March’s huge job losses are just the tip of the iceberg of what’s to come

https://www.epi.org/press/marchs-huge-job-losses-are-just-the-tip-of-the-iceberg-of-whats-to-come/

https://www.epi.org/press/mar... href="https://twtext.com//hashtag/COVID19"> #COVID19 #coronavirus #JobsReport #JobsDay

https://www.epi.org/press/marchs-huge-job-losses-are-just-the-tip-of-the-iceberg-of-whats-to-come/

This morning’s Bureau of Labor Statistics ( #BLS) data show that total payroll employment contracted by a whopping 701,000 jobs in March, including a loss of 713,000 private-sector jobs.

2/n

2/n

As the #coronavirus pandemic ripples through the economy, the monthly jobs numbers released today show just the leading edge of the deep recession we are certainly now in (these numbers only refer to the payroll period containing March 12, before shutdowns accelerated).

3/n

3/n

This is the first month in nearly ten years—since September 2010—in which the U.S. economy lost jobs. We did see an expected uptick in hiring in the federal government as temporary hiring for the 2020 Census ramped up (+ 17,000).

4/n

4/n

Despite already being genuinely out-of-date, today’s data provide some important information about the early days of the labor market crisis we are now in, including which sectors were the very first-affected, most vulnerable sectors.

5/n

5/n

In particular, leisure and hospitality lost 459,000 jobs, mostly in food services and drinking places, down 417,000 in March.

This leisure and hospitality job loss is the largest 1 month decline in the history of that series, since 1939!

https://www.bls.gov/web/empsit/ceshighlights.pdf

6/n">https://www.bls.gov/web/empsi...

This leisure and hospitality job loss is the largest 1 month decline in the history of that series, since 1939!

https://www.bls.gov/web/empsit/ceshighlights.pdf

6/n">https://www.bls.gov/web/empsi...

Temporary help also lost 50,000 jobs, the largest monthly decline in over 10 years (since April 2009).

7/n

7/n

Average weekly hours are down for March, as employers began to reduce hours worked and lay off their staff. Average weekly hours has hovered around 34.4 hours per week over the last year and fell to 34.2 hours per week in March, reflecting the first signs of weakness.

8/n

8/n

Average weekly hours fell overall, but particularly in leisure and hospitality, from 25.8 in February to 24.4 in March.

9/n

9/n

In March, the index of aggregate weekly hours fell 1.1%, reflecting losses in both weekly hours and overall payroll employment.

(Aggregate weekly hours are the product of estimates of average weekly hours and employment.)

10/n

(Aggregate weekly hours are the product of estimates of average weekly hours and employment.)

10/n

Nominal wages grew a solid 3.1% over the year. At turning points in the economy, compositional effects tend to swamp any changes in wages within sectors. This is exacerbated by the fact that many workers who had already lost their jobs by mid-March are in lower wage sectors.

11/n

11/n

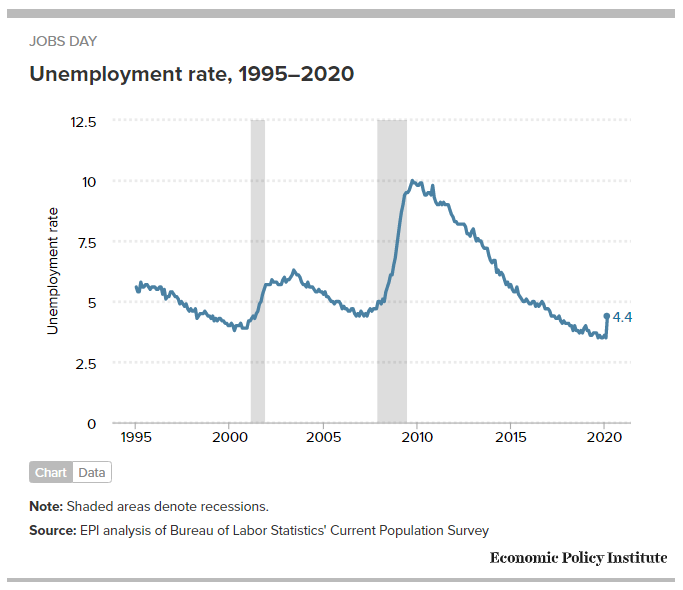

The household survey shows initial signs of weakness as well. The unemployment rate rose from 3.5% in February to 4.4% in March. This is the highest the unemployment we’ve seen in nearly three years. The last time the unemployment rate hit 4.4% was in August 2017.

12/n

12/n

The unemployment rate for Black, Hispanic, and White workers did not change much in March. Unfortunately, I expect significant increases in coming months as the recession continues to take hold.

13/n

13/n

People working part-time for economic reasons rose as employers cut work hours; 1.4 million more workers were working part time because their hours had been reduced or they were unable to find full-time jobs.

14/n

14/n

Labor force participation and the employment-to-population ratio fell in March, dropping 0.7 and 1.1 percentage points, respectively. If participation hadn’t fallen, the unemployment rate would be even higher.

15/n

15/n

During the COVID-19 pandemic and this period of social distancing to flatten the curve, I expect the unemployment rate to understate weakness as would-be workers follow the advice of health experts and stay home instead of actively seeking other employment.

16/n

16/n

Because of COVID-19 and social distancing measures, I expect the unemployment rate to understate labor market weakness because if an out-of-work individual is not actively seeking work, they are not counted as unemployed.

https://www.youtube.com/watch?v=Vw9K07eyi9A

17/n">https://www.youtube.com/watch...

https://www.youtube.com/watch?v=Vw9K07eyi9A

17/n">https://www.youtube.com/watch...

When policymakers determine when to turn off any relief or stimulus, they should use measures aside from the unemployment rate, such as the employment-to-population ratio as the policy trigger.

https://www.epi.org/blog/the-unemployment-rate-is-not-the-right-measure-to-make-economic-policy-decisions-around-the-coronavirus-driven-recession/

18/n">https://www.epi.org/blog/the-...

https://www.epi.org/blog/the-unemployment-rate-is-not-the-right-measure-to-make-economic-policy-decisions-around-the-coronavirus-driven-recession/

18/n">https://www.epi.org/blog/the-...

Today& #39;s losses are huge, but it& #39;s nothing compared to what we expect to see from #COVID-19 in the next #JobsReport on May 8.

19/n

19/n

Today’s data, combined with yesterday’s unprecedented unemployment insurance claims, show that Congress must act quickly to mitigate as much of the economic harm from the coronavirus as possible.

https://www.epi.org/press/marchs-huge-job-losses-are-just-the-tip-of-the-iceberg-of-whats-to-come/

https://www.epi.org/press/mar... href=" https://www.epi.org/press/a-portrait-of-disaster-initial-ui-claims-jump-from-211000-to-6-6-million-in-three-weeks/

20/n">https://www.epi.org/press/a-p...

https://www.epi.org/press/marchs-huge-job-losses-are-just-the-tip-of-the-iceberg-of-whats-to-come/

20/n">https://www.epi.org/press/a-p...

My colleagues @metaCoop @JuliaWolfe94 @EconomicPolicy estimate that nearly 20 million jobs could be lost by July, and many more could be lost if further action isn’t taken.

https://www.epi.org/blog/nearly-20-million-jobs-lost-by-july-due-to-the-coronavirus/

21/n">https://www.epi.org/blog/near...

https://www.epi.org/blog/nearly-20-million-jobs-lost-by-july-due-to-the-coronavirus/

21/n">https://www.epi.org/blog/near...

Congress should craft another relief package that includes a larger infusion of state and local aid, continues cash assistance to households, and extends the unemployment insurance provisions in the earlier bill with explicit triggers-off tied to economic conditions.

22/n

22/n

Congress should provide additional funds to strengthen incentives for employers to keep workers on payroll through better “short time compensation” capability so fewer families face the consequences of job loss and so workers are ready to jump back in to work post-pandemic.

23/23

23/23

Read on Twitter

Read on Twitter #COVID19 #coronavirus #JobsReport #JobsDay" title="March’s huge job losses are just the tip of the iceberg of what’s to come https://www.epi.org/press/mar... href="https://twtext.com//hashtag/COVID19"> #COVID19 #coronavirus #JobsReport #JobsDay">

#COVID19 #coronavirus #JobsReport #JobsDay" title="March’s huge job losses are just the tip of the iceberg of what’s to come https://www.epi.org/press/mar... href="https://twtext.com//hashtag/COVID19"> #COVID19 #coronavirus #JobsReport #JobsDay">

#COVID19 #coronavirus #JobsReport #JobsDay" title="March’s huge job losses are just the tip of the iceberg of what’s to come https://www.epi.org/press/mar... href="https://twtext.com//hashtag/COVID19"> #COVID19 #coronavirus #JobsReport #JobsDay">

#COVID19 #coronavirus #JobsReport #JobsDay" title="March’s huge job losses are just the tip of the iceberg of what’s to come https://www.epi.org/press/mar... href="https://twtext.com//hashtag/COVID19"> #COVID19 #coronavirus #JobsReport #JobsDay">