$JCP J.C. Penny was my worst trade ever. I did so many things wrong, but I was learning at the same time. Ray @RayTL_ brought up that I should go through it again and explain the lessons I learned so this thread will attempt to do that.

Some background first, It was the start of 2017 and I was trading with real money for about 2 years. My account was small, about 5k because I knew I was learning and that is all the money my wife would let me have at the time.

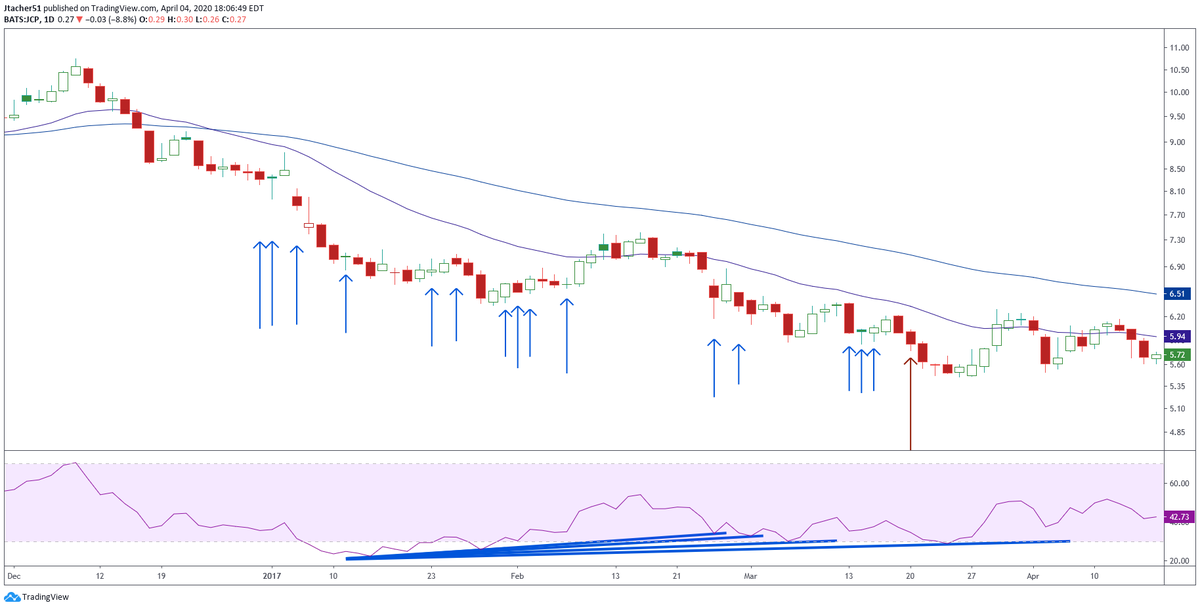

I was still in the mindset of trying to catch the bottom. I was convinced at the time that RSI bullish momentum divergence as the holy grail in doing this. Here comes J.C. Penny& #39;s.

This was an anchor store in the mall that had been around for 100 years, this was a perfect candidate since it had fallen from its highs of around 87.00 in 2007 and how much lower could it go. I started buying a small position on December 30 2016 at about $8.40.

It had a quick move up and I added a little more and then it gapped down below my entry price so I dollar cost averaged and bought more. As it got oversold I started seeing bullish momentum divergences appear on the chart so that must be the bottom so I bought more,

I bought at every blue arrow on the chart. In total I bought in 15 different time and saw 6 different bullish momentum divergences that were all fake. By March 100% of my trading account was now J.C. Penny.

I capitulated on March 20 2017 and took some time off to reflect on what happened and re-evaluate what the hell I was doing. So these are some of the lessons I learned and things I did to get my head on straight. 1) I got off stocktwits and started posting on Twitter.

2) I tried to follow only serious traders (There are amazing traders and the sharing of information is amazing on Twitter, but be careful because there are a lot of charlatans out there also), I don& #39;t have time for YOLO traders.

3) I started the journey of defining the trader I want to be... this took a long time to figure out. 4) I decided I was in this to make money not be right ie. cut your damn losses! 5) I read the right books, for me it was O& #39;neil, Schwager, Weinstein, and Minervini

6) I began to understand there is no holy grail (and you can always find a momentum divergence if you look hard enough, heck I found 6 of them in a downtrend) 7) I defined my time frame which is a weeks to months trader in a bullish market

8) I worked out a system to mitigate my risk and take a paper cut and not a bludgeoning. 9) I had to accept that I was going to be wrong and dollar cost averaging into a loser is just stupid and makes me lose even more money.

10) I created a system so that I would only buy stocks in uptrends and look even deeper to look for the sectors that are outperforming and then the strongest stocks within those sectors and now I grade my stocks which I learned from @mwebster1971 .

My process is always evolving as I continue to gain experience and know myself better. I am working on buying closer to my buy signal which in turn will let me ratchet my stop up by a couple percent. I continuously look for ways to decrease the noise in my trading (and life).

Peak to trough I lost about 33% on my JCP trade which really stung. I don& #39;t use RSI too often anymore and if I do it is secondary to price action. I buy high to sell higher. I defined my process to the point that minimizes emotional buying. I created a process to mitigate my risk

Read on Twitter

Read on Twitter