What are the risks in #EmergingMarkets?

1/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Domestic financial conditions depend as much on global financial cycles as domestic monetary policy even with flexible FX. https://twitter.com/elinaribakova/status/1246244018301927428">https://twitter.com/elinariba...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Domestic financial conditions depend as much on global financial cycles as domestic monetary policy even with flexible FX. https://twitter.com/elinaribakova/status/1246244018301927428">https://twitter.com/elinariba...

1/

2/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/or

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/or

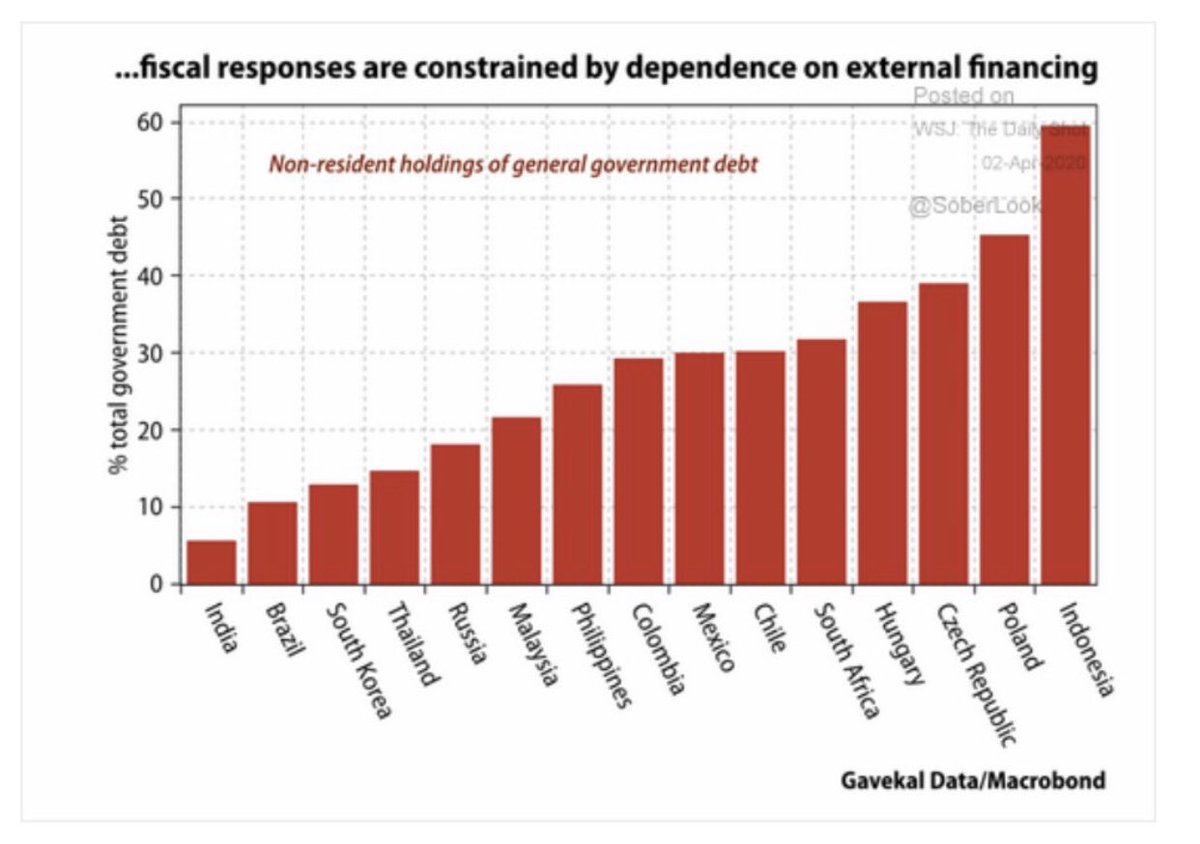

Due to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook

@helene_rey wrote about it extensively https://www.nber.org/papers/w21162 ">https://www.nber.org/papers/w2...

Due to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook

@helene_rey wrote about it extensively https://www.nber.org/papers/w21162 ">https://www.nber.org/papers/w2...

2/

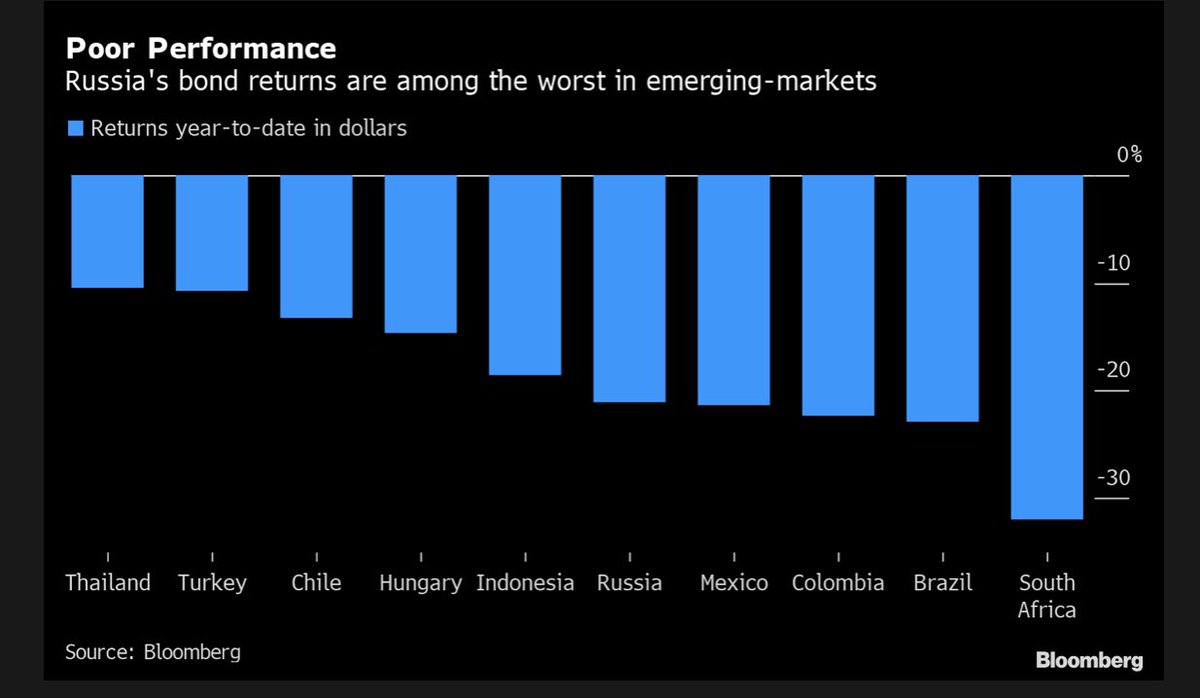

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal

3/

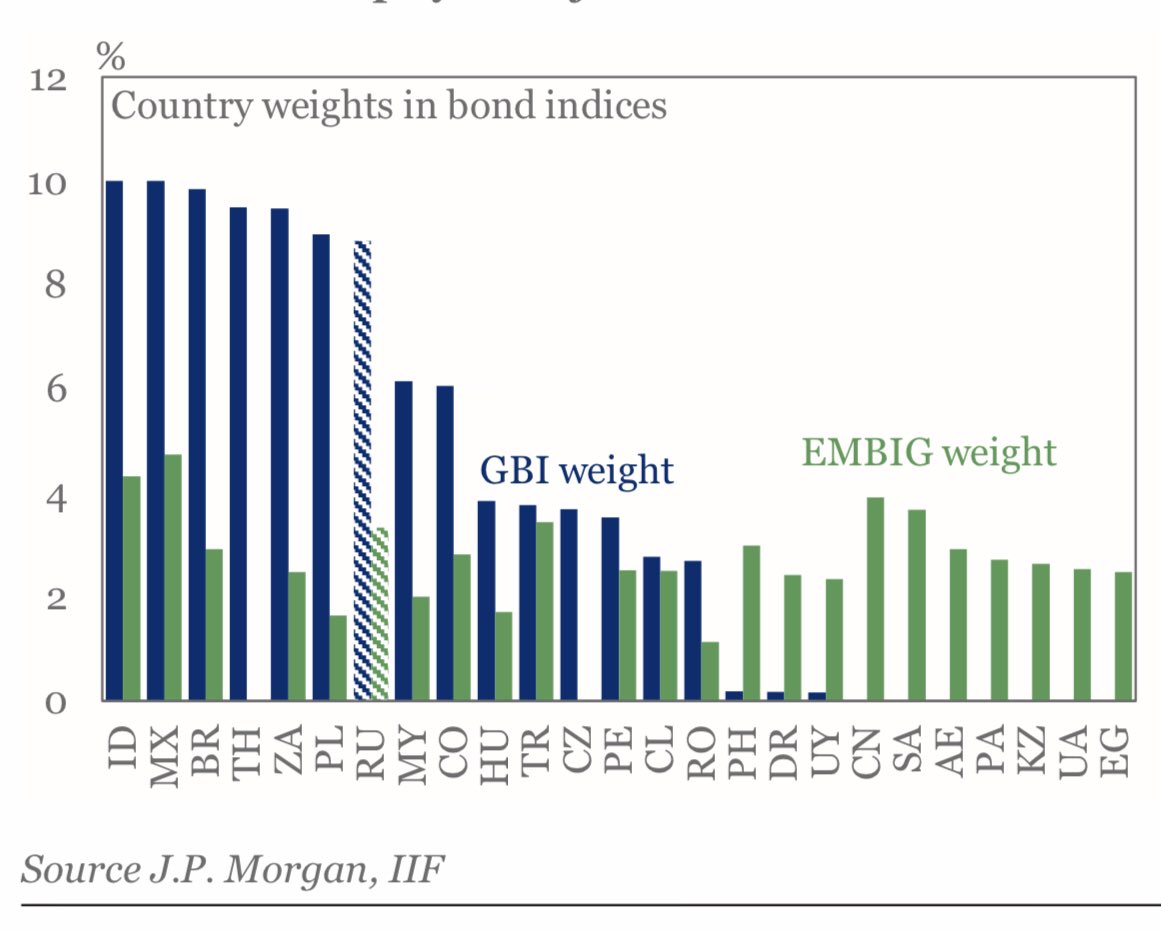

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above.

4/

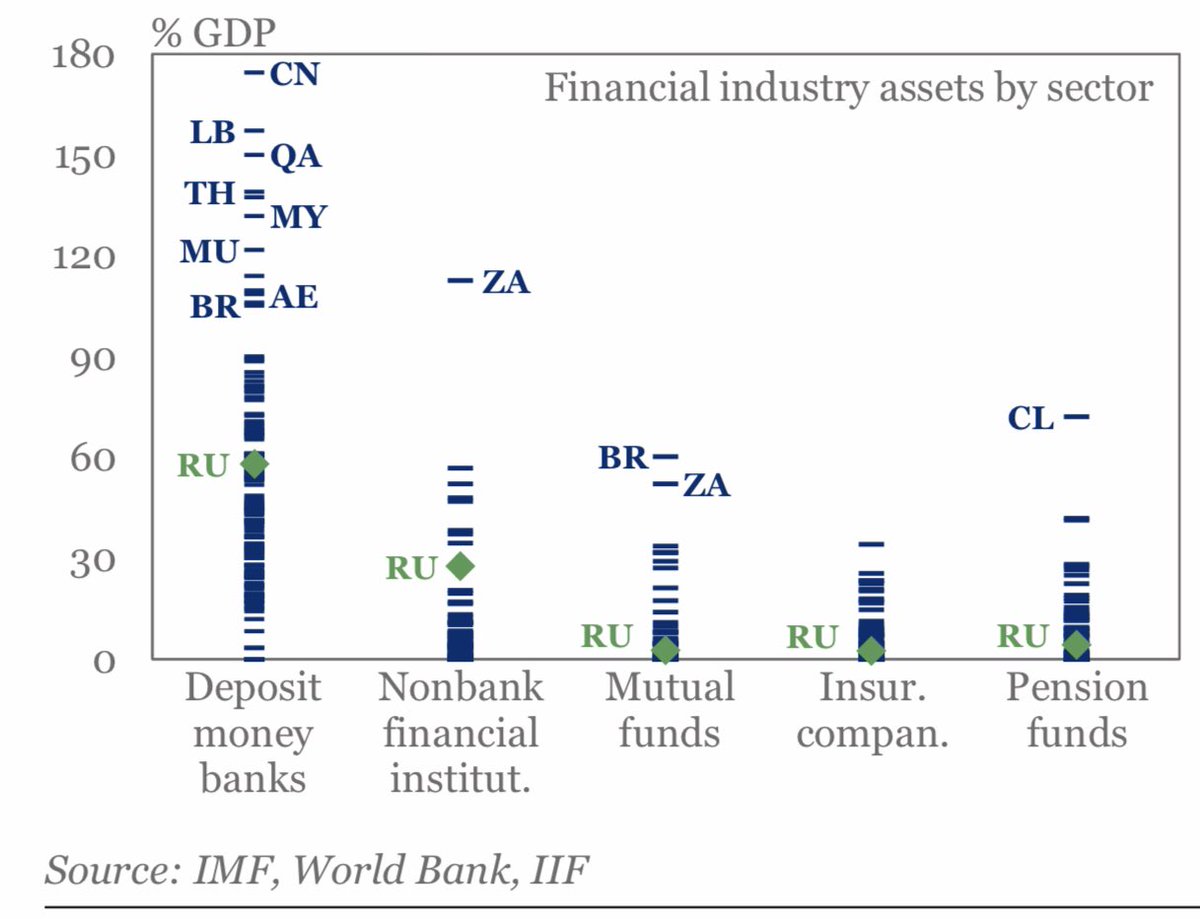

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Counties particularly exposed are those that

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Counties particularly exposed are those that

a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets

b) with banking systems already holding a lot of government debt as a share of their assets.

a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets

b) with banking systems already holding a lot of government debt as a share of their assets.

5/

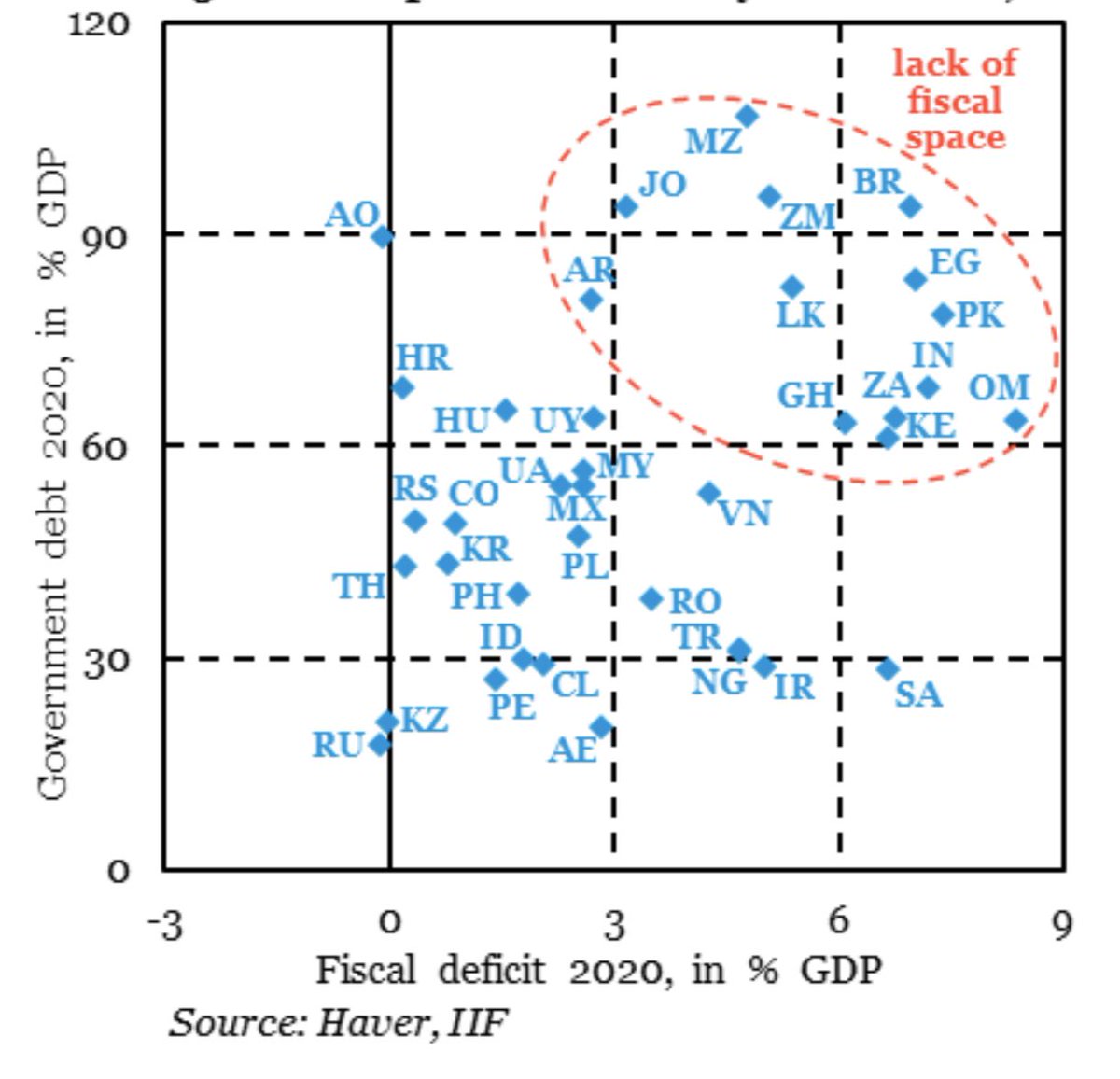

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?

Read on Twitter

Read on Twitter It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/orDue to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook @helene_rey wrote about it extensively https://www.nber.org/papers/w2..." title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/orDue to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook @helene_rey wrote about it extensively https://www.nber.org/papers/w2..." class="img-responsive" style="max-width:100%;"/>

It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/orDue to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook @helene_rey wrote about it extensively https://www.nber.org/papers/w2..." title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> It can be due to “original sin” i.e. borrowing in FX directly @upanizza and/orDue to large shares of FX holdings of local debt @Brad_Setser @adam_tooze @Gavekal via @SoberLook @helene_rey wrote about it extensively https://www.nber.org/papers/w2..." class="img-responsive" style="max-width:100%;"/>

As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal" title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal" class="img-responsive" style="max-width:100%;"/>

As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal" title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> As a result, many EMs cut rates, but instead see their government curves widening and steepening. @AndrianovaAnna @TheTerminal" class="img-responsive" style="max-width:100%;"/>

Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above." title="3/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above." class="img-responsive" style="max-width:100%;"/>

Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above." title="3/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Benchmark investing may exacerbate run for the exit from #EmergingMarkets. Here an example of weight allocation by some of the key globally followed benchmark for local currency (blue, GBI) and hard currency (green, EMBIG). It explains the holdings above." class="img-responsive" style="max-width:100%;"/>

Counties particularly exposed are those that a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets b) with banking systems already holding a lot of government debt as a share of their assets." title="4/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Counties particularly exposed are those that a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets b) with banking systems already holding a lot of government debt as a share of their assets." class="img-responsive" style="max-width:100%;"/>

Counties particularly exposed are those that a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets b) with banking systems already holding a lot of government debt as a share of their assets." title="4/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> Counties particularly exposed are those that a) lack deep domestic long term sources of savings, a great majority of #EmergingMarkets b) with banking systems already holding a lot of government debt as a share of their assets." class="img-responsive" style="max-width:100%;"/>

In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?" title="5/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?" class="img-responsive" style="max-width:100%;"/>

In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?" title="5/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow"> In the end, not only monetary policy effectiveness is at risk, but also room for fiscal spending. Who will buy their debt, when foreign investors flee?" class="img-responsive" style="max-width:100%;"/>