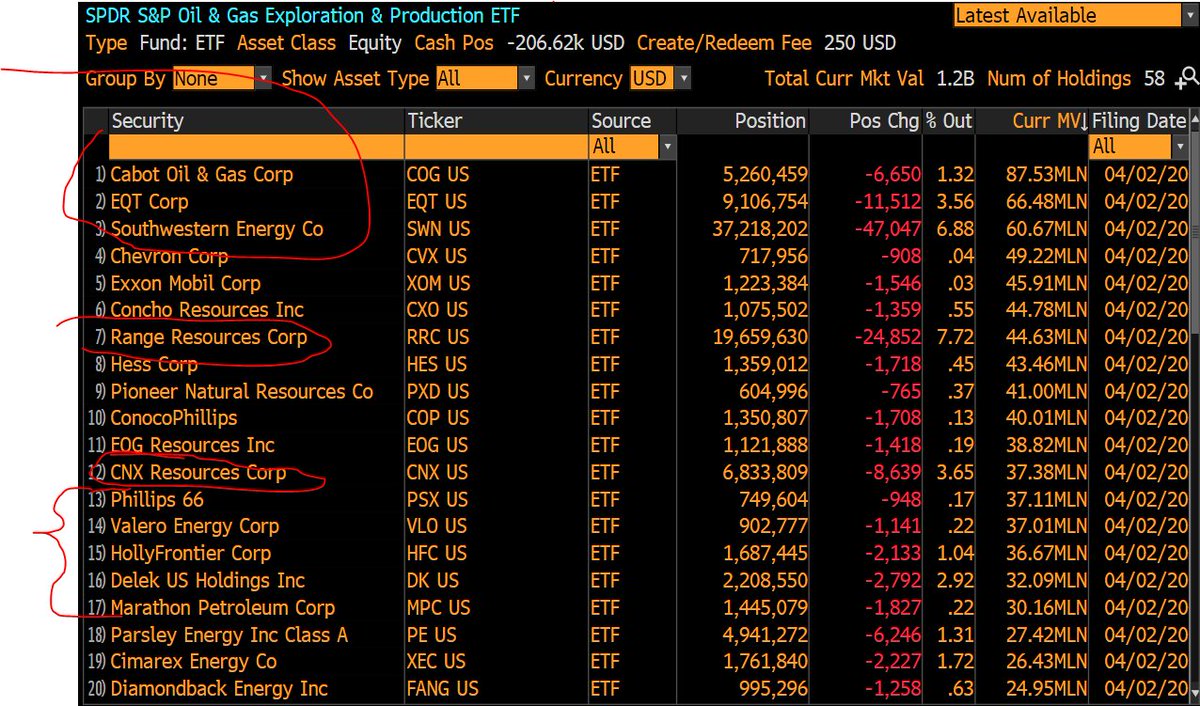

Energy ETFs are all fucked up. $XOP

They haven& #39;t rebalance since the crash.

People buy this shit cuz trump tweets about oil and #shaleout

Did they get oil exposure?

They haven& #39;t rebalance since the crash.

People buy this shit cuz trump tweets about oil and #shaleout

Did they get oil exposure?

You got gas.

And refining. So short oil.

And some integrated.

Then maybe you got some 50% BOE Permians at the bottom.

So maybe you got 10% of what you asked for

And refining. So short oil.

And some integrated.

Then maybe you got some 50% BOE Permians at the bottom.

So maybe you got 10% of what you asked for

Ranked by ownership in underlying.

Wondering why $WLL was up 80% today?

Why $CRC rallied almost a 100% over two days?

This POS is the largest shareholder in ever dead shale shitco.

Wondering why $WLL was up 80% today?

Why $CRC rallied almost a 100% over two days?

This POS is the largest shareholder in ever dead shale shitco.

If you buy $XLE do you get oil exposure?

No...

50% 2 majors is this really an ETF?

Then you pluck 1 or 2 E&Ps that get you some bbls.

But really your just getting downstream exposure whose margins got assholed over the #shaleout fiasco.

No...

50% 2 majors is this really an ETF?

Then you pluck 1 or 2 E&Ps that get you some bbls.

But really your just getting downstream exposure whose margins got assholed over the #shaleout fiasco.

Read on Twitter

Read on Twitter