Networks of business relationships are the tissue of a modern economy. The current crisis is a common shock to these relationships.

This new paper develops a network theory of why such shocks are devastating, especially for complex production.

http://bengolub.net/papers/SNFF.pdf ">https://bengolub.net/papers/SN...

This new paper develops a network theory of why such shocks are devastating, especially for complex production.

http://bengolub.net/papers/SNFF.pdf ">https://bengolub.net/papers/SN...

THREAD

The theory shows that supply networks are naturally drawn to operate near tipping points where they are fragile.

If many links experience a shock in their value -- even if that shock is small relative to total long-run value -- the damage can be grave.

2/N

The theory shows that supply networks are naturally drawn to operate near tipping points where they are fragile.

If many links experience a shock in their value -- even if that shock is small relative to total long-run value -- the damage can be grave.

2/N

Thus, *relational capital* is valuable and fragile, and can be particularly important to reinforce in a crisis.

These are the punchlines, and the rest of the thread is a quick sketch of what is actually going on in the model.

3/N

These are the punchlines, and the rest of the thread is a quick sketch of what is actually going on in the model.

3/N

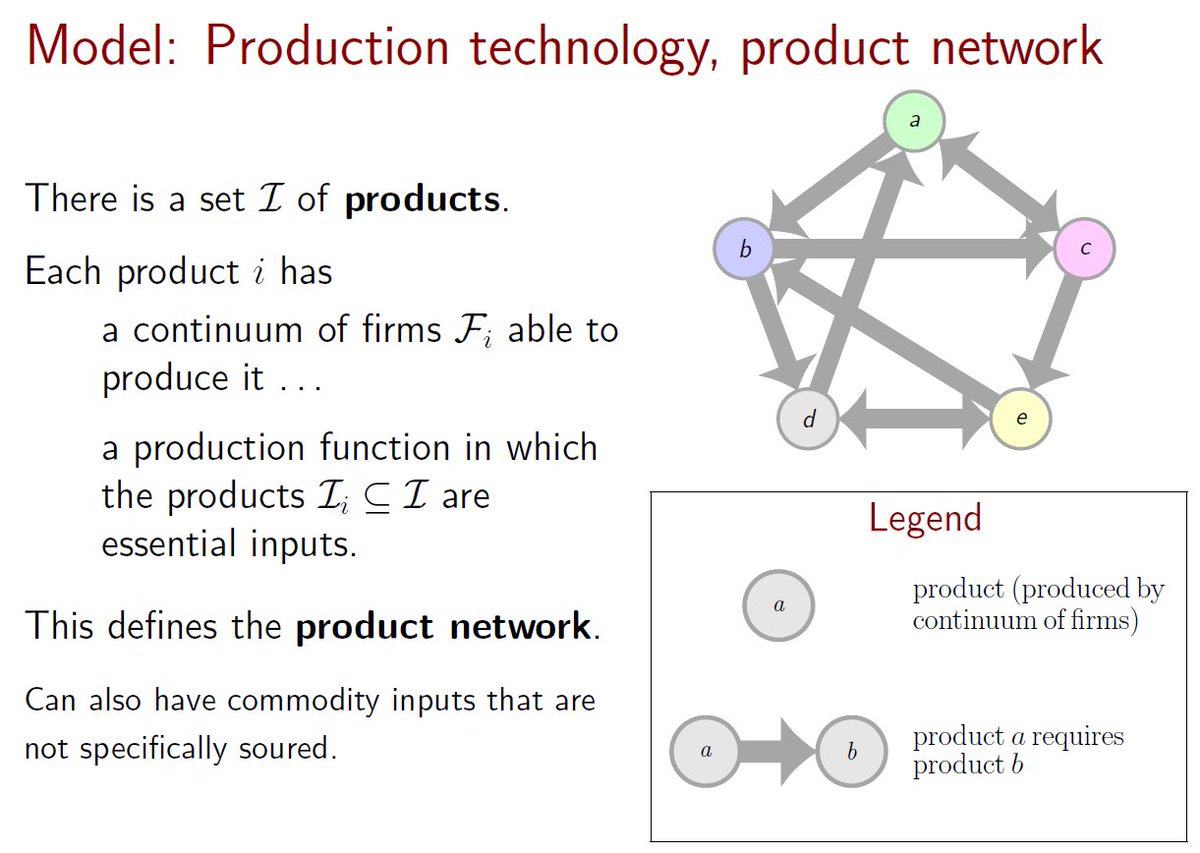

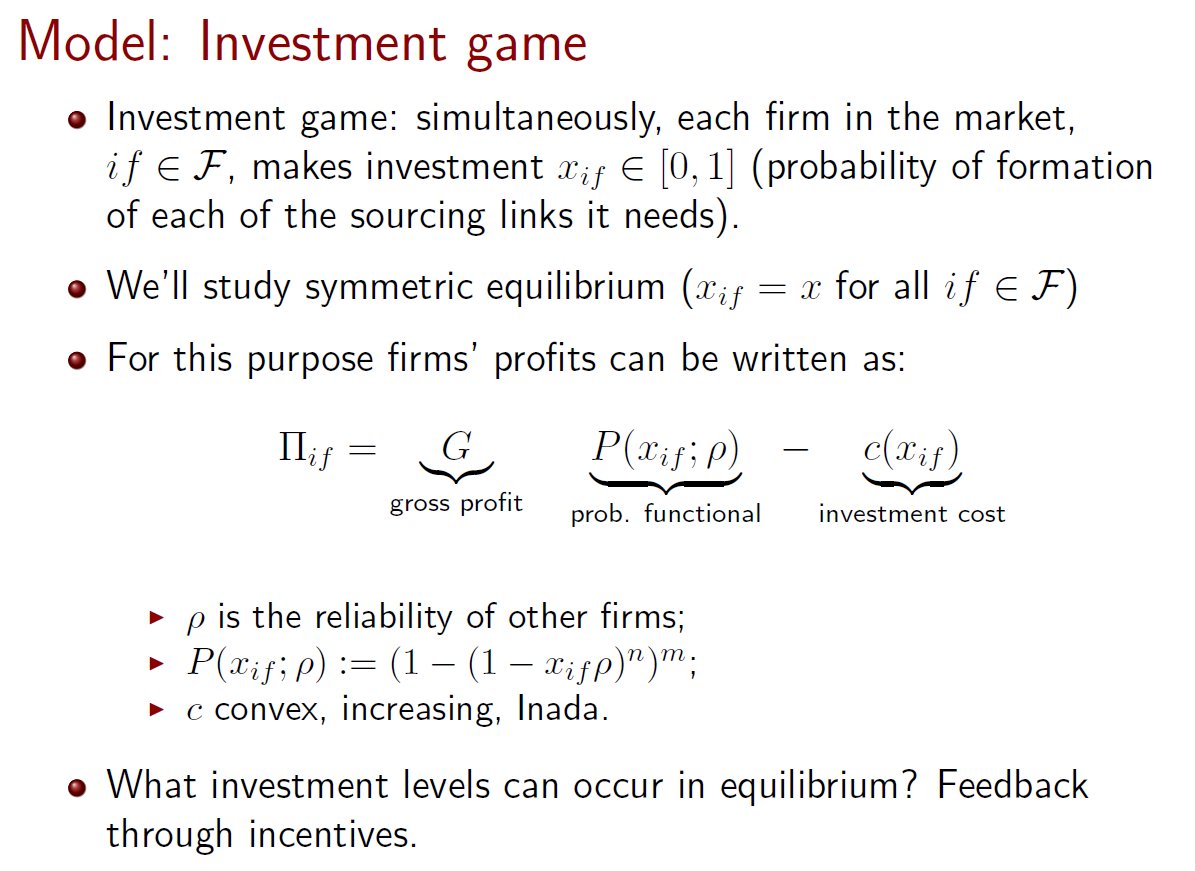

Basic setup: there are many products, and a continuum of firms making each.

To make a given product, a firm must source SEVERAL other products as inputs. These may be physical inputs, professional services, etc.

It gets these inputs through relationships with other firms.

4/N

To make a given product, a firm must source SEVERAL other products as inputs. These may be physical inputs, professional services, etc.

It gets these inputs through relationships with other firms.

4/N

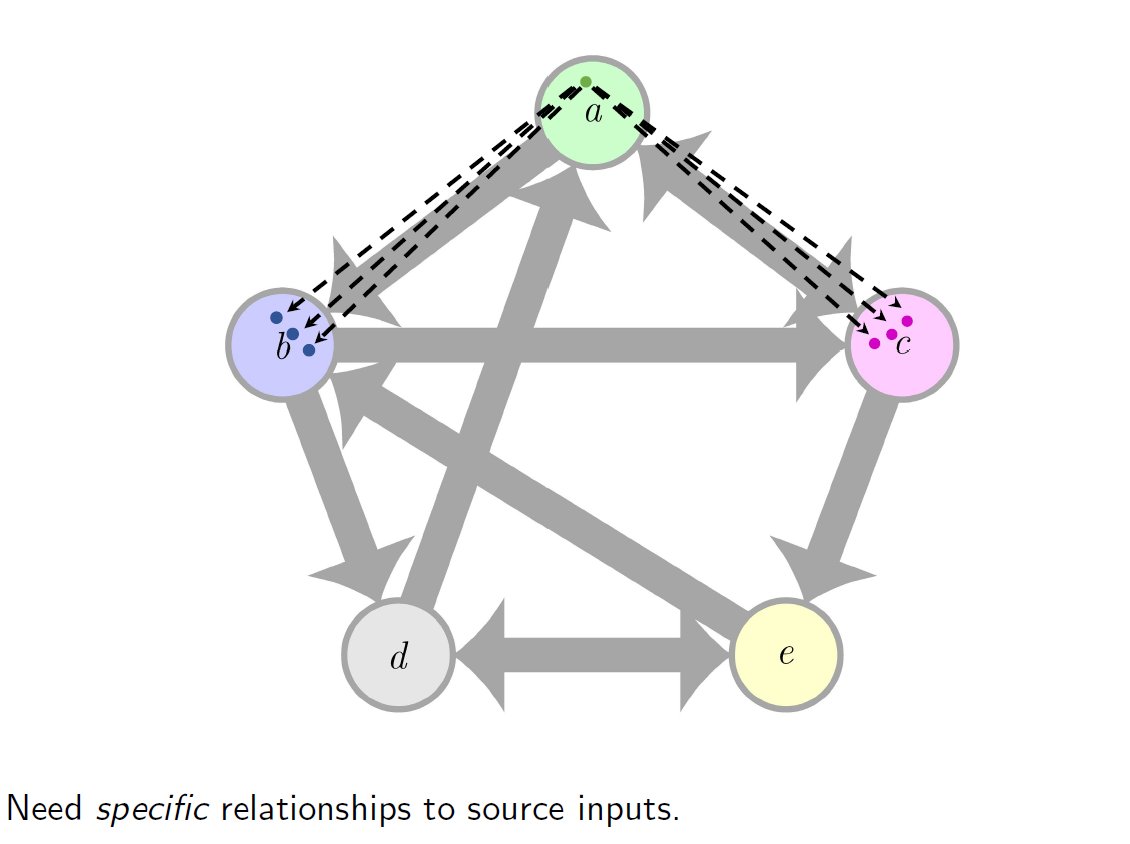

Each firm has a set of relationships -- POTENTIAL supply links -- that can provide the needed inputs. If none of them can deliver a needed input, then the firm cannot produce.

5/N

5/N

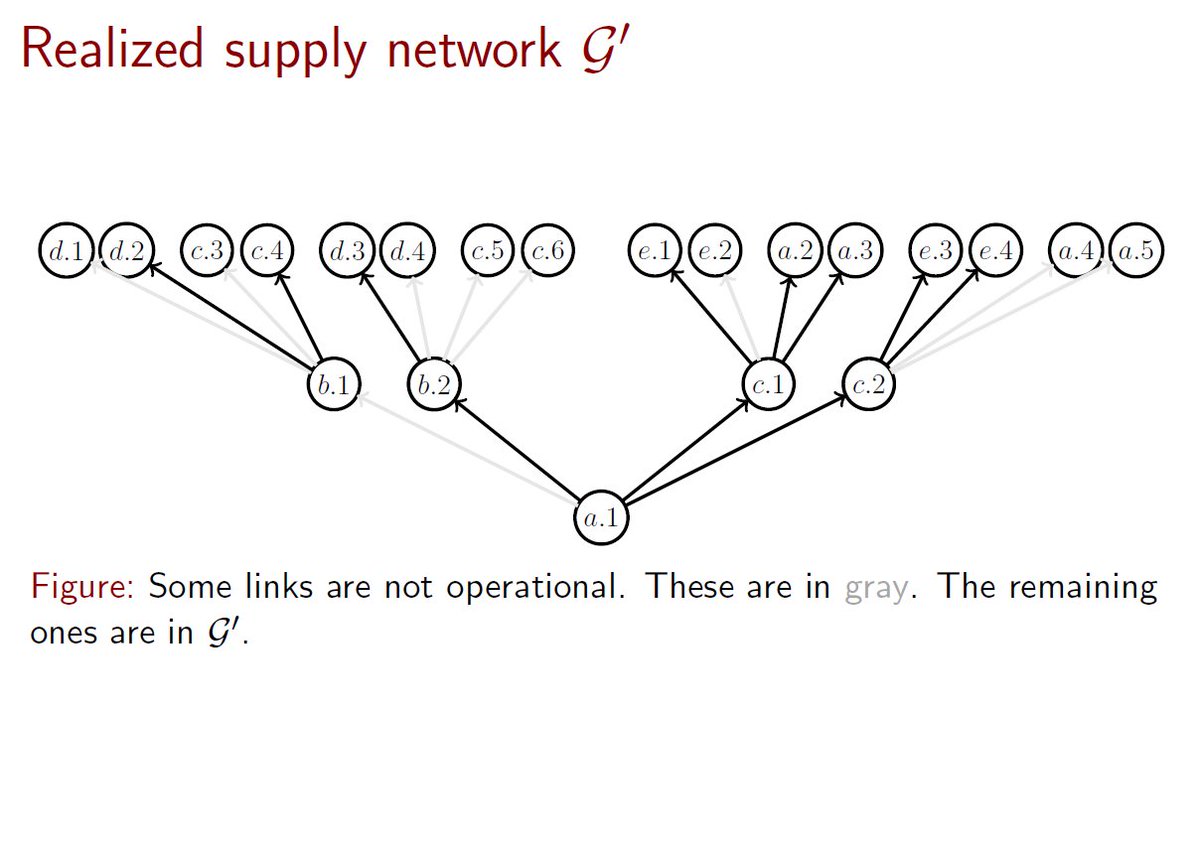

Each of these may operate successfully or not. Whether or not it does is random. Idiosyncratic disruptions occur with some probability -- e.g., workers are sick, or a firm lacks cash/credit to meet commitments. "Relationship strength" = prob. that any relationship works.

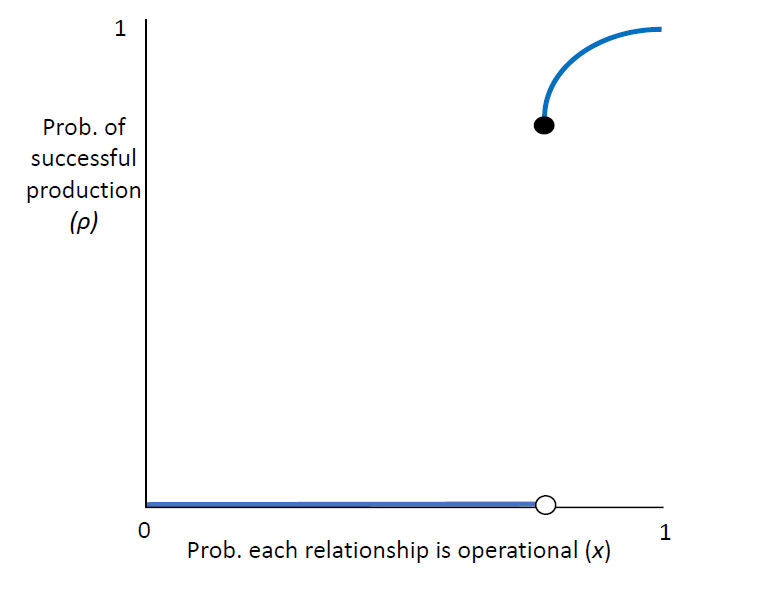

We are interested in the RELIABILITY = share of firms in the economy that CAN produce. There are stark discontinuities in this as we vary relationship strength.

Vertical axis -- reliability (given disruptions).

Horizontal axis -- strength of supply relationships.

7/N

Vertical axis -- reliability (given disruptions).

Horizontal axis -- strength of supply relationships.

7/N

Consider the impact of a common shock to relationship strength. What then happens to a given supply chain will depend on where it is located on the curve above: whether it is close to the discontinuity or far.

8/N

8/N

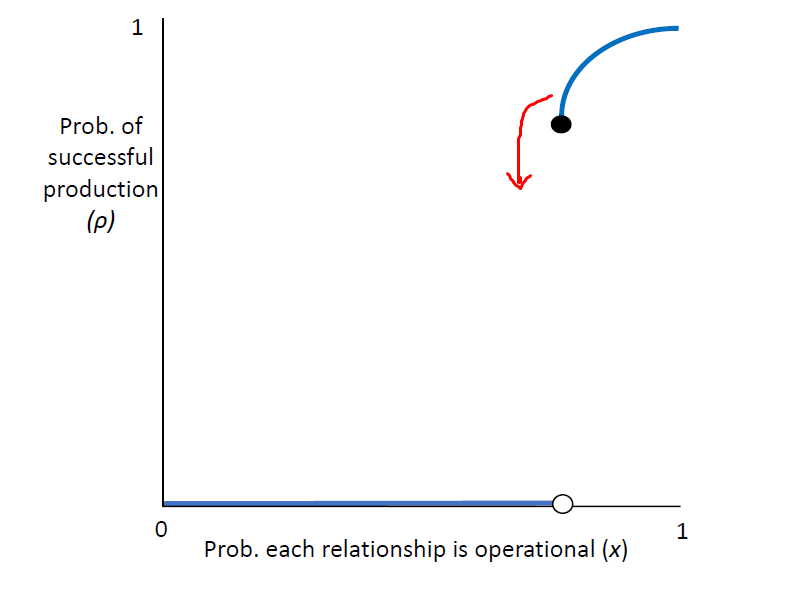

So where will supply chains be in the "cliff picture"?

It is socially efficient for them to be away from the precipice; the social returns to strength are HUGE there.

But businesses choose investments in the strength of their relationships based on individual incentives.

9/N

It is socially efficient for them to be away from the precipice; the social returns to strength are HUGE there.

But businesses choose investments in the strength of their relationships based on individual incentives.

9/N

We find that equilibrium investment choices push supply chains inefficiently toward the precipice.

Indeed, it& #39;s much more likely than you might think that a "generic" supply network tiptoes toward the cliff.

When a shock hits, many networks simultaneously collapse.

10/N

Indeed, it& #39;s much more likely than you might think that a "generic" supply network tiptoes toward the cliff.

When a shock hits, many networks simultaneously collapse.

10/N

To elucidate this force fully, we go a bit beyond the scope of this thread. (What I& #39;m not getting into here is an endogenous entry decision by firms: do they want to produce at all.)

But the takeaway is that

complex production + firms investing in relationships = FRAGILITY.

But the takeaway is that

complex production + firms investing in relationships = FRAGILITY.

Read on Twitter

Read on Twitter