Alot of ppl are talking about the market and the interests of the US Gov being all about the corp/biz.

If you feel that way then check this out.

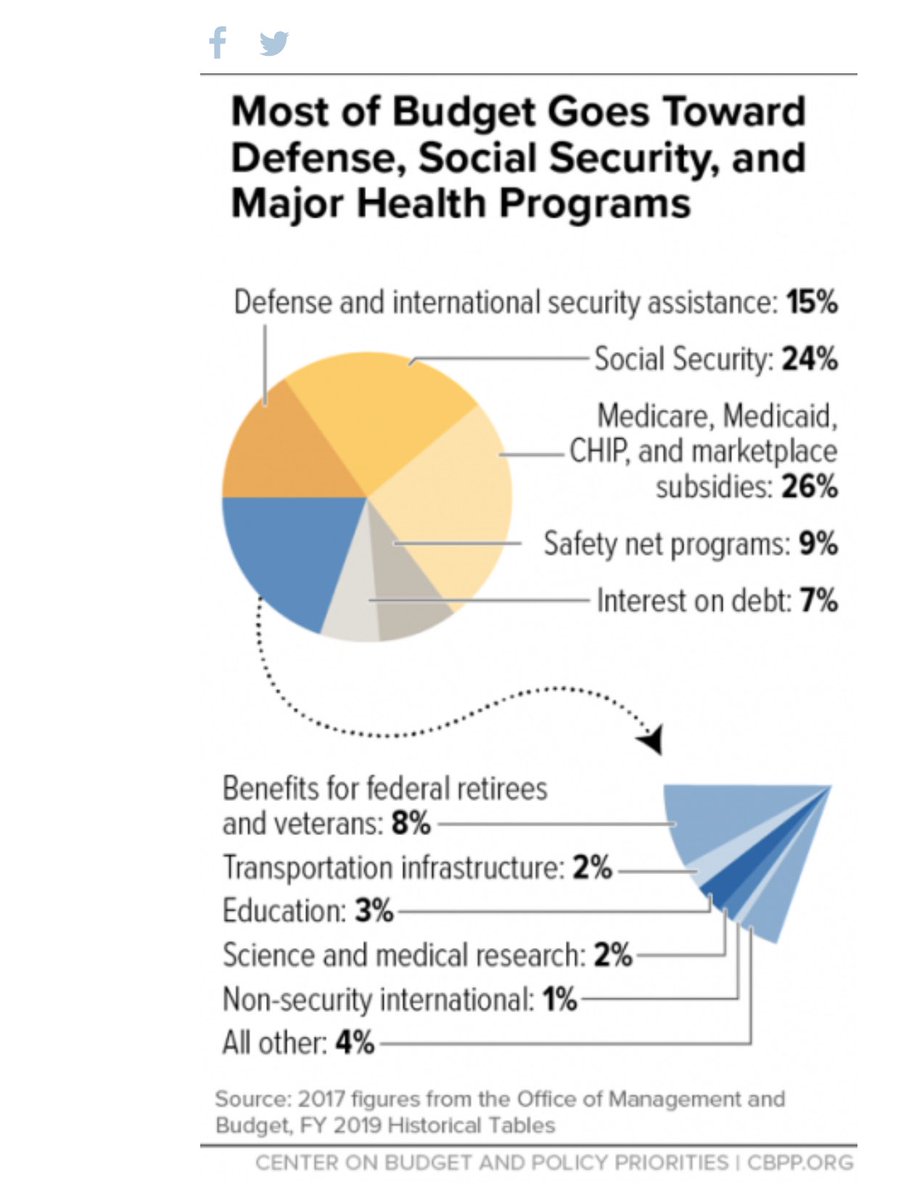

- The Gov spends YOUR taxes on whatever THEY deem appropriate and no it’s not majority “schools & roads.” You have no say so.

If you feel that way then check this out.

- The Gov spends YOUR taxes on whatever THEY deem appropriate and no it’s not majority “schools & roads.” You have no say so.

There are 3 ways you can control your money from a tax perspective.

When you see Bezos paying $1 in taxes, but giving $100M to food banks, etc. he’s bypassing federal taxes and giving how he wants.

Middle America can play that game at a smaller scale also.

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

When you see Bezos paying $1 in taxes, but giving $100M to food banks, etc. he’s bypassing federal taxes and giving how he wants.

Middle America can play that game at a smaller scale also.

Thread

Business Ownership:

- Your employer deducts your salary on their taxes. YOU pay “their” taxes on your salary (W2).

- Business or 1099 filers get tax deductions. Business owners can make BIG https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> and pay little to no taxes by deductions & offshoring taxation to their W2 employees.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> and pay little to no taxes by deductions & offshoring taxation to their W2 employees.

- Your employer deducts your salary on their taxes. YOU pay “their” taxes on your salary (W2).

- Business or 1099 filers get tax deductions. Business owners can make BIG

Financial Assets:

- You’re not paying taxes on your 401k/403b/457/401a/Traditional IRA right now, but as they grow and the IRS raises taxes then you’ll pay them BIG tax dollars. The gov FEASTS here.

- You’re not paying taxes on your 401k/403b/457/401a/Traditional IRA right now, but as they grow and the IRS raises taxes then you’ll pay them BIG tax dollars. The gov FEASTS here.

- Savings accts are taxed at your top tax bracket (10-37%) & growth sucks.

- Mutual Funds/ETFs/Stocks are taxes any from 0-20% and the growth has upside.

You keep and make more money investing than stockpiling cash.

- Mutual Funds/ETFs/Stocks are taxes any from 0-20% and the growth has upside.

You keep and make more money investing than stockpiling cash.

TAX FREE Financial Assets:

There are only TWO in U.S.

1) ROTH IRA/401k. - Retirement investment acct that is taxed today and never taxed again.

2) Cash Value Life Insurance* - grows tax free and can be used tax free without penalty. Growth is guaranteed. Mutual companies only.

There are only TWO in U.S.

1) ROTH IRA/401k. - Retirement investment acct that is taxed today and never taxed again.

2) Cash Value Life Insurance* - grows tax free and can be used tax free without penalty. Growth is guaranteed. Mutual companies only.

If you have tax free money then you have control of your money while alive and your heirs receive money from these assets tax free. No IRS hands in the pot.

You can give, donate, spend, etc however you like for family, community, organization, etc.

You can give, donate, spend, etc however you like for family, community, organization, etc.

Real Estate:

- You can buy and flip investment properties by utilizing a 1031 exchange which allows you to make money through sell and not pay taxes.

- You can sell a residential property and not pay tax on profit of up $250k if you’re single. Up to $500k if you’re married.

- You can buy and flip investment properties by utilizing a 1031 exchange which allows you to make money through sell and not pay taxes.

- You can sell a residential property and not pay tax on profit of up $250k if you’re single. Up to $500k if you’re married.

Understanding and operating with efficiency in the Retirement/Investment Accounts, Tax Free Assets, Business Ownership, and Real Estate will change lives and perspective.

The US Tax Code was written to explain how not to pay taxes. Understand and win.

The US Tax Code was written to explain how not to pay taxes. Understand and win.

Read on Twitter

Read on Twitter