Tomorrow, oil executives are scheduled to meet w/ President Trump to discuss the wrecking ball currently hitting the oil and gas industry. A long thread on the folks in the room, what they want, and why they are in such a mess… https://twitter.com/SullyCNBC/status/1245413045574213636">https://twitter.com/SullyCNBC...

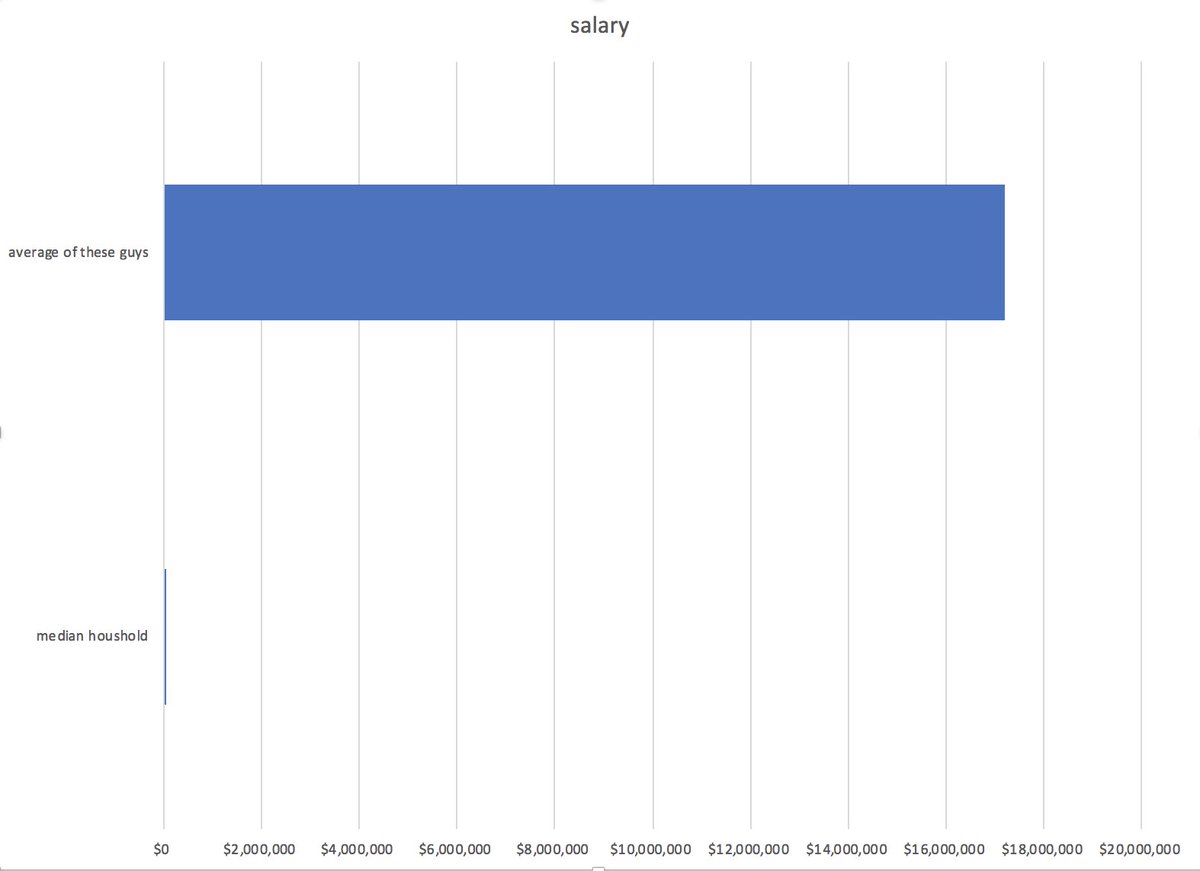

The executives are Darren Woods ($XOM), Mark Wirth ($CVX), Kelcy Warren ($ET), Harold Hamm ($CLR), Vicki Hollub ($OXY), Greg Garland ($PSX), and David Stover ($NBL). Last year, this group made well over $100 million in total compensation.

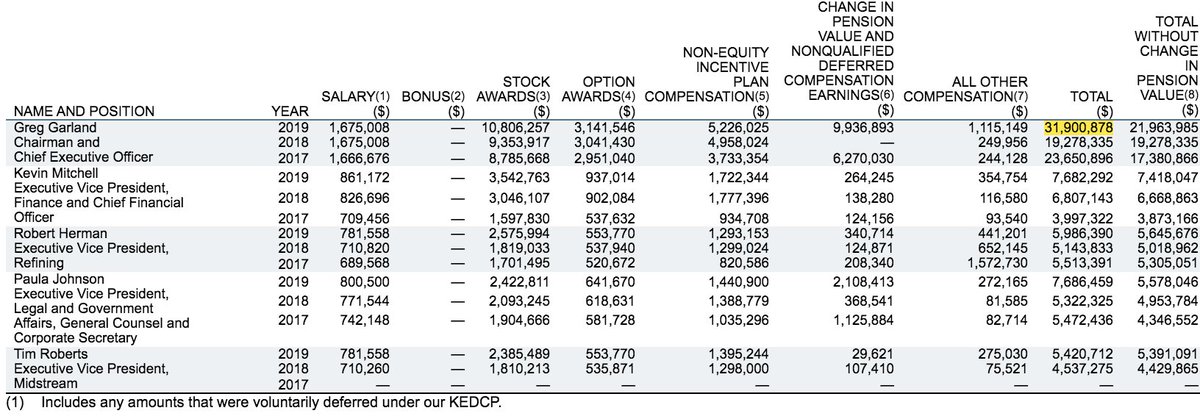

Phillips 66 CEO Greg Garland gets a special shout out for bringing home more than $30 million in 2019 (including changes to his pension plan).

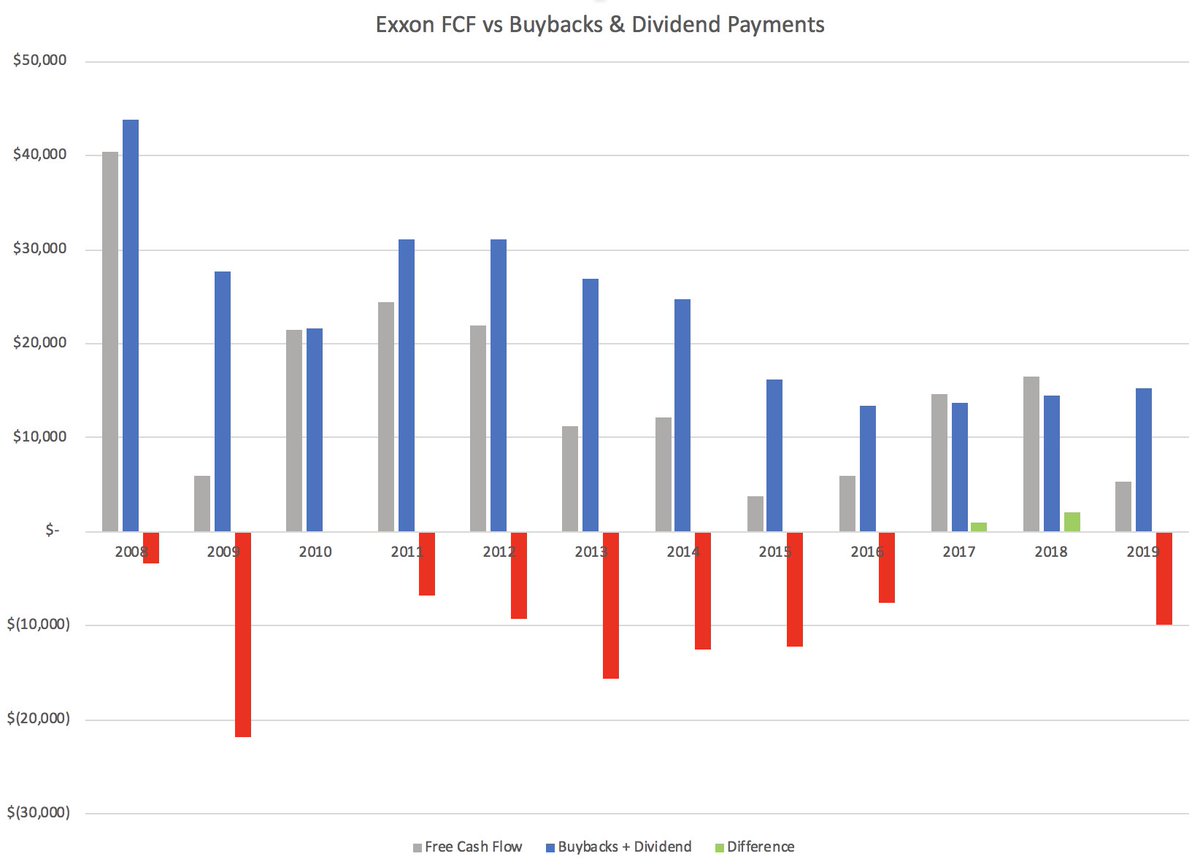

Even in “better” times, many of these firms have prioritized executives & investors over the workers and health of their companies. Since the last financial crisis in 2008, Exxon has paid out $100 BILLION in stock buybacks & dividends than it has generated from operations.

These companies carry $21 billion in unfunded pension liabilities on their books and sit on a pile of debt exceeding $158 billion. And these are some of the best performing, well capitalized, and politically connected oil companies in the world.

So, what do they want out of this meeting? The oil industry is fractured about the best response to this crisis. Independent E&Ps have backed direct bailouts and production cuts. Oil majors and their trade associations ( @APIenergy, TXOGA) have publicly opposed such actions.

Trump is hoping to pressure Saudi Arabia and Russia into making deep production cuts, but it appears that Riyadh is not interested in curbing output without reciprocal action from other producers including the US.

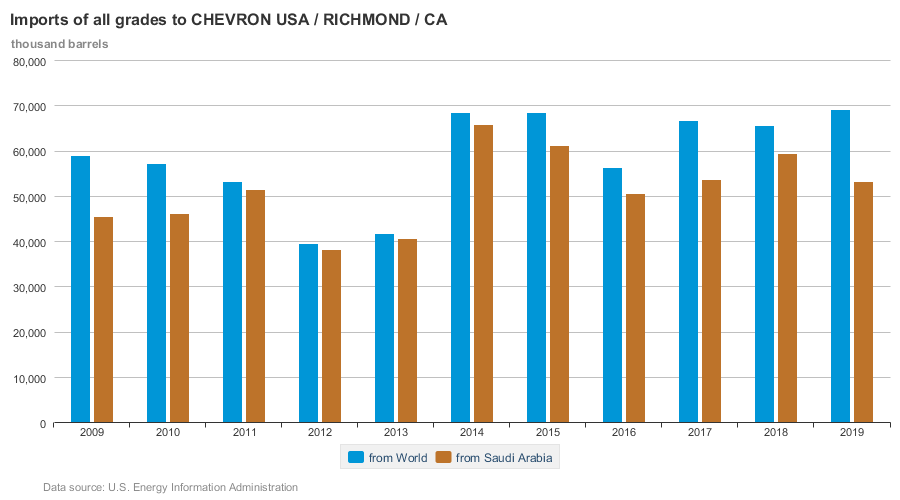

The oil executives assembling tomorrow are unlikely to back any formal ban on Saudi imports. Exxon, Chevron, and Phillips 66 refineries alone receive nearly half of all Saudi oil imported to the US. Saudi oil makes up 77% of the imports to Chevron’s Richmond refinery.

Exxon and Chevron also have several long standing joint ventures with Saudi Aramco, including a massive petrochemical facility in Texas and drilling projects in Saudi Arabia.

Instead of curbing imports, these CEOs may be looking for significant regulatory rollbacks, including royalty relief and changes to permitting or leasing requirements. In effect, using this crisis to secure their pre-existing political agenda.

Read on Twitter

Read on Twitter