Thursday Morning Thread: I figured something out last night, which might explain the financial despair we& #39;re all feeling. It has to do with how most people determine whether or not to feel good about their financial lives. 1/

On a daily basis, both pre-pandemic and now, I ask people how they feel about their finances. I don& #39;t ask because I want to hear whether they& #39;re doing good or bad, but instead I want to know WHY they think they& #39;re doing however they say they& #39;re doing. 2/

There are typically four ways people quantify their financial feelings, although the first one is more qualitative than quantitative -- mood/stress, debt, savings, and income. When a person says either "I& #39;m good" or "I& #39;m bad" it& #39;s typically because of these four categories. 3/

As it turns-out, which is not necessarily the point of our time here today, I think those are generally NOT GREAT ways to measure your financial health. As we& #39;ve come to learn, they measure stability, but they don& #39;t necessarily measure health. 4/

A person with no debt, a decent savings, and a solid income, is stable, but they aren& #39;t necessarily living a healthy financial lifestyle. A healthy lifestyle involves saving/investing or paying down debt on a regular basis. Anyway, back to the original four metrics. 5/

Let& #39;s begin with mood/stress. Well, I& #39;m gonna take the liberty to speak for everyone right now. Mood/stress are in the gutter, and understandably so. That means if you& #39;re one of those "mood/stress" dictate my financial health people, you& #39;re feeling terrible right now. 6/

Next is debt. If you feel good about your life because you don& #39;t have a ton of debt, that may shift soon as an emergency fund is what saves people, not a lack of debt. 7/

Savings is the next item on the list, and MILLIONS of Americans who have some semblance of an emergency fund, are now on the verge of tapping it. And if you don& #39;t have savings, you feel even worse about that. 8/

Finally, there& #39;s the metric of income. In the last three weeks, I& #39;ve spoken to people at nearly every income level who& #39;ve lost jobs. From minimum wage to deep 6 and 7-figure earners. If you measure your financial health by your income, and you don& #39;t have one, you& #39;re hurting. 9/

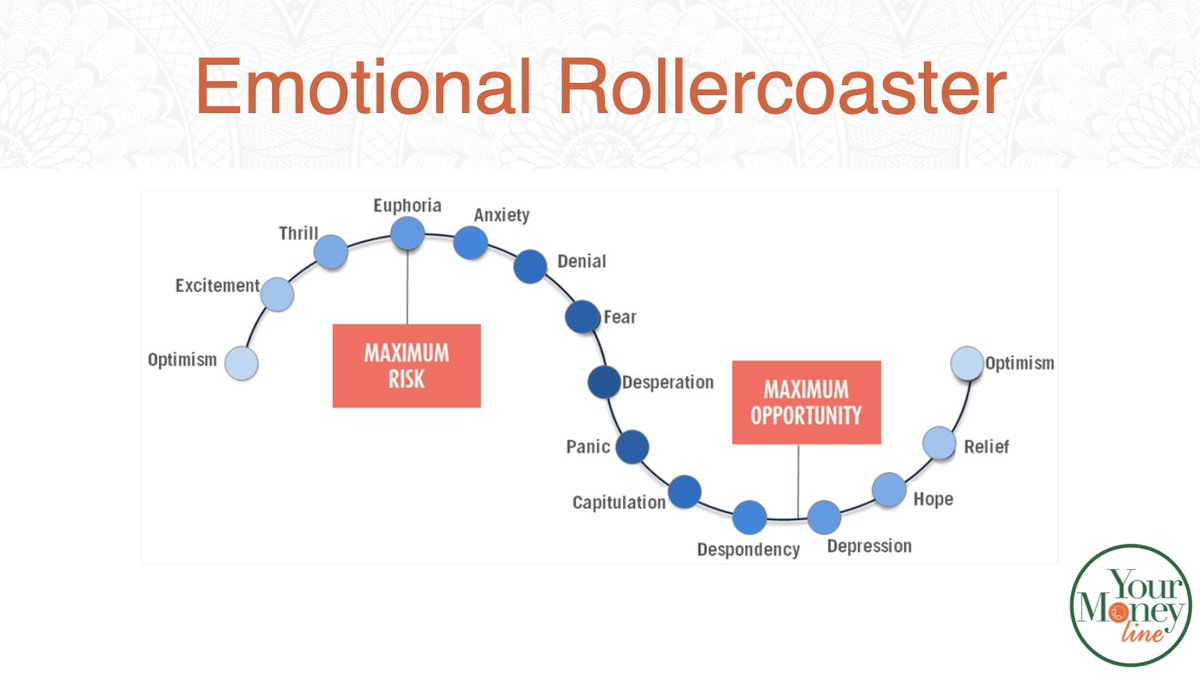

So here& #39;s the (probably) obvious conclusion I came to last night. For the first time in modern history, a vast majority of Americans feel the exact same way about their finances. They& #39;re shook, scared, and nearly despondent. 10/

This is highly unusual. And anecdotally, the people who are used to feeling bad about their finances are handling this crisis better than people who generally feel healthy. Whereas preparation is typically meant to help people weather a storm, thick-skin is doing it better. 11/

There& #39;s no doubt many Americans are experiencing financial turmoil the likes they& #39;ve never seen before, no matter how they typically measure financial health. For those who are experiencing this for the first time, just know you& #39;ve been healthy before and will be again. 12/

And for those who have never been able to achieve financial strength and stability, there is hope on the other side of this thing, no matter how tough times are right now. When we& #39;re all able to rebuild, we need to do so with health and stability in-mind. 13/

Read on Twitter

Read on Twitter