1/THREAD: WHY OPEC+ CUTS ARE IRRELEVANT AND MARKET OBSESSION WITH THEM IS IRRATIONAL

Production cuts are only effective and meaningful when they achieve a balance between supply and demand.

When this balance can be achieved by voluntary cuts, forced balancing by crashing prices

Production cuts are only effective and meaningful when they achieve a balance between supply and demand.

When this balance can be achieved by voluntary cuts, forced balancing by crashing prices

2/ can be avoided.

No such opportunity exists here. OPEC+ was previously unable to agree on a 0.5mm bbl cut. We face an estimated 20mm bpd demand destruction.

What is CERTAIN to happen, regardless of any OPEC+ action or inaction, is that more oil will be produced than we have

No such opportunity exists here. OPEC+ was previously unable to agree on a 0.5mm bbl cut. We face an estimated 20mm bpd demand destruction.

What is CERTAIN to happen, regardless of any OPEC+ action or inaction, is that more oil will be produced than we have

3/ storage capacity to absorb.

The UNAVOIDABLE CERTAINTY is that eventually prices will crash, timespreads will explode as spare storage capacity goes to zero, and production shut-ins will be forced.

The only way to prevent the above from happening would be a collective

The UNAVOIDABLE CERTAINTY is that eventually prices will crash, timespreads will explode as spare storage capacity goes to zero, and production shut-ins will be forced.

The only way to prevent the above from happening would be a collective

4/ production cut of 20MM BBL. That simply isn& #39;t plausible because it would require Russia, Saudi Arabia, and USA to all voluntarily cut production by about 50%, something they simply won& #39;t be willing to do voluntarily because it& #39;s politically not viable in any of those countries

5/ Therefore, under these circumstances, expectations that OPEC+ is going to do anything meaningful to support oil prices is absurd.

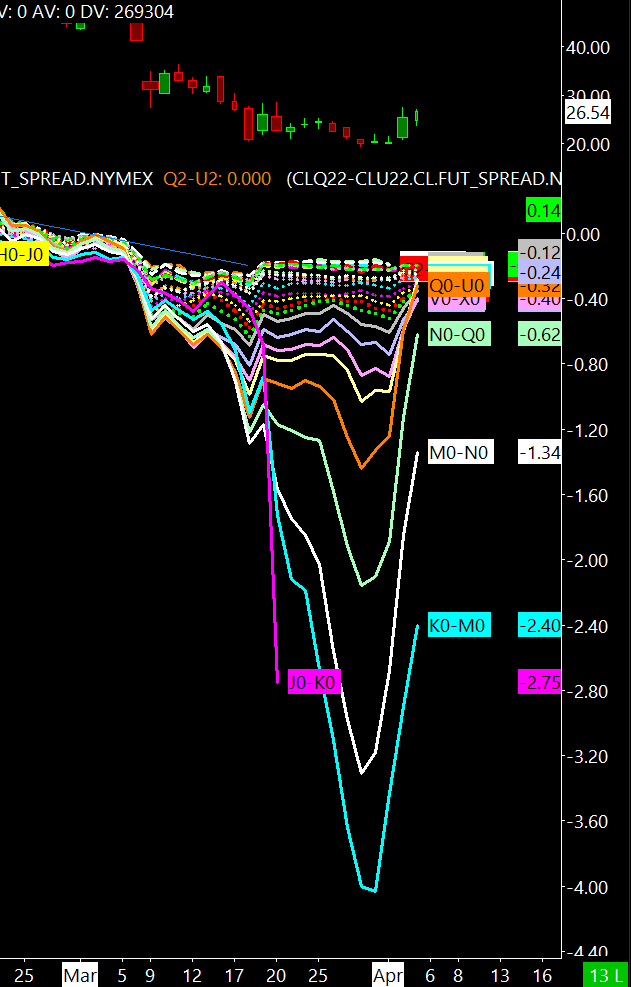

But the real story is not in flat prices, but in time spreads. Look at WTI timespreads in this chart. Each 1-month timespread is a proxy for

But the real story is not in flat prices, but in time spreads. Look at WTI timespreads in this chart. Each 1-month timespread is a proxy for

6/ storage demand at the time of expiry of the first contract in the spread.

What the market is doing (against all logic and reason) is breathing a huge sigh of relief that storage won& #39;t be as tight as first feared come late April (K0/M0 expiry), late May (M0/N0) or

What the market is doing (against all logic and reason) is breathing a huge sigh of relief that storage won& #39;t be as tight as first feared come late April (K0/M0 expiry), late May (M0/N0) or

7/ late June (N0/Q0). That just plain doesn& #39;t make any sense. The only way to avoid an oil storage crisis in this timeframe would be to cut 20MM BPD of global production. Anyone who thinks OPEC+ could orchestrate that is crazy.

The storage crisis is unavoidable and certain.

The storage crisis is unavoidable and certain.

8/ These timespreads are certain to widen (go down in price) when that storage crisis occurs. Yet they are rallying briskly this morning on ridiculously misplaced hopes that somehow OPEC+ will avert a global oil storage crisis.

9/ I therefore contend that shorting these spreads is the best trade on earth right now

M/N and N/Q are most ripe, because by the time M/N expires in late May, spare storage will be non-existent. K/M expires in Late April and will be the first the blow out to record wides. #OOTT

M/N and N/Q are most ripe, because by the time M/N expires in late May, spare storage will be non-existent. K/M expires in Late April and will be the first the blow out to record wides. #OOTT

10/ I welcome critique if anyone thinks I& #39;m missing something here.

Read on Twitter

Read on Twitter