First look at TRREB March stats in this thread. As expected, sales and average price are  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> a good chunk from last March.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> a good chunk from last March.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUT https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1

First of all, I& #39;m giving rare kudos to TRREB. They totally acknowledged the "tale of two halves" for March and didn& #39;t revel in the overall numbers for the sake of  https://abs.twimg.com/emoji/v2/... draggable="false" alt="➕" title="Heavy plus sign" aria-label="Emoji: Heavy plus sign"> spin. The month totally did the "in like a

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➕" title="Heavy plus sign" aria-label="Emoji: Heavy plus sign"> spin. The month totally did the "in like a  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦁" title="Lion face" aria-label="Emoji: Lion face">, out like a lamb" thing. (Couldn& #39;t find lamb emoji

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦁" title="Lion face" aria-label="Emoji: Lion face">, out like a lamb" thing. (Couldn& #39;t find lamb emoji  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">) /2

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">) /2

They even straight up said, "For the purposes of this release, the start of the post-COVID-19 period was the week beginning Sunday, March 15" and acknowledged "The overall March sales result was clearly driven by the first two weeks of the month." /3

Pre-C (pre-COVID-19): 4,643 sales (58% of total transactions in 45% of days),  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow">49% vs. first 14 days of March 2019

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow">49% vs. first 14 days of March 2019

Post-C: 3,369 sales (42% in 55% of days) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">16% vs. same period in March 2019

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">16% vs. same period in March 2019

/4

Post-C: 3,369 sales (42% in 55% of days)

/4

TRREB: "Uncertainty surrounding the outbreak’s

impact on the broader economy and the onset of the necessary social distancing measures resulted in the

decline in sales since March 15. Sales figures for April will give us a better sense as to the trajectory of the

market." No https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Pile of poo" aria-label="Emoji: Pile of poo">/6

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Pile of poo" aria-label="Emoji: Pile of poo">/6

impact on the broader economy and the onset of the necessary social distancing measures resulted in the

decline in sales since March 15. Sales figures for April will give us a better sense as to the trajectory of the

market." No

I& #39;m guessing we stay in the same  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">40% range. Just transaction volumes. You& #39;ll note active listings (inventory) is still really low,

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">40% range. Just transaction volumes. You& #39;ll note active listings (inventory) is still really low,  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">32% from March last year. That& #39;s eased a tiny bit from -35% in Jan and -34% in Feb, but still low. /7

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">32% from March last year. That& #39;s eased a tiny bit from -35% in Jan and -34% in Feb, but still low. /7

This low inventory we& #39;re starting with (and fact people are withholding listings because they don& #39;t want strangers coming in and touching their stuff) is why I think prices will remain stable for at least the next 2 or 3 months. /8

Here& #39;s GTA avg prices last 3 months:

Jan $839K

Feb $910K

Mar $903K

I& #39;ve written about the "February bump" before - just has to do with better stock coming on market. You& #39;ll note March is https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> vs. Feb... /9

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> vs. Feb... /9

Jan $839K

Feb $910K

Mar $903K

I& #39;ve written about the "February bump" before - just has to do with better stock coming on market. You& #39;ll note March is

It& #39;ll be important to watch the Home Price Index (HPI) the next while, bc I think we& #39;ll see a shift in mix. IMO entry-level stuff will be what& #39;s trading and more expensive stuff won& #39;t be listed as much. GTA HPI composite numbers:

Jan $828.2K

Feb $846.1K

Mar $865.2K

/10

Jan $828.2K

Feb $846.1K

Mar $865.2K

/10

So average was down, but again averages hide a lot of underlying stuff. HPI looks at "benchmark" homes so controls for that stuff. Not saying prices won& #39;t go down, just saying average prices might distort more. /11

There& #39;s no way everybody& #39;s home values fell 7.4% in the last half of this month. Just like they didn& #39;t fall 2.2% last year (period of rising prices). Averages can distort. /12

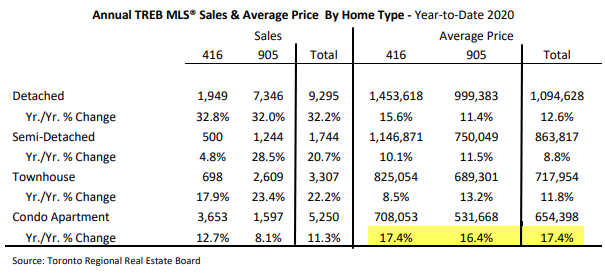

For me condos are the most interesting thing to watch over the rest of year. Up 17% makes it due for some "regression to the mean" and I& #39;m predicting as the severity of the recession deepens/lengthens, a bunch of mom & pop investors are going to sell /13

Either to cash out while they& #39;re up, or because they can& #39;t afford the negative cash flow - especially if they lose their own jobs. We& #39;ve already seen former Airbnbs dumped on the resale and rental market since revenues dropped to  https://abs.twimg.com/emoji/v2/... draggable="false" alt="0⃣" title="Keycap digit zero" aria-label="Emoji: Keycap digit zero"> in a snap. /14

https://abs.twimg.com/emoji/v2/... draggable="false" alt="0⃣" title="Keycap digit zero" aria-label="Emoji: Keycap digit zero"> in a snap. /14

"Only goes  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15

Anyway, this is quick first look. As always, deeper analysis with my monthly charts is forthcoming. (And I& #39;ll keep providing weekly updates on some stats where I see warranted.) Stay healthy and strong, my people.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✊" title="Raised fist" aria-label="Emoji: Raised fist"> /16

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✊" title="Raised fist" aria-label="Emoji: Raised fist"> /16

Read on Twitter

Read on Twitter a good chunk from last March. https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUThttps://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1" title="First look at TRREB March stats in this thread. As expected, sales and average price are https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> a good chunk from last March. https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUThttps://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1" class="img-responsive" style="max-width:100%;"/>

a good chunk from last March. https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUThttps://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1" title="First look at TRREB March stats in this thread. As expected, sales and average price are https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> a good chunk from last March. https://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk">BUThttps://abs.twimg.com/emoji/v2/... draggable="false" alt="*⃣" title="Keycap asterisk" aria-label="Emoji: Keycap asterisk"> there& #39;s a lot underlying averages, and that& #39;s why you look for analysis, instead of just taking surface numbers, right? My initial thoughts... /1" class="img-responsive" style="max-width:100%;"/>

in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15" title=""Only goes https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15" class="img-responsive" style="max-width:100%;"/>

in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15" title=""Only goes https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow"> in value" doesn& #39;t seem so certain anymore, eh? Especially when the top 3 indicators that TRREB tracks are going to get worse. Also that immigration that everyone always banks on for pop& #39;n growth looks to be on hold for awhile. /15" class="img-responsive" style="max-width:100%;"/>