The generous covid-19 stimulus packages by advanced economies are being used as a benchmark for analysing Pak’s package.

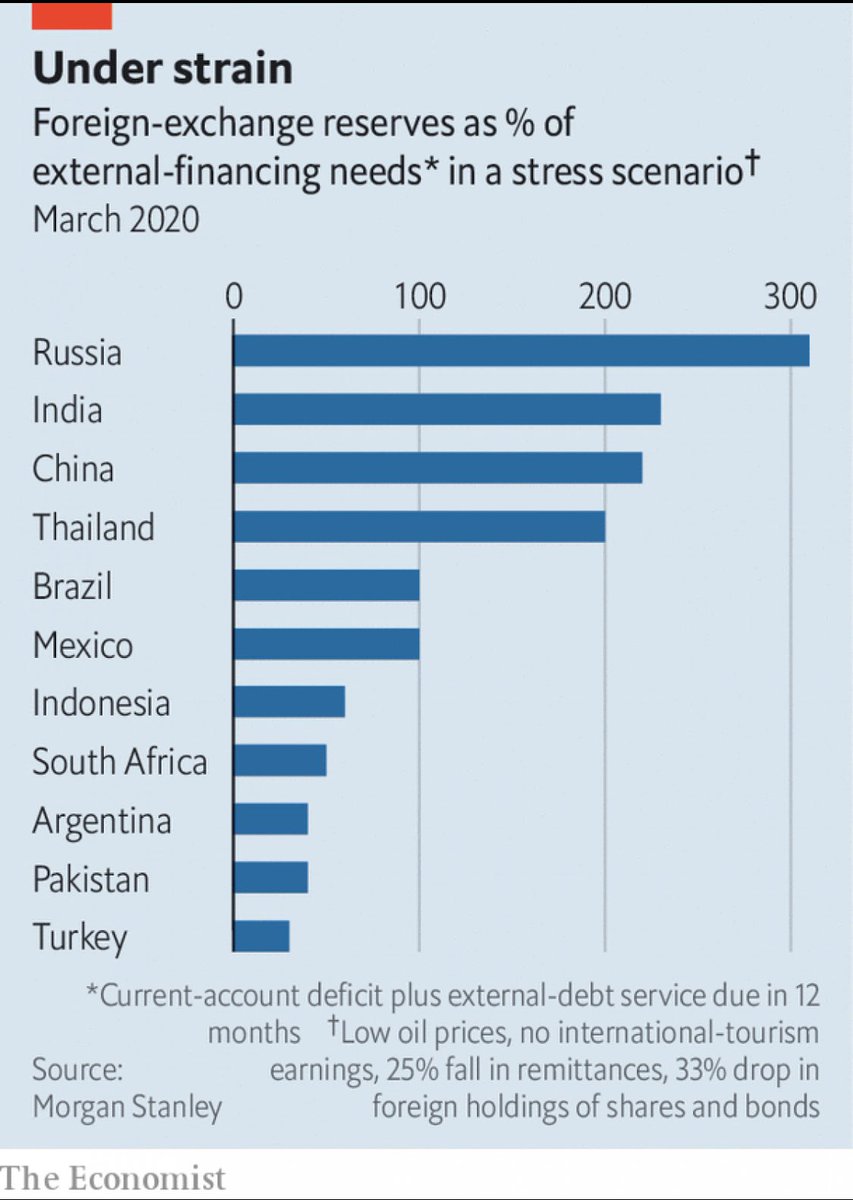

This analysis reported by @TheEconomist shows how we are struggling compared to other emerging econs w.r.t reserve adequacy for external financing needs

1/N

This analysis reported by @TheEconomist shows how we are struggling compared to other emerging econs w.r.t reserve adequacy for external financing needs

1/N

This is forecasting current account deficit + external debt servicing due in 12 months under a stress scenario with below assumptions:

- low oil prices (this has a positive impact)

- no tourism

- 25% decline in remittances

- 33% decline in foreign holdings of bonds/equities

2/N

- low oil prices (this has a positive impact)

- no tourism

- 25% decline in remittances

- 33% decline in foreign holdings of bonds/equities

2/N

Goes to show the precarious position PK’s balance of payments is under giving http://v.limited"> http://v.limited space to policymakers for either fiscal/monetary stimulus. This is an extremely challenging situation..analysts should keep this in mind before presenting their wish lists.

3/N

3/N

In hindsight Pakistan should have tapped the eurobond mkt b/w July-Dec’19 when turnaround story was hot with global investors & appetite for riskier assets was there.

Then again hindsight is a wonderful thing but nobody really saw this crisis coming

4/4

Then again hindsight is a wonderful thing but nobody really saw this crisis coming

4/4

Read on Twitter

Read on Twitter