TESLA - TAKING A FRESH LOOK AT 2020

The halting of vehicle and battery cell production at Fremont and GF1 in March 2020 and the prospect of an extended shutdown will naturally change the shape of planning for 2020 production and sales

What might we reasonably expect for 2020 ?

The halting of vehicle and battery cell production at Fremont and GF1 in March 2020 and the prospect of an extended shutdown will naturally change the shape of planning for 2020 production and sales

What might we reasonably expect for 2020 ?

The interruption breaks the historical quarterly cadence

- and maybe that’s a good thing

Let’s start with a clean sheet of paper and see what we can learn

1. TODAY

- there are about 10~15k excess cars in inventory to sell

- GF3 might be making 2~3k cars per week

- and maybe that’s a good thing

Let’s start with a clean sheet of paper and see what we can learn

1. TODAY

- there are about 10~15k excess cars in inventory to sell

- GF3 might be making 2~3k cars per week

2. GF3 PRODUCTION MODEL 3

Let us assume that GF3 is just focused on M3 production and MY only becomes a factor at the end of the year

Q2 production at 2-3k per week = 26~39k

Q3 production at 3k per week = 39k

Q4 production at 3k per week = 39k

GF3 Q2-Q4 2020 TOTAL = 104~117k

Let us assume that GF3 is just focused on M3 production and MY only becomes a factor at the end of the year

Q2 production at 2-3k per week = 26~39k

Q3 production at 3k per week = 39k

Q4 production at 3k per week = 39k

GF3 Q2-Q4 2020 TOTAL = 104~117k

3. FREMONT PRODUCTION MODEL S + X

Let us assume that the rate of production for MS + MX averages 20k per quarter for the rest of 2020 to match an equivalent amount of demand

Q2 production = 20k

Q3 production = 20k

Q4 production = 20k

MS + MX Q2-Q4 2020 TOTAL = 60k

Let us assume that the rate of production for MS + MX averages 20k per quarter for the rest of 2020 to match an equivalent amount of demand

Q2 production = 20k

Q3 production = 20k

Q4 production = 20k

MS + MX Q2-Q4 2020 TOTAL = 60k

4. FREMONT PRODUCTION MODEL 3 + Y

Let us assume Q2 at 8k per week AFTER RESTART and 10k per week for Q3 and Q4

Q2 production at 8k per week x 8 weeks = 64k

Q3 production at 10k per week = 130k

Q4 production at 10k per week = 130k

M3 + MY Fremont Q2-Q4 2020 TOTAL = 324k

Let us assume Q2 at 8k per week AFTER RESTART and 10k per week for Q3 and Q4

Q2 production at 8k per week x 8 weeks = 64k

Q3 production at 10k per week = 130k

Q4 production at 10k per week = 130k

M3 + MY Fremont Q2-Q4 2020 TOTAL = 324k

* Note that Fremont M3 + MY annual capacity is due to be increased from 400k to 500k in mid-2020

- this 25% increase drives the assumed production change from 8k per week to 10k per week

- this 25% increase drives the assumed production change from 8k per week to 10k per week

5. 2020 TOTAL PRODUCTION

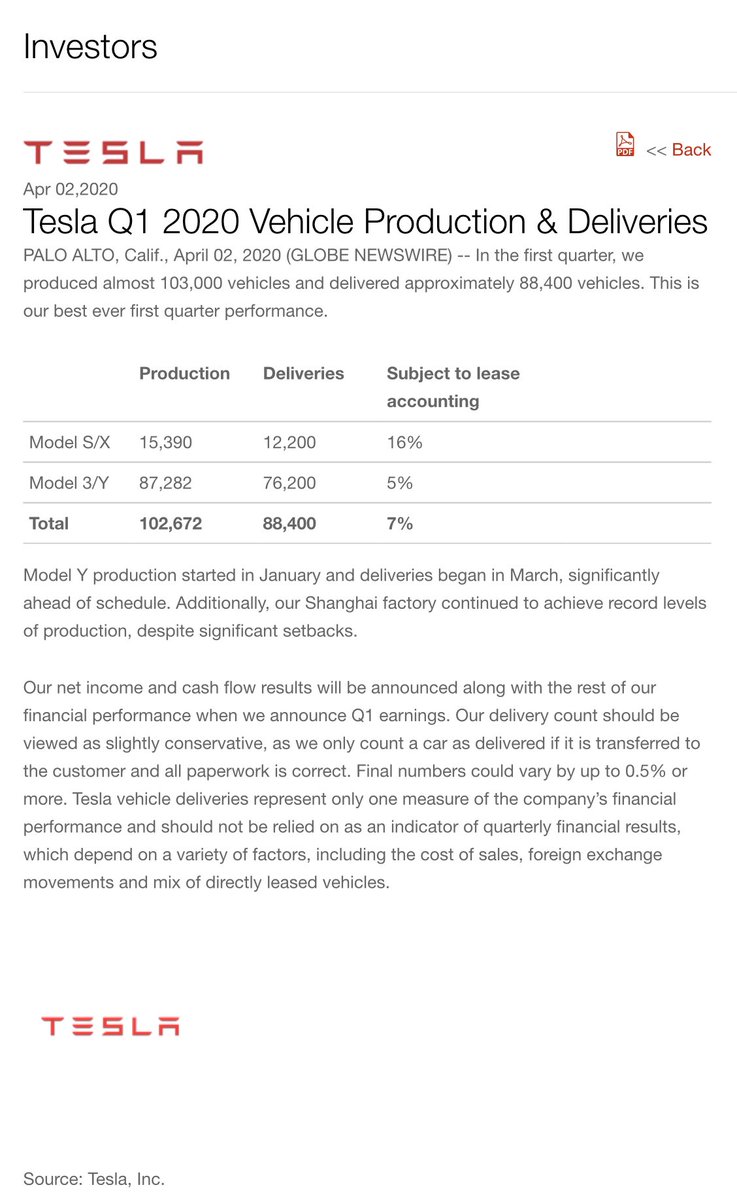

Q1 = 102k EXISTING

GF3 M3 = 102~117k PROJECTED

MS + MY = 60k PROJECTED

M3 + MY Fremont = 324k PROJECTED

TOTAL 2020 PRODUCTION = 588~603k

Company Guidance has been for 500k

- so there is clearly lots of room between the low end and top end

Q1 = 102k EXISTING

GF3 M3 = 102~117k PROJECTED

MS + MY = 60k PROJECTED

M3 + MY Fremont = 324k PROJECTED

TOTAL 2020 PRODUCTION = 588~603k

Company Guidance has been for 500k

- so there is clearly lots of room between the low end and top end

6. 2020 TOTAL DELIVERIES

With the current disruptions of both the market and production there is little point in focusing on quarterly delivery patterns

International shipment patterns have been disrupted and may restart on a whole different basis

With the current disruptions of both the market and production there is little point in focusing on quarterly delivery patterns

International shipment patterns have been disrupted and may restart on a whole different basis

Tesla can take this opportunity to reconsider its international shipments and move to a steadier flow of goods to all markets

This could have the effect of increasing in-transit inventories at quarter-end but that is a minor issue compared to the current market uncertainties

This could have the effect of increasing in-transit inventories at quarter-end but that is a minor issue compared to the current market uncertainties

Production and cost optimizations become more important along with closer matching to short-term demand

So for our purpose here the only question would be year-end in-transit inventory balances

For the sake of illustration let us assume this number to be 38k at the end of 2020

So for our purpose here the only question would be year-end in-transit inventory balances

For the sake of illustration let us assume this number to be 38k at the end of 2020

This leaves us with a 2020 deliveries projection of :

588~603k minus 38k = 550~565k units

Which would give Revenues of say $30~31 billion

588~603k minus 38k = 550~565k units

Which would give Revenues of say $30~31 billion

NOTE

* This analysis does not include anything for :

- GF3 Model Y

- Tesla Semi

- Tesla Roadster 2

* This analysis depends on sufficient Battery Supply to match these production capabilities

* This analysis does not include anything for :

- GF3 Model Y

- Tesla Semi

- Tesla Roadster 2

* This analysis depends on sufficient Battery Supply to match these production capabilities

Read on Twitter

Read on Twitter