Some good news amidst the storm: Thrilled to announce that my new book Power Grab is out from @CUP_PoliSci! It’s about how leaders survive in power by nationalizing oil, metals, & minerals. Why care about nationalizations?? Glad you asked! A brief https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://www.cambridge.org/core/books/power-grab/1069CD3CA50620BB1AF204156D13B2C8">https://www.cambridge.org/core/book...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://www.cambridge.org/core/books/power-grab/1069CD3CA50620BB1AF204156D13B2C8">https://www.cambridge.org/core/book...

National oil companies (NOCs) own $3 trillion of oil/gas assets on behalf of their citizens, almost DOUBLE what #WorldBank #IMF + Dev Banks manage combined. In some cases, NOCs & extractive SOEs *are* the economy, collecting 20-90% of all govt revenue https://www.internationalbudget.org/2019/05/fiscal-futures-are-national-oil-companies-champions-or-obstacles-for-energy-transition/">https://www.internationalbudget.org/2019/05/f...

And importantly, nationalization gives control over production levels -- which takes on a whole new meaning in the #ClimateCrisis as we ponder how oil producers react to the end of fossil fuels https://www.theguardian.com/environment/2019/oct/09/secretive-national-oil-companies-climate">https://www.theguardian.com/environme...

Nearly all oil-producers have nationalized at one point or another. The ONLY exception is the US. But as @KateAronoff writes, that’s not off the table in today’s low-price market. https://newrepublic.com/article/156941/moderate-proposal-nationalize-fossil-fuel-industry">https://newrepublic.com/article/1...

Yet nationalization has led to political & economic catastrophes like #Maduro’s Venezuela, or to international retaliation like 1938 Mexican oil embargo, 1953 Iranian Coup, or sanctions against Argentina for its 2012 YPF nationalization.

Nationalization is also clearly inefficient from a production standpoint. Wolf shows that NOCs produce 50% less than multinational oil firms. And @CBrunnschweiler finds NOCs less successful in discoveries when they go it alone

https://doi.org/10.1016/j.enpol.2009.02.041

https://doi.org/10.1016/j... href=" https://pdfs.semanticscholar.org/fbbe/698fafabb30200462048439f37cbd855fa92.pdf">https://pdfs.semanticscholar.org/fbbe/698f...

https://doi.org/10.1016/j.enpol.2009.02.041

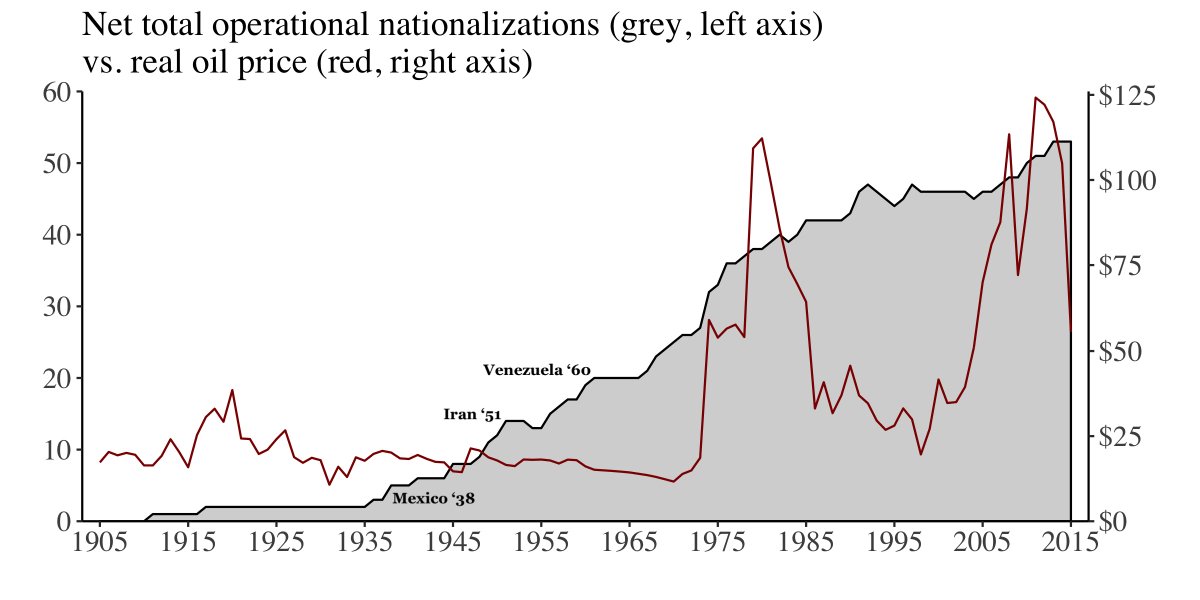

So why nationalize? Great work by @sguriev, @k_sonin, & Kolotinin shows that when oil prices are high, the benefits outweigh these costs -- which is why we see so many expropriations during price spikes (the 1970s and 2010s). https://academic.oup.com/jleo/article-abstract/27/2/301/2194061">https://academic.oup.com/jleo/arti...

But it’s not just about economics. Most major nationalizations happened during low-price spells: Mexico in 1938, Iran in 1951, Venezuela in 1960, and non-oil nationalizations like Chile in 1971 (copper) and India in 1971-75 (coal).

So what’s the answer? In the book, I argue that by taking control of the means of production and establishing SOEs, leaders capture revenues that might otherwise flow to private firms, and use this increased capital to secure political support.

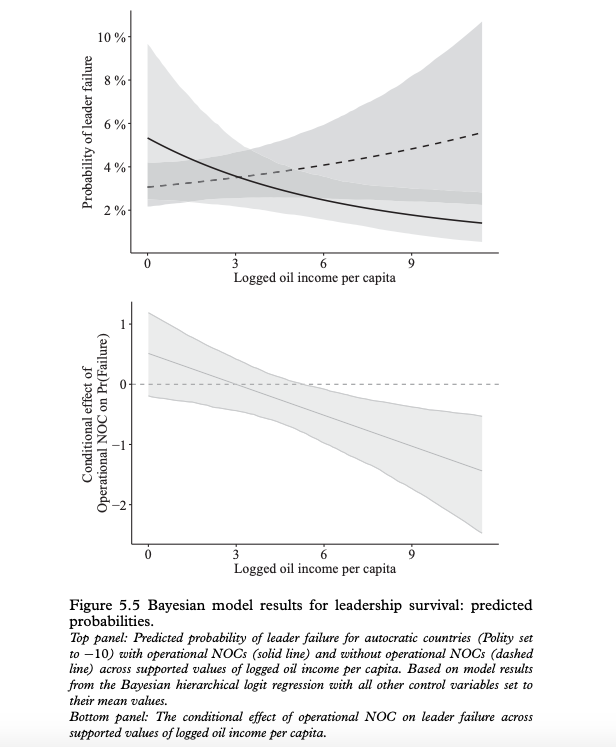

The basic idea is this: for those whose days in power may be numbered -- politically weak resource-rich leaders --nationalization is a risk worth taking. But for those who foresee long, lasting rule -- strong resource-rich leaders -- the returns may be too costly.

Case studies of Iran & Saudi in 1950s + Libya & Iraq in 60s/70s reveal how Idris, Faisal II, Ibn Saud passed on nationalizing given long time horizons; while Qaddafi, al-Bakr, Shah had little to lose, so the gamble was worth taking--and it paid off w decades of continued rule

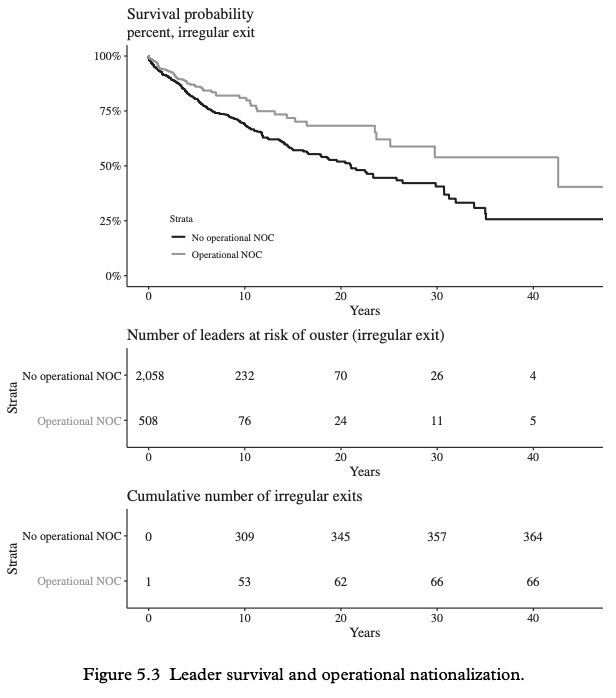

But does this apply outside the MidEast? Using Bayesian modeling on a new database of 175 countries over 110 years, I then found that non-nationalizers were up to THREE times more likely to be ousted than nationalizers.

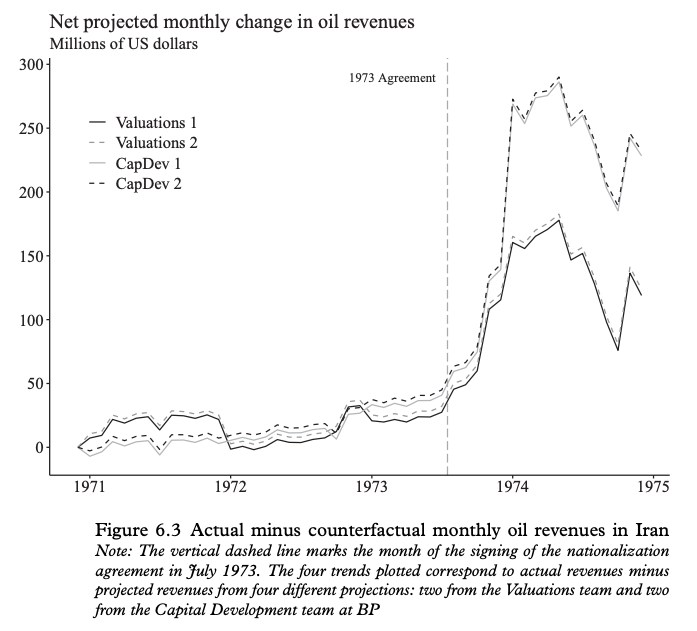

Key is that despite inefficiencies, nationalization brings fast $$ but at cost of long-term gains. Using archival data to construct viable within-unit counterfactuals for 1973 Iran, I found that re-nationalization brought $2.8 bn MORE over 16-mo period than if hadn’t nationalized

And we know from pathbreaking work by @margaretlevi that with more discretionary money in their coffers, leaders can spend on tactics to keep themselves in power. https://www.ucpress.edu/book/9780520067509/of-rule-and-revenue">https://www.ucpress.edu/book/9780...

NOCs also serve as perfect tools for patronage -- see great research by @jurpelai, @andrewcheon and @MaurKLack https://journals.sagepub.com/doi/abs/10.1177/0010414014543440">https://journals.sagepub.com/doi/abs/1...

Ultimately nationalization is a gamble, one worth taking by leaders who sense their end is near. More to come in the next few days--especially on the flip side of nationalization, as leaders ponder privatizing nationalized assets & selling off SOEs as last-resort for raising $$

And if you’ve made it this far, a couple more links to the book: https://www.amazon.com/Power-Grab-Political-Extractive-Nationalization-ebook/dp/B0845QG6KS">https://www.amazon.com/Power-Gra... (kindle)

https://www.cambridge.org/us/academic/subjects/politics-international-relations/political-economy/power-grab-political-survival-through-extractive-resource-nationalization?format=HB">https://www.cambridge.org/us/academ... (hardcover)

DM me for a discount code if you’re buying the hardcover!

https://www.cambridge.org/us/academic/subjects/politics-international-relations/political-economy/power-grab-political-survival-through-extractive-resource-nationalization?format=HB">https://www.cambridge.org/us/academ... (hardcover)

DM me for a discount code if you’re buying the hardcover!

And finally to Ben Smith @politiconcology, Pauline Jones, Victor Menaldo, and David Victor for such humbling endorsements!

Lastly, too many people to thank for getting here and many are twitterless (see the acknowledgments for more!) But HUGE thanks first to

@MichaelRoss7

-- no way this would’ve happened without Michael and his incredible generosity & wisdom! Couldn& #39;t have asked for a better mentor

@MichaelRoss7

-- no way this would’ve happened without Michael and his incredible generosity & wisdom! Couldn& #39;t have asked for a better mentor

Read on Twitter

Read on Twitter