Coronavirus: what is the impact on European energy markets?

@AuroraER_Oxford released a report and webinar with @bcg earlier this week on this topic.

Email contact@auroraer.com if you& #39;d like copy of the slides or recording.

Key insights here in THREAD

@AuroraER_Oxford released a report and webinar with @bcg earlier this week on this topic.

Email contact@auroraer.com if you& #39;d like copy of the slides or recording.

Key insights here in THREAD

COVID-19 has had huge impact on stock markets, although utilities have generally fared better than the market as a whole.

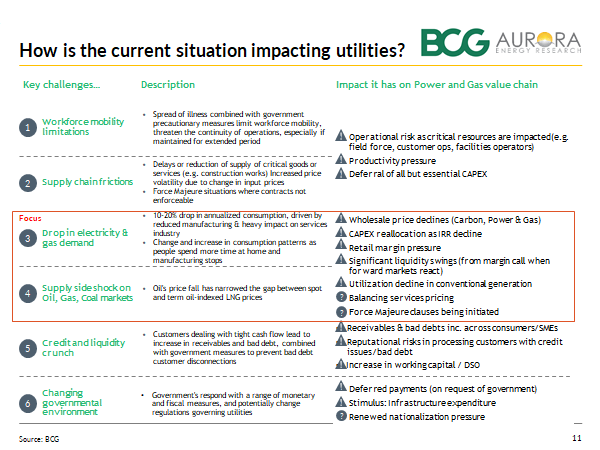

COVID-19 impacts the energy sector in a number of ways including workforce mobility, supply chain impacts, lower power demand, commodity market shocks, credit and liquidity issues, and changes in the overall Government/regulatory environment.

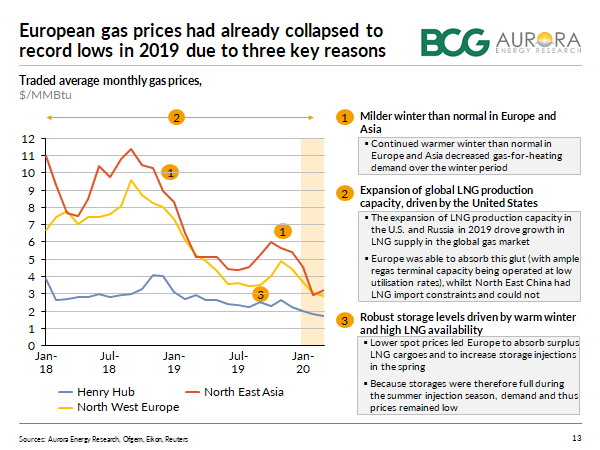

Gas prices were already low before the impact of COVID-19, as a result of mild winters in 2018-19 and 2019-20, and a global LNG supply glut. COVID has pushed prices down further in Feb-March.

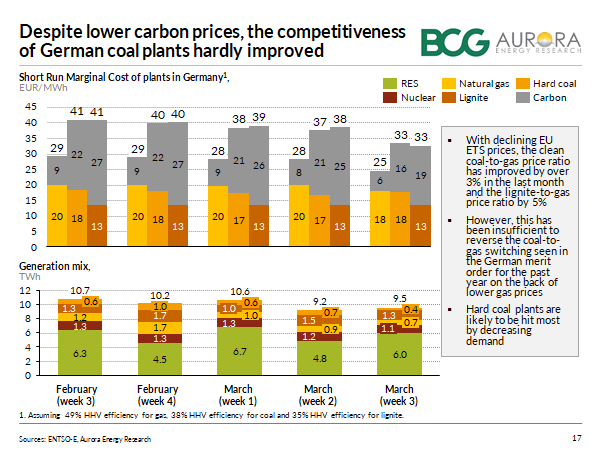

COVID-19 has put downward pressure on ETS carbon prices due to falling demand for permits in power, industry and aviation. Despite this German coal stations are still uncompetitive relative to gas stations due to the low prevailing gas prices.

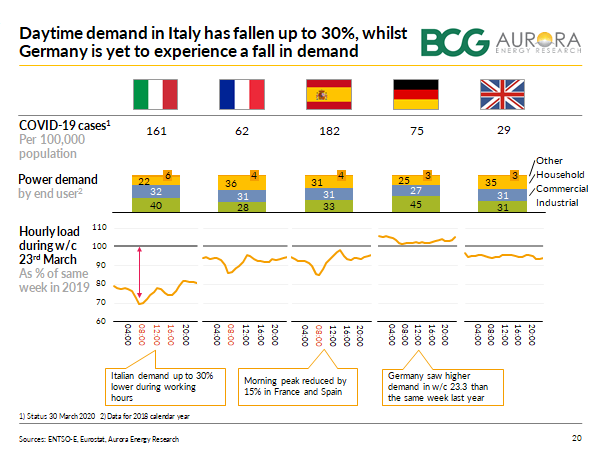

Power demand is down in many European countries with Italy and France seeing the most significant decreases to date. Demand has fallen most during working hours. By contrast, power demand in Germany hasn& #39;t yet taken a hit as a result of Coronavirus.

Coronavirus-related impacts drove GB wholesale power prices to the lowest level in a decade in March 2020 - as a result of low gas prices and falling demand.

Looking forward, power generators in GB should expect to see a 20-25% reduction in margins in 2020 relative to 2019 - with gas CCGTs and solar PV the worst hit.

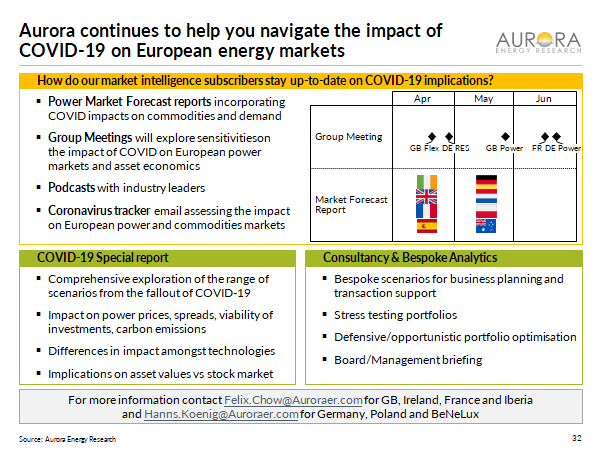

. @AuroraER_Oxford will be continuing to analyse the impacts of COVID on European power markets through our regular research reports and bespoke scenarios analysis. Get in touch for more details.

Read on Twitter

Read on Twitter