FICO is an interesting business.

You know that credit score you get?

Yeah, FICO makes more than 100% of its profit from those. Think about how asset-light they are.

Quick [THREAD]

You know that credit score you get?

Yeah, FICO makes more than 100% of its profit from those. Think about how asset-light they are.

Quick [THREAD]

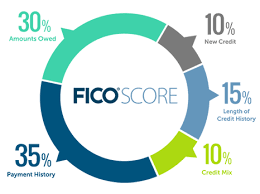

1/ The key is the industry dynamics.

Here is a simplified version of the value chain:

- someone applies for a loan

- the bank needs a credit report and FICO score to assess risk

- credit bureaus supply data to FICO and distribute FICO scores

Here is a simplified version of the value chain:

- someone applies for a loan

- the bank needs a credit report and FICO score to assess risk

- credit bureaus supply data to FICO and distribute FICO scores

2/ FICO services 98 of the top 100 financial institutions globally. These lenders have FICO scores embedded in their processes for determining risk.

FICO& #39;s brand has power.

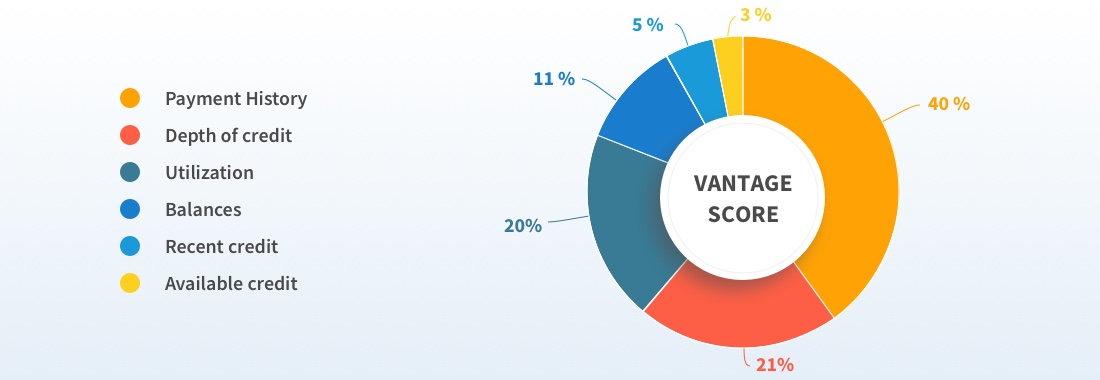

This is why the credit bureaus can& #39;t cut FICO out. They tried with VantageScore but not successful.

FICO& #39;s brand has power.

This is why the credit bureaus can& #39;t cut FICO out. They tried with VantageScore but not successful.

3/ It& #39;s a very rare dynamic for a company to be a supplier and a distributor and not have ultimate leverage.

This is the case with credit bureaus and FICO.

Bureaus can& #39;t raise prices too much on their data either because FICO would raise its royalty rates.

This is the case with credit bureaus and FICO.

Bureaus can& #39;t raise prices too much on their data either because FICO would raise its royalty rates.

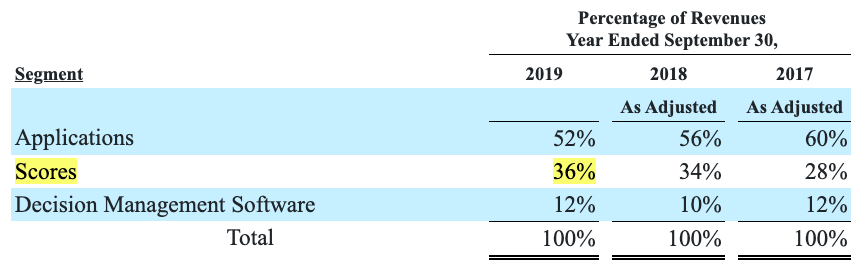

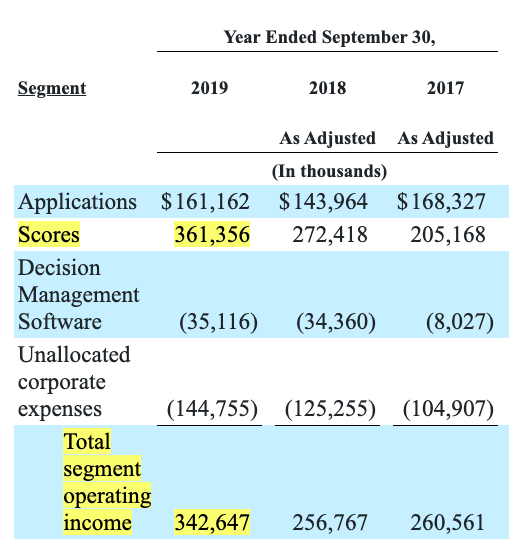

End/ Clearly FICO& #39;s business is driven by its Scores.

Anyone seen a business with higher than 86% operating margins?

Anyone seen a business with higher than 86% operating margins?

Read on Twitter

Read on Twitter![FICO is an interesting business. You know that credit score you get?Yeah, FICO makes more than 100% of its profit from those. Think about how asset-light they are.Quick [THREAD] FICO is an interesting business. You know that credit score you get?Yeah, FICO makes more than 100% of its profit from those. Think about how asset-light they are.Quick [THREAD]](https://pbs.twimg.com/media/EUnjbgNWoAAYsiU.png)