Someone called today to ask “what score do lenders look at when quailfying to buy? “

My answer: Different lenders have different criteria. What’s your situation?

Now stick with me for the rest of this convo.

My answer: Different lenders have different criteria. What’s your situation?

Now stick with me for the rest of this convo.

My credit score is 592, one lender suspended ALL their 580-620 programs, I need a 680.

Another company said I can qualify with my score & last 3 months of income.

Me:

1. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">Ok see what they qualify you for

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">Ok see what they qualify you for

2. But a 680 is very doable (them: not for me) https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

Next https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Right-pointing triangle" aria-label="Emoji: Right-pointing triangle"> the kicker

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Right-pointing triangle" aria-label="Emoji: Right-pointing triangle"> the kicker

Another company said I can qualify with my score & last 3 months of income.

Me:

1.

2. But a 680 is very doable (them: not for me)

Next

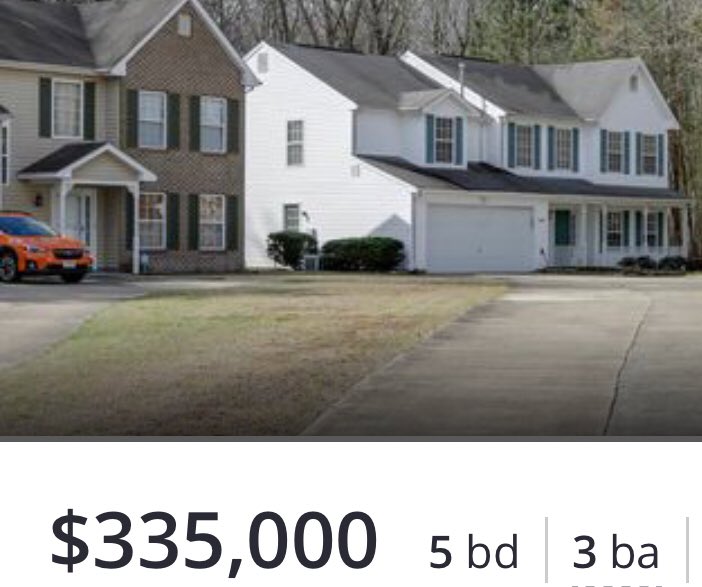

Me after I look up the house:

Read on Twitter

Read on Twitter