Can the negative supply shock from this pandemic lead to a demand deficient recession?

Yes. Together with the brilliant Veronica Guerrieri, Guido Lorenzoni and Ludwig Straub, I explore the conditions for this to happen in this new paper.

https://economics.mit.edu/files/19351

(start">https://economics.mit.edu/files/193... thread)

Yes. Together with the brilliant Veronica Guerrieri, Guido Lorenzoni and Ludwig Straub, I explore the conditions for this to happen in this new paper.

https://economics.mit.edu/files/19351

(start">https://economics.mit.edu/files/193... thread)

Everyone agrees (despite claims to the contrary!) that the pandemic should sharply reduce activity. It& #39;s just not healthy to try to keep the economy going like before.

But once you move past this basic consensus there are disagreements.

But once you move past this basic consensus there are disagreements.

Reasonable people debate: is this purely a supply shock or also a demand shock? This matters. It affects the macro policy response, monetary and fiscal.

Our perspective: demand is not exogenous and a negative supply shock can trigger too strong a response in demand.

Our perspective: demand is not exogenous and a negative supply shock can trigger too strong a response in demand.

Supply ---> Demand

To thinking about this relation deep we need to go beyond the most basic macro models. Sectoral heterogeneity is important. So are financial frictions, for households, as well as firms.

To thinking about this relation deep we need to go beyond the most basic macro models. Sectoral heterogeneity is important. So are financial frictions, for households, as well as firms.

This is, most basic macro model gives you exact opposite: negative supply shock does not reduce demand enough! Representative agent single-sector model may recommend raising interest rates right now!

Fortunately, the policy discussions from all sides have been much wiser.

Fortunately, the policy discussions from all sides have been much wiser.

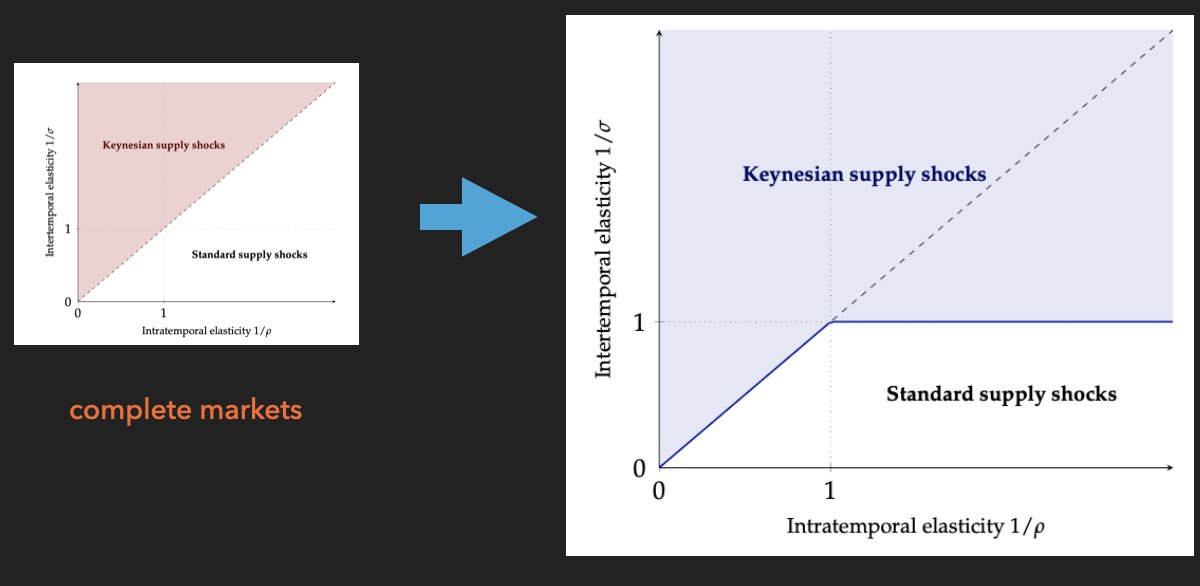

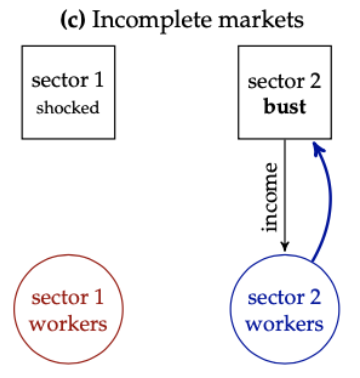

This chart summarizes some of our results. Moving towards more realism from left to right, from top to bottom.

This surprised us: financial frictions (cash-constrained consumers) isn& #39;t enough to get things going and get demand deficiency.

This surprised us: financial frictions (cash-constrained consumers) isn& #39;t enough to get things going and get demand deficiency.

It is important to think of different sectors, the shock hits asymmetrically. As @MacRoweNick has put it: it& #39;s not the same if we all lose 50%, than if half of us to lose 100%!

This is true even without credit frictions, but even more true with credit frictions (an interaction).

This is true even without credit frictions, but even more true with credit frictions (an interaction).

The parameter space where we you predict demand deficiency (we call it Keynesian Supply Shock) grows, when markets are incomplete:

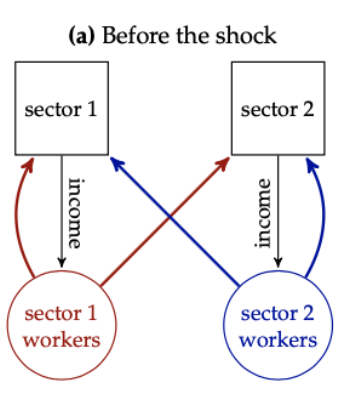

Here is the intuition. Start with the healthy economy. The chart shows two sectors. Different workers work in each, but consume from both.

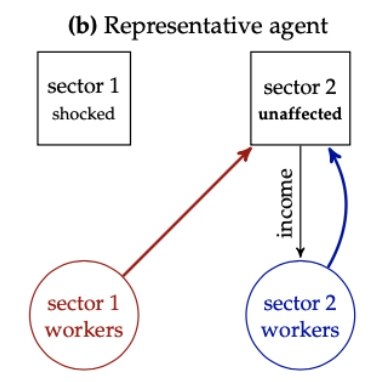

But now shut down sector 1. For the idilic representative agent this looks like this.

Although demand and work in sector 2 may fall, workers hit in sector 1 still buy stuff from 2, because they are perfectly insured.

Although demand and work in sector 2 may fall, workers hit in sector 1 still buy stuff from 2, because they are perfectly insured.

Read on Twitter

Read on Twitter