HOW ARE THE BANKS SCREWING YOU OVER FROM TAKING THE MORATORIUM (AND TAKE CREDITS FROM IT)

We all have heard about how banks like to screw over people, today I am going to explain how.

It& #39;s a thread.

We all have heard about how banks like to screw over people, today I am going to explain how.

It& #39;s a thread.

This is an analytical piece on how taking the moratorium might impact you, so that you can ask your banks the right questions and make better calculated decisions. Note that is applies to all reducing balance loans, which means that car loans are not applicable.

Here& #39;s the breakdown of the analysis:

1. Assumptions

2. Prerequisite 1: Reducing balance loan

3. Prerequisite 2: Interest accrued, not compounded

4. Moratorium interest payment seniority

5. How you& #39;ll end up screwed

1. Assumptions

2. Prerequisite 1: Reducing balance loan

3. Prerequisite 2: Interest accrued, not compounded

4. Moratorium interest payment seniority

5. How you& #39;ll end up screwed

Note: Along this thread, I will use int to represent both interest (for conventional bank) & profit (for Islamic bank) interchangeably except for when I& #39;m talking about one specific case.

1. Because there are different mechanisms set by different banks, these assumptions are made:

a. After moratorium, monthly payment amount doesn& #39;t change

b. The loan term is extended for 6 months

c. Seniority of moratorium interest payment (explained later)

a. After moratorium, monthly payment amount doesn& #39;t change

b. The loan term is extended for 6 months

c. Seniority of moratorium interest payment (explained later)

2. Reducing Balance Loan

This type of loan means that int will be charged on your remaining principal amount. When you make your payment, the money goes to 2 places, the principal (pokok), and the interest (bunga).

This type of loan means that int will be charged on your remaining principal amount. When you make your payment, the money goes to 2 places, the principal (pokok), and the interest (bunga).

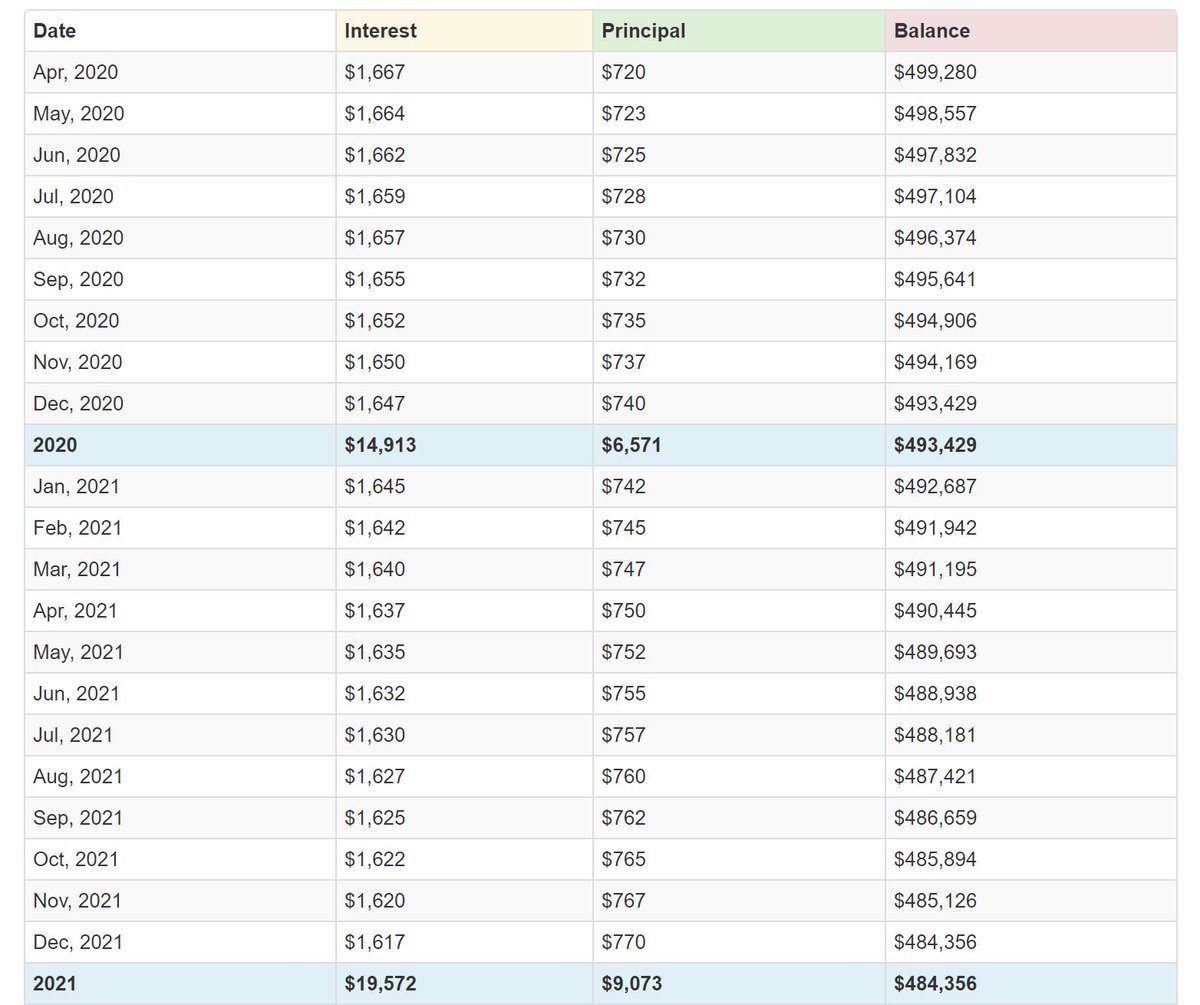

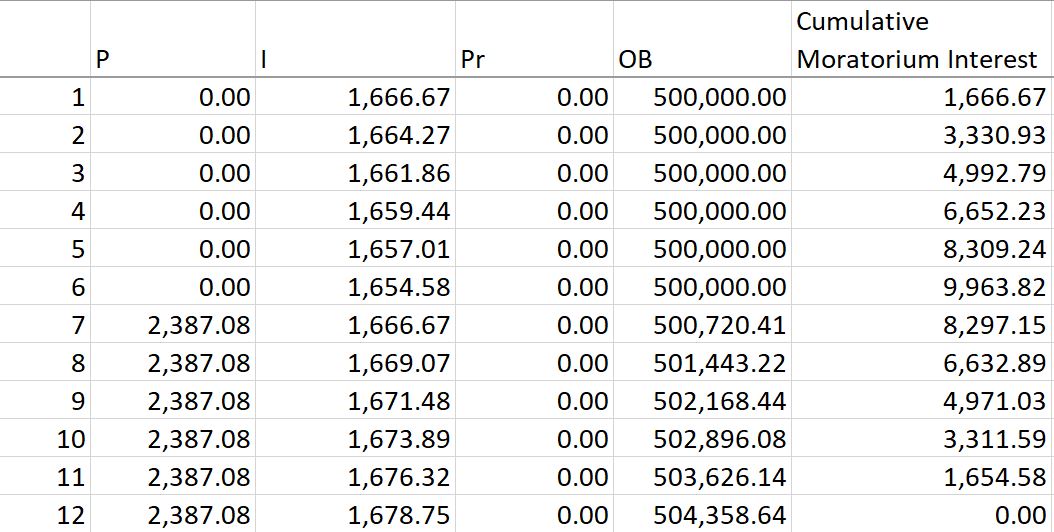

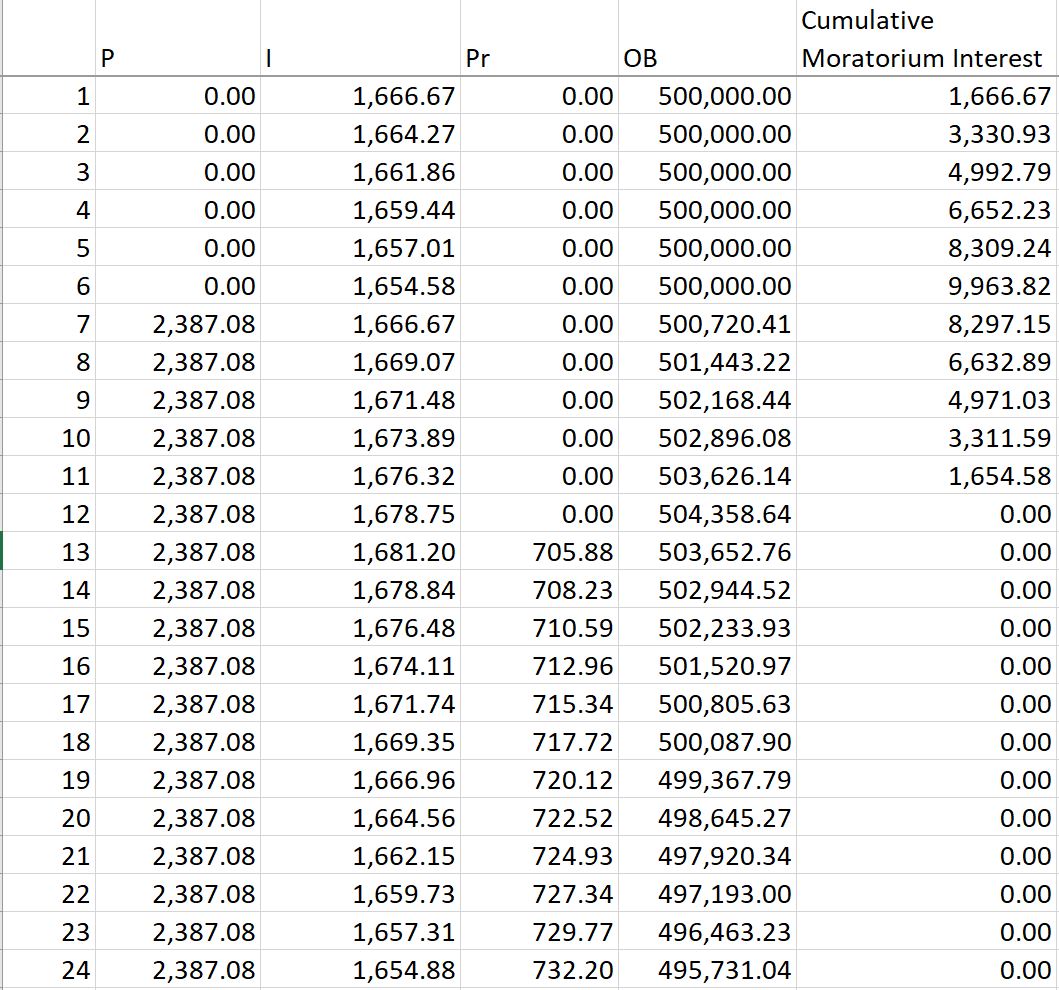

As the principal being paid up, the interest reduces as as result of having less remaining principal. Below is an illustration of a typical reducing balance loan.

3. Interest accrued, not compounded

This is the statement used by most banks to explain about the moratorium. This doesn& #39;t mean that there will be no int. There is int for the 6 months, but it just means that they won& #39;t charge a further int on top of the int.

This is the statement used by most banks to explain about the moratorium. This doesn& #39;t mean that there will be no int. There is int for the 6 months, but it just means that they won& #39;t charge a further int on top of the int.

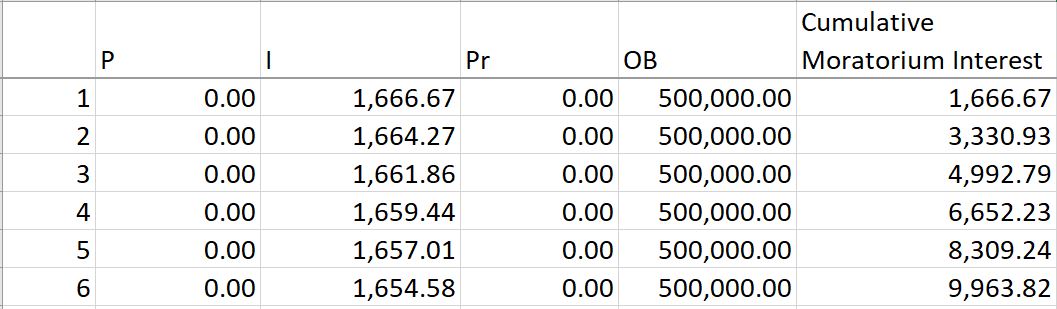

4. I talked to a bank representative and asked about how and when are we paying for the moratorium interest that accrued. They explained that the payment seniority goes as follows; from your payment:

a. Int from the moratorium will be paid on monthly basis

b. The balance (if sufficient) will go towards the current month& #39;s int. If it& #39;s not enough, only partially will be paid.

c. If there is balance (unlikely), the rest will go towards paying up the principal.

b. The balance (if sufficient) will go towards the current month& #39;s int. If it& #39;s not enough, only partially will be paid.

c. If there is balance (unlikely), the rest will go towards paying up the principal.

For example (500k , 4%, 30 years, conventional), your monthly payment is 2.4k. 1.6k is used to pay for moratorium int, that leaves you with 800 to pay for about 50% of current interest. No money goes towards principal at all. These depends on remaining balance and terms left.

5. This is how things go from bad to worse, because:

a. The principal is not reduced, nor your interest.

b. For conventional loans, things are worse because the unpaid current interests will be added towards remaining principal, which increase your future interests.

a. The principal is not reduced, nor your interest.

b. For conventional loans, things are worse because the unpaid current interests will be added towards remaining principal, which increase your future interests.

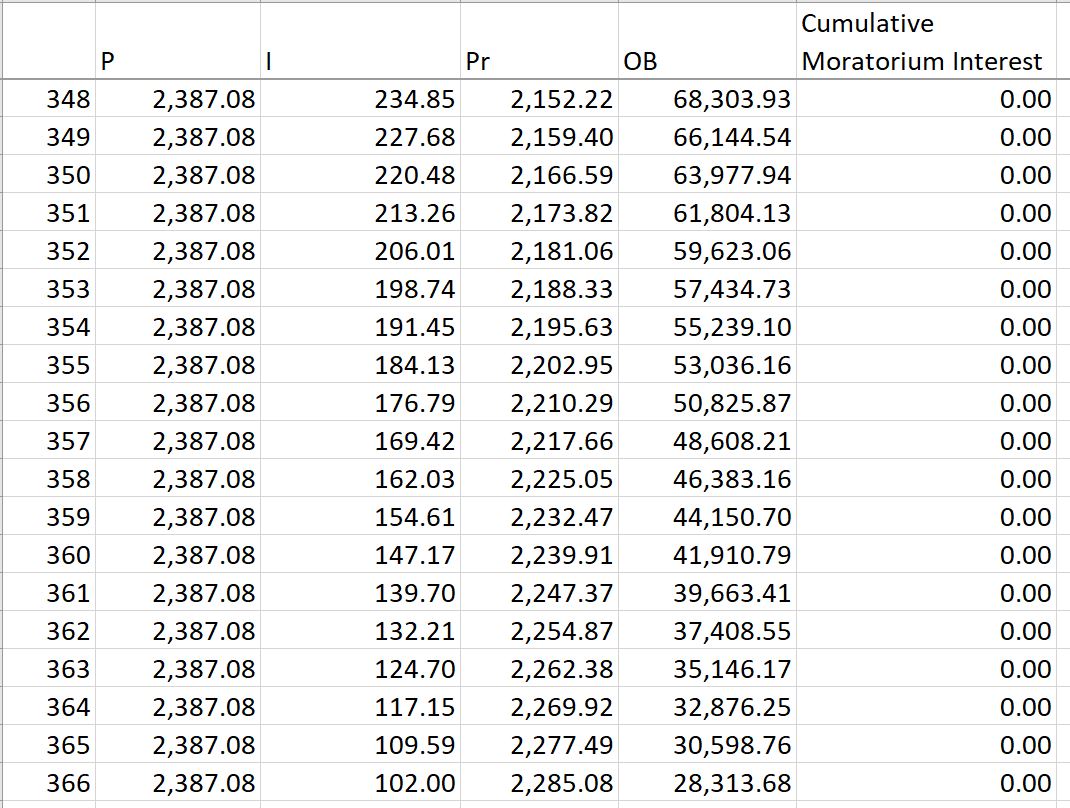

For this particular case, it takes about 11 months AFTER moratorium ends to get back to the initial remaining principal which is 500k. This add your total payment by quite some amount.

(5b) does not apply for Islamic loans, because it is forbidden to charge profit on profit. However, insufficient current payments have to be paid. Although it is non-compoundable, you would still have to pay for it, on top of the moratorium accrued profits.

Not to forget (5a), as your remaining principal will not decrease for a few months although it will not increase for the above reason. The effect for Islamic loans won& #39;t be as bad as conventional, but bad is bad.

For the above example, at the end of the loan term (30 years + 6 months extension), the loan holder still has about 28k of remaining principal which has to be paid eventually. Based on the rep I talked to, they said that you either have to pay in lump sum or refinance (more int).

So it can be said that for the above example, the & #39;cost& #39; of taking the moratorium is about 28k, and that is how you get screwed.

Is it worth it? I& #39;ll leave it to you to decide https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

Is it worth it? I& #39;ll leave it to you to decide

Disclaimer: I use a specific case and few specific assumptions in this threads, using information gained from a specific source. Your bank might or might not use the exact same mechanism; however the main thing is that you have to pay for the accrued interest during moratorium.

Also, there will be cases that your total payment would increase, as in the example. I hope this thread would help you to understand better about the moratorium as I see that there is not much details being told by any authority (partly maybe to avoid panic,etc).

As consumers, I view that we deserve to know the real deal and have the access to all information especially when money is what& #39;s at stake. By reading this thread, I hope you can ask your banks the right questions and make better informed decision.

Take care, and stay inside! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinning face with smiling eyes" aria-label="Emoji: Grinning face with smiling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinning face with smiling eyes" aria-label="Emoji: Grinning face with smiling eyes">

Take care, and stay inside!

Read on Twitter

Read on Twitter