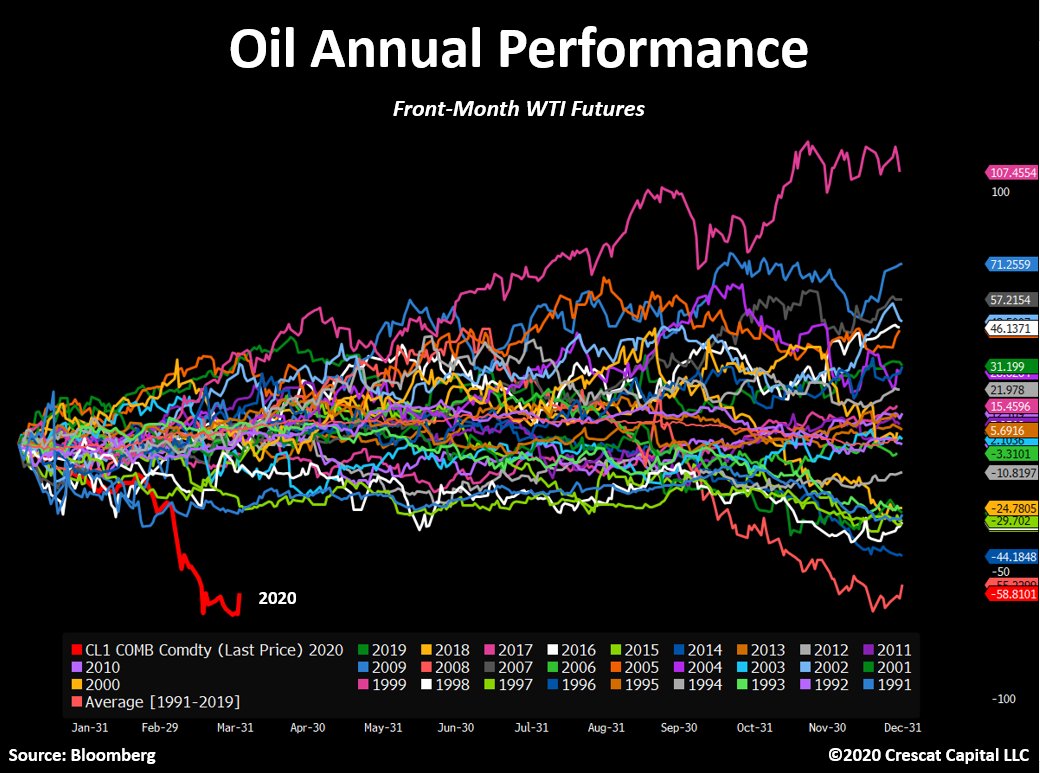

This is oil YTD folks…

Absolutely destroyed.

It’s hard not to buy some at these levels.

Let me elaborate on the bull case.

Absolutely destroyed.

It’s hard not to buy some at these levels.

Let me elaborate on the bull case.

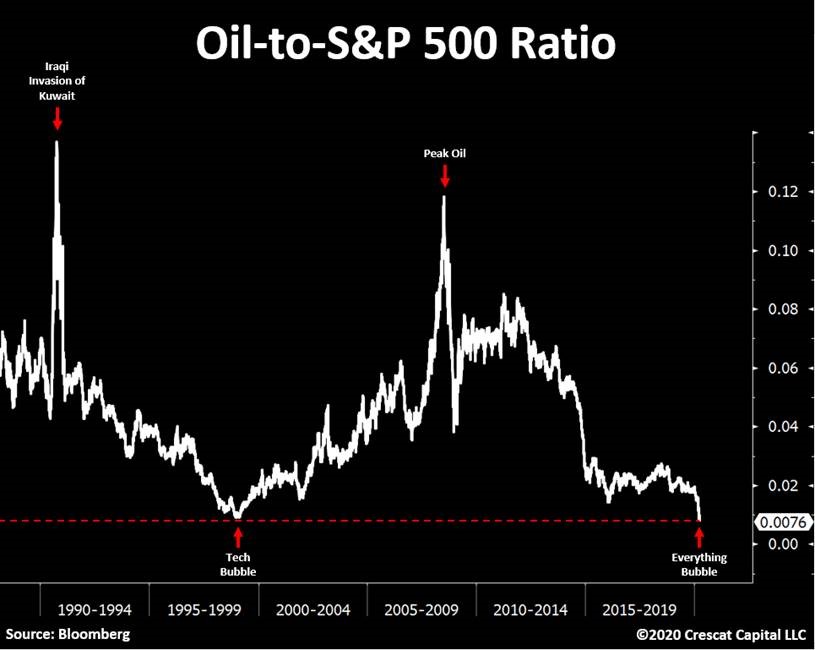

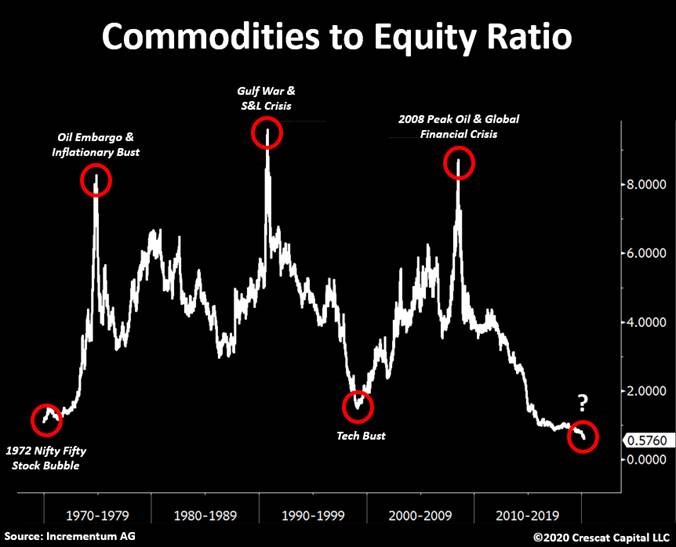

Oil-to-S&P 500 is forming a historic double bottom.

Prior low was December 1998.

Oil went up 240% in the next 22 months.

Prior low was December 1998.

Oil went up 240% in the next 22 months.

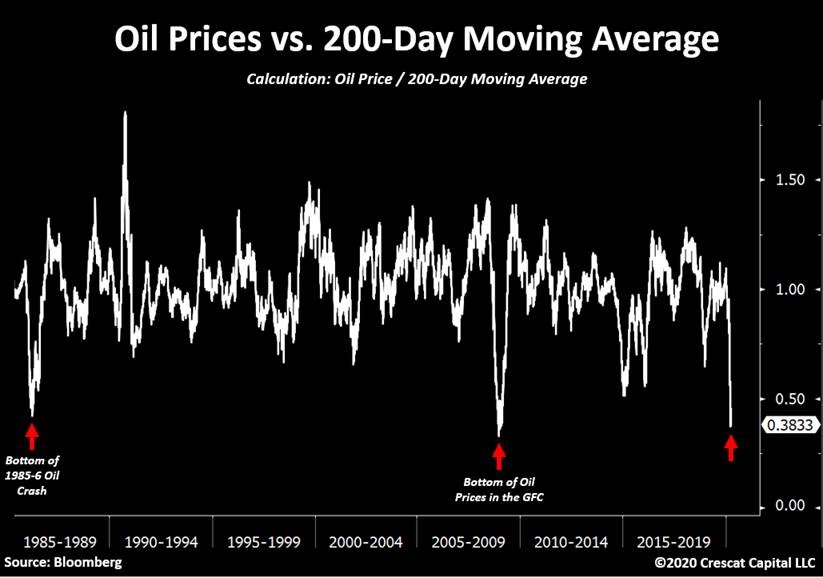

Oil vs. its 200-day moving average:

Now as distorted as it was in the depth of the global financial crisis and bottom of the 1985-6 crash.

Now as distorted as it was in the depth of the global financial crisis and bottom of the 1985-6 crash.

Energy high-yield credit spreads just reached record levels with WTI prices at 18-year lows.

An incredibly bullish setup.

An incredibly bullish setup.

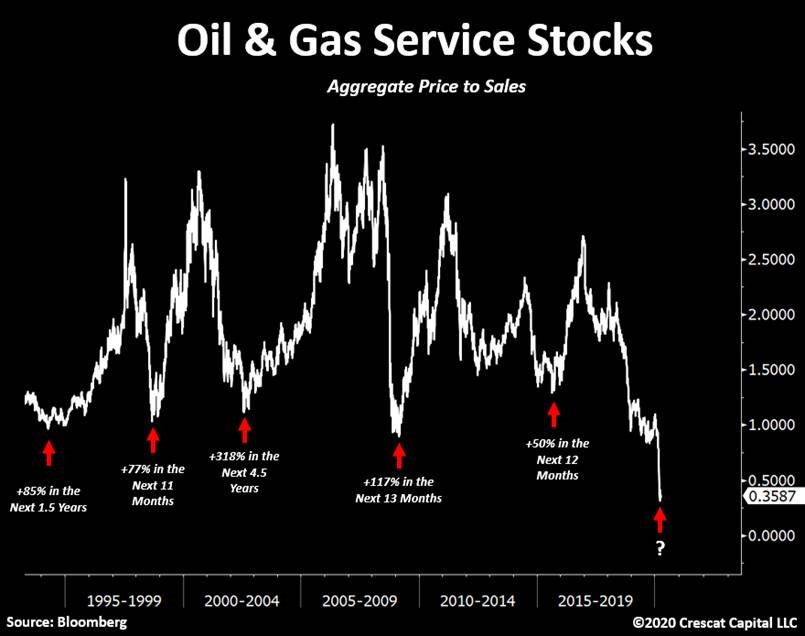

Energy service stocks are truly at historic low valuations.

The overall industry now trades at 0.35x annual revenues!

Plenty value to be found.

The overall industry now trades at 0.35x annual revenues!

Plenty value to be found.

Read on Twitter

Read on Twitter