We& #39;re all suckers for a good story. I think stories/narratives are a coping mechanism for us to arrange events, facts, etc into a logical sequence, ignore things that don& #39;t fit so that they make sense for us. BUT, yes, there& #39;s always a but.

But one thing I have noticed time and again in my experience is that stories almost always get retail investors into trouble. Maybe, stories are an easier way for us to cope with things that are monumentally hard. The last 3-4 years have been a brilliant demonstration of this.

Plenty of story stocks have gone to zero. Of course, you can attach a story to anything, but, what I have seen is the biggest stories stocks, blow up the hardest.

Story: India is a growing economy, which means it needs lakhs of KMS of roads, bridges, ports, etc.

Story: India is a growing economy, which means it needs lakhs of KMS of roads, bridges, ports, etc.

Infra is a really good bet on India shining.

Reality: Lanco, JP Group, IL&FS, Reliance Infra, Aban, Punj Lloyd and a 10s of other POPULAR infra stocks are worthless.

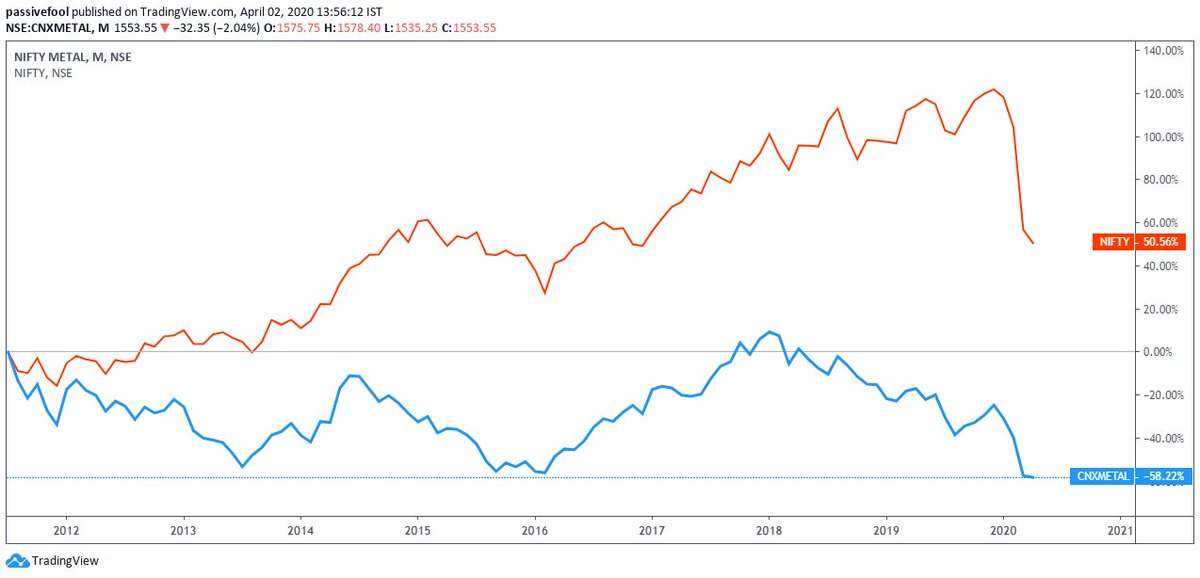

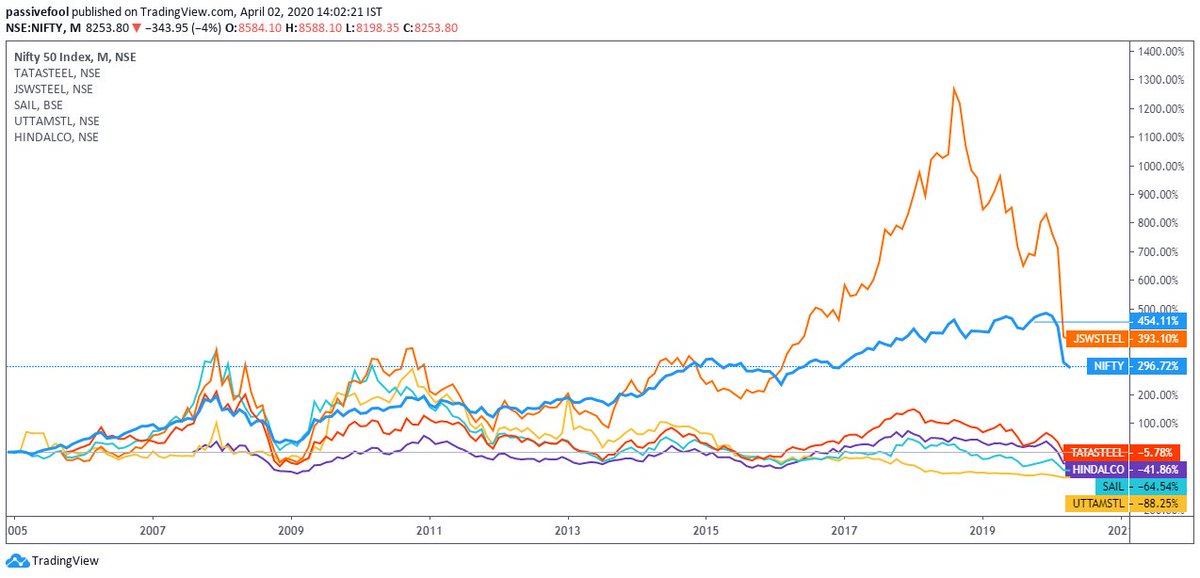

Story: A growing India needs a humongous amount of steel. Buy steel stocks.

Reality: Lanco, JP Group, IL&FS, Reliance Infra, Aban, Punj Lloyd and a 10s of other POPULAR infra stocks are worthless.

Story: A growing India needs a humongous amount of steel. Buy steel stocks.

Reality: Most of these are debt-laden companies. Except for JSW Stell, pretty much all the other stocks have lost money. Companies like Bhushan went bankrupt.

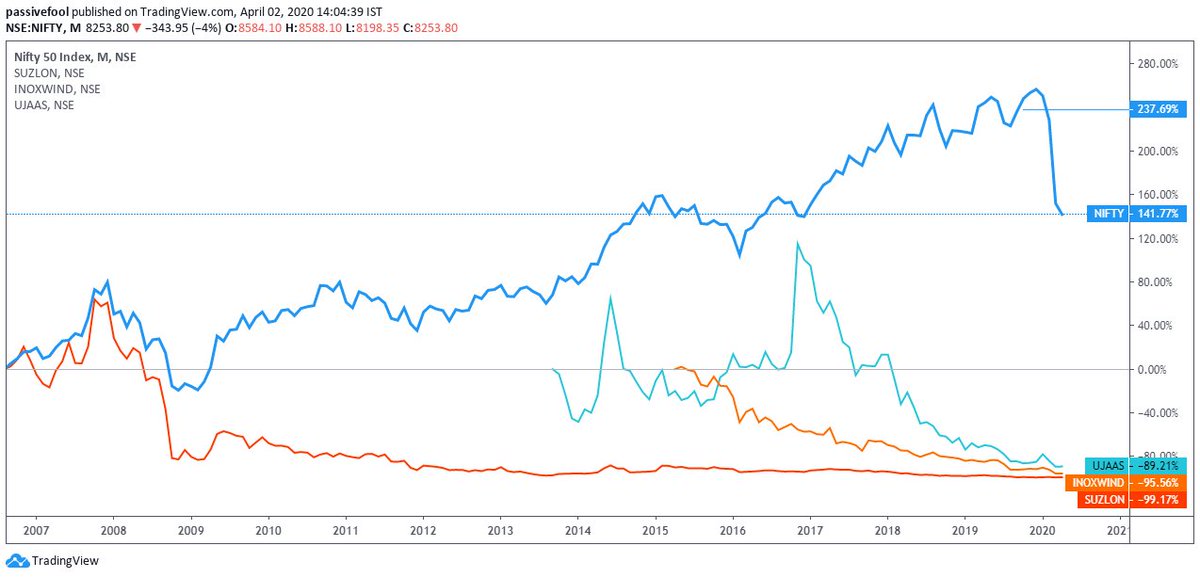

Story: Climate change is killing the planet. India will have to transition to green energy. Bet on wind and solar.

Reality. Suzlon is a Rs 1 stock now, it& #39;s lifetime high was Rs 440 odd. Inox Wind made a high of Rs 490, now it& #39;s 18 bucks. Ujaas was a hot trading penny stock.

Reality. Suzlon is a Rs 1 stock now, it& #39;s lifetime high was Rs 440 odd. Inox Wind made a high of Rs 490, now it& #39;s 18 bucks. Ujaas was a hot trading penny stock.

Story: India is an aspirational economy. As the country develops, as opportunities increase, incomes go up, people will travel more. Buy airlines

Reality: Jet went bankrupt. Spice Jet hasn& #39;t underperformed an SB account. Indigo seem to be the only decent stock.

Reality: Jet went bankrupt. Spice Jet hasn& #39;t underperformed an SB account. Indigo seem to be the only decent stock.

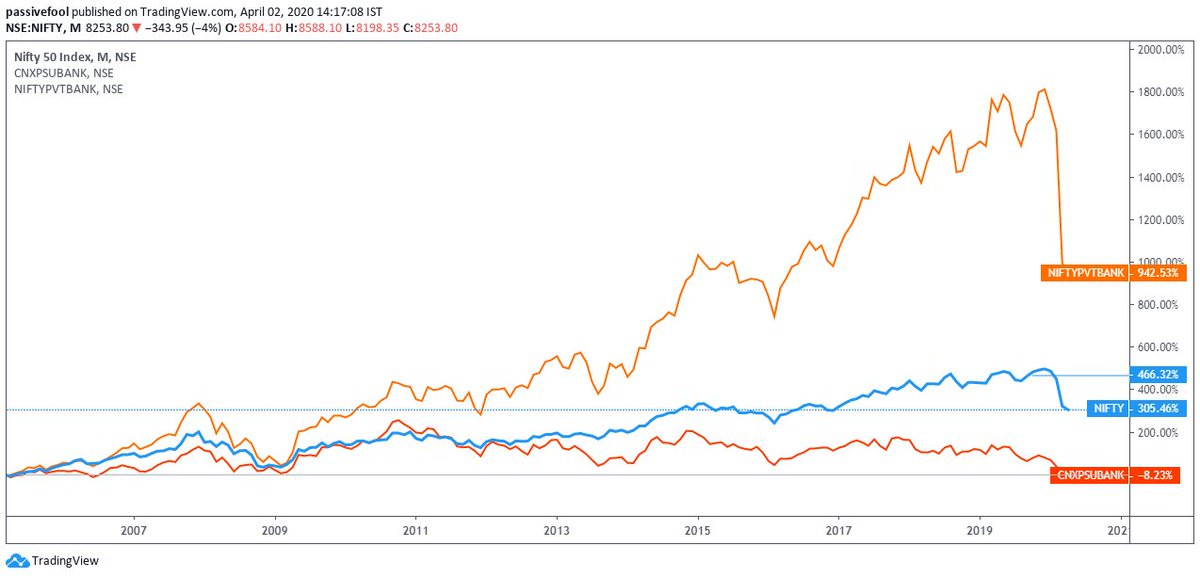

Story: India is an unbanked country. As the country develops, as opportunities increase, incomes rise, people will need banks. Buy banks.

Reality: This one is a tale of 2 cities. While Pvt banks except Yes Bank have done phenomenally.

Reality: This one is a tale of 2 cities. While Pvt banks except Yes Bank have done phenomenally.

PSUs have gone to the dogs. And the average retail trust a PSU more than a private bank. If you invested all your money in PSU banks, well, you& #39;d have jack! You& #39;d have been better off with an FD.

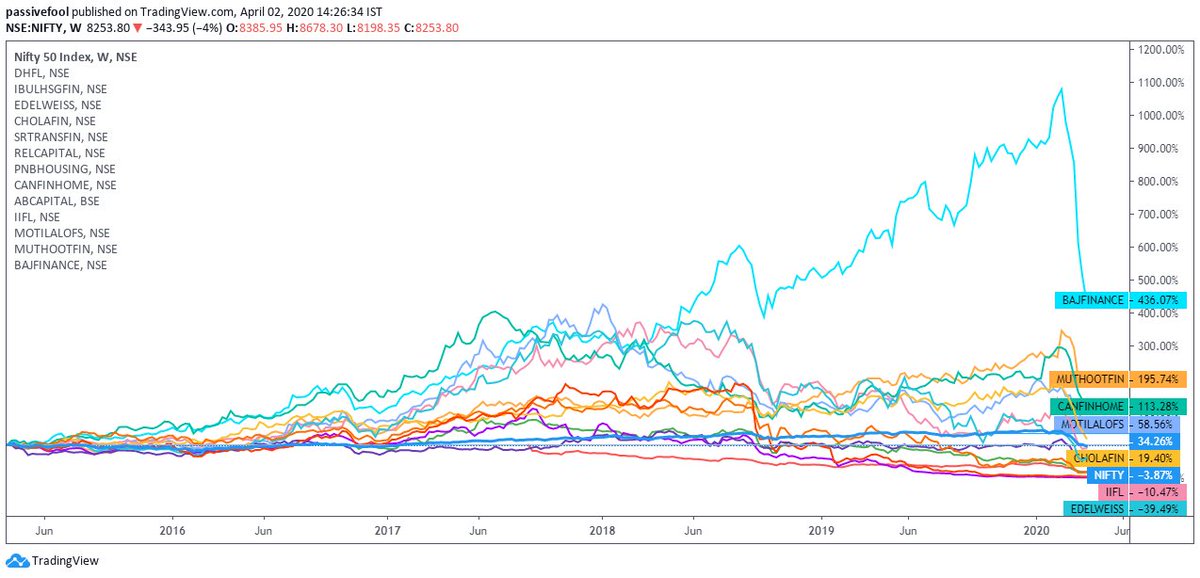

Story: As India grows, more people will need access to finance. Buy finance companies, NBFCs/Housing fin cos

Reality. Tale of two cities again. While companies like DHFL, Reliance Cap IL&FS went kaput, Bajaj Muthoot have done well.

Reality. Tale of two cities again. While companies like DHFL, Reliance Cap IL&FS went kaput, Bajaj Muthoot have done well.

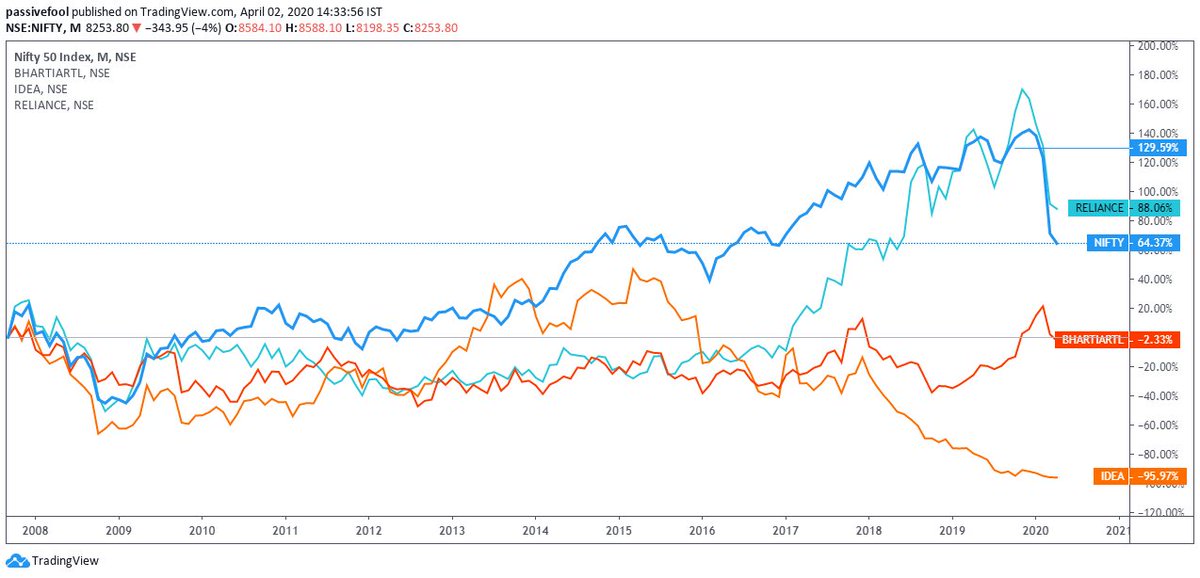

Telecom: As India grow, more income, more phone, more smartphones, more phonecalls, more data usage. Buy telecoms.

Reality: This sector has pretty much died. Jio and regulatory burdens have led to mergers, exits and near bankruptcies.

Reality: This sector has pretty much died. Jio and regulatory burdens have led to mergers, exits and near bankruptcies.

The likes of Tata, Unitech, Essar, BPL, BSNL, Hutch, Aircel, Rel Com, etc all had to exit, shutdown, merge, or go bankrupt.

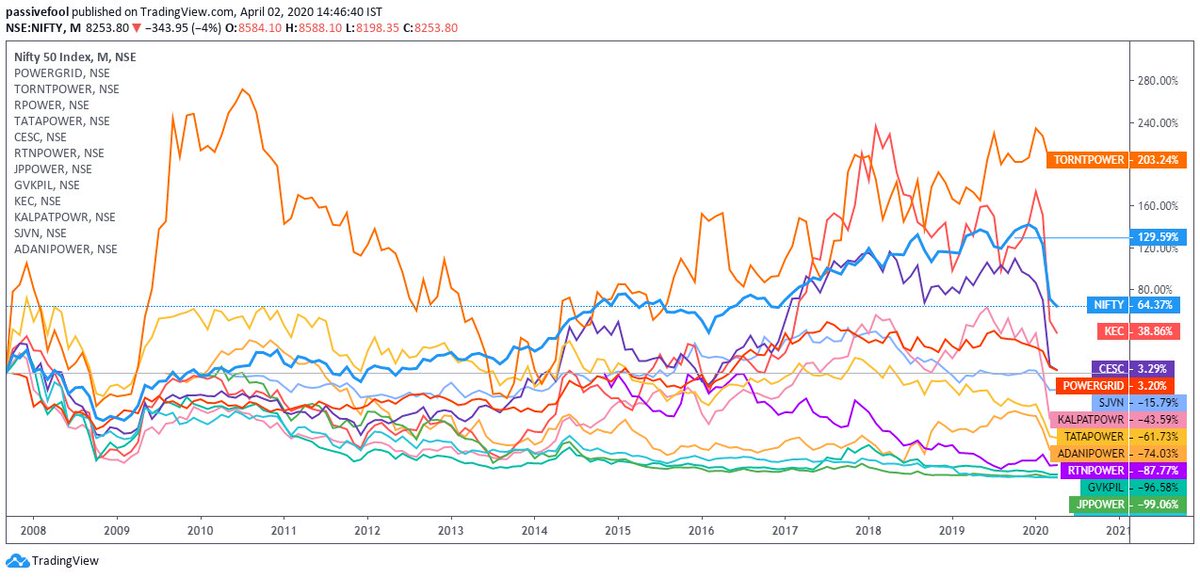

Story: India is a growing economy, which means it needs more electricity. Buy power and transmission companies.

Reality: Storied names like GVP, India& #39;s most famous IPO - Rpower, JP Power etc went to 0. Most other stocks haven& #39;t even caught up with Nifty.

Reality: Storied names like GVP, India& #39;s most famous IPO - Rpower, JP Power etc went to 0. Most other stocks haven& #39;t even caught up with Nifty.

A while ago, I had tweeted, something similar. People mistook the point I was making to mean that "since stock picking was hard, you shouldn& #39;t do it" But I was again talking about the glamour of stock picking. The Buffett stories and what not https://twitter.com/passivefool/status/1226125573971251200">https://twitter.com/passivefo...

I was making the very same point. Trying to pick stocks based on other people& #39;s success - which is again a narrative they most like would have crafted or the narrative that stock picking is easy if you just buy "good companies" and "hold to death".

It& #39;s not just stocks, even in mutual funds, there& #39;s plenty of stories sold. My favorite is the "India growth story", the reality is equities have don jack in the last 10 years. When I tweeted this, people jumped at for picking a random timeframe to suit https://twitter.com/passivefool/status/1243379574756368384?s=20">https://twitter.com/passivefo...

my point. But only about 35% investors stay invested for more than 2 years according to AMFI, make it 4 for comparison. To make things worse, plenty of CEO, CIOs, and the "so-called advisors" speak to mean 5 years as being long-term. In reality even 10 years in the stock markets

So, the very narrative they& #39;ve created themselves comes back and bites them in the bum. Of course, you cannot blame the MF industry for poor returns when the Indian economy is constipated and is having motions.

Then the narrative about generating alpha (beating benchmarks) when the reality is over 50% of mutual funds underperform their benchmarks. https://indexheads.substack.com/p/lets-start-from-scratch-shall-we">https://indexheads.substack.com/p/lets-st...

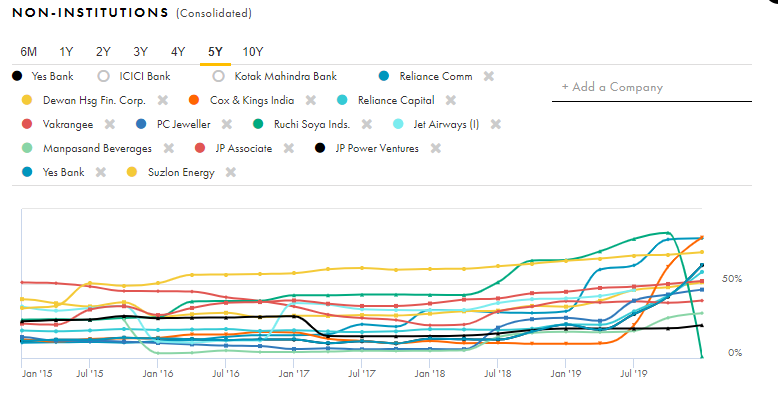

What& #39;s worse is that a good chunk of retail investors don& #39;t just fall for the story, they marry and stay loyal no matter what. In pretty much all the cases where the stock prices have gone to 0, retail investors kept increasing the stake in the companies, the prices kept falling.

A classic case of sunk cost fallacy and endowment bias. People refuse to consider the fact there& #39;s a chance that the story doesn& #39;t hold water since the stock prices are falling. They continue to average it to 0. Yes Bank, DHFL Suzlon, countless other examples.

It& #39;s the same with mutual funds. Most investors continue to hold dud funds, just because they are already invested and bought the story of the AMC, the fund managers, analysts, you name it. The AMCs are happy because inertia plays in their favor. Don& #39;t beat me - not all AMCs.

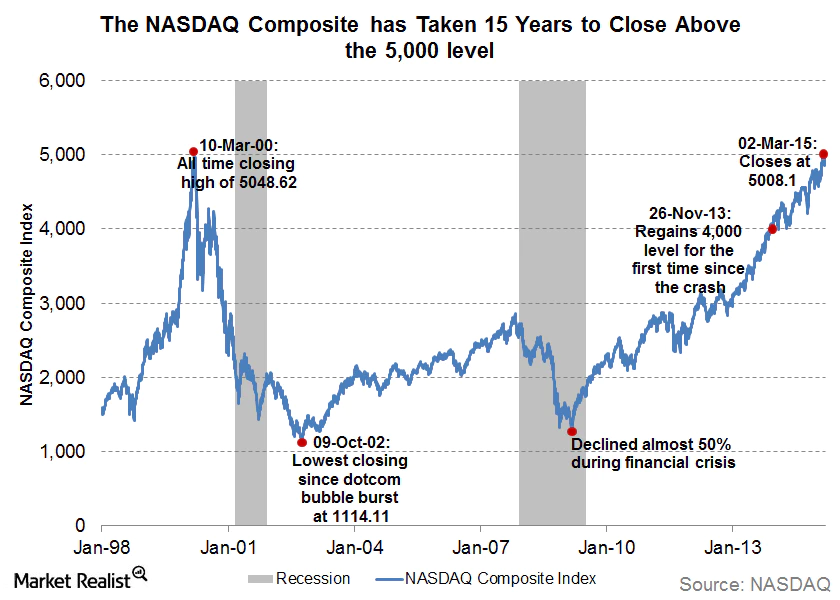

There& #39;s probably no better illustration of a story going wrong than the dot-com crash. The story that new internet companies changing the world were sold hard. Junk and useless companies rose like crazy and it all came crashing down - NASDAQ fell 80%.

https://ideas.ted.com/an-eye-opening-look-at-the-dot-com-bubble-of-2000-and-how-it-shapes-our-lives-today/">https://ideas.ted.com/an-eye-op...

https://ideas.ted.com/an-eye-opening-look-at-the-dot-com-bubble-of-2000-and-how-it-shapes-our-lives-today/">https://ideas.ted.com/an-eye-op...

Make no mistake, I am not saying all stories are bad. But investing just because a story is good is stupid, which is what most retail investors do.

Solution? I am not saying investors should be dispassionate, unemotional, and robotic when analysis stocks, I don& #39;t even think

Solution? I am not saying investors should be dispassionate, unemotional, and robotic when analysis stocks, I don& #39;t even think

is possible, and we& #39;ll always be colored by our biases. But being aware is probably the difference between you keeping your money vs losing it all and being homeless. https://twitter.com/LAForeverHall/status/1206173812493967362?s=20">https://twitter.com/LAForever...

In the incredible words of Morgan Housel

"Stories are more powerful than statistics because the most believable thing in the world is whatever takes the least amount of effort to contextualize your own life experiences."

"Stories are more powerful than statistics because the most believable thing in the world is whatever takes the least amount of effort to contextualize your own life experiences."

Again, I am not saying all stories are bad. You may just get one right and hit it big time. But just think of it terms of probabilities. Stock picking is already hard. Here are some numbers on how hard it is. https://twitter.com/passivefool/status/1226125573971251200">https://twitter.com/passivefo...

Which is even fund managers with all the amazing resources like PhDs, drones, satellites, quantum underwear can& #39;t beat simple benchmarks, you think just because you believe in a story, you& #39;ll get it right and make money?

Nicholas Vardy puts it brilliantly

https://libertythroughwealth.com/2020/01/23/wealth-builders-avoid-story-stocks/?src=email">https://libertythroughwealth.com/2020/01/2...

https://libertythroughwealth.com/2020/01/23/wealth-builders-avoid-story-stocks/?src=email">https://libertythroughwealth.com/2020/01/2...

Read on Twitter

Read on Twitter