One of the big Brexit scare stories was that € swap trading, which is mostly done in London, would have to move THREAD https://next.ft.com/content/0aad0312-3f7a-11e6-9f2c-36b487ebd80a">https://next.ft.com/content/0...

1/ The journalist muppets who propagate these stories don& #39;t work in the business & instead rely on think tanks like @OliverWyman. But we can look at what companies that actually work in the business say https://wp.me/p6sAEp-2XZ ">https://wp.me/p6sAEp-2X...

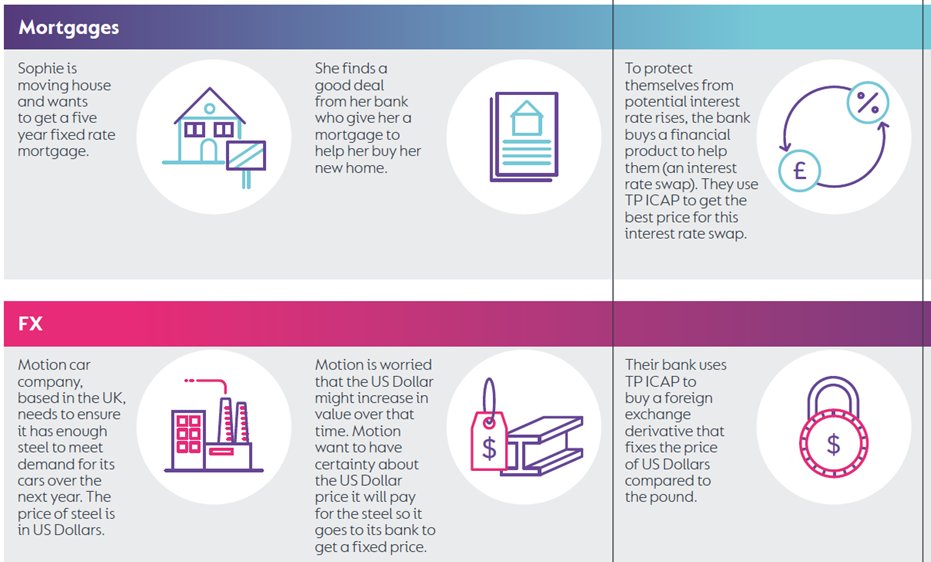

2/ For Swaps trading, we can look at TP ICAP, which is also active in FX and government bonds. Along with equities & commodities, these assets account for nearly all financial trading activity

3/ Formed from the merger of the largest & second largest companies in the sector, TP ICAP is an excellent barometer of the industry as a whole

4/ Page 11 of the latest annual report (2018) says that 90% of TP ICAP& #39;s business is unaffected

5/ Our thesis is confirmed. London& #39;s role of intermediating for EU mortgage banks in € Swaps is not affected. The main part of the 10% is business which TP ICAP already carried out in the EU

6/ This business is not relocated from London. TP ICAP simply needs to set up a venue & subsidiary in the EU. No mention of any job losses or creations. No loss of tax

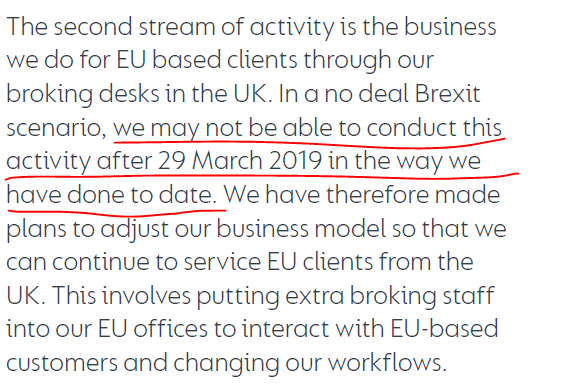

7/ The smaller part that is affected is, yes, the direct business with EU clients. The job impact is a small addition of staff in the EU, not reduction in the UK

8/ But note the language: "we may not be able to" so not a definite problem & "in the way we have done to date" - in other words they will be able to continue to service those clients *from London* with a workaround

9/ That workaround involves "putting extra staff" into their EU offices. Not job losses in the UK

10/ Note that all of these measures are in anticipation of a "no deal Brexit." So there we have it, the impact on the UK activities of the biggest € swaps inter-dealer broker of a no deal Brexit is minimal. END

Another Brexit scare story that keeps cropping up is asset managers being affected. THREAD

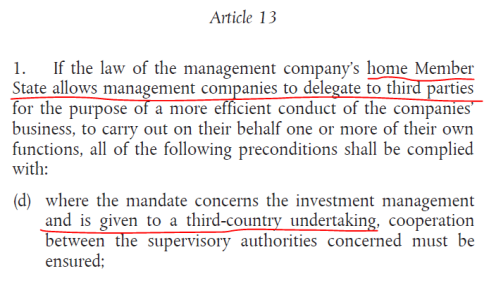

1/ By way of reminder, A13 of UCITS allows third country fund managers to manage UCITS funds, the main fund sold in Europe. So I couldn& #39;t figure out why so many people claiming to work in fund management were claiming Brexit impacted them

2/ The answer I put forward was that the actual sales & client services to EU clients would have to be done from the EU. And that is small, as most of that is done by third party wealth managers or salespeople already in the EU

3/ To test that hypothesis, let& #39;s look at the annual report of the UK& #39;s largest asset manager, Standard Life Aberdeen, with £555bn assets under management & 6,268 staff

5/ No revenue impact. No job losses.

6/ The MiFID firm is there to serve customers directly. As I repeatedly pointed out, most people servicing EU clients were already in the EU pre-Brexit. And most UK fund managers sold funds to wealth managers in EU. Not directly. ASI& #39;s statement confirms this

7/ The Luxembourg based management company is the fund company itself, independent from but managed by ASI, which was already in Luxembourg

8/ So they expand the activities of that entity already in Luxembourg. No relocation from the UK. No wonder the impact of Brexit on the City is so microscopic https://wp.me/p6sAEp-5FM ">https://wp.me/p6sAEp-5F...

Read on Twitter

Read on Twitter