Some thoughts and charts on the inflation vs deflation argument as it relates to Fed action now and over the last 20 years (1/x)

Inflation is driven by both size of money supply as well as velocity of money; monetary supply is obviously the concern in everyone’s minds, which has positively exploded since 2000 (2/x)

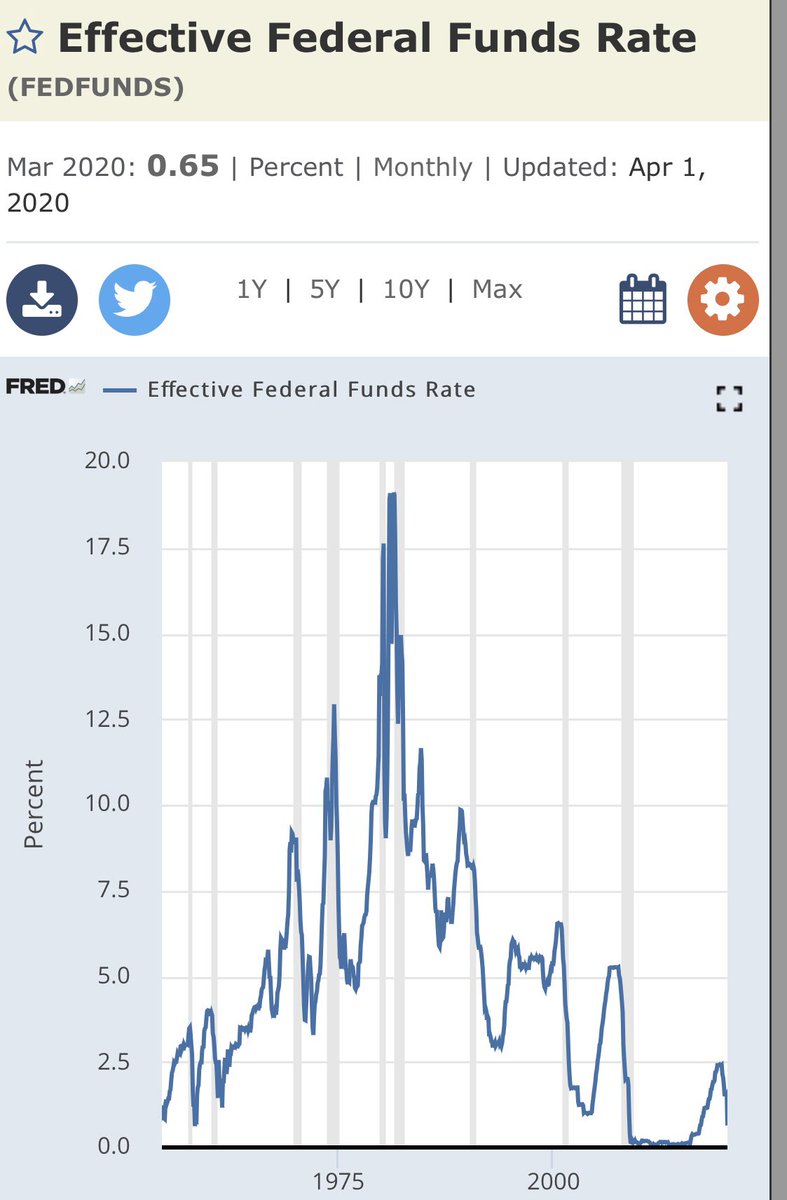

Monetary velocity is driven by a lot of things, but interest rates are a huge correlating factor. So while the monetary base has expanded, the corresponding drop in rates has worked to offset inflation

Looking at monetary velocity, you can easily see where the Fed started to raise in 2018. What’s really interesting is velocity usually picks up in bull markets, whereas velocity absolutely got crushed in the 2010’s, well below historical averages

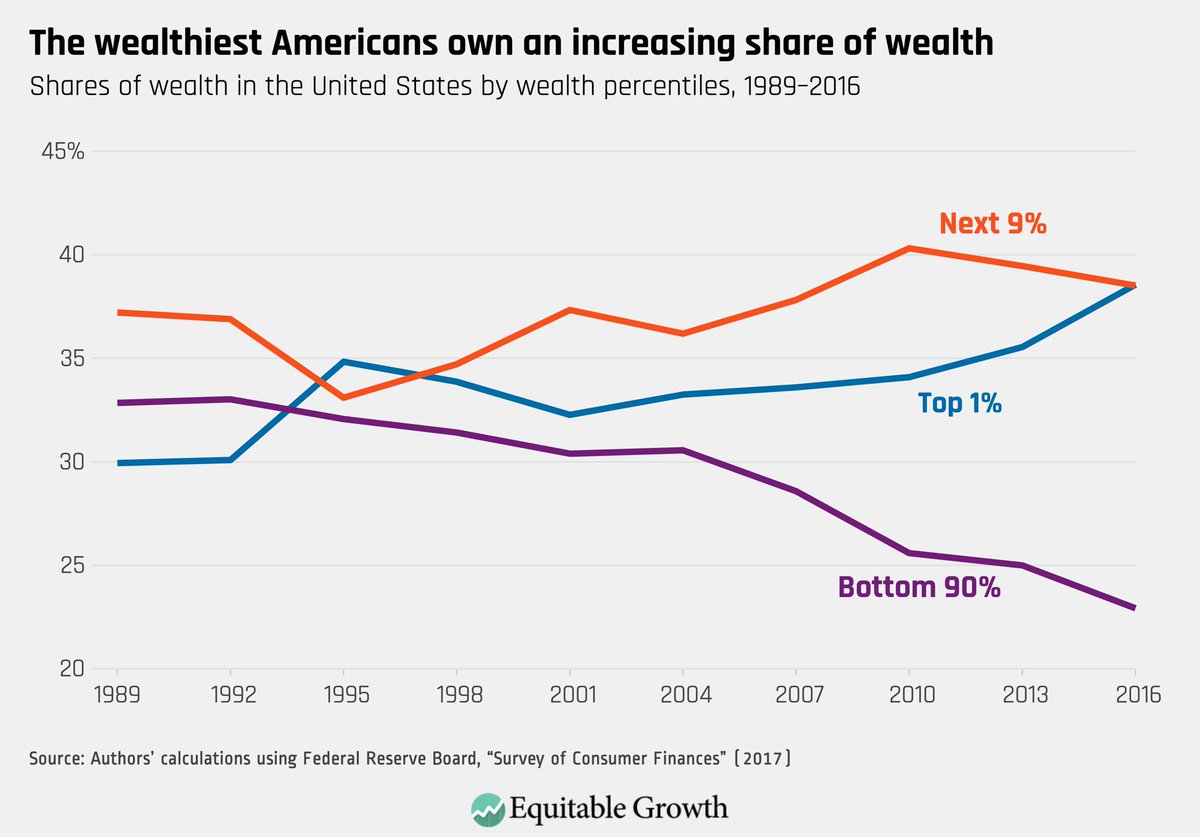

Velocity of money is defined as the ratio of GDP to monetary supply, and I believe the increase in wealth inequality has a lot to do with this as well. Lots of cash hoarded over the last decade that simply was not changing hands in the way that it used to

So in today’s era, the concern is that an increase in money supply as well as demand for goods compared to the decreased supply or availability of goods will drive huge inflation

But on the other side is this massive wealth and debt deflation happening, and global lockdown absolutely destroying monetary velocity. It’s a massive push/pull with extraordinary implications and I believe we will see deflation at least in the short term.

Not to mention the additional impact on velocity from the zero rate environment. Obviously these factors have changed dramatically since 2000 and it’s changed the way really our whole monetary system functions

If we can seek to normalize interest rates and monetary supply, as well as address the wealth gap in some reinvention of capitalism, I feel like we can restore monetary velocity and hence GDP growth and experience a true broad based recovery that we avoided in 2010

@threadreaderapp unroll

Read on Twitter

Read on Twitter