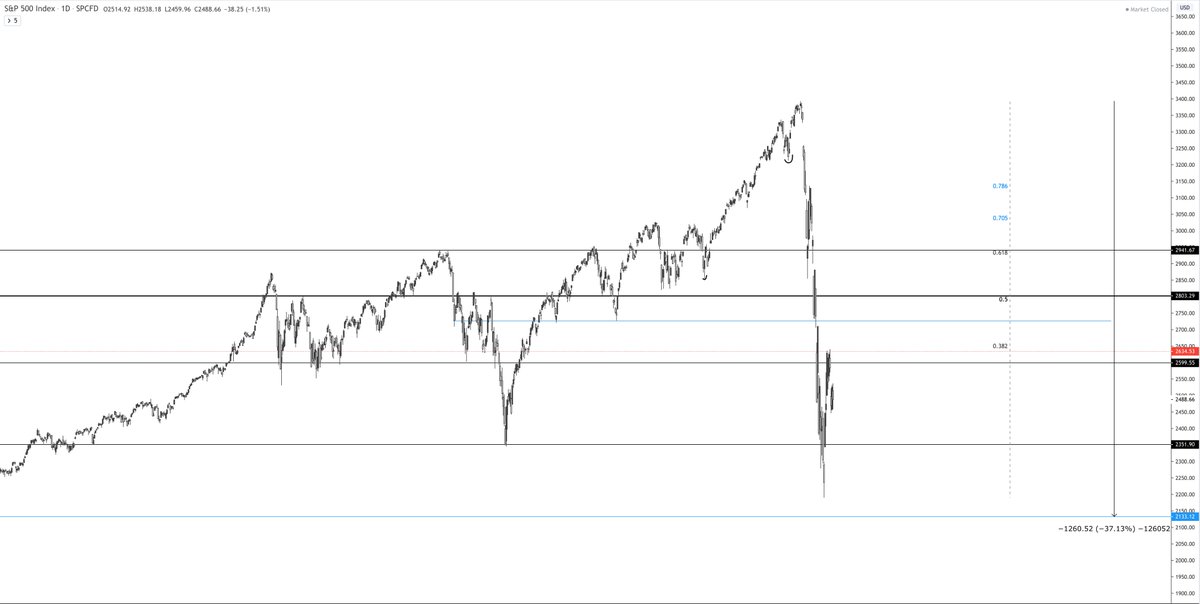

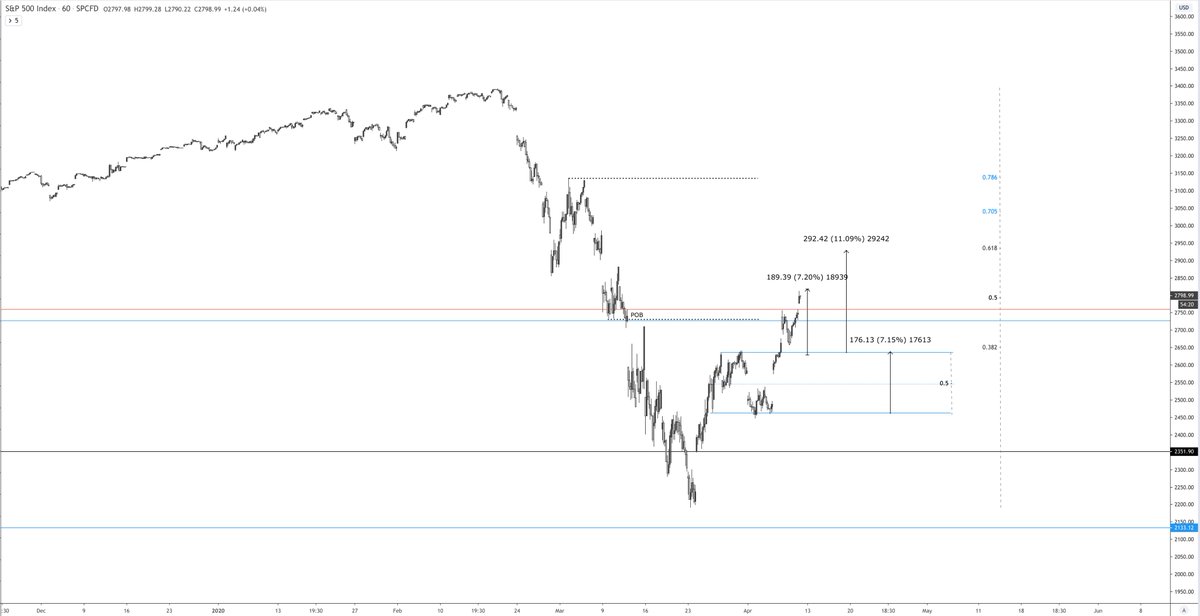

Futures trading around mid range.

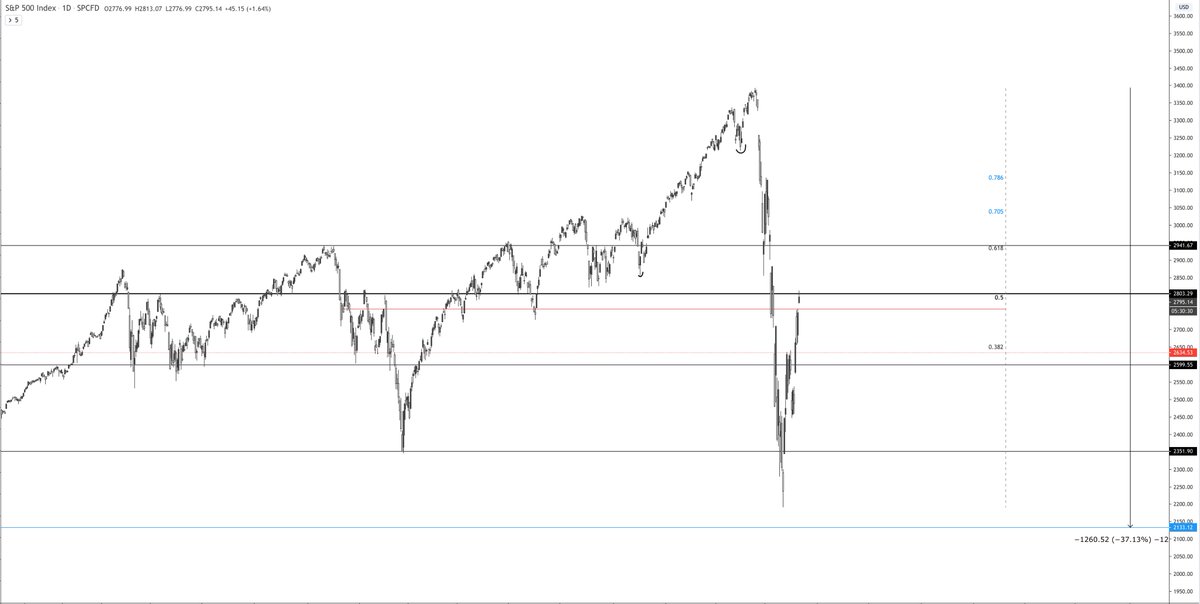

If SPX breaks this mini range to the upside I expect some of those higher fibs to be hit.

Would look at the 50% 1st.

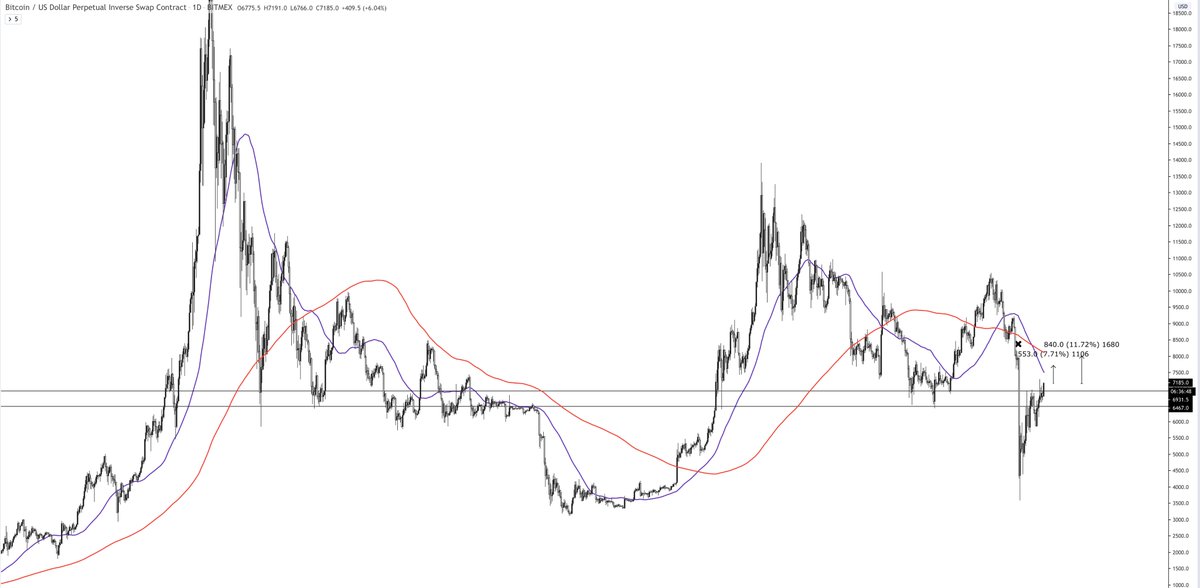

I think the correlation between SPX and BTC will be back on this week.

I just see a rough week ahead with the NY situation.

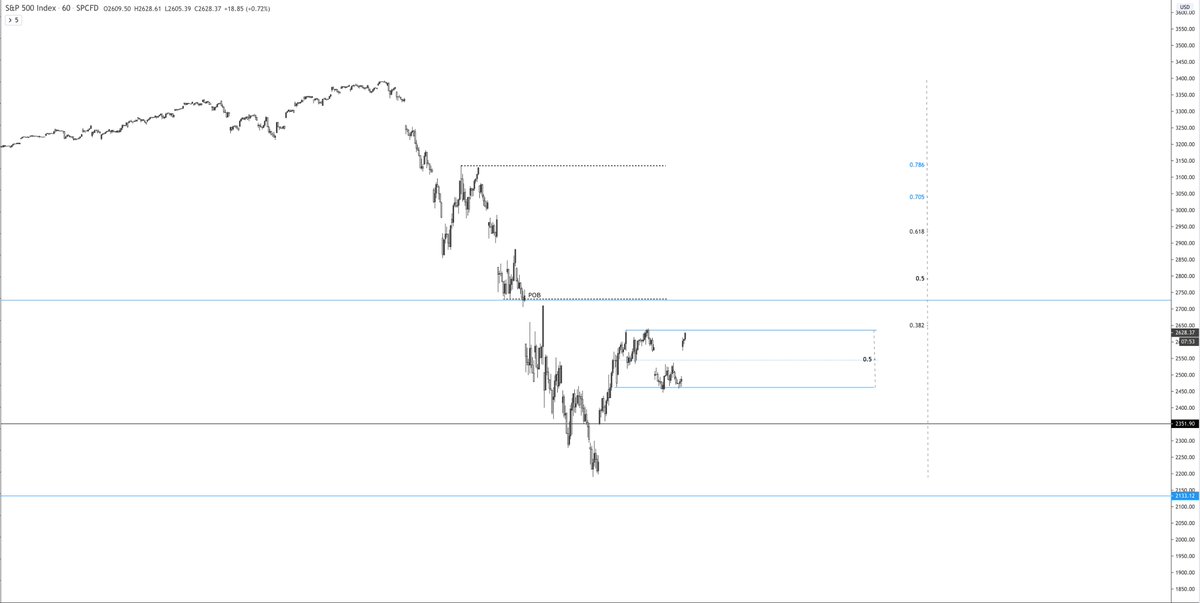

If SPX breaks this mini range to the upside I expect some of those higher fibs to be hit.

Would look at the 50% 1st.

I think the correlation between SPX and BTC will be back on this week.

I just see a rough week ahead with the NY situation.

So far BTC and SPX are moving in line for the most part.

Higher fibs on SPX are suggesting a 7-11% move.

7-11% move in BTC lines up nicely with daily levels around fibs, MA& #39;s and key POB& #39;s.

This is risk on.

Correlation is quite clear.

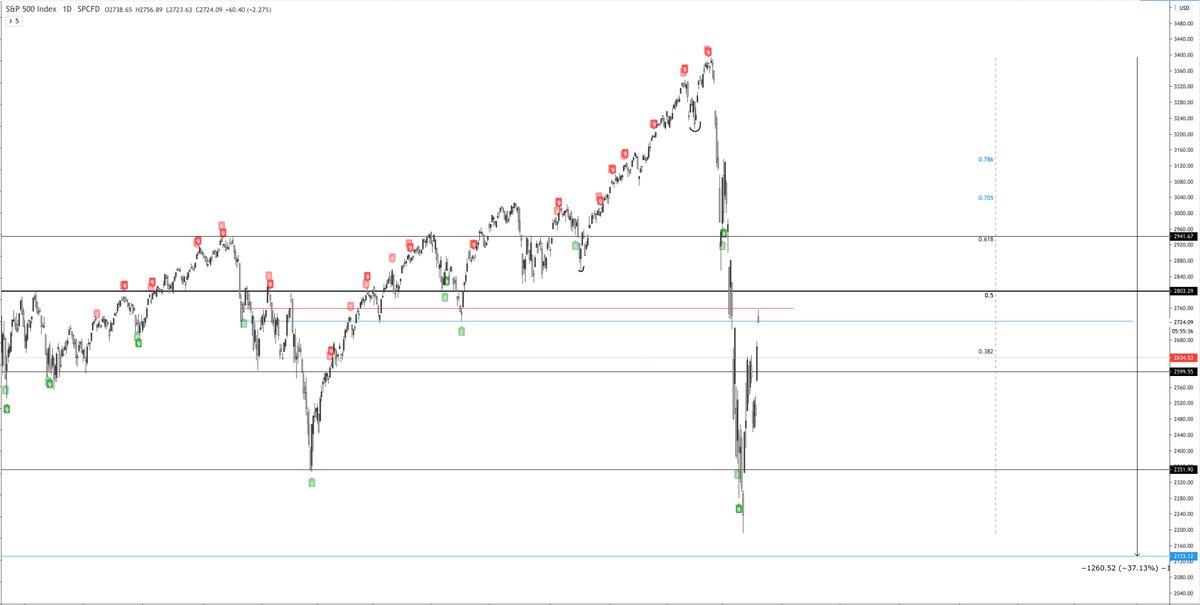

Higher fibs on SPX are suggesting a 7-11% move.

7-11% move in BTC lines up nicely with daily levels around fibs, MA& #39;s and key POB& #39;s.

This is risk on.

Correlation is quite clear.

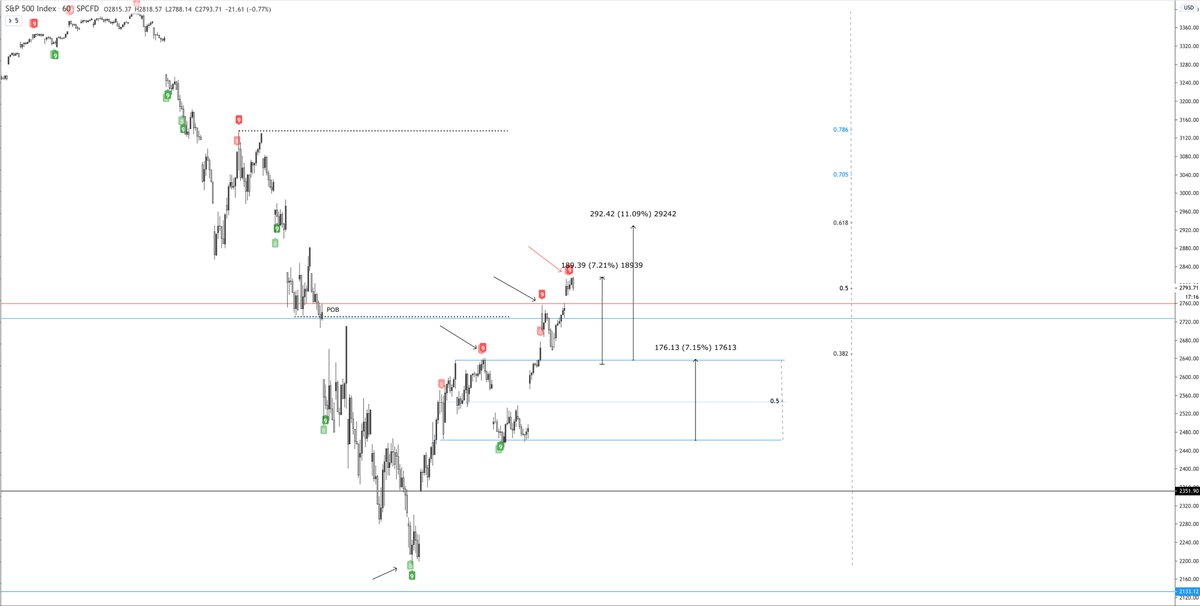

Range high break and hold.

POB next.

Still don& #39;t think shorting corn here is best move with strength in SPX.

POB next.

Still don& #39;t think shorting corn here is best move with strength in SPX.

First target tagged.

Incoming hourly TD9 sell.

50% fib run.

I wouldn& #39;t be surprised if the high is in for today.

Incoming hourly TD9 sell.

50% fib run.

I wouldn& #39;t be surprised if the high is in for today.

This was a great thread for anyone wondering about SPX and BTC.

I suggest having an SPX chart up at all times when trading corn.

I suggest having an SPX chart up at all times when trading corn.

Read on Twitter

Read on Twitter