Why $TSLA could go bankrupt in 8 charts.

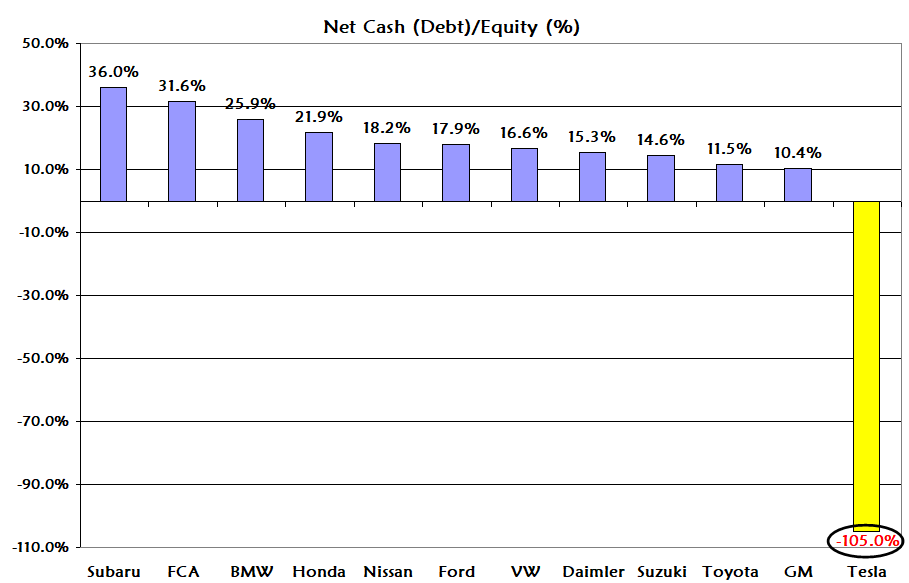

Chart-1: Net Cash/Equity by Major Carmaker.

Note that $GM & $FCAU went BK in & #39;08 b/c of being net debt as they entered the crisis.

$TSLAQ

Chart-1: Net Cash/Equity by Major Carmaker.

Note that $GM & $FCAU went BK in & #39;08 b/c of being net debt as they entered the crisis.

$TSLAQ

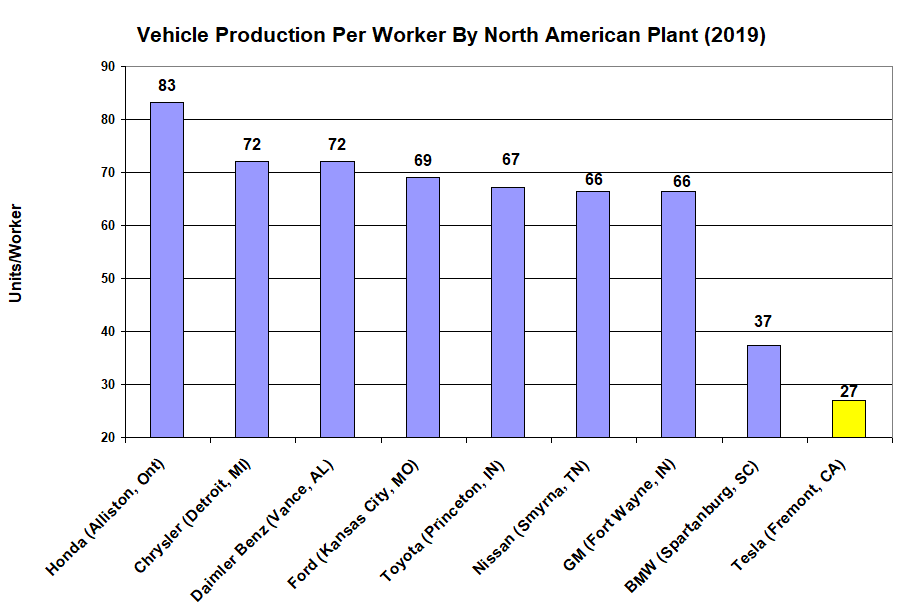

Chart-2: $TSLA also is the most inefficient carmaker in North America, on an output/worker basis.

$TSLAQ

$TSLAQ

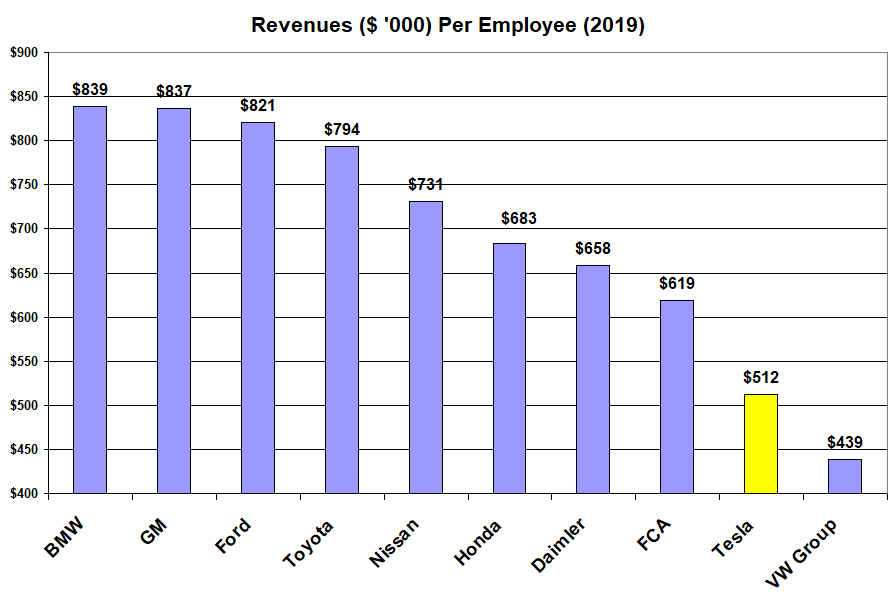

Chart-3: $TSLA also generates the least revenues per worker in the world while having a non-unionized workforce.

$TSLAQ

$TSLAQ

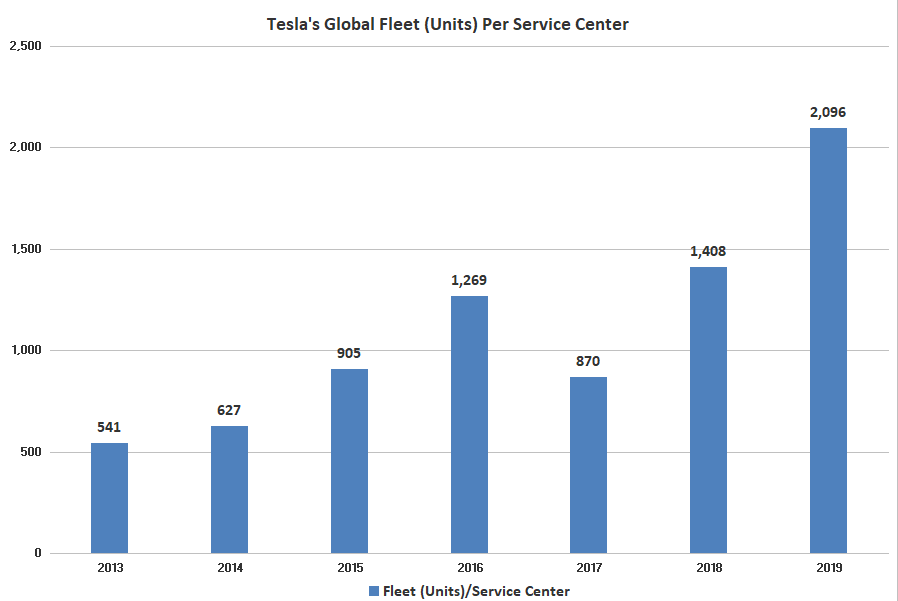

Chart-4: $TSLA will eventually have the worst brand value in the world b/c customers can& #39;t get their crappy Teslas fixed.

Tesla& #39;s global fleet (units) per Service Center is at an unsustainable high. And $TSLA doesn& #39;t have the money to build new Service Centers.

$TSLAQ

Tesla& #39;s global fleet (units) per Service Center is at an unsustainable high. And $TSLA doesn& #39;t have the money to build new Service Centers.

$TSLAQ

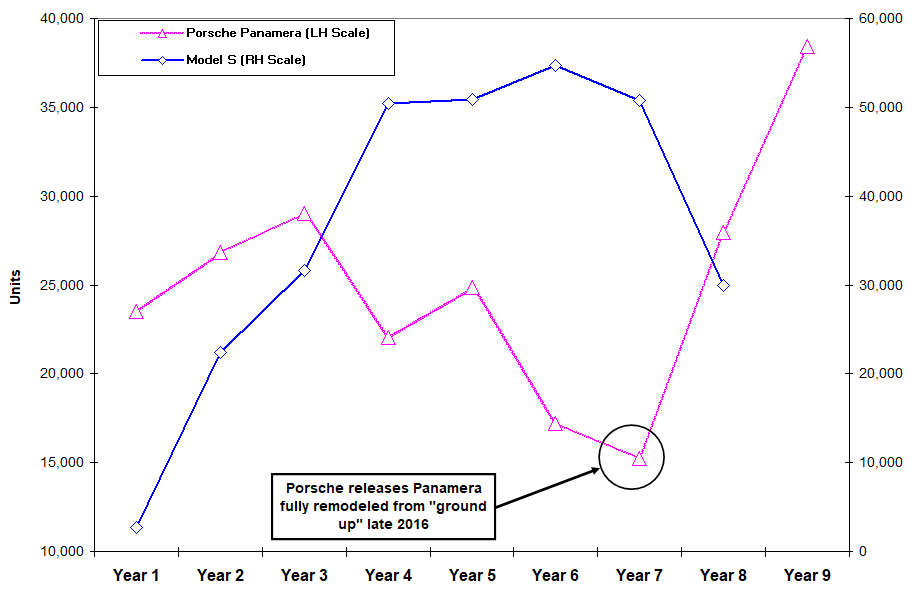

Chart-5: "Exponential Growth?" Ha! Look at the Model S vs Porsche& #39;s Panamera, which was getting killed by the Model S till Porsche conducted an expensive full-model change (>$700m). $TSLA can& #39;t afford that.

By 2021, all of $TSLA& #39;s line-up (ex Model Y) will be >3yrs old.

$TSLAQ

By 2021, all of $TSLA& #39;s line-up (ex Model Y) will be >3yrs old.

$TSLAQ

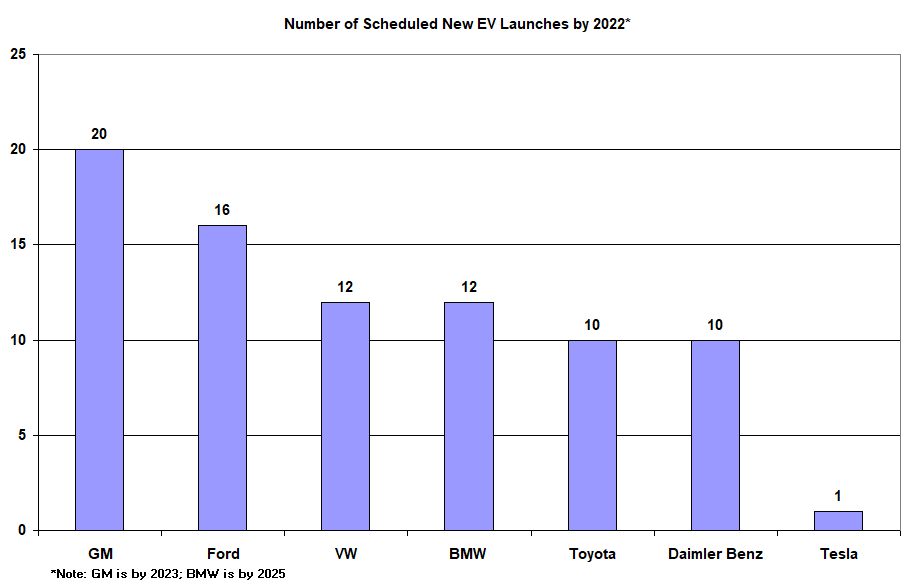

Chart-6: And by 2022, this is the kind of "EV rainshower" $TSLA is facing, without any money to develop the CyberTruck or whatever else @elonmusk has contrived for his new model pipeline.

$TSLAQ

$TSLAQ

Read on Twitter

Read on Twitter