George Orwell said:

“Statistics were just as much a fantasy in their original version as in as in their rectified version.”

and

"He who controls the past controls the future. He who controls the present controls the past." https://twitter.com/Diplomat_APAC/status/1246625857466060800">https://twitter.com/Diplomat_...

“Statistics were just as much a fantasy in their original version as in as in their rectified version.”

and

"He who controls the past controls the future. He who controls the present controls the past." https://twitter.com/Diplomat_APAC/status/1246625857466060800">https://twitter.com/Diplomat_...

Just so you know, my guess is that most people, and that includes the media, normal people, experts etc, that cite statistics (GDP, coronavirus, CPI, stock indices etc) don& #39;t know what& #39;s:

a) In the index

b) How it is collected/measured

c) Meaning.

Next time u hear a stat, ask.

a) In the index

b) How it is collected/measured

c) Meaning.

Next time u hear a stat, ask.

I will go over a thread on how to think about basic statistics soon so that you can read the news better. Again, listen to George, he knows. Statistics are just a way to present a version of the “truth” u want to show, especially in economics. I’ll explain why soon.

News headline:

Goldman predicts first quarter US GDP to fall -34%!!! (reaction: omg so bad).

Before u panic, let& #39;s ask, what is GDP? How is GDP being collected/measured? How did GS derive at the -34%? And what are you supposed to take away from such a figure for the future?

Goldman predicts first quarter US GDP to fall -34%!!! (reaction: omg so bad).

Before u panic, let& #39;s ask, what is GDP? How is GDP being collected/measured? How did GS derive at the -34%? And what are you supposed to take away from such a figure for the future?

These are basic questions for anyone who wants to discuss the -34% Q1 US GDP headline to ask & know before they go on about how bad that is.

But my guess is that they don& #39;t. And so here I am explaining how u should think about statistics.

Key difference: a sample & population!

But my guess is that they don& #39;t. And so here I am explaining how u should think about statistics.

Key difference: a sample & population!

A sample is data that u get that u hope represent the entire population. Most data is just sample & NOT POPULATION, ex say the census & that& #39;s done every 10 years as very costly to do.

Say u need a sample, the pt is that u sample so that it& #39;s representative of the population.

Say u need a sample, the pt is that u sample so that it& #39;s representative of the population.

A good example is something I talk about often, Markit PMIs. They have different names because different sponsors buy the right to "own" the dataset for different country but done by the same company.

Sample size of China Caixin manufacturing is 500 (same for most countries).

Sample size of China Caixin manufacturing is 500 (same for most countries).

Why 500? Well, Markit has to do so many countries & has to send out a survey & these managers have to answer & then they have to take the answers & quantify & give a score. That& #39;s a lot of work already if u cover the world. So 500 is good enough as long as it PRESENTS THE ECONOMY

Now u understand SAMPLE & POPULATION, need to talk about HOW U SAMPLE. Must try to make a survey that& #39;s not biased & representative of the population.

State PMI has 3000 in survey & has more large firms vs Markit representative of econ so lots of SMEs. Knowing the sample is key.

State PMI has 3000 in survey & has more large firms vs Markit representative of econ so lots of SMEs. Knowing the sample is key.

If u don& #39;t know what& #39;s in the sample, how the data is collected, and etc then you CAN& #39;T ANALYZE THE DATA. The source of the data is key. Let& #39;s talk about GDP. What& #39;s GDP? It& #39;s a measure of a national output. Hard to measure a national output, esp if u got a large econ like the US

Why do people measure output? People measure it so that they can BENCHMARK. Remember this concept. Statistics are useful as a narrative tool. You say, oh I made 100 in 2019 & so if I made 90 in 2020 then I am SHRINKING THEN OMG NOT GOOD.

Must change policy to excel in BENCHMARK.

Must change policy to excel in BENCHMARK.

Other than material benchmark, can have others, like national happiness or health or whatever. If you measure GDP, the US is awesome, BIGGEST IN THE WORLD, but if you measure BMI index, well not so awesome is it.

Remember: a) What is being measured; b) Why it& #39;s being measured?

Remember: a) What is being measured; b) Why it& #39;s being measured?

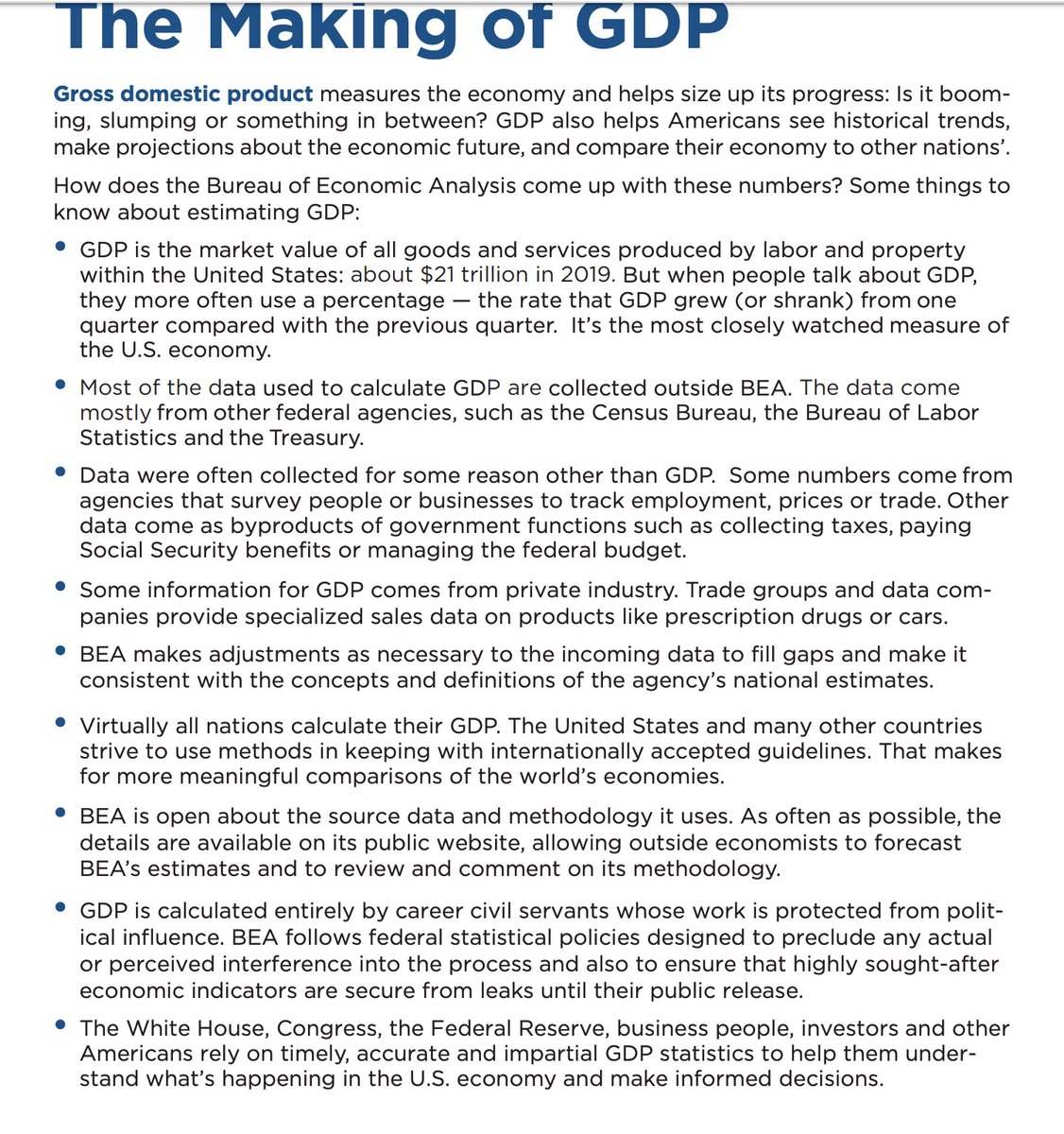

So let& #39;s talk about NATIONAL OUTPUT. The US arguable has the best statistics on this. One of the few countries that you can go back very far in time & got lots of details. Still, u must realize that this is a GUESSTIMATE.

So how does the BEA do it? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/files/2020-04/BEA-in-Brief-GDP-Final.pdf">https://www.bea.gov/system/fi...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/files/2020-04/BEA-in-Brief-GDP-Final.pdf">https://www.bea.gov/system/fi...

So how does the BEA do it?

That& #39;s a great primer by the BEA for you to know what& #39;s in US GDP & u read and u& #39;re like: Ugh, I don& #39;t know. Haha

Basically, the BEA is just saying that it& #39;s hard to measure a national output so it takes a bunch of different data & then aggregate that to measure output of the US

Basically, the BEA is just saying that it& #39;s hard to measure a national output so it takes a bunch of different data & then aggregate that to measure output of the US

Almost every country takes such an exercise. Take data (say ISM, non-farm payroll etc) and then you adjust it to then say: OUR GUESS NATIONAL OUTPUT. And they revise the data too as they get more info. This is why people say GDP is a lagging indicator, as in tells u about past.

If interested, u can study US GDP in the past to 1929. So I hope by now you understand the importance of knowing WHAT (what& #39;s in the sample, size of sample etc); HOW (how is it being measured & why it is being measured).

Now we go to the analytical part, this is interesting.

Now we go to the analytical part, this is interesting.

I will use simple #s to illustrate data & statistics & why u must up your knowledge to understand current events: Usually, data shows level, that means the actual unit & then people use that to analyze.

But NOT ALL DATA HAS THAT (China real quarterly GDP doesn& #39;t have level).

But NOT ALL DATA HAS THAT (China real quarterly GDP doesn& #39;t have level).

Say USA output in Q4 2019 was 100. Here comes the coronavirus & given that it hits around second half of March 2020 then say the BEA measures output to be 90.

Q4 2019=100

Q1 2020=90

That& #39;s a -10% drop in output & we call it quarter over quarter (QoQ growth).

Say Q1 2019 =90.

Q4 2019=100

Q1 2020=90

That& #39;s a -10% drop in output & we call it quarter over quarter (QoQ growth).

Say Q1 2019 =90.

If Q1 2019 =90 and Q1 2020 = 90, then percentage change year over year = 0%.

Yes, that& #39;s right!!! No contraction! Flat!

Btw, if the -10% is annualized (to the 4th power) then = -34%

So u can say, Q1 GDP grew 0%, -10% or -34%, ALL THESE FACTS ARE CORRECT!

Yes, that& #39;s right!!! No contraction! Flat!

Btw, if the -10% is annualized (to the 4th power) then = -34%

So u can say, Q1 GDP grew 0%, -10% or -34%, ALL THESE FACTS ARE CORRECT!

So you can choose however you want to present the economy as you like, a massive contraction like Goldman& #39;s headline of QoQ SA (seasonally adjusted) and annualized (AR),

So when you read a figure of GDP, ask, is it a %YoY, %QoQ, %QoQ SAAR???

Let& #39;s talk about the diff b/n them!

So when you read a figure of GDP, ask, is it a %YoY, %QoQ, %QoQ SAAR???

Let& #39;s talk about the diff b/n them!

The reason why people like to use % YoY (Q1 2020 vs Q1 2019) is that it is served to STRIP OUT THE SEASONALITY.

In East Asia, we have the lunar new year (LNY), so we tend to take 2 wks off in Q1 so Q1 always WEAKER than Q4 2019. So comparing Q1 2020 vs Q1 2019 makes more sense.

In East Asia, we have the lunar new year (LNY), so we tend to take 2 wks off in Q1 so Q1 always WEAKER than Q4 2019. So comparing Q1 2020 vs Q1 2019 makes more sense.

In many formerly planned economies (communists), have GROWTH TARGETS. Vietnam and China are such good examples. Vietnam and China data tends to have year-to-date, which is an accumulation of the output over the year.

Why? To speed up credit/production to meet annual GDP target!

Why? To speed up credit/production to meet annual GDP target!

Because of this, Q1 tends to be weak in Asia but picks up, esp in places in like Vietnam & China to meet target. So if Q1 too strong, u tighten to make it less strong and vice versa.

What about %QoQ? Don& #39;t just report Q1 2020 vs Q4 2019, they adjust for seasonality such as LNY.

What about %QoQ? Don& #39;t just report Q1 2020 vs Q4 2019, they adjust for seasonality such as LNY.

China started to report %QoQ SA only in recent years. Most QoQ figures are SEASONALLY ADJUSTED.

How do you do this? You just look at the past & then account for how much the seasonal pattern of that is & smooth it out. NOT AN EXACT SCIENCE.

So what? Let& #39;s look at USA estimate.

How do you do this? You just look at the past & then account for how much the seasonal pattern of that is & smooth it out. NOT AN EXACT SCIENCE.

So what? Let& #39;s look at USA estimate.

First of all, to get to the -34% QoQ SaaR, you are supposed to seasonally adjust. But how do you seasonally adjust the coronavirus?

And then why do people annualize? You do it to see that if u were to CONTINUE on the same trend, this is what the OUTPUT CHANGE& #39;d be for the yr.

And then why do people annualize? You do it to see that if u were to CONTINUE on the same trend, this is what the OUTPUT CHANGE& #39;d be for the yr.

Again, the reality is up to you how u want to think about the US, if you are a bear, then you can QoQ SAAR & get the -34% or if you are bearish but not so much then u say -10% & that& #39;s a one-off.

And if want to paint it nicely, then u say, not so bad is it, 0% YoY growth!

And if want to paint it nicely, then u say, not so bad is it, 0% YoY growth!

But what& #39;s important is that u understand what& #39;s in the unit in which u analyze & the sub-component of the unit. US GDP has plenty of subcomponents so can slice & dice it all day long for whatever analysis u need. And that& #39;s the beauty of that data, detailed & goes back far!

So?

So?

Not all GDP data is like this. China releases GDP figures, and we& #39;ll get it soon for Q1 & u will only get three levels (primary, secondary, tertiary) & no details of what& #39;s underneath in terms of composition & also u only get the level. Most take headline %YoY & call it a day.

Why? You just don& #39;t have a lot to go on. That said, China data is very rich for other aspects of its economy if u are willing to dig beyond news headlines. For example, trade data is rich. Also household expenditure surveys. And also daily production data etc.

I analyze ALL data across Asia so I can tell you the quality of Asian data on a comparative basis. And so what I can say is that what matters is UNDERSTANDING what you are reading & asking the right questions.

Statistics are not truths. Just data to analyze & write narratives.

Statistics are not truths. Just data to analyze & write narratives.

And they have utility. We have to have something to benchmark, to measure trends, to understand our past, our present and our future. So this is why I urge you to lobby for better public education to teach people about statistics. It& #39;s a tool & like all tools, it& #39;s how u use it!

Finally, what we must remember is that WHAT we measure says who we are. WHAT WE BENCHMARK, says about our value & culture.

So as an American, I lobby for the US to not just focus on GDP growth but move beyond to for example, wellness of its citizens, such as quality of life!!!

So as an American, I lobby for the US to not just focus on GDP growth but move beyond to for example, wellness of its citizens, such as quality of life!!!

Oh I forgot to say one more thing, if you compare data across economies, you have to use the name calculation. So if you take US %QoQ SaaR, then you have to use the same for other economies & not:

%QoQ SaaR number vs %YoY as you can see that they measure different things https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Red apple" aria-label="Emoji: Red apple">vs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Red apple" aria-label="Emoji: Red apple">vs https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Tangerine" aria-label="Emoji: Tangerine">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Tangerine" aria-label="Emoji: Tangerine">

%QoQ SaaR number vs %YoY as you can see that they measure different things

Also for example, budget deficits, to measure the expansion of a budget or the short fall you have to ask:

What is the the revenue calculation, what kind of accounting, and is it just central & local & does it include contingent liability etc?

Can& #39;t compare unless same as https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Red apple" aria-label="Emoji: Red apple">vs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Red apple" aria-label="Emoji: Red apple">vs https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Tangerine" aria-label="Emoji: Tangerine">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Tangerine" aria-label="Emoji: Tangerine">

What is the the revenue calculation, what kind of accounting, and is it just central & local & does it include contingent liability etc?

Can& #39;t compare unless same as

Btw, this is why people to develop accounting standards & the IMF has accounting standards for fiscal across economies & also BOP accounting standards.

Know this as well before u take the headline # & compare between countries!

Ask, do they have the same accounting standard?

Know this as well before u take the headline # & compare between countries!

Ask, do they have the same accounting standard?

Here is also a fact for my Indian followers to know, did you know that the Modi government discontinued the labor market survey so we actually don& #39;t have employment data in India? The ILO just make guesses.

Not just China quarterly GDP that& #39;s limited. Across Asia, data an issue!

Not just China quarterly GDP that& #39;s limited. Across Asia, data an issue!

Japan, a developed economy, data is convoluted. Have u looked at its fiscal? Many special budgets you are like how do I consolidate this stuff?

So data can be too simple (China quarterly GDP w/o level & details) & too complex (Japan fiscal). Sometime it& #39;s missing!!!

Ask why!

So data can be too simple (China quarterly GDP w/o level & details) & too complex (Japan fiscal). Sometime it& #39;s missing!!!

Ask why!

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/fi..." title="So let& #39;s talk about NATIONAL OUTPUT. The US arguable has the best statistics on this. One of the few countries that you can go back very far in time & got lots of details. Still, u must realize that this is a GUESSTIMATE. So how does the BEA do it? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/fi..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/fi..." title="So let& #39;s talk about NATIONAL OUTPUT. The US arguable has the best statistics on this. One of the few countries that you can go back very far in time & got lots of details. Still, u must realize that this is a GUESSTIMATE. So how does the BEA do it? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.bea.gov/system/fi..." class="img-responsive" style="max-width:100%;"/>