1/ THREAD: Real-time charts on the economic impact of COVID-19, using data from @Quandl and other sources both proprietary and public  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

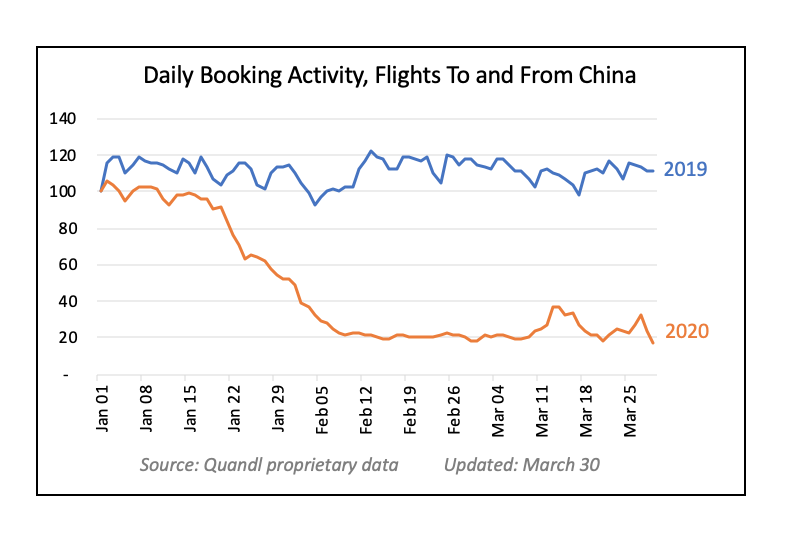

1/ Daily flight booking activity to and from China. Dropped >80% YOY in February. A couple of brief upticks in March but not robust or persistent; as of March 30, still down 85% YOY.

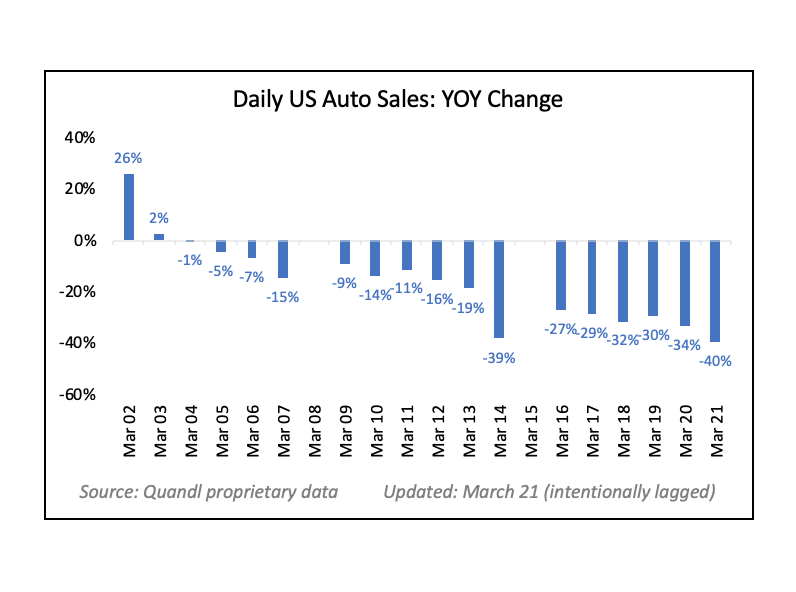

2/ Daily US auto sales inferred from auto insurance policy sales. Soft start to March followed by a dramatic decline in the second half of the month.

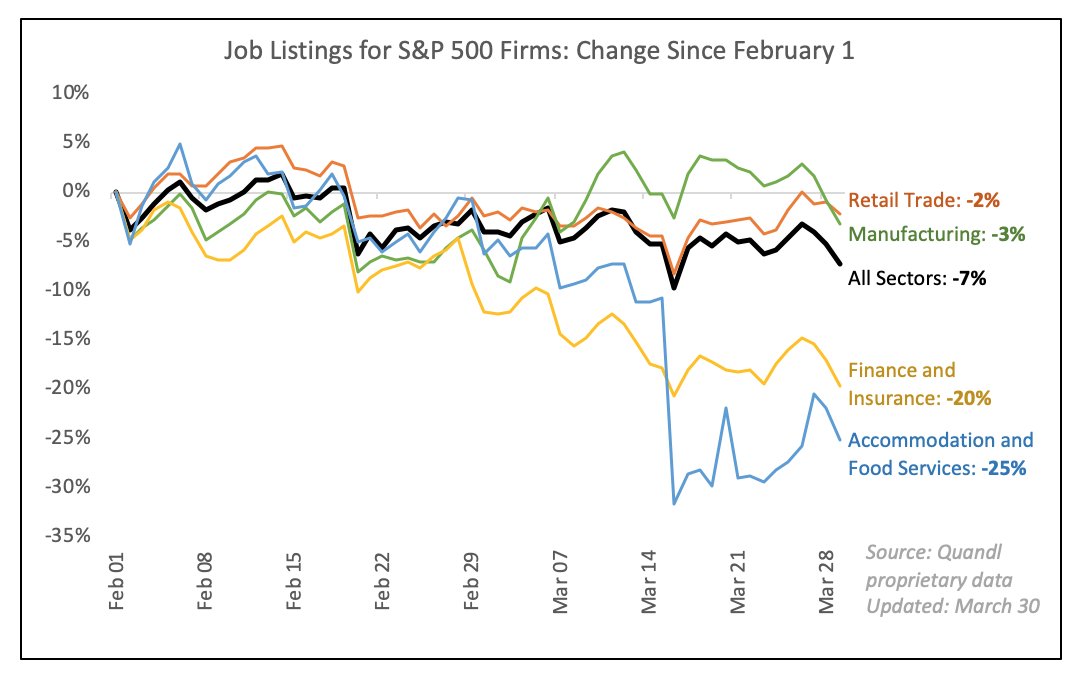

3/ Daily US job listings (a lagging indicator of downturns, but potentially a leading indicator of recoveries) have been trending down since mid February. The overall downward trend accelerated in March, accompanied by a sectoral divergence.

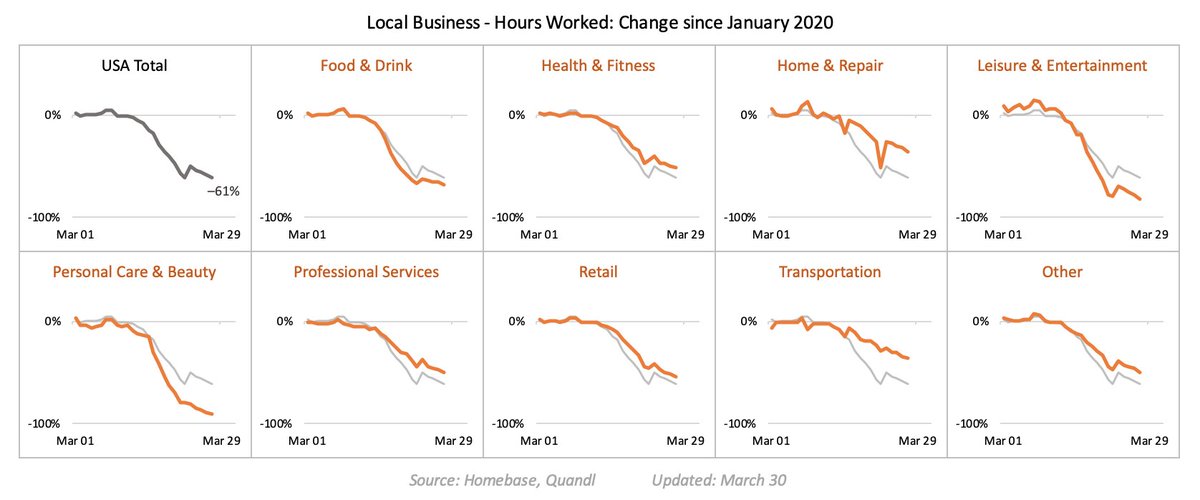

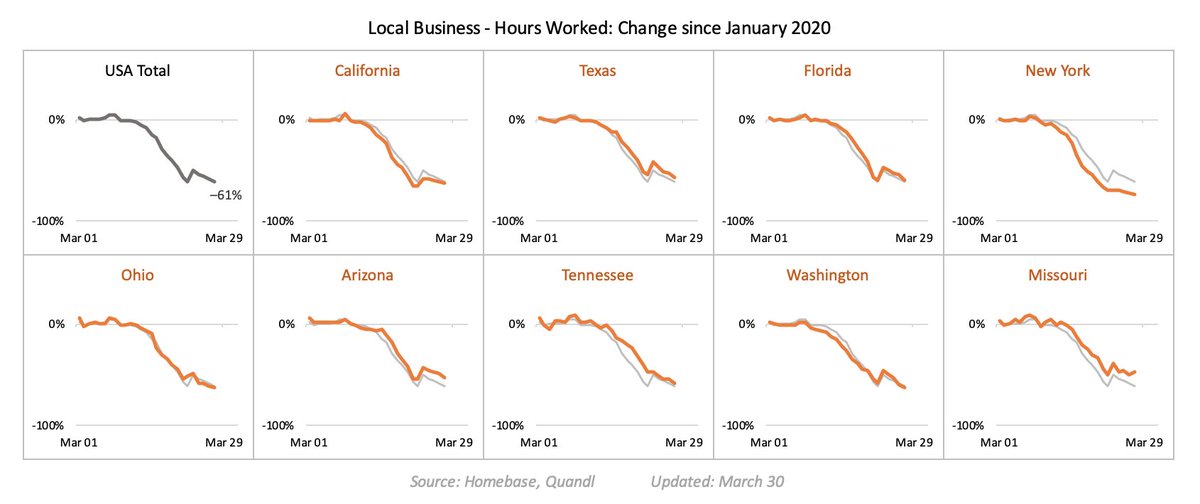

4/ Hours worked at local businesses by category, via Homebase. Personal care, beauty, leisure and entertainment all badly hit. Transportation, retail, professional services and (perhaps surprisingly) home & repair doing relatively less poorly. (but only relatively).

5/ The decline in hours worked is nation-wide. While states with high COVID case counts (such as New York) have seen more layoffs than states with low counts (such as Arizona), the difference is not dramatic. (Homebase data, shared with permission).

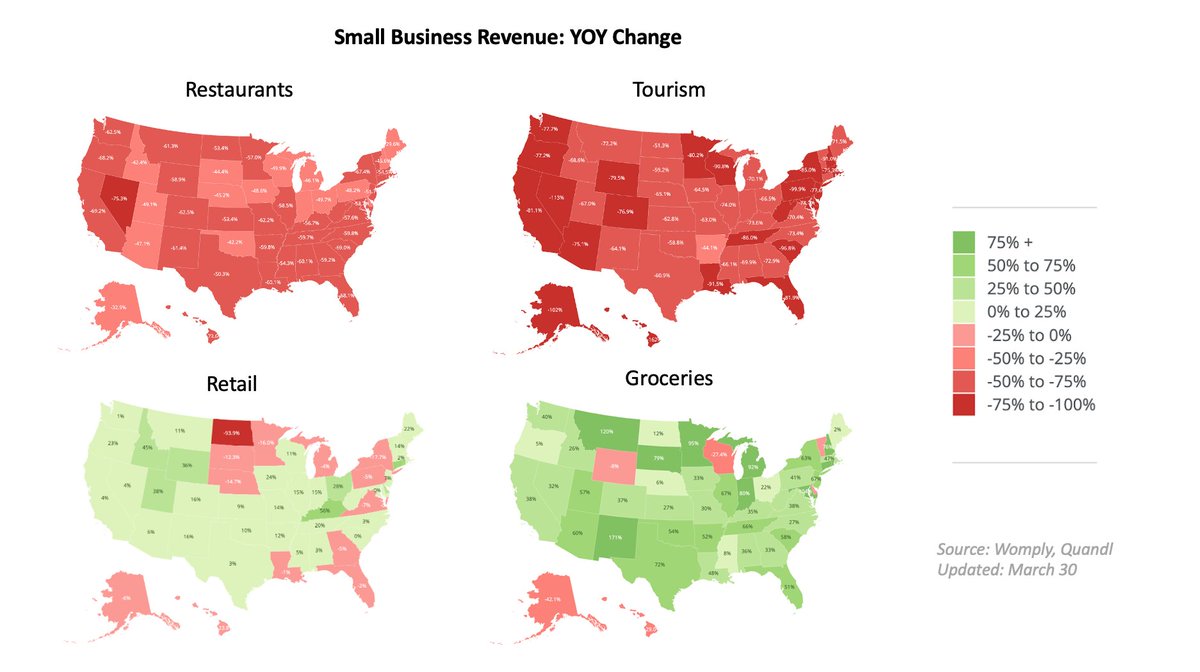

6/ Small biz customer transaction data from Womply: Restaurants in trouble everywhere, but especially NV (Las Vegas). Retail down in the upper midwest but reasonable elsewhere. Groceries strong across the country but surprisingly weak in WI and WY. (Shared with permission).

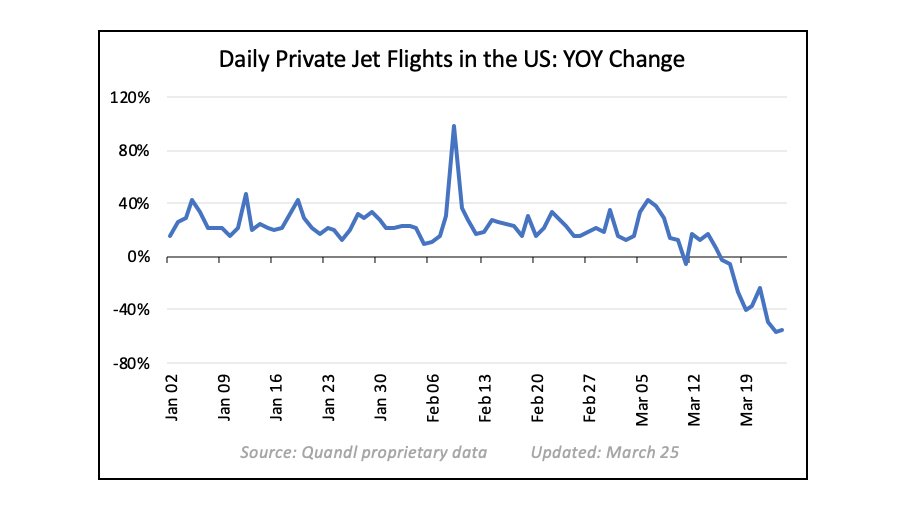

7/ Private jet traffic in the US declined later than many other indicators, holding steady till early March before dipping sharply.

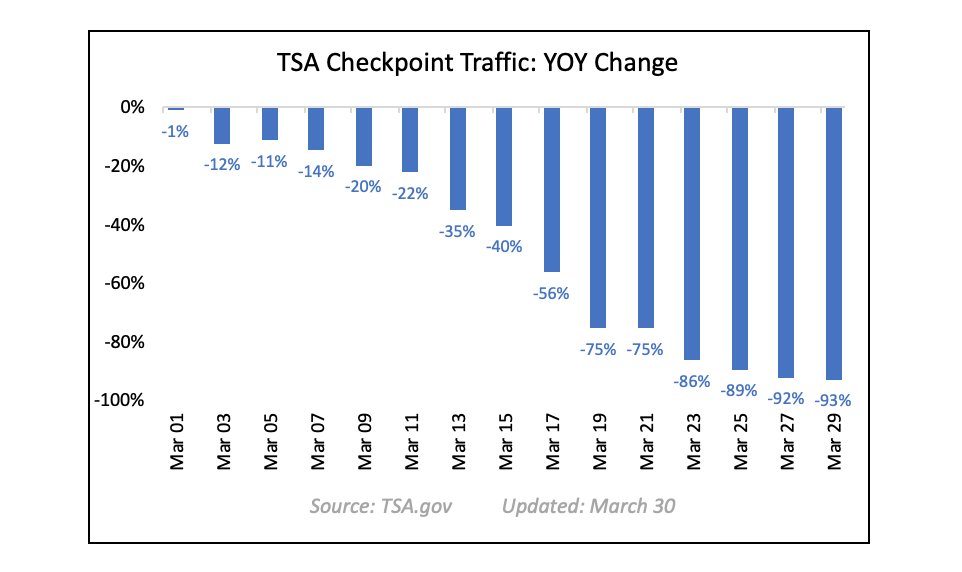

8/ Meanwhile, commercial air travel fell earlier and even more dramatically. By the end of March, the number of passengers passing through TSA checkpoints was down 93% YOY.

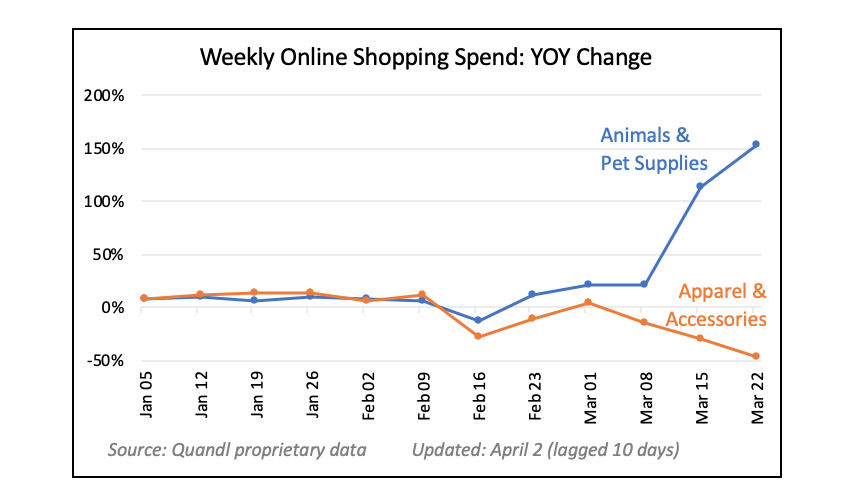

9/ E-commerce shows strong category divergences. Online sales of pet supplies exploded in March (+154% YOY), while sales of apparel collapsed (-47% YOY).

10/ Context for the above thread: I& #39;m the co-founder of @Quandl. We specialize in "alternative data": unusual and untapped sources of information about the economy. I& #39;ll be sharing more graphs on the real-time economic impact of COVID-19 over the coming weeks; stay tuned!

Next thread in this series: https://twitter.com/athomasq/status/1248287916020961285">https://twitter.com/athomasq/...

Read on Twitter

Read on Twitter