category wise mutual fund schemes performance.

Thread

Please note, most of the investors do investing using rear view mirror (past performance).

look at the size of front windshield (it tells you what is coming) Vs. rear view mirror which tells you what has passed.

#mutualfunds

Thread

Please note, most of the investors do investing using rear view mirror (past performance).

look at the size of front windshield (it tells you what is coming) Vs. rear view mirror which tells you what has passed.

#mutualfunds

large cap funds:

post the SEBI categorization & rationalization, large cap schemes have to maintain minimum 80% of total assets in large cap companies

the circular also defined the definition of Large Cap.

Large Cap: 1st -100th company in terms of full market capitalization

post the SEBI categorization & rationalization, large cap schemes have to maintain minimum 80% of total assets in large cap companies

the circular also defined the definition of Large Cap.

Large Cap: 1st -100th company in terms of full market capitalization

going forward my view is that it will be difficult for large cap MFs to beat their respective benchmark:

1) previously there was no definition of large cap

2) information asymmetry has reduced many fold

3) cost of active funds vs passive

https://twitter.com/stepbystep888/status/1194945816663715842">https://twitter.com/stepbyste...

1) previously there was no definition of large cap

2) information asymmetry has reduced many fold

3) cost of active funds vs passive

https://twitter.com/stepbystep888/status/1194945816663715842">https://twitter.com/stepbyste...

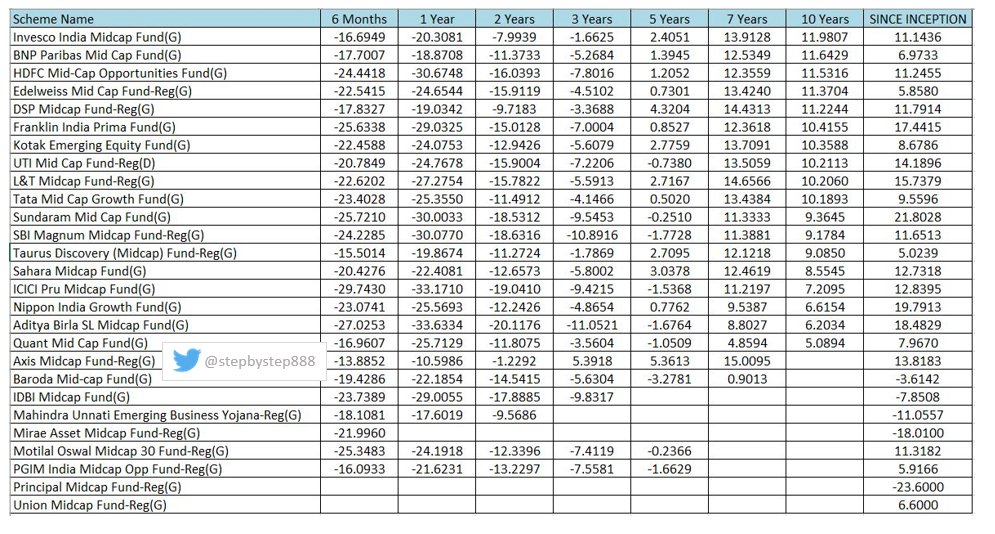

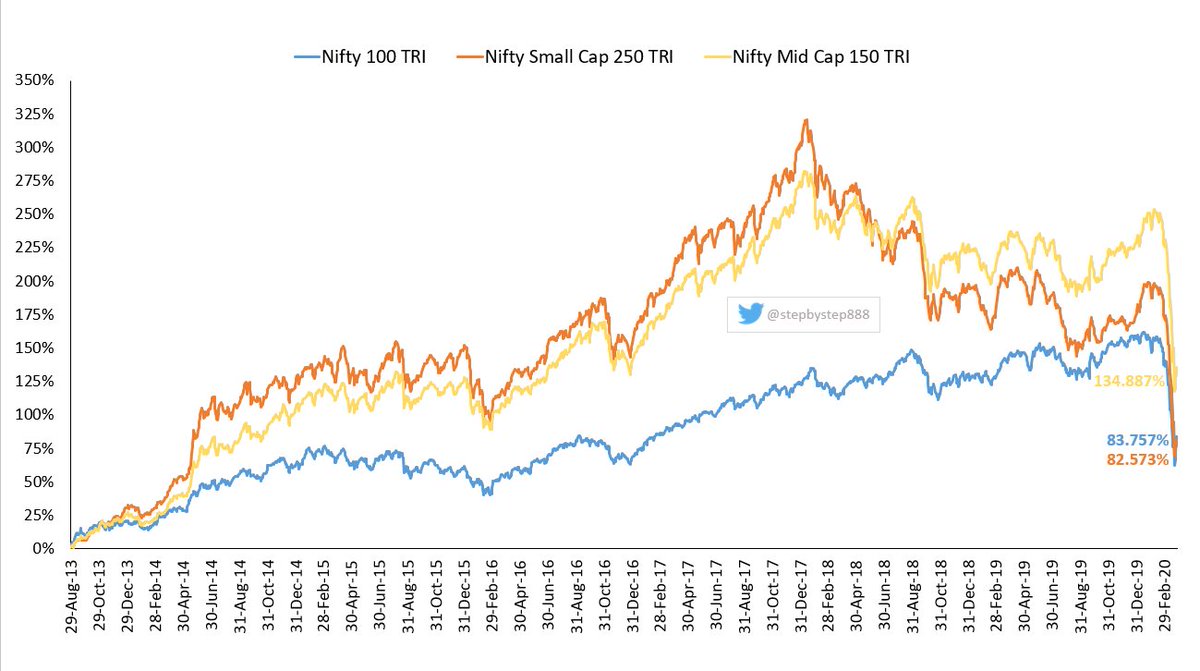

Mid cap funds:

definition of mid cap:

101st -250th company in terms of full market capitalization

Minimum investment in mid cap companies- 65% of total assets

definition of mid cap:

101st -250th company in terms of full market capitalization

Minimum investment in mid cap companies- 65% of total assets

general perception is that mid caps are down.

Are they really down.

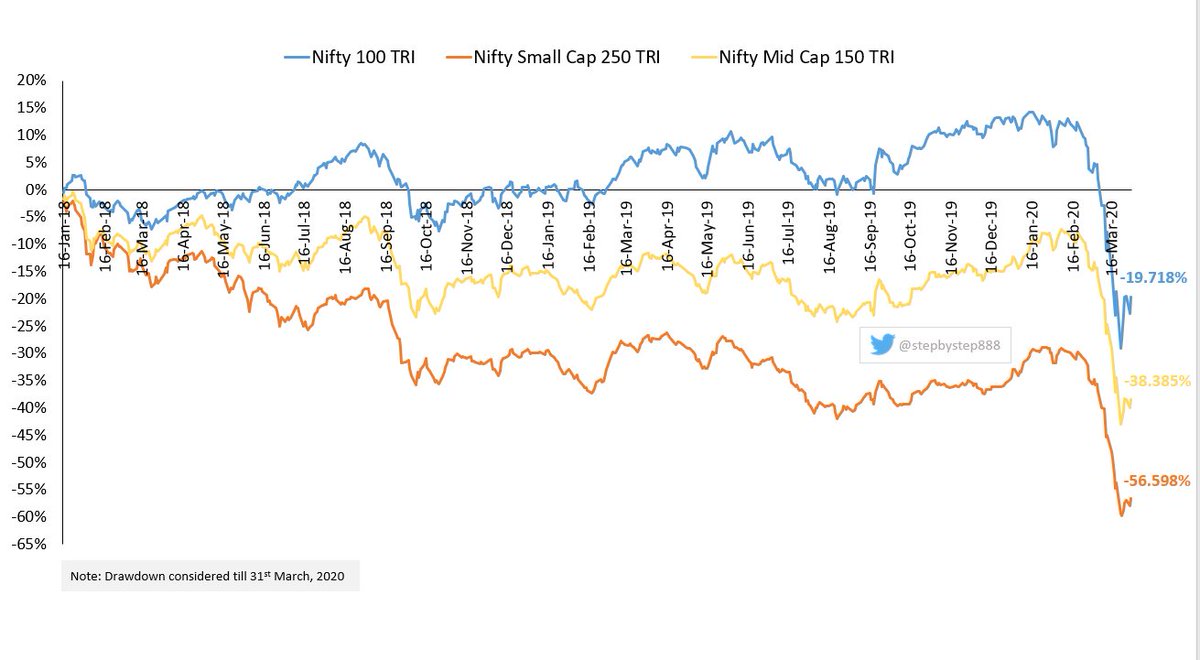

if you compare the data from Jan& #39;2018 peaks, Midcap 150 TRI appears to be more down than Nifty 100 TRI

but if you compare the data from August 2013 lows, story is different.

Are they really down.

if you compare the data from Jan& #39;2018 peaks, Midcap 150 TRI appears to be more down than Nifty 100 TRI

but if you compare the data from August 2013 lows, story is different.

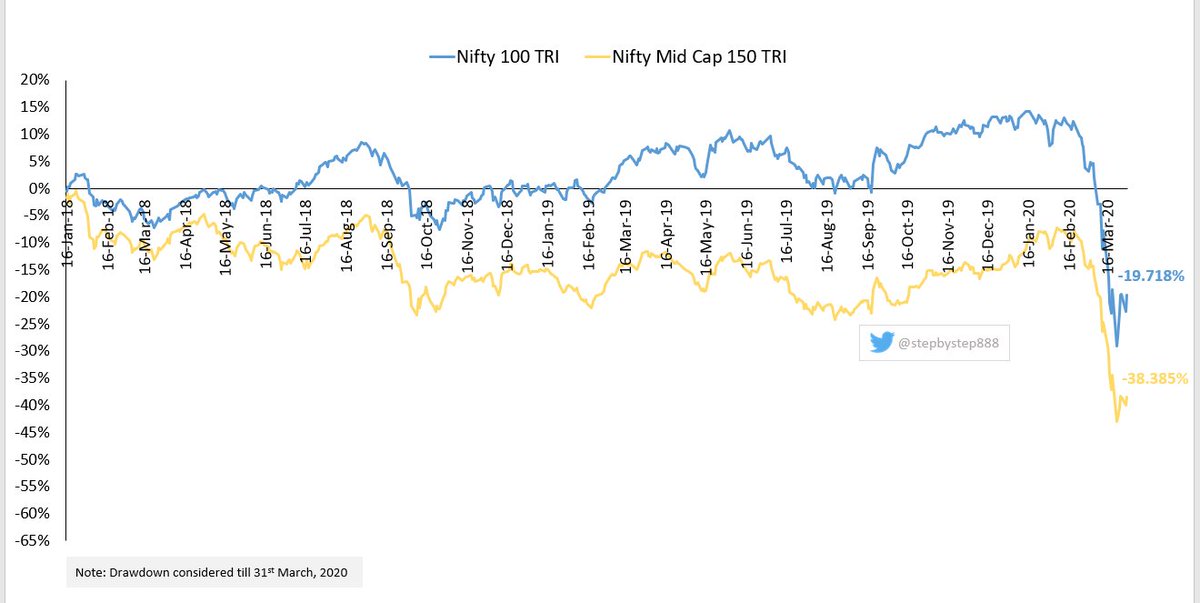

small cap funds:

Minimum investment in small cap companies - 65% of total assets

definition of small cap:

251st company onwards in terms of full market capitalization

Minimum investment in small cap companies - 65% of total assets

definition of small cap:

251st company onwards in terms of full market capitalization

now, lets compare Nifty 100 TRI, Midcap 150 TRI & Small cap 250 TRI from Jan 2018 peaks and August 2013 lows

my view on small cap

https://twitter.com/stepbystep888/status/1232210962557652992

I">https://twitter.com/stepbyste... hold similar view for mid cap as well ;)

https://twitter.com/stepbystep888/status/1232210962557652992

I">https://twitter.com/stepbyste... hold similar view for mid cap as well ;)

ELSS

Minimum investment in equity & equity related instruments - 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance)

Minimum investment in equity & equity related instruments - 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance)

if you cannot save more than 150,000, ELSS is not for you

if you can save more, invest incremental savings > 1.5L into low cost passive

opportunity cost of investing in 80C, below all have EEE status

PPF: 7.1% (Q1 FY2020-21, historical rates https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">)

EPF: 8.5%

Sukanya Samridhi : 7.6%

if you can save more, invest incremental savings > 1.5L into low cost passive

opportunity cost of investing in 80C, below all have EEE status

PPF: 7.1% (Q1 FY2020-21, historical rates

EPF: 8.5%

Sukanya Samridhi : 7.6%

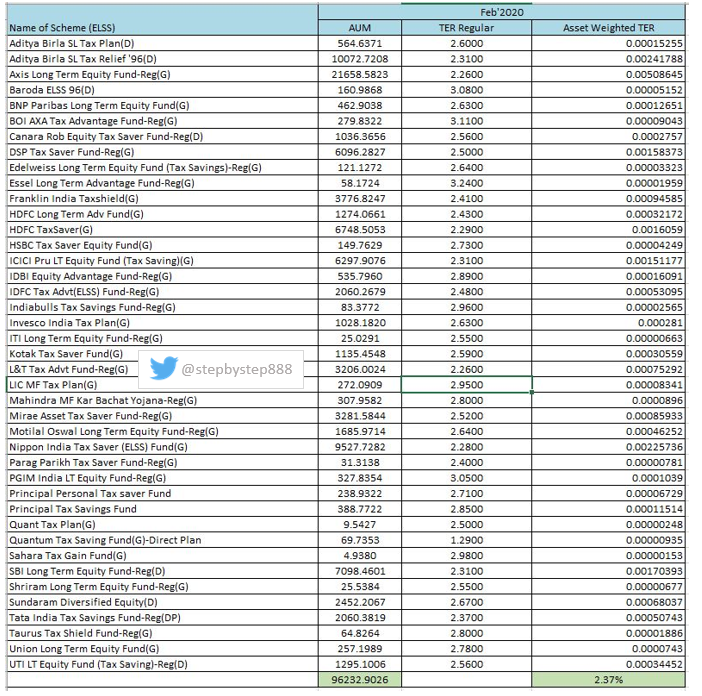

ELSS:

As on 29th Feb& #39;2020, 43 AMC offer ELSS (most in any category), with AUM of 96565.34 Crore among 12184832 folios with average folio holdings of ~ 79k

As on 29th Feb& #39;2020, 43 AMC offer ELSS (most in any category), with AUM of 96565.34 Crore among 12184832 folios with average folio holdings of ~ 79k

look at the AUM & expense ratio (regular) of these schemes

AAUM for feb2020 = 106373.02 cr

Regular = 94052.71 (88.41%)

Direct = 12320.31

Asset Weighted Expense for these regular schemes is 2.37%

this category is one of the best for AMCs & Distributors as there is a lock in

AAUM for feb2020 = 106373.02 cr

Regular = 94052.71 (88.41%)

Direct = 12320.31

Asset Weighted Expense for these regular schemes is 2.37%

this category is one of the best for AMCs & Distributors as there is a lock in

Contra Funds:

Scheme should follow a contrarian investment strategy.

Consider these funds cap agnostics as any other multi cap fund.

HDFC Bank is there in all three funds in top 5 holdings (feb 2020 end)

Scheme should follow a contrarian investment strategy.

Consider these funds cap agnostics as any other multi cap fund.

HDFC Bank is there in all three funds in top 5 holdings (feb 2020 end)

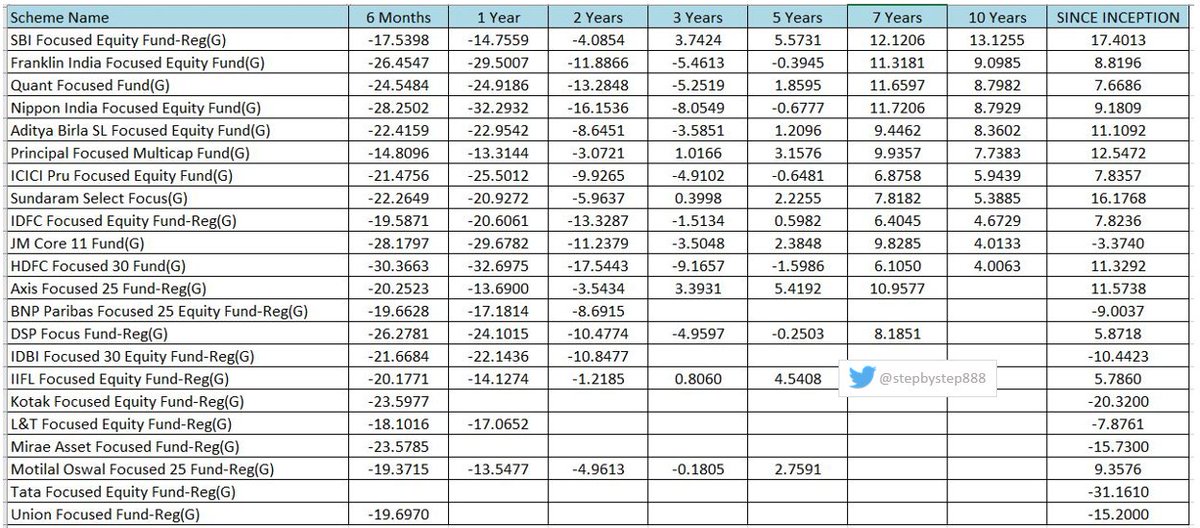

Focused Funds:

A scheme focused on the maximum 30 number of stocks.

it is better than any PMS at least past data is reliable. point 4 & 6 in below image & one need not invest 50 lakh as minimum.

A scheme focused on the maximum 30 number of stocks.

it is better than any PMS at least past data is reliable. point 4 & 6 in below image & one need not invest 50 lakh as minimum.

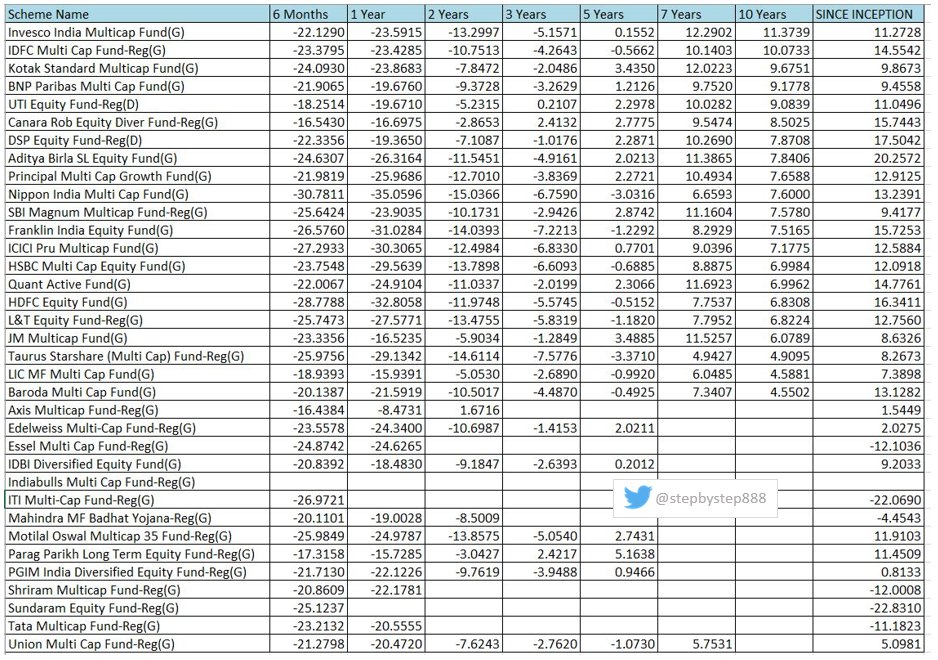

Multicap Funds:

cap agnostic funds.

can anyone please tell me, what will it take for one of the most hyped fund to feature in top quartile ;)

cap agnostic funds.

can anyone please tell me, what will it take for one of the most hyped fund to feature in top quartile ;)

Value Funds:

Scheme should follow a value investment strategy.

don& #39;t know whats value & whats growth on the basis of analyzing these portfolios. Its subjective. Consider this scheme as cap agnostic scheme only.

Scheme should follow a value investment strategy.

don& #39;t know whats value & whats growth on the basis of analyzing these portfolios. Its subjective. Consider this scheme as cap agnostic scheme only.

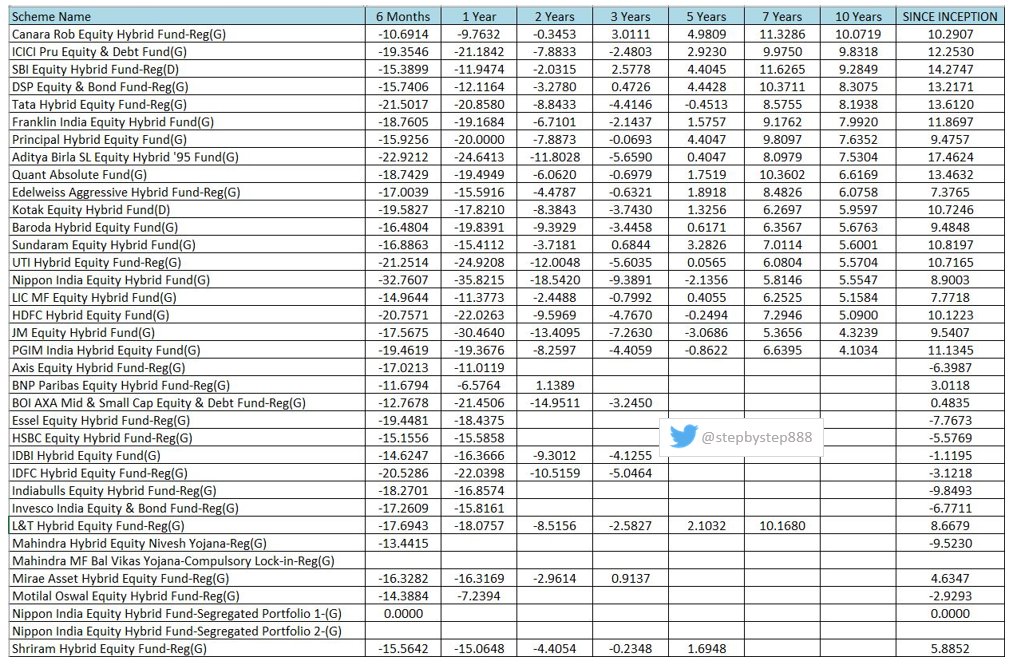

Aggressive Hybrid Fund

Equity & Equity related instruments- between 65% and 80% of total assets;

Debt instruments- between 20% 35% of total assets

these static hybrid funds are one of the most mis sold schemes by Private Banks to retail customers on the pretext of fixed dividend

Equity & Equity related instruments- between 65% and 80% of total assets;

Debt instruments- between 20% 35% of total assets

these static hybrid funds are one of the most mis sold schemes by Private Banks to retail customers on the pretext of fixed dividend

Aggressive Hybrid Fund

at these depressed yields when 20-35% of the debt portion is charged with equity like expense, it affects the overall returns.

TER/Yield applicable for these funds in regular mode is around 38%

yes, 38% of the returns from debt component get charged

at these depressed yields when 20-35% of the debt portion is charged with equity like expense, it affects the overall returns.

TER/Yield applicable for these funds in regular mode is around 38%

yes, 38% of the returns from debt component get charged

Dynamic Asset Allocation or Balanced Advantage

(my favorite)

Investment in equity/ debt that is managed dynamically, all the fund houses have defined their unhedged equity bands in SID.

(my favorite)

Investment in equity/ debt that is managed dynamically, all the fund houses have defined their unhedged equity bands in SID.

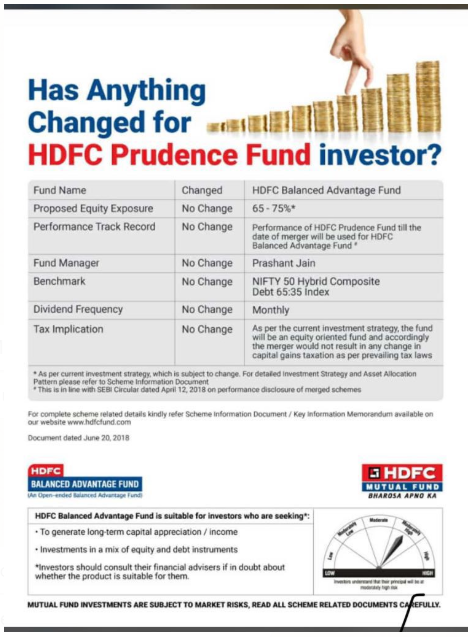

HDFC Balanced Advantage

A lot of questions have been raised on HDFC AMC for not managing the scheme dynamically and sticking to static equity.

but but but, they have clearly told for their intentions while merging the prudence with BAF.

A lot of questions have been raised on HDFC AMC for not managing the scheme dynamically and sticking to static equity.

but but but, they have clearly told for their intentions while merging the prudence with BAF.

my view on ICICI BAF https://twitter.com/stepbystep888/status/1230751563078979585?s=19">https://twitter.com/stepbyste...

Read on Twitter

Read on Twitter

)EPF: 8.5%Sukanya Samridhi : 7.6%" title="if you cannot save more than 150,000, ELSS is not for youif you can save more, invest incremental savings > 1.5L into low cost passiveopportunity cost of investing in 80C, below all have EEE statusPPF: 7.1% (Q1 FY2020-21, historical rates https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">)EPF: 8.5%Sukanya Samridhi : 7.6%" class="img-responsive" style="max-width:100%;"/>

)EPF: 8.5%Sukanya Samridhi : 7.6%" title="if you cannot save more than 150,000, ELSS is not for youif you can save more, invest incremental savings > 1.5L into low cost passiveopportunity cost of investing in 80C, below all have EEE statusPPF: 7.1% (Q1 FY2020-21, historical rates https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">)EPF: 8.5%Sukanya Samridhi : 7.6%" class="img-responsive" style="max-width:100%;"/>