PPP applications this week will be chaos. Hugely needed, and will save many small businesses.

A few details worth paying attention to:

A few details worth paying attention to:

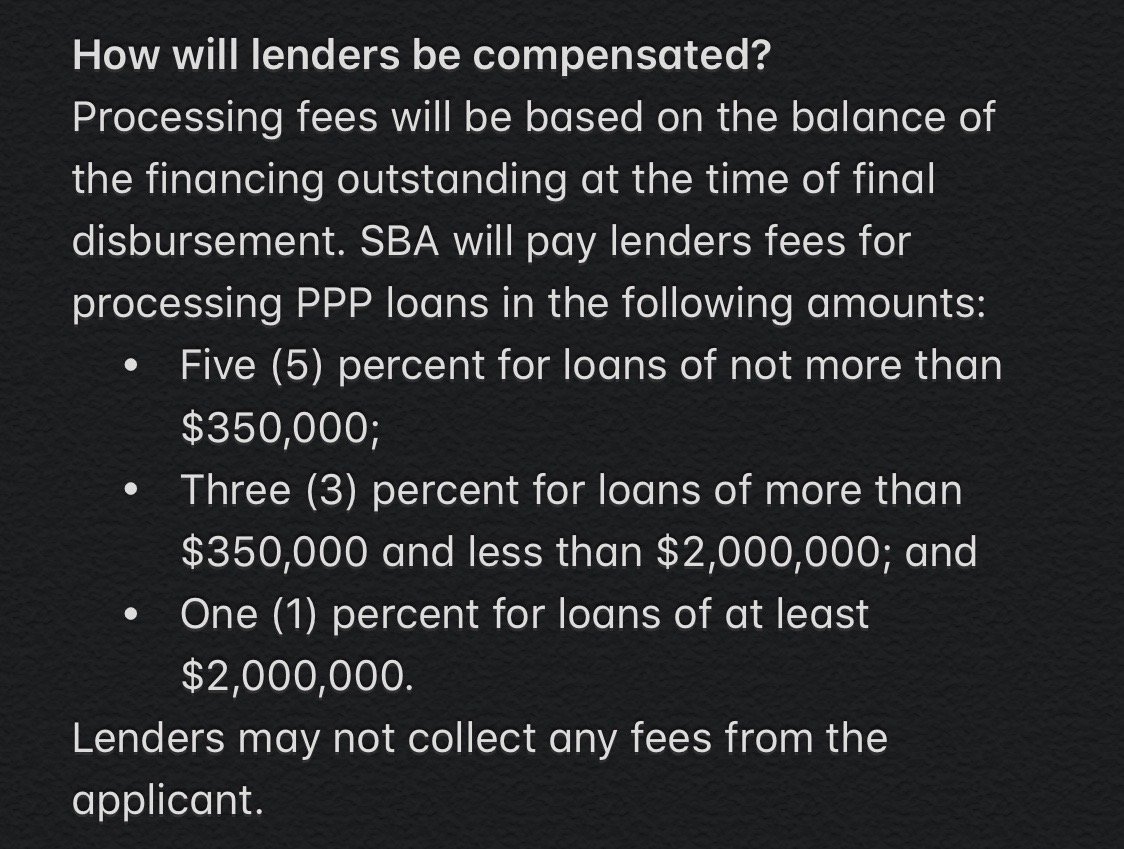

Lender incentives:

Lenders are paid a one-time fee of up to 5% of the value of the loan for every one they make. The loans are 1% interest, guaranteed by the gov’t, and they can be sold on the secondary market. Lenders are very incentivized to make these loans.

Lenders are paid a one-time fee of up to 5% of the value of the loan for every one they make. The loans are 1% interest, guaranteed by the gov’t, and they can be sold on the secondary market. Lenders are very incentivized to make these loans.

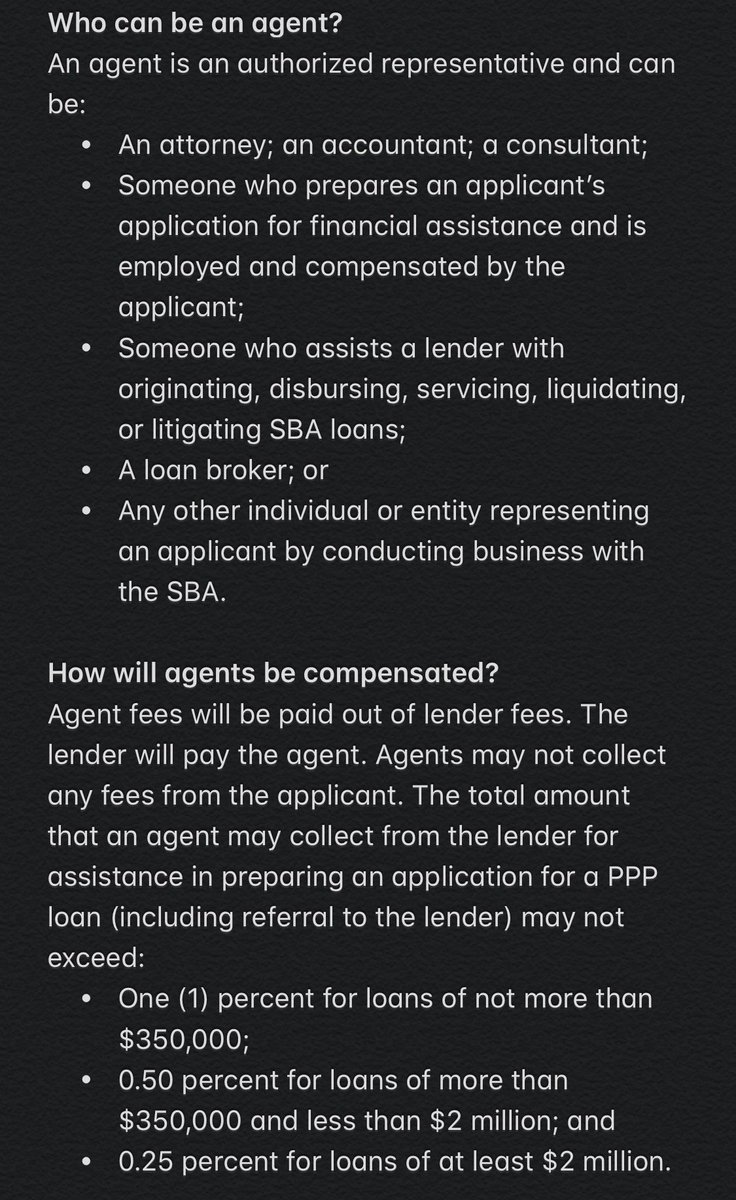

Agent incentives.

Almost anyone who helps a borrower prepare their application is eligible to be paid up to 1% of the loan value as an “agent.”

Almost anyone who helps a borrower prepare their application is eligible to be paid up to 1% of the loan value as an “agent.”

Gov& #39;t will pay out $5-10b in incentives to lend $349B. The result is that every eligible small business will have someone (service providers, lawyers, consultants, etc.) them to take a loan. Incentives are not bad, but they leave room for profit seeking.

The fraud system used for SBA loans (eTran) is manual for most banks, meaning each loan must be typed into an online portal. This system is set up to prevent “loan stacking”, when businesses file multiple simultaneous loan applications (intentionally or unintentionally).

Eligibility is not based on impact. All businesses who have seen declines + meet requirements are eligible, regardless of the magnitude of decline. No filters on industry or business type.

Non-bank and other new SBA lenders have not yet been able to apply for certification to make PPP loans. Most banks are only serving existing customers, and thus many businesses do not have an easy way to apply. Hopefully this will change on Monday.

Read on Twitter

Read on Twitter