Pakistan& #39;s Economic Crises 2018

Economic crises are not earthquakes which strike without warning; they are culmination of years of excesses & misguided macroeconomic policies

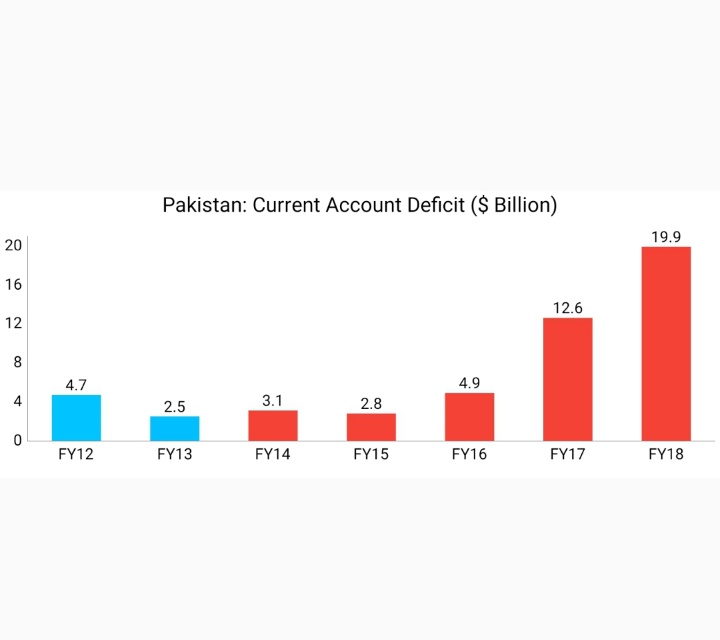

CAD reached $19.9bn in FY18 which was the highest ever in the country’s history in absolute terms

1/N

Economic crises are not earthquakes which strike without warning; they are culmination of years of excesses & misguided macroeconomic policies

CAD reached $19.9bn in FY18 which was the highest ever in the country’s history in absolute terms

1/N

Current Account Deficit (CAD) surged from 1.1% of GDP in FY13 to 6.3% of GDP in FY18

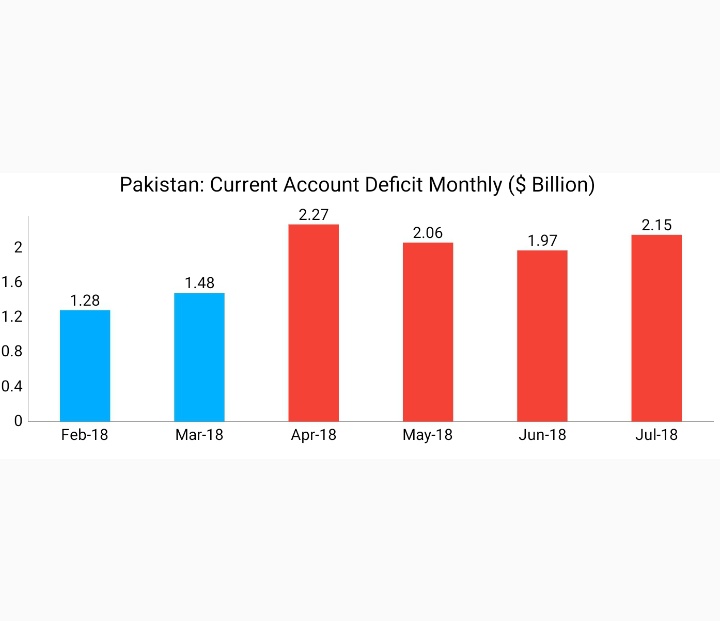

Last 4 months before the new govt coming into power we were running a CAD of $2bn a month this means at an annualised pace of $24bn

Source:

http://www.sbp.org.pk/ecodata/BOP-Services/bop.pdf

https://www.sbp.org.pk/ecodata/B... href=" http://www.sbp.org.pk/ecodata/BOP_arch/index.asp

2/N">https://www.sbp.org.pk/ecodata/B...

Last 4 months before the new govt coming into power we were running a CAD of $2bn a month this means at an annualised pace of $24bn

Source:

http://www.sbp.org.pk/ecodata/BOP-Services/bop.pdf

2/N">https://www.sbp.org.pk/ecodata/B...

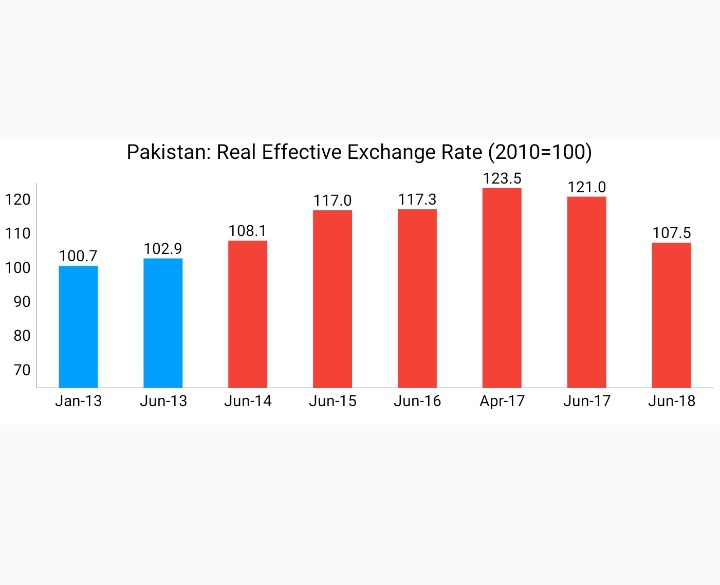

An increase in REER implies that exports become more expensive & imports become cheaper; therefore, an increase indicates a loss in trade competitiveness

REER value of 100 reflects fair valuation

REER had appreciated to 123.5 by April-17

Source: http://www.sbp.org.pk/departments/stats/Notice/Revision-Study(REER).pdf

3/N">https://www.sbp.org.pk/departmen...

REER value of 100 reflects fair valuation

REER had appreciated to 123.5 by April-17

Source: http://www.sbp.org.pk/departments/stats/Notice/Revision-Study(REER).pdf

3/N">https://www.sbp.org.pk/departmen...

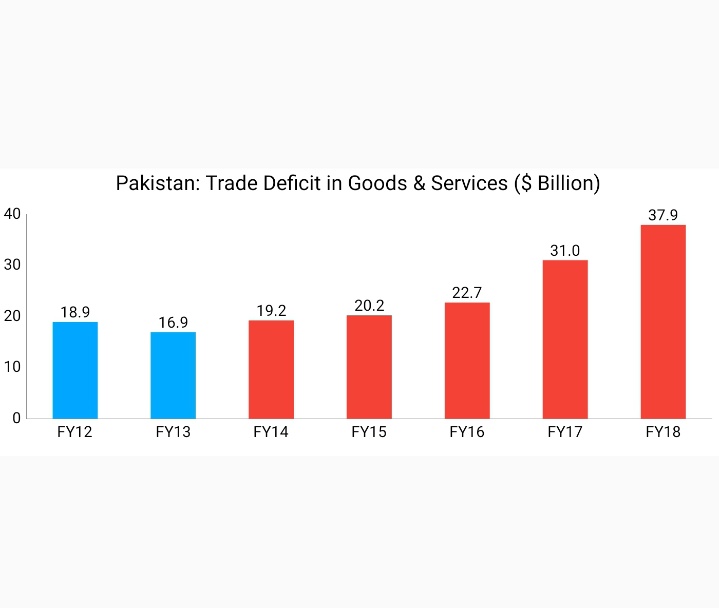

Misaligned exchange rate subsidized imports, leading to huge surge in the trade deficit

Trade Deficit more than doubled to $37.9bn by FY18, from $16.9bn in FY13

Real effective exchange rate (REER)

Free on board (FOB)

Source:

http://www.sbp.org.pk/ecodata/ExportsImports-Goods-Arch.xls

https://www.sbp.org.pk/ecodata/E... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf

4/N">https://www.finance.gov.pk/survey/ch...

Trade Deficit more than doubled to $37.9bn by FY18, from $16.9bn in FY13

Real effective exchange rate (REER)

Free on board (FOB)

Source:

http://www.sbp.org.pk/ecodata/ExportsImports-Goods-Arch.xls

4/N">https://www.finance.gov.pk/survey/ch...

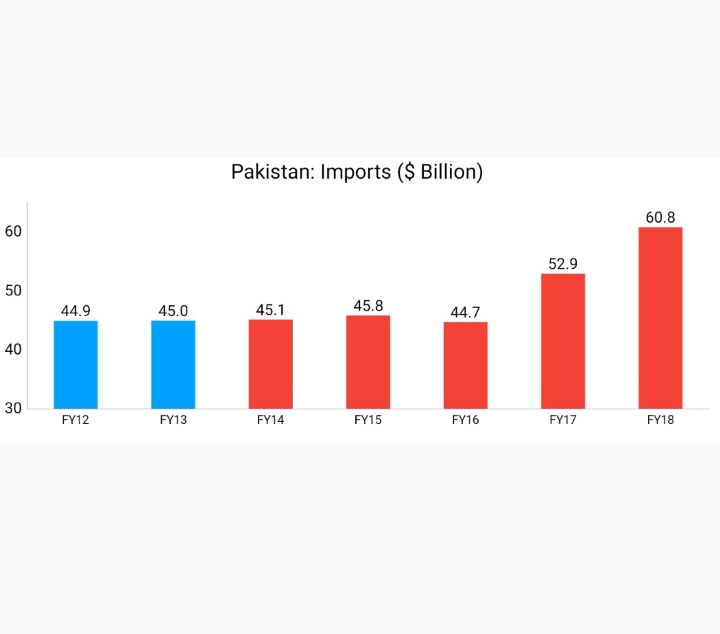

Imports increased from $45bn in FY13 to $60.8bn in FY18

Imports (FOB) increased from 17.4% of GDP in FY13 to 18% of GDP in FY18

Source:

http://www.pbs.gov.pk/sites/default/files//tables/14.08.pdf

https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf

5/N">https://www.finance.gov.pk/survey/ch...

Imports (FOB) increased from 17.4% of GDP in FY13 to 18% of GDP in FY18

Source:

http://www.pbs.gov.pk/sites/default/files//tables/14.08.pdf

5/N">https://www.finance.gov.pk/survey/ch...

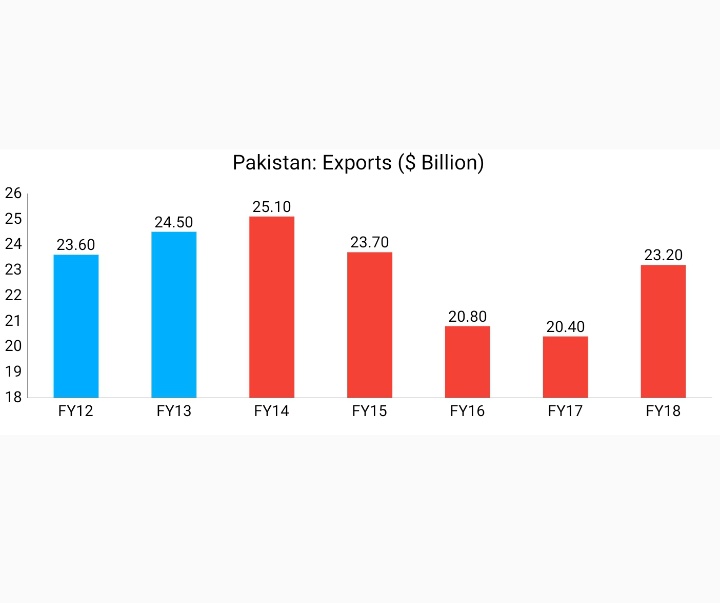

Pakistan& #39;s exports fell from $24.5bn in FY13 to $23.2bn in FY18

Exports (FOB) fell from 10.7% of GDP in FY13 to 7.9% of GDP in FY18

State Bank of Pakistan (SBP)

Public Sector Enterprises (PSEs)

Source:

http://www.pbs.gov.pk/sites/default/files//tables/14.08.pdf

https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf

6/N">https://www.finance.gov.pk/survey/ch...

Exports (FOB) fell from 10.7% of GDP in FY13 to 7.9% of GDP in FY18

State Bank of Pakistan (SBP)

Public Sector Enterprises (PSEs)

Source:

http://www.pbs.gov.pk/sites/default/files//tables/14.08.pdf

6/N">https://www.finance.gov.pk/survey/ch...

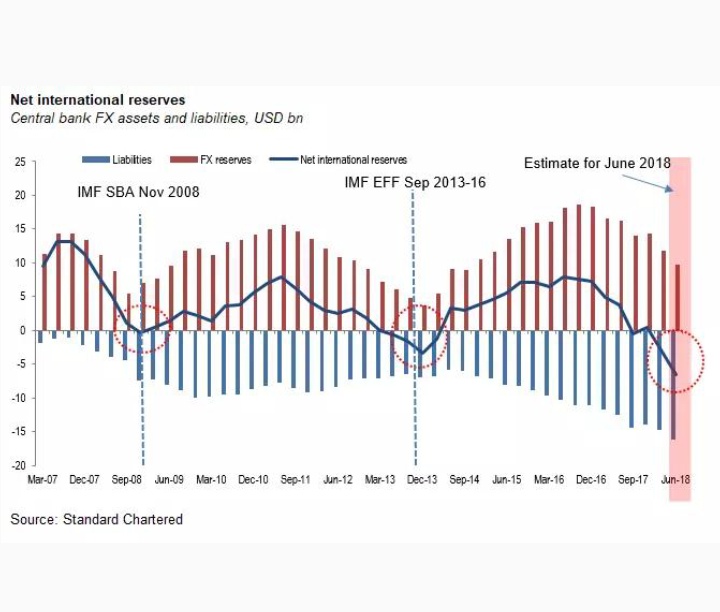

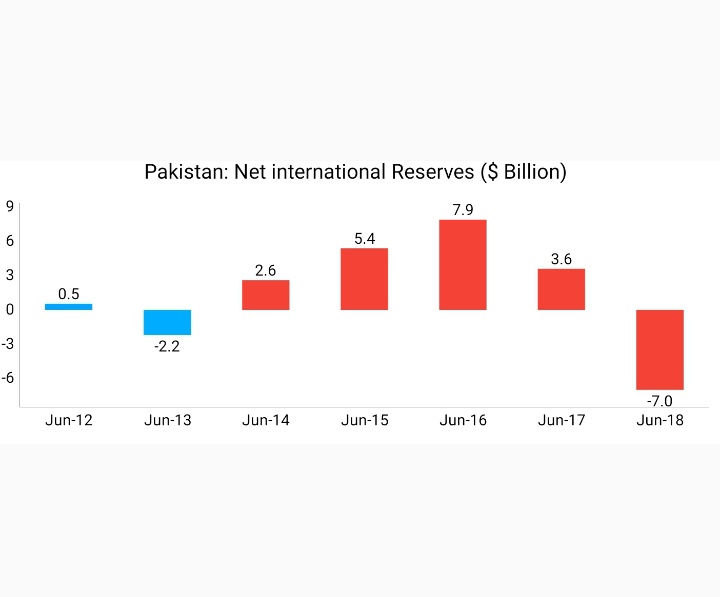

Net International Reserve (NIR) is about the amount SBP has to finance CAD by its own – in short it depicts, how much import led growth a country can afford

NIR is the amount which gives a country leverage to run pro-growth policies where import increase can be absorbed

7/N

NIR is the amount which gives a country leverage to run pro-growth policies where import increase can be absorbed

7/N

When the NIR runs in negative, any external shock can create massive crisis – crippling the economy by free fall in currency which can be followed by hyper-inflation

NIR fell from -$2.2bn in FY13 to -$7bn in FY18

Source:

http://www.sbp.org.pk/ecodata/Liquidity_arch.xls

https://www.sbp.org.pk/ecodata/L... href=" http://www.sbp.org.pk/ecodata/Forex_Arch.xlsx

8/N">https://www.sbp.org.pk/ecodata/F...

NIR fell from -$2.2bn in FY13 to -$7bn in FY18

Source:

http://www.sbp.org.pk/ecodata/Liquidity_arch.xls

8/N">https://www.sbp.org.pk/ecodata/F...

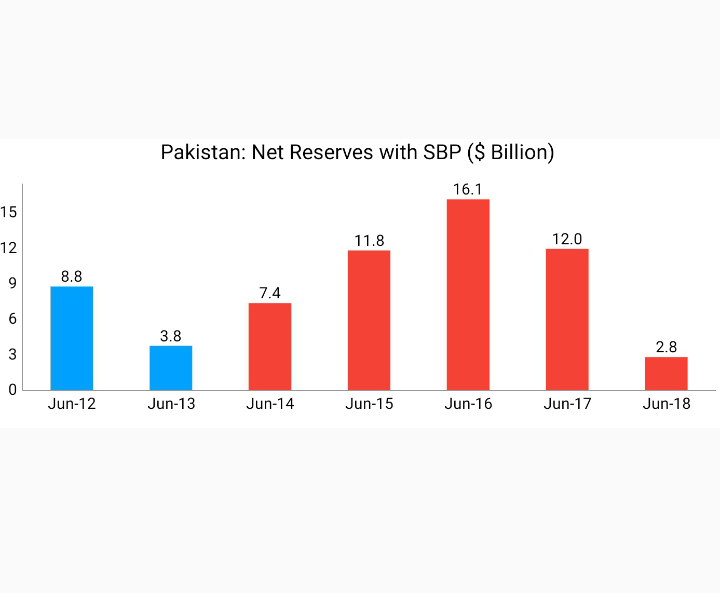

Net Reserves with SBP are calculated by subtracting forward/Swaps from SBP& #39;s Gross Reserves

With CAD averaging $2bn a month & SBP& #39;s Net Reserves falling to $2.8bn this indicated risks of a sovereign default

Source:

http://www.sbp.org.pk/ecodata/Forex_Arch.xlsx

https://www.sbp.org.pk/ecodata/F... href=" http://www.sbp.org.pk/ecodata/pakdebt_Arch.xlsx

9/N">https://www.sbp.org.pk/ecodata/p...

With CAD averaging $2bn a month & SBP& #39;s Net Reserves falling to $2.8bn this indicated risks of a sovereign default

Source:

http://www.sbp.org.pk/ecodata/Forex_Arch.xlsx

9/N">https://www.sbp.org.pk/ecodata/p...

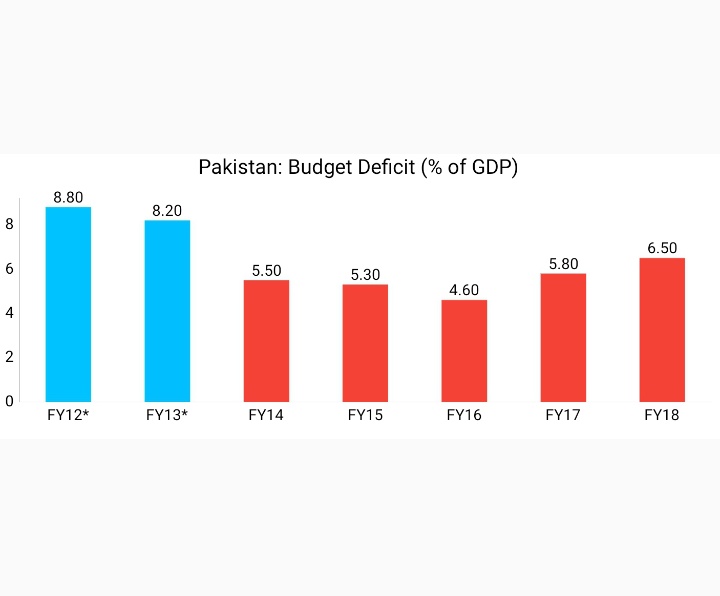

Fiscal deficit soared to 6.5% in FY18

Financial losses of PSEs were at a record high level of 1.4%

of GDP, implying overall fiscal & quasi fiscal deficit of about 8% of GDP & Energy sector circular debt of Rs1.2tr

Source:

http://www.finance.gov.pk/publications/FPS_2019_2020.pdf

https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/A_Roadmap_for_Stability_and_Growth_April_8.pdf

10/N">https://www.finance.gov.pk/A_Roadmap...

Financial losses of PSEs were at a record high level of 1.4%

of GDP, implying overall fiscal & quasi fiscal deficit of about 8% of GDP & Energy sector circular debt of Rs1.2tr

Source:

http://www.finance.gov.pk/publications/FPS_2019_2020.pdf

10/N">https://www.finance.gov.pk/A_Roadmap...

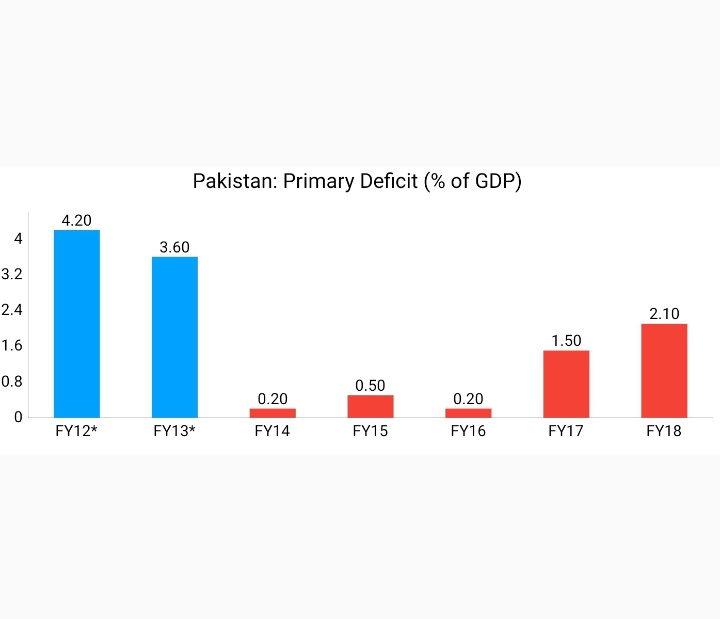

Primary balance is the total revenues minus non-interest exp

Primary deficit means that govt is borrowing monies to pay interest

payment on the debt stock, debt trap

FY12* include payment of debt consolidation 2% of GDP

FY13* include resolution of Circular Debt 1.4% of GDP

11/N

Primary deficit means that govt is borrowing monies to pay interest

payment on the debt stock, debt trap

FY12* include payment of debt consolidation 2% of GDP

FY13* include resolution of Circular Debt 1.4% of GDP

11/N

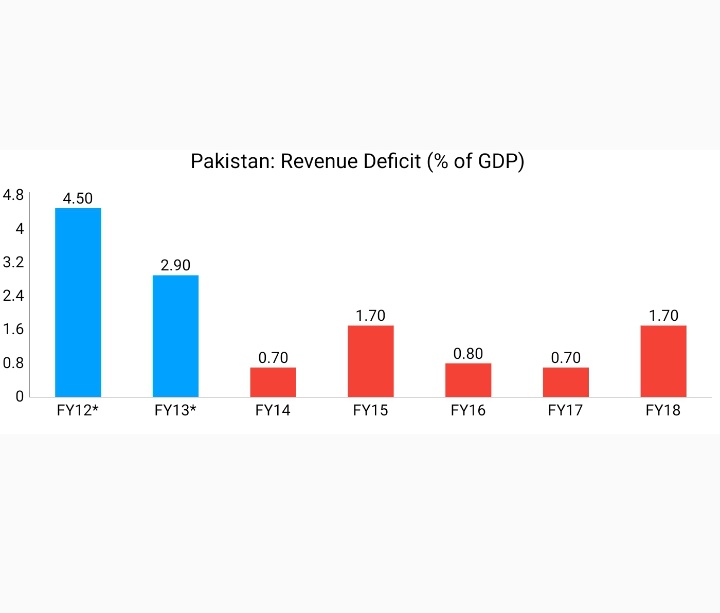

Revenue balance is the total revenues minus current exp

The persistence of revenue deficit indicates that the govt is not only borrowing to finance its development exp, but partially also financing its current exp

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf

12/N">https://www.finance.gov.pk/publicati...

The persistence of revenue deficit indicates that the govt is not only borrowing to finance its development exp, but partially also financing its current exp

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

12/N">https://www.finance.gov.pk/publicati...

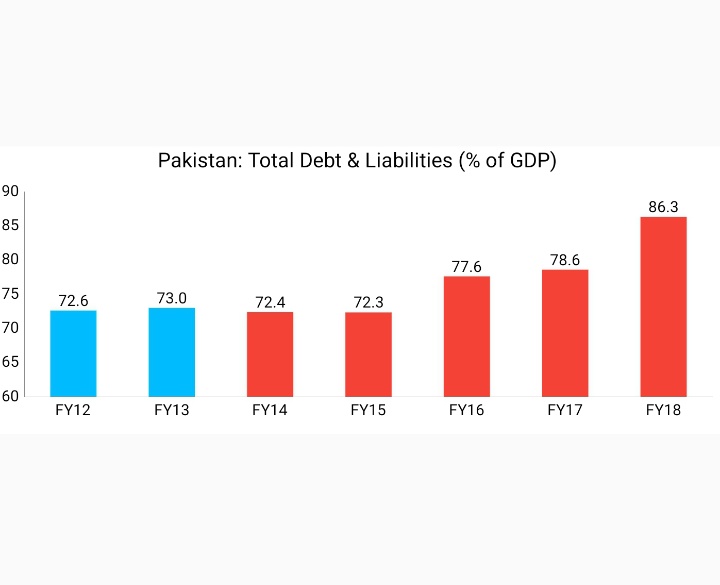

Total Debt & Liabilities (TDL) surged from 73% of GDP in FY13 to 86.3% of GDP in FY18

In absolute terms, it surged from Rs16,338bn in FY13 to Rs29,879bn in FY18 - up 83%

TDL includes Govt, Private sector, PSEs Debt & commodity operations etc

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

13/N">https://www.sbp.org.pk/ecodata/S...

In absolute terms, it surged from Rs16,338bn in FY13 to Rs29,879bn in FY18 - up 83%

TDL includes Govt, Private sector, PSEs Debt & commodity operations etc

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

13/N">https://www.sbp.org.pk/ecodata/S...

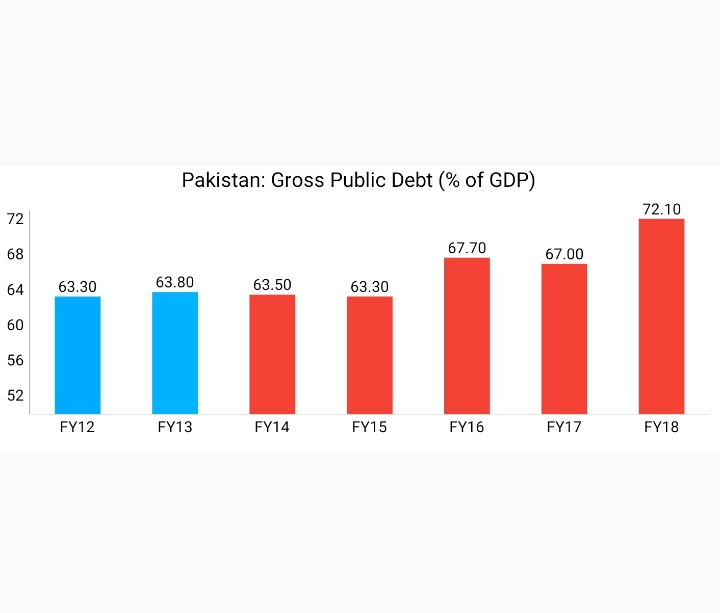

Gross Public Debt increased from 63.8% of GDP in FY13 to 72.1% of GDP in FY18

In absolute terms, it increased from Rs14,292bn in FY13 to Rs24,953bn in FY18 - an increase of 75%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

14/N">https://www.sbp.org.pk/ecodata/S...

In absolute terms, it increased from Rs14,292bn in FY13 to Rs24,953bn in FY18 - an increase of 75%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

14/N">https://www.sbp.org.pk/ecodata/S...

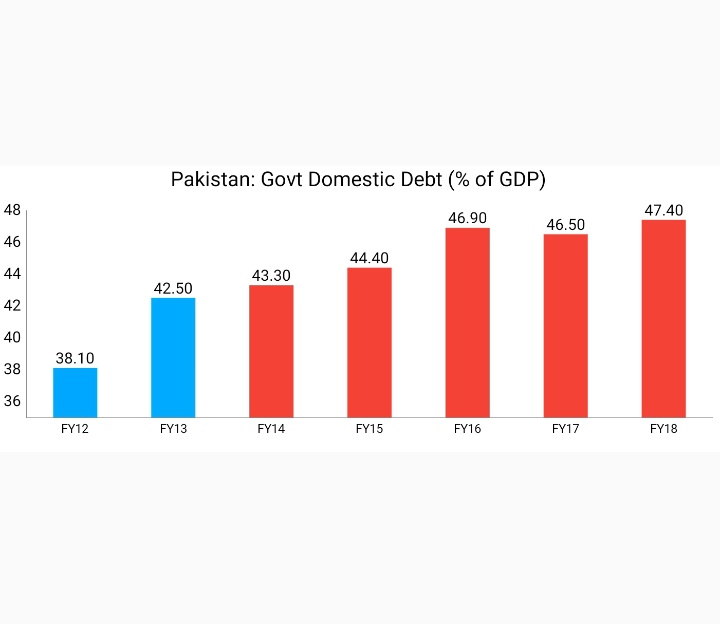

Govt Domestic Debt increased from 42.5% of GDP in FY13 to 47.4% of GDP in FY18

In absolute terms, It increased from Rs9,520bn in FY13 to Rs16,416bn in FY18 - an increase of 72%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

15/N">https://www.sbp.org.pk/ecodata/S...

In absolute terms, It increased from Rs9,520bn in FY13 to Rs16,416bn in FY18 - an increase of 72%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

15/N">https://www.sbp.org.pk/ecodata/S...

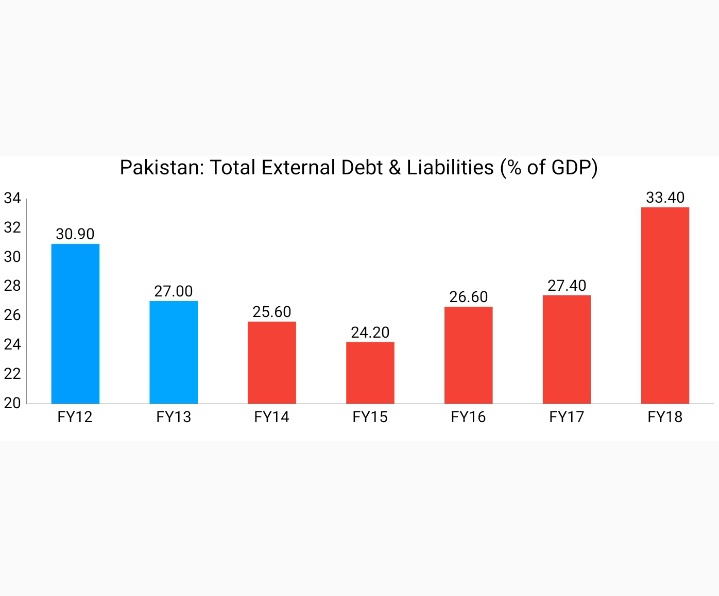

Total External Debt & Liabilities increased from 27% of GDP in FY13 to 33.4% of GDP in FY18

In absolute terms, It increased from $60,899 million in FY13 to $95,237 million in FY18 - an increase of 56.4%

Source: http://www.sbp.org.pk/ecodata/pakdebt_Arch.xlsx

16/N">https://www.sbp.org.pk/ecodata/p...

In absolute terms, It increased from $60,899 million in FY13 to $95,237 million in FY18 - an increase of 56.4%

Source: http://www.sbp.org.pk/ecodata/pakdebt_Arch.xlsx

16/N">https://www.sbp.org.pk/ecodata/p...

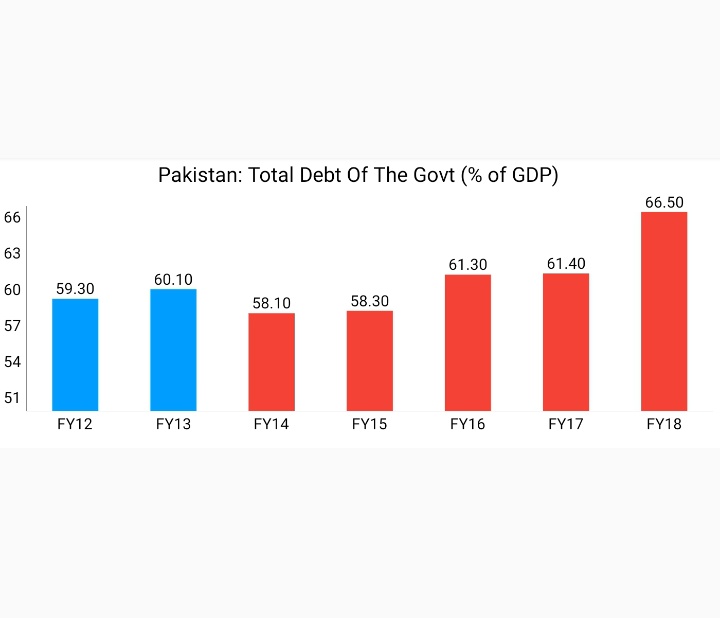

Total Debt of the Govt increased from 60.1% of GDP in FY13 to 66.5% of GDP in FY18

In absolute terms, It increased from Rs13,457bn in FY13 to Rs23,024bn in FY18 - an increase of 71%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

17/N">https://www.sbp.org.pk/ecodata/S...

In absolute terms, It increased from Rs13,457bn in FY13 to Rs23,024bn in FY18 - an increase of 71%

Source: http://www.sbp.org.pk/ecodata/Summary-Arch.xls

17/N">https://www.sbp.org.pk/ecodata/S...

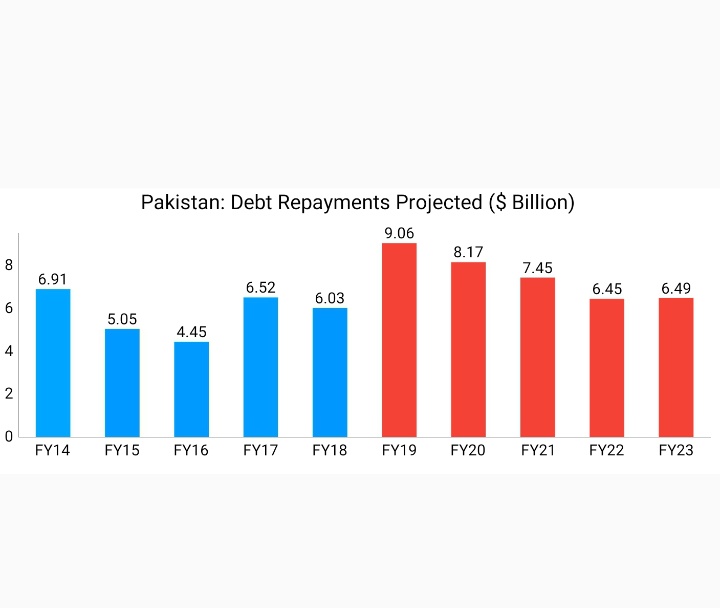

Total Debt Repayment obligations for the incoming govt cumulatively stood at $37.6bn in 5 years without borrowing a single penny

In Blue bars are the actual Debt Repayments

In Red bars are the debt Repayments due

Source:

https://nation.com.pk/06-Jan-2019/govt-to-continue-arranging-financing-in-its-tenure

https://nation.com.pk/06-Jan-20... href=" http://www.finance.gov.pk/publications/DPS_2018_19.pdf

18/N">https://www.finance.gov.pk/publicati...

In Blue bars are the actual Debt Repayments

In Red bars are the debt Repayments due

Source:

https://nation.com.pk/06-Jan-2019/govt-to-continue-arranging-financing-in-its-tenure

18/N">https://www.finance.gov.pk/publicati...

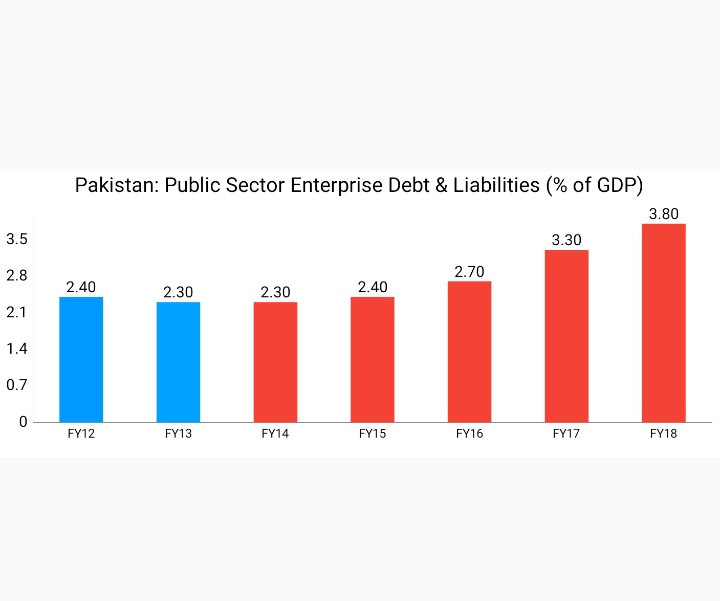

PSEs Debt & Liabilities surged from 2.3% of GDP in FY13 to 3.8% of GDP in FY18

In absolute terms, it surged from Rs538.1bn in FY13 to Rs1,299.5bn in FY18 - an increase of 141.5%

Central Power Purchasing Agency (CPPA)

Source:

http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2018/Dec/DomesticExternalDebt.pdf

https://www.sbp.org.pk/reports/s... href=" http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2013/Dec/InternalExternalPublicDebt.pdf

19/N">https://www.sbp.org.pk/reports/s...

In absolute terms, it surged from Rs538.1bn in FY13 to Rs1,299.5bn in FY18 - an increase of 141.5%

Central Power Purchasing Agency (CPPA)

Source:

http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2018/Dec/DomesticExternalDebt.pdf

19/N">https://www.sbp.org.pk/reports/s...

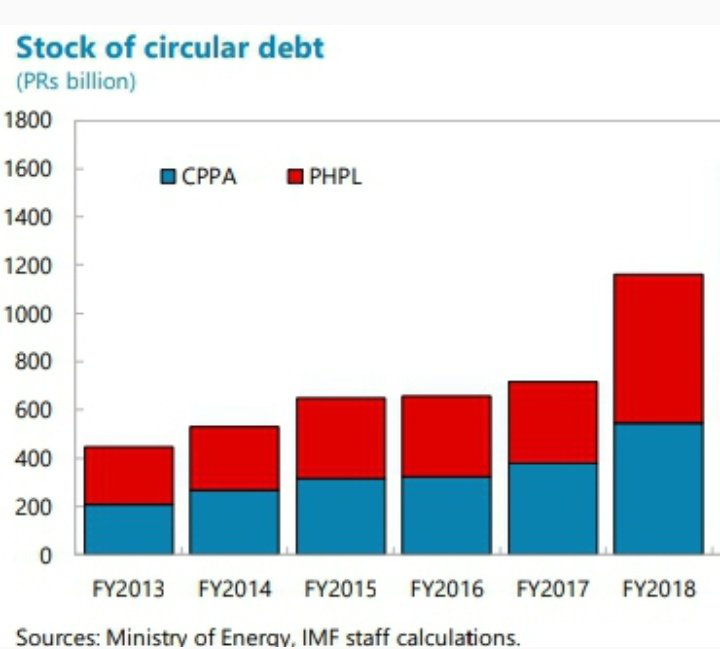

Circular debt surged from Rs503bn at end may& #39;13 to Rs1,196bn in FY18 - an increase of 137.8%

It is the amount of cash shortfall within the CPPA which it cannot pay to power supply companies

Source:

http://www.senate.gov.pk/uploads/documents/1538128795_955.pdf

https://www.senate.gov.pk/uploads/d... href=" http://www.senate.gov.pk/uploads/documents/questions/1383717414_521.pdf

https://www.senate.gov.pk/uploads/d... href=" https://www.imf.org/~/media/Files/Publications/CR/2019/1PAKEA2019002.ashx

20/N">https://www.imf.org/~/media/F...

It is the amount of cash shortfall within the CPPA which it cannot pay to power supply companies

Source:

http://www.senate.gov.pk/uploads/documents/1538128795_955.pdf

20/N">https://www.imf.org/~/media/F...

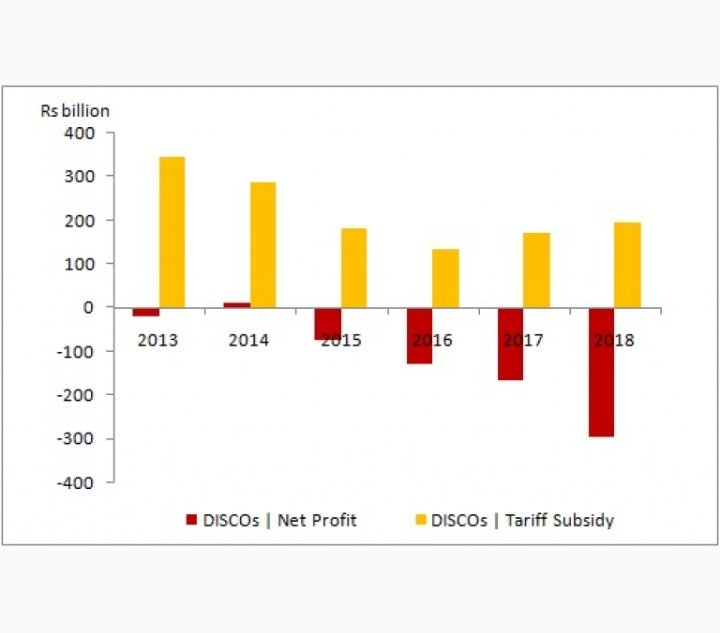

In Jun& #39;13, Accumulated losses of 10 discos were a mere Rs20bn, & the year previous govt left the toll surged to Rs296bn. The Accumulated losses of DISCOs in previous govt& #39;s last 4 years stood at Rs662bn. This is how circular debt builds

Source: https://www.brecorder.com/2019/05/06/494796/power-discos-the-bleeding-goes-on/

21/N">https://www.brecorder.com/2019/05/0...

Source: https://www.brecorder.com/2019/05/06/494796/power-discos-the-bleeding-goes-on/

21/N">https://www.brecorder.com/2019/05/0...

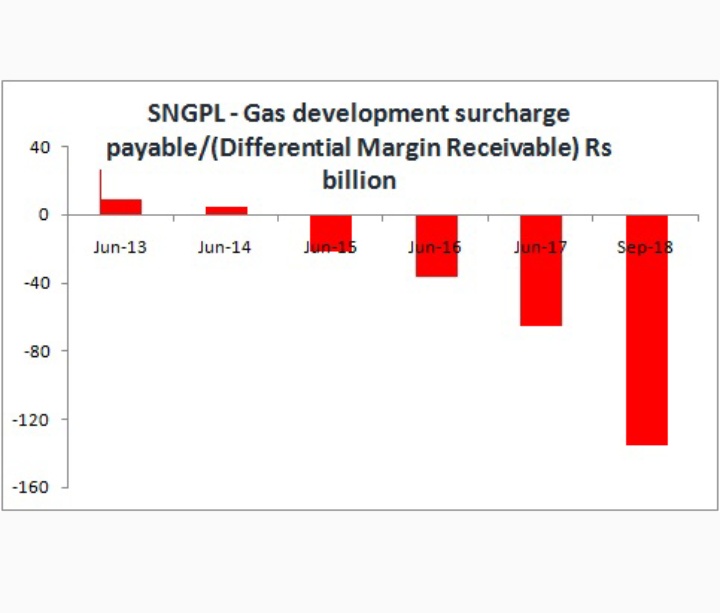

Circular debt refers to cash flow shortfall incurred in power sector from non-payment of obligations by consumers, distribution companies, & govt

Differential margin is created by disparity between prescribed gas prices by OGRA & notified consumer tariff(includes subsidies)

22/N

Differential margin is created by disparity between prescribed gas prices by OGRA & notified consumer tariff(includes subsidies)

22/N

In Jun& #39;13, The gas development surcharge payable to govt was Rs26bn which turned into differential margin- receivable from govt in FY15 & it stood at Rs122bn by the end of FY18

This explains why gas prices increased

Source:

https://www.brecorder.com/2019/05/06/494796/power-discos-the-bleeding-goes-on/

https://www.brecorder.com/2019/05/0... href=" https://www.brecorder.com/2019/05/09/495617/sngpl-of-ufg-and-differential-margin/

23/N">https://www.brecorder.com/2019/05/0...

This explains why gas prices increased

Source:

https://www.brecorder.com/2019/05/06/494796/power-discos-the-bleeding-goes-on/

23/N">https://www.brecorder.com/2019/05/0...

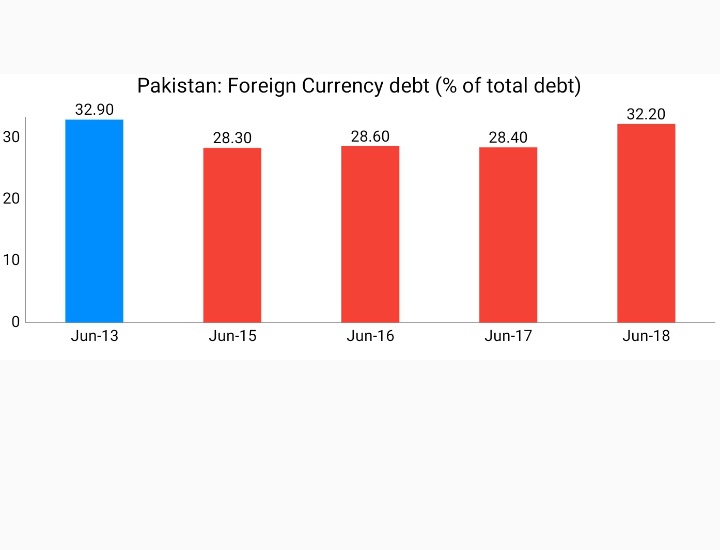

The Foreign Currency debt (% of total debt) increased from 28.4% in Jun& #39;17 to 32.2% by Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

https://www.finance.gov.pk/dpco/Risk... href=" http://www.finance.gov.pk/Quarterly_Risk_Report_End_June_2017.pdf

24/N">https://www.finance.gov.pk/Quarterly...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

24/N">https://www.finance.gov.pk/Quarterly...

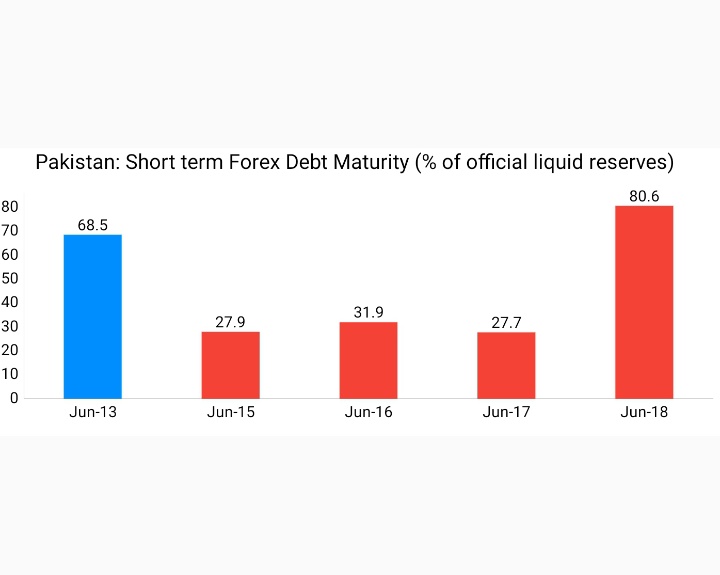

Pakistan’s short & long-term debt (maturing in the one year) increased to 80.6% of the total liquid foreign currency reserves by Jun& #39;18. This ratio was only 27.7% in Jun& #39;17, indicating the danger of a default

Source:

http://www.finance.gov.pk/Quarterly_Risk_Report_June_30_2016.pdf

https://www.finance.gov.pk/Quarterly... href=" http://www.finance.gov.pk/RiskReportOnDebtManagement_End%20June%202015.pdf

25/N">https://www.finance.gov.pk/RiskRepor...

Source:

http://www.finance.gov.pk/Quarterly_Risk_Report_June_30_2016.pdf

25/N">https://www.finance.gov.pk/RiskRepor...

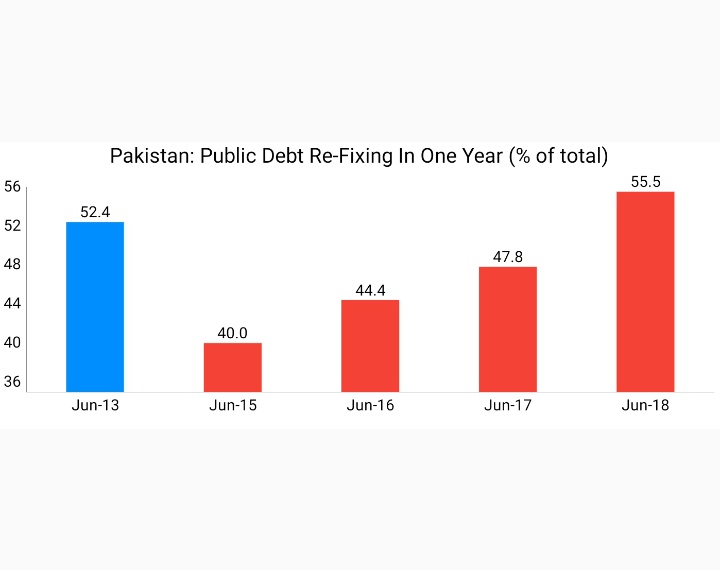

Public Debt that has to be re-fixed in one year increased from 47.8% in Jun& #39;17 to 55.5% in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

26/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

26/N">https://www.finance.gov.pk/dpco/Risk...

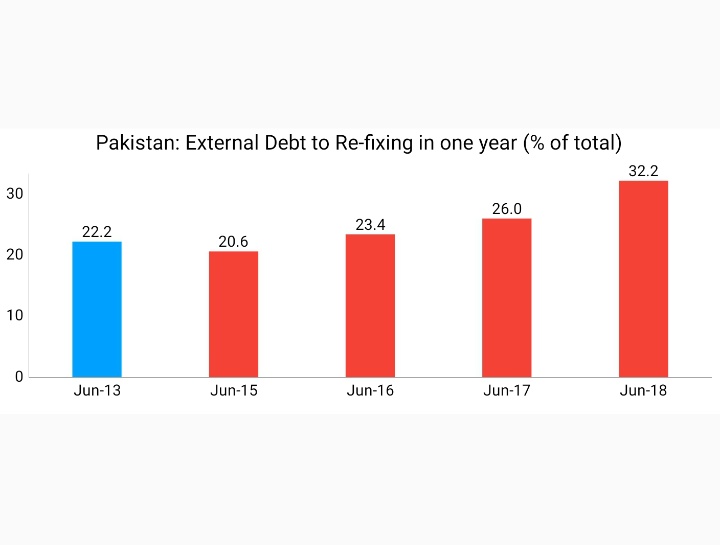

The external debt that requires to be readjusted in one year to new interest rates increased from 22.2% in Jun& #39;13 to 32.2% in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

27/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

27/N">https://www.finance.gov.pk/dpco/Risk...

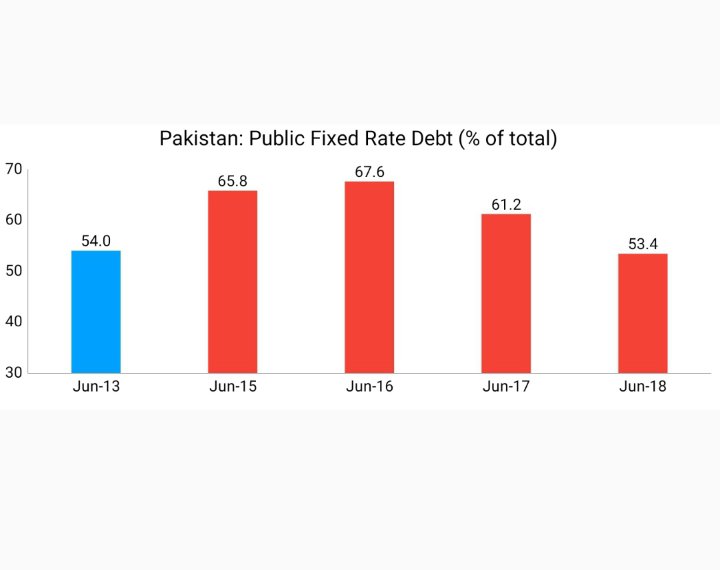

The ratio of fixed rate public debt came down from 61.2% in Jun& #39;17 to 53.4% by Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

https://www.finance.gov.pk/dpco/Risk... href=" https://tribune.com.pk/story/1821958/2-pakistans-debt-sustainability-indicators-disarray/

28/N">https://tribune.com.pk/story/182...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

28/N">https://tribune.com.pk/story/182...

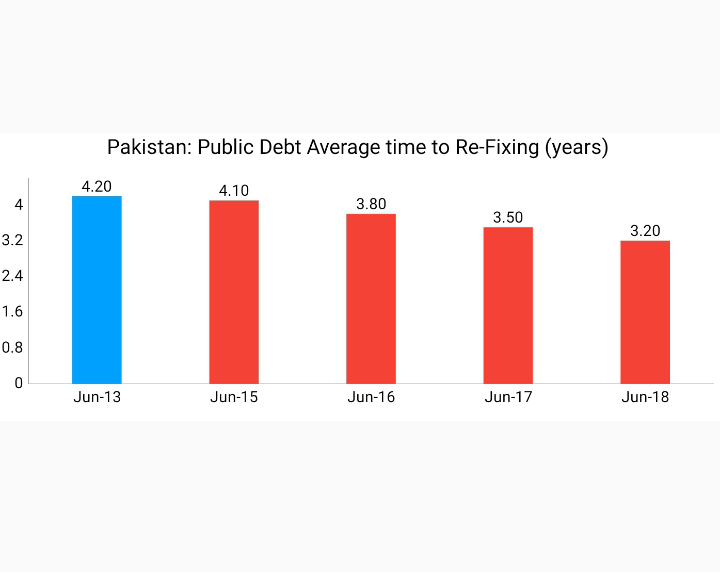

Average time to re-fixing is a measure of weighted average time until all principal payments in the debt portfolio become subject to a new interest rate

Average time to Re-Fixing of Public Debt fell from 4.2 yrs in Jun& #39;13 to 3.2 yrs in Jun18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

29/N">https://www.finance.gov.pk/dpco/Risk...

Average time to Re-Fixing of Public Debt fell from 4.2 yrs in Jun& #39;13 to 3.2 yrs in Jun18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

29/N">https://www.finance.gov.pk/dpco/Risk...

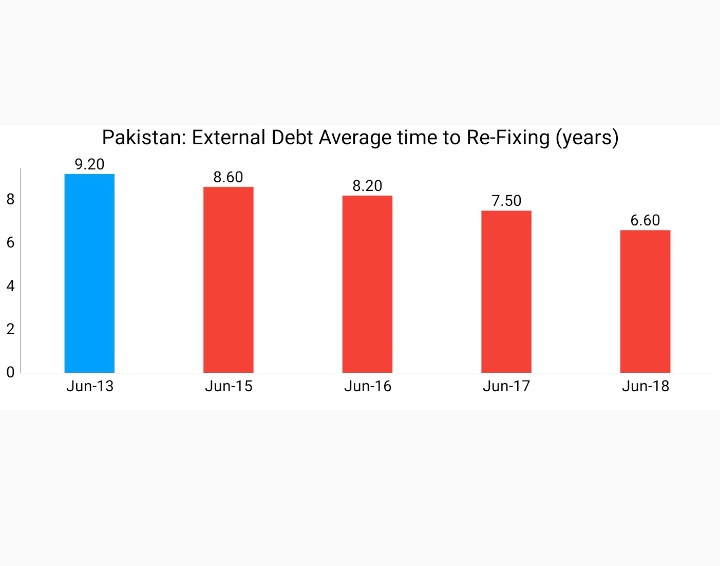

External Debt Average time to Re-Fixing fell from 9.2 years in Jun& #39;13 to 6.6 years in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

30/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

30/N">https://www.finance.gov.pk/dpco/Risk...

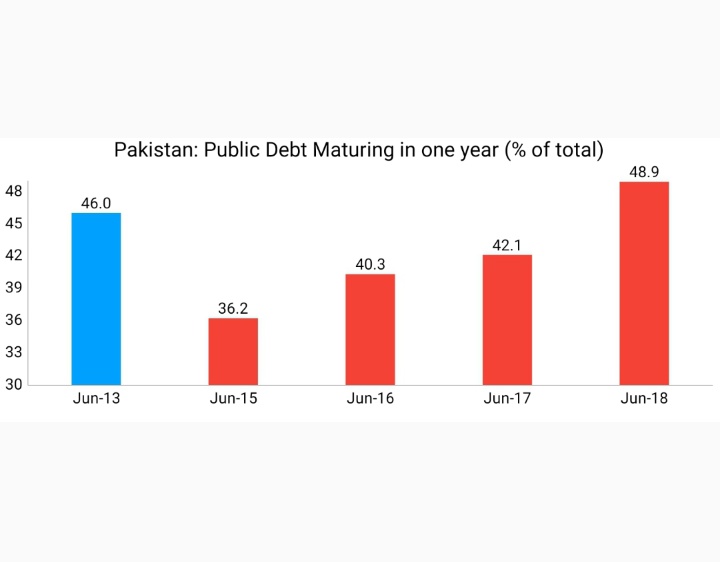

Public Debt Maturing in one year (% of total) surged from 36.2% in Jun& #39;15 to 48.9% in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

31/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

31/N">https://www.finance.gov.pk/dpco/Risk...

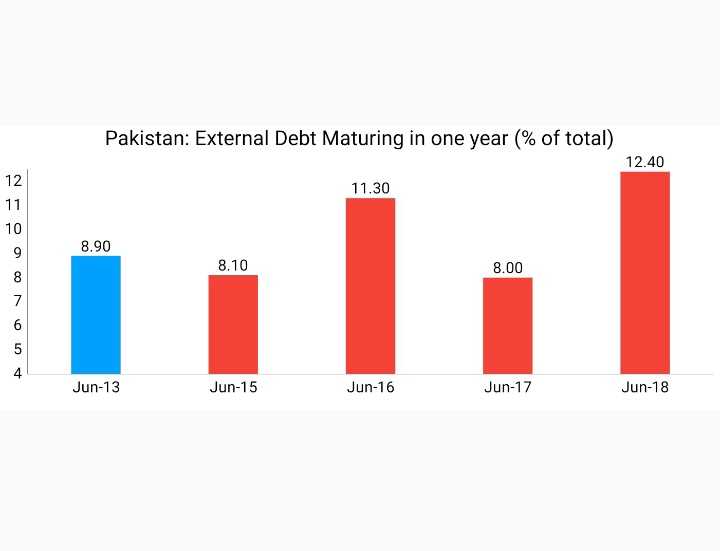

External Debt Maturing in one year (% of total) surged from 8.9% in Jun& #39;13 to 12.4% in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

32/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

32/N">https://www.finance.gov.pk/dpco/Risk...

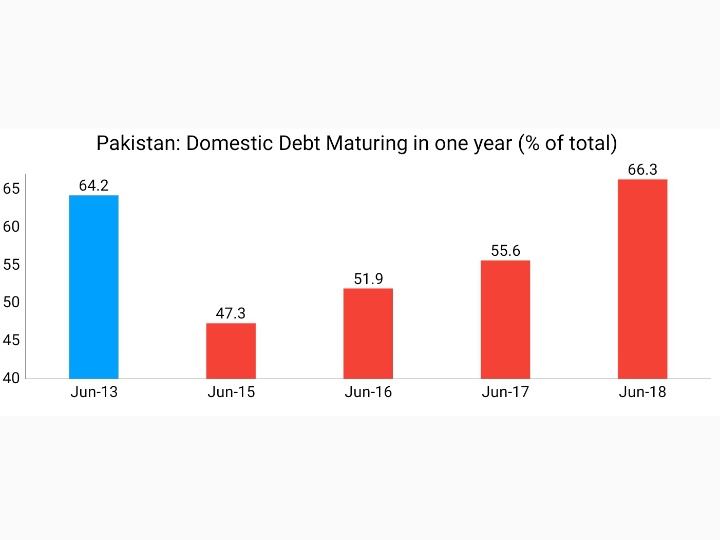

Domestic Debt Maturing in one year (% of total) surged from 47.3% in Jun& #39;15 to 66.3% in Jun& #39;18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

33/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

33/N">https://www.finance.gov.pk/dpco/Risk...

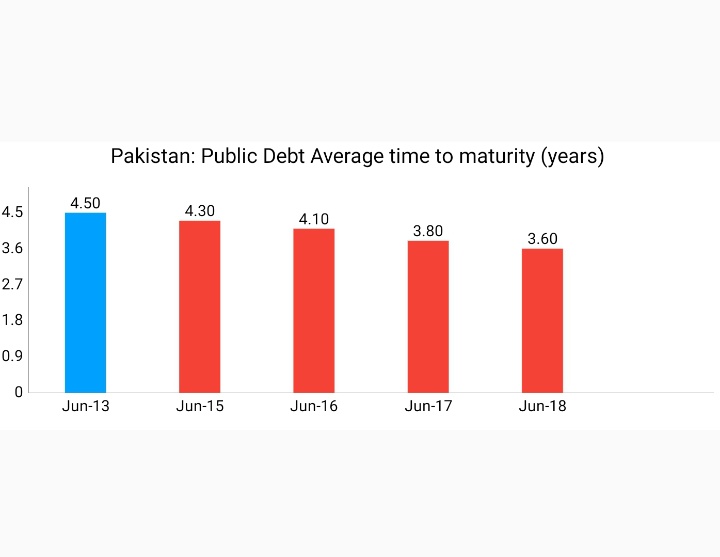

Public Debt Average time to maturity fell from 4.5 years to 3.6 years

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

34/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

34/N">https://www.finance.gov.pk/dpco/Risk...

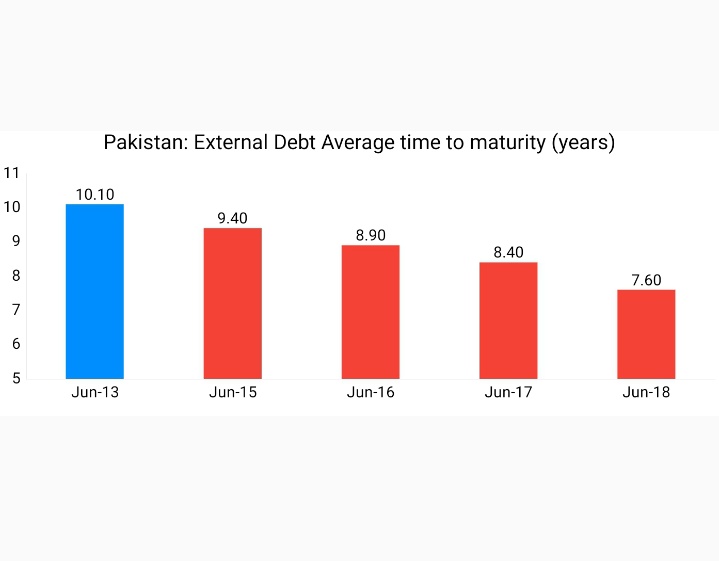

The average time-to-maturity of external debt decreased from 10.1 years in FY13 to 7.6 years in FY18

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

35/N">https://www.finance.gov.pk/dpco/Risk...

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

35/N">https://www.finance.gov.pk/dpco/Risk...

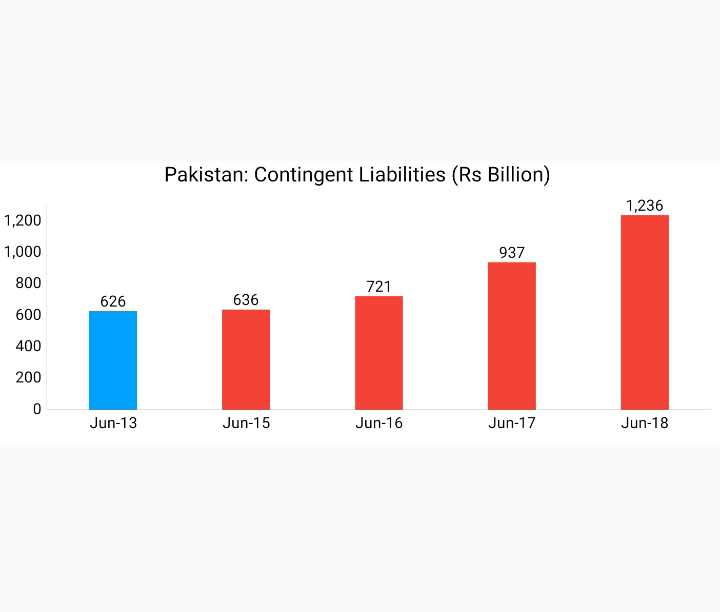

Contingent liabilities (CLs) are off-budget activities that appear on govt balance sheet only

when event actually happens

It relates to govt guarantees on behalf of PSEs

CLs surged from Rs625.9bn in Jun& #39;13 to Rs1236.2 in Jun& #39;18 - up 97.5%

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

36/N">https://www.finance.gov.pk/dpco/Risk...

when event actually happens

It relates to govt guarantees on behalf of PSEs

CLs surged from Rs625.9bn in Jun& #39;13 to Rs1236.2 in Jun& #39;18 - up 97.5%

Source:

http://www.finance.gov.pk/dpco/RiskReportOnDebtManagement_End_June_2018.pdf

36/N">https://www.finance.gov.pk/dpco/Risk...

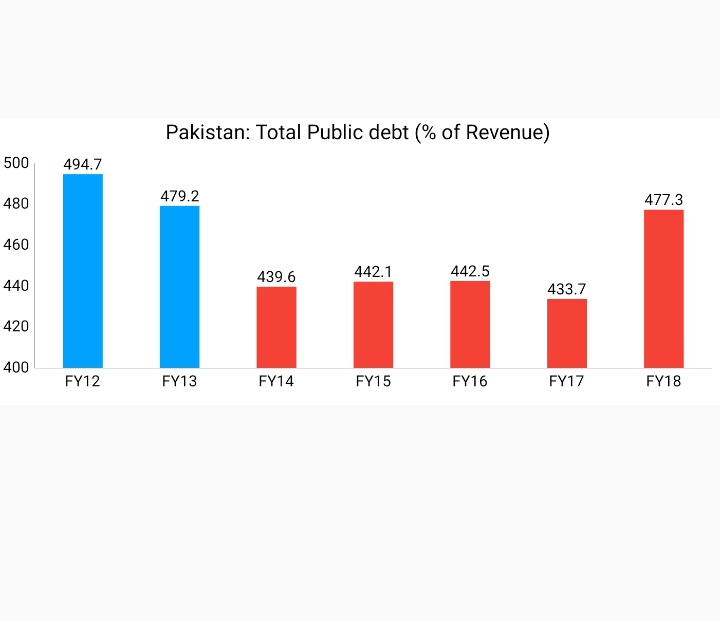

Total Public debt (% of Revenue) increased from 439.6% in FY14 to 477.3% in FY18

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf

37/N">https://www.finance.gov.pk/publicati...

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

37/N">https://www.finance.gov.pk/publicati...

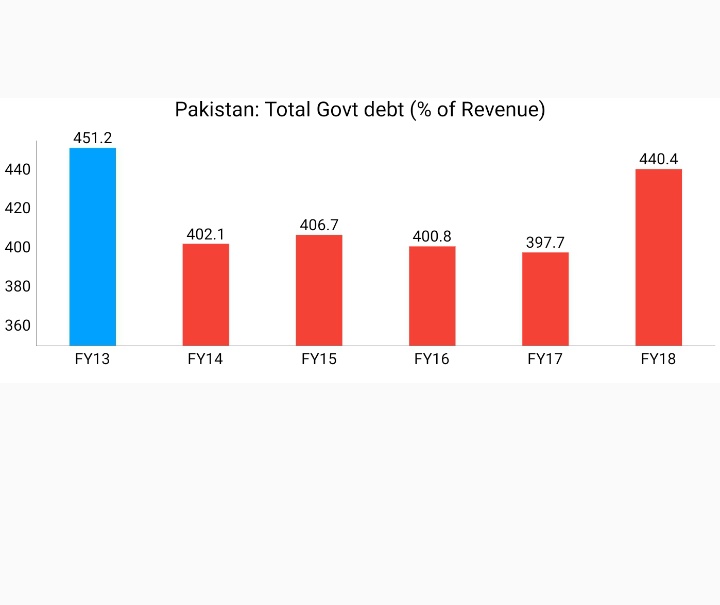

Total Govt debt (% of Revenue) increased from 402.1% in FY14 to 440.4% in FY18

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

38/N">https://www.finance.gov.pk/publicati...

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

38/N">https://www.finance.gov.pk/publicati...

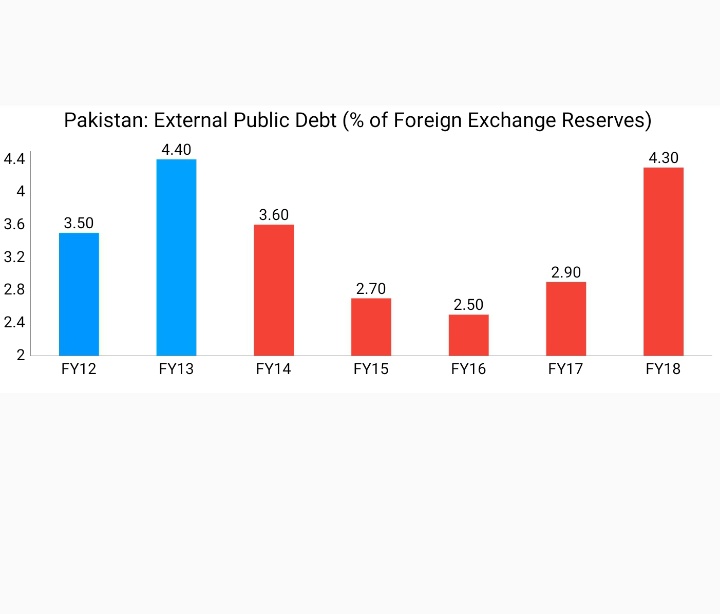

External Public Debt (% of Foreign Exchange Reserves) increased from 3.6% in FY14 to 4.3% in FY18

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2016_17.pdf

39/N">https://www.finance.gov.pk/publicati...

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

39/N">https://www.finance.gov.pk/publicati...

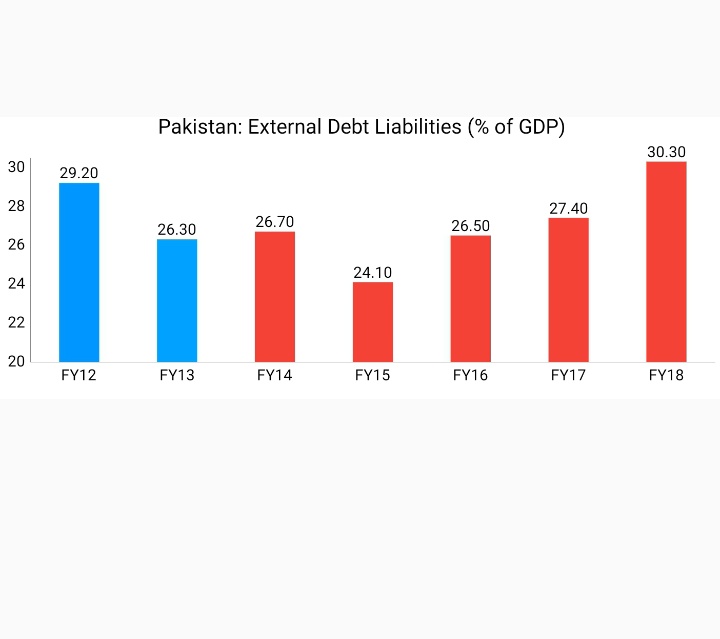

External Debt Liabilities (% of GDP) increased from 26.3% in FY13 to 30.3% in FY18

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf

40/N">https://www.finance.gov.pk/publicati...

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

40/N">https://www.finance.gov.pk/publicati...

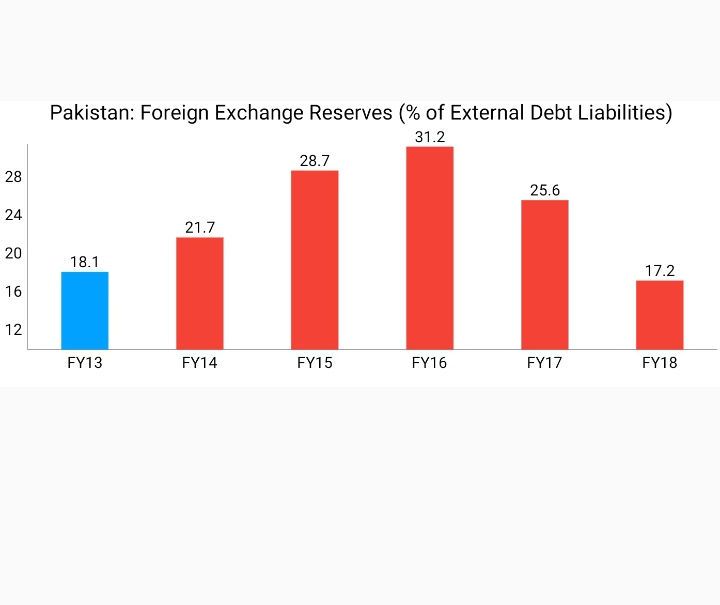

Foreign Exchange Reserves (% of External Debt Liabilities) decreased from 18.1% in FY13 to 17.2% in FY18

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

41/N">https://www.finance.gov.pk/publicati...

Source:

http://www.finance.gov.pk/publications/DPS_2019_2020.pdf

41/N">https://www.finance.gov.pk/publicati...

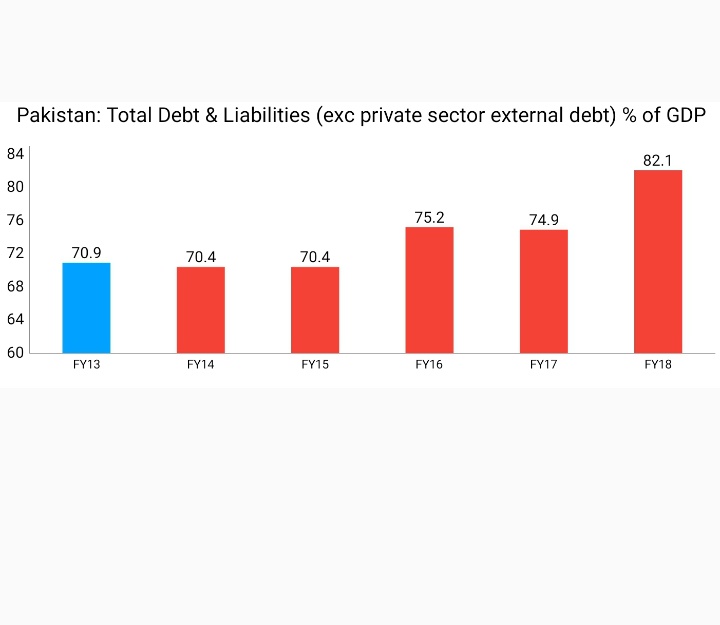

Total Debt & Liabilities (excluding private sector external debt) as % of GDP increased from 70.9% in FY13 to 82.1% in FY18

In absolute terms, it increased from Rs15,873bn in FY13 to Rs28,253 in FY18 - an increase of 78%

Source:

http://www.finance.gov.pk/publications/DPS_2018_19.pdf

42/N">https://www.finance.gov.pk/publicati...

In absolute terms, it increased from Rs15,873bn in FY13 to Rs28,253 in FY18 - an increase of 78%

Source:

http://www.finance.gov.pk/publications/DPS_2018_19.pdf

42/N">https://www.finance.gov.pk/publicati...

Read on Twitter

Read on Twitter

https://www.sbp.org.pk/ecodata/B..." title="Current Account Deficit (CAD) surged from 1.1% of GDP in FY13 to 6.3% of GDP in FY18Last 4 months before the new govt coming into power we were running a CAD of $2bn a month this means at an annualised pace of $24bnSource: https://www.sbp.org.pk/ecodata/B... href=" http://www.sbp.org.pk/ecodata/BOP_arch/index.asp2/N">https://www.sbp.org.pk/ecodata/B..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/ecodata/B..." title="Current Account Deficit (CAD) surged from 1.1% of GDP in FY13 to 6.3% of GDP in FY18Last 4 months before the new govt coming into power we were running a CAD of $2bn a month this means at an annualised pace of $24bnSource: https://www.sbp.org.pk/ecodata/B... href=" http://www.sbp.org.pk/ecodata/BOP_arch/index.asp2/N">https://www.sbp.org.pk/ecodata/B..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Misaligned exchange rate subsidized imports, leading to huge surge in the trade deficitTrade Deficit more than doubled to $37.9bn by FY18, from $16.9bn in FY13Real effective exchange rate (REER)Free on board (FOB)Source: https://www.sbp.org.pk/ecodata/E... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf4/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Misaligned exchange rate subsidized imports, leading to huge surge in the trade deficitTrade Deficit more than doubled to $37.9bn by FY18, from $16.9bn in FY13Real effective exchange rate (REER)Free on board (FOB)Source: https://www.sbp.org.pk/ecodata/E... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf4/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Imports increased from $45bn in FY13 to $60.8bn in FY18Imports (FOB) increased from 17.4% of GDP in FY13 to 18% of GDP in FY18Source: https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf5/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Imports increased from $45bn in FY13 to $60.8bn in FY18Imports (FOB) increased from 17.4% of GDP in FY13 to 18% of GDP in FY18Source: https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf5/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Pakistan& #39;s exports fell from $24.5bn in FY13 to $23.2bn in FY18Exports (FOB) fell from 10.7% of GDP in FY13 to 7.9% of GDP in FY18State Bank of Pakistan (SBP)Public Sector Enterprises (PSEs)Source: https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf6/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/survey/ch..." title="Pakistan& #39;s exports fell from $24.5bn in FY13 to $23.2bn in FY18Exports (FOB) fell from 10.7% of GDP in FY13 to 7.9% of GDP in FY18State Bank of Pakistan (SBP)Public Sector Enterprises (PSEs)Source: https://www.pbs.gov.pk/sites/def... href=" http://www.finance.gov.pk/survey/chapters_19/Economic%20Indicators%201819.pdf6/N">https://www.finance.gov.pk/survey/ch..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/ecodata/F..." title="When the NIR runs in negative, any external shock can create massive crisis – crippling the economy by free fall in currency which can be followed by hyper-inflationNIR fell from -$2.2bn in FY13 to -$7bn in FY18Source: https://www.sbp.org.pk/ecodata/L... href=" http://www.sbp.org.pk/ecodata/Forex_Arch.xlsx8/N">https://www.sbp.org.pk/ecodata/F..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/ecodata/F..." title="When the NIR runs in negative, any external shock can create massive crisis – crippling the economy by free fall in currency which can be followed by hyper-inflationNIR fell from -$2.2bn in FY13 to -$7bn in FY18Source: https://www.sbp.org.pk/ecodata/L... href=" http://www.sbp.org.pk/ecodata/Forex_Arch.xlsx8/N">https://www.sbp.org.pk/ecodata/F..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/ecodata/p..." title="Net Reserves with SBP are calculated by subtracting forward/Swaps from SBP& #39;s Gross ReservesWith CAD averaging $2bn a month & SBP& #39;s Net Reserves falling to $2.8bn this indicated risks of a sovereign defaultSource: https://www.sbp.org.pk/ecodata/F... href=" http://www.sbp.org.pk/ecodata/pakdebt_Arch.xlsx9/N">https://www.sbp.org.pk/ecodata/p..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/ecodata/p..." title="Net Reserves with SBP are calculated by subtracting forward/Swaps from SBP& #39;s Gross ReservesWith CAD averaging $2bn a month & SBP& #39;s Net Reserves falling to $2.8bn this indicated risks of a sovereign defaultSource: https://www.sbp.org.pk/ecodata/F... href=" http://www.sbp.org.pk/ecodata/pakdebt_Arch.xlsx9/N">https://www.sbp.org.pk/ecodata/p..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/A_Roadmap..." title="Fiscal deficit soared to 6.5% in FY18Financial losses of PSEs were at a record high level of 1.4%of GDP, implying overall fiscal & quasi fiscal deficit of about 8% of GDP & Energy sector circular debt of Rs1.2trSource: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/A_Roadmap_for_Stability_and_Growth_April_8.pdf10/N">https://www.finance.gov.pk/A_Roadmap..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/A_Roadmap..." title="Fiscal deficit soared to 6.5% in FY18Financial losses of PSEs were at a record high level of 1.4%of GDP, implying overall fiscal & quasi fiscal deficit of about 8% of GDP & Energy sector circular debt of Rs1.2trSource: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/A_Roadmap_for_Stability_and_Growth_April_8.pdf10/N">https://www.finance.gov.pk/A_Roadmap..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Revenue balance is the total revenues minus current expThe persistence of revenue deficit indicates that the govt is not only borrowing to finance its development exp, but partially also financing its current expSource: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf12/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Revenue balance is the total revenues minus current expThe persistence of revenue deficit indicates that the govt is not only borrowing to finance its development exp, but partially also financing its current expSource: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf12/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Total Debt Repayment obligations for the incoming govt cumulatively stood at $37.6bn in 5 years without borrowing a single pennyIn Blue bars are the actual Debt RepaymentsIn Red bars are the debt Repayments due Source: https://nation.com.pk/06-Jan-20... href=" http://www.finance.gov.pk/publications/DPS_2018_19.pdf18/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Total Debt Repayment obligations for the incoming govt cumulatively stood at $37.6bn in 5 years without borrowing a single pennyIn Blue bars are the actual Debt RepaymentsIn Red bars are the debt Repayments due Source: https://nation.com.pk/06-Jan-20... href=" http://www.finance.gov.pk/publications/DPS_2018_19.pdf18/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/reports/s..." title="PSEs Debt & Liabilities surged from 2.3% of GDP in FY13 to 3.8% of GDP in FY18In absolute terms, it surged from Rs538.1bn in FY13 to Rs1,299.5bn in FY18 - an increase of 141.5%Central Power Purchasing Agency (CPPA)Source: https://www.sbp.org.pk/reports/s... href=" http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2013/Dec/InternalExternalPublicDebt.pdf19/N">https://www.sbp.org.pk/reports/s..." class="img-responsive" style="max-width:100%;"/>

https://www.sbp.org.pk/reports/s..." title="PSEs Debt & Liabilities surged from 2.3% of GDP in FY13 to 3.8% of GDP in FY18In absolute terms, it surged from Rs538.1bn in FY13 to Rs1,299.5bn in FY18 - an increase of 141.5%Central Power Purchasing Agency (CPPA)Source: https://www.sbp.org.pk/reports/s... href=" http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2013/Dec/InternalExternalPublicDebt.pdf19/N">https://www.sbp.org.pk/reports/s..." class="img-responsive" style="max-width:100%;"/>

https://www.brecorder.com/2019/05/0..." title="In Jun& #39;13, The gas development surcharge payable to govt was Rs26bn which turned into differential margin- receivable from govt in FY15 & it stood at Rs122bn by the end of FY18This explains why gas prices increasedSource: https://www.brecorder.com/2019/05/0... href=" https://www.brecorder.com/2019/05/09/495617/sngpl-of-ufg-and-differential-margin/23/N">https://www.brecorder.com/2019/05/0..." class="img-responsive" style="max-width:100%;"/>

https://www.brecorder.com/2019/05/0..." title="In Jun& #39;13, The gas development surcharge payable to govt was Rs26bn which turned into differential margin- receivable from govt in FY15 & it stood at Rs122bn by the end of FY18This explains why gas prices increasedSource: https://www.brecorder.com/2019/05/0... href=" https://www.brecorder.com/2019/05/09/495617/sngpl-of-ufg-and-differential-margin/23/N">https://www.brecorder.com/2019/05/0..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/Quarterly..." title="The Foreign Currency debt (% of total debt) increased from 28.4% in Jun& #39;17 to 32.2% by Jun& #39;18Source: https://www.finance.gov.pk/dpco/Risk... href=" http://www.finance.gov.pk/Quarterly_Risk_Report_End_June_2017.pdf24/N">https://www.finance.gov.pk/Quarterly..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/Quarterly..." title="The Foreign Currency debt (% of total debt) increased from 28.4% in Jun& #39;17 to 32.2% by Jun& #39;18Source: https://www.finance.gov.pk/dpco/Risk... href=" http://www.finance.gov.pk/Quarterly_Risk_Report_End_June_2017.pdf24/N">https://www.finance.gov.pk/Quarterly..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/RiskRepor..." title="Pakistan’s short & long-term debt (maturing in the one year) increased to 80.6% of the total liquid foreign currency reserves by Jun& #39;18. This ratio was only 27.7% in Jun& #39;17, indicating the danger of a defaultSource: https://www.finance.gov.pk/Quarterly... href=" http://www.finance.gov.pk/RiskReportOnDebtManagement_End%20June%202015.pdf25/N">https://www.finance.gov.pk/RiskRepor..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/RiskRepor..." title="Pakistan’s short & long-term debt (maturing in the one year) increased to 80.6% of the total liquid foreign currency reserves by Jun& #39;18. This ratio was only 27.7% in Jun& #39;17, indicating the danger of a defaultSource: https://www.finance.gov.pk/Quarterly... href=" http://www.finance.gov.pk/RiskReportOnDebtManagement_End%20June%202015.pdf25/N">https://www.finance.gov.pk/RiskRepor..." class="img-responsive" style="max-width:100%;"/>

https://tribune.com.pk/story/182..." title="The ratio of fixed rate public debt came down from 61.2% in Jun& #39;17 to 53.4% by Jun& #39;18Source: https://www.finance.gov.pk/dpco/Risk... href=" https://tribune.com.pk/story/1821958/2-pakistans-debt-sustainability-indicators-disarray/28/N">https://tribune.com.pk/story/182..." class="img-responsive" style="max-width:100%;"/>

https://tribune.com.pk/story/182..." title="The ratio of fixed rate public debt came down from 61.2% in Jun& #39;17 to 53.4% by Jun& #39;18Source: https://www.finance.gov.pk/dpco/Risk... href=" https://tribune.com.pk/story/1821958/2-pakistans-debt-sustainability-indicators-disarray/28/N">https://tribune.com.pk/story/182..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Total Public debt (% of Revenue) increased from 439.6% in FY14 to 477.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf37/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="Total Public debt (% of Revenue) increased from 439.6% in FY14 to 477.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf37/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="External Public Debt (% of Foreign Exchange Reserves) increased from 3.6% in FY14 to 4.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2016_17.pdf39/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="External Public Debt (% of Foreign Exchange Reserves) increased from 3.6% in FY14 to 4.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2016_17.pdf39/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="External Debt Liabilities (% of GDP) increased from 26.3% in FY13 to 30.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf40/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>

https://www.finance.gov.pk/publicati..." title="External Debt Liabilities (% of GDP) increased from 26.3% in FY13 to 30.3% in FY18Source: https://www.finance.gov.pk/publicati... href=" http://www.finance.gov.pk/publications/DPS_2014_15.pdf40/N">https://www.finance.gov.pk/publicati..." class="img-responsive" style="max-width:100%;"/>