There has been so much talk by so many people about a potential "Stigma" associated with countries accessing a ESM credit line.

Based on my work with @valentin_lang on the IMF, letme try to explain where that term is coming from and whether it is warranted here 1/n

Based on my work with @valentin_lang on the IMF, letme try to explain where that term is coming from and whether it is warranted here 1/n

The term originates from the literature about the international monetary fund (IMF), and it describes a negative signal that is supposedly conveyed when a country asks the IMF for some type of program.

You can think of this stigma and signal as being more about politics and economics. What both have in common is that for there to be a stigma going to the IMF must reveal negative information that was not public before.

With regard to politics, it can be seen as a negative signal about the competence of the politicians in power, endangering their reelection prospects. With regard to financial markets, the fear is that the price countries pay on international financial markets increases

The two best ways to measure access and cost of international financial market access are sovereign bond spreads and Sovereign credit ratings. Data coverage is better for credit ratings.

Now there are two questions. Is a really a stigma defined as revealing additional negative information to investors or voters. And is there a perception that a stigma exists?

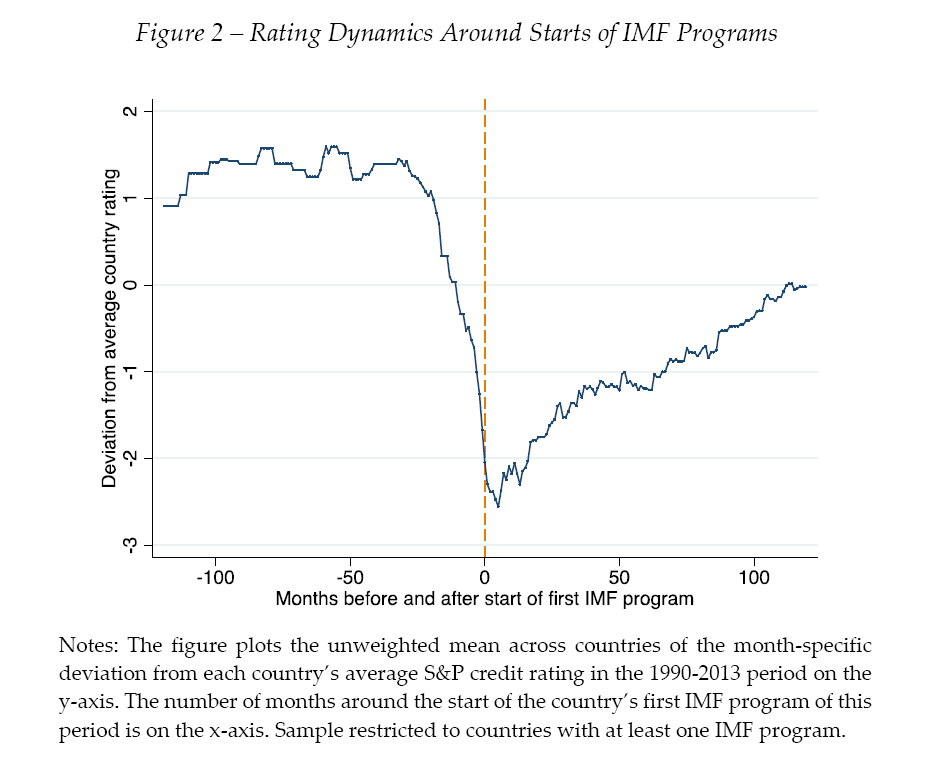

As usual, correlation and causation are hard to disentangle. What we see in our work is that countries turn to the IMF when their creditworthiness is deteriorating dramatically already. This is over several years.

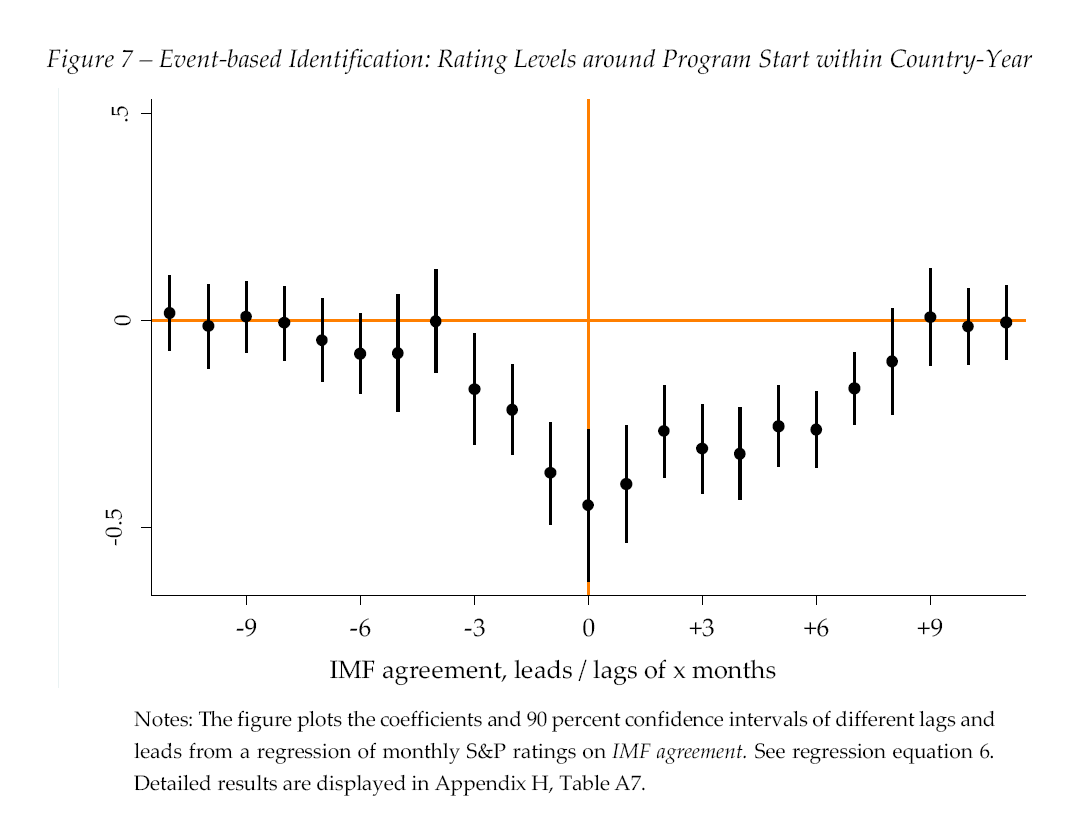

Simply controlling for available economic indicators at the yearly level is not sufficient to get rid of this dramatic selection bias. Even within years, you can see that conditions further deteriorate and IMF programs start at the lowest point.

Hence, many or most studies find strongly negative effects in all dimensions related to IMF programs. Similarly, politicians and citizens who simply observe that coincidence attribute it to the IMF.

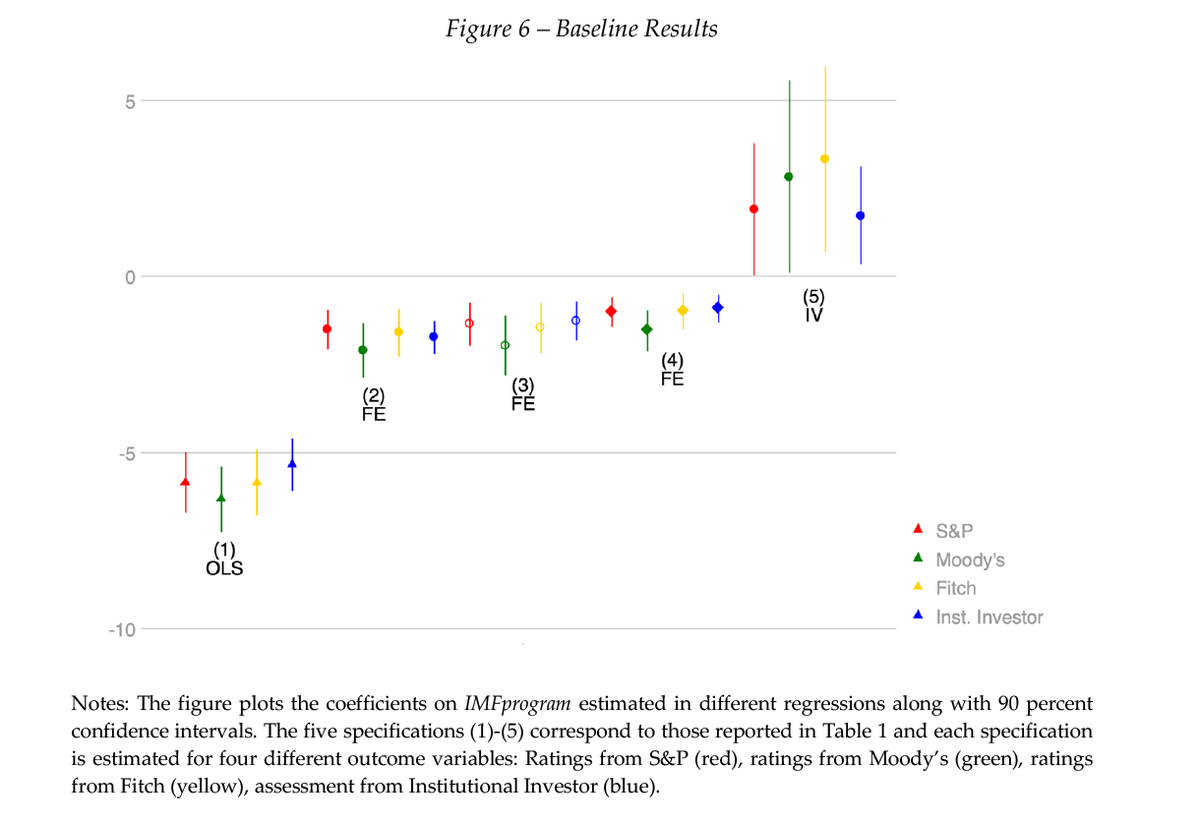

Besides showing this, the main contribution of our paper is to show that when using plausibly exogenous variation in the likelihood to receive an IMF program, this relationship actually reverses. This holds true for ratings by all major agencies as well as investor assessments.

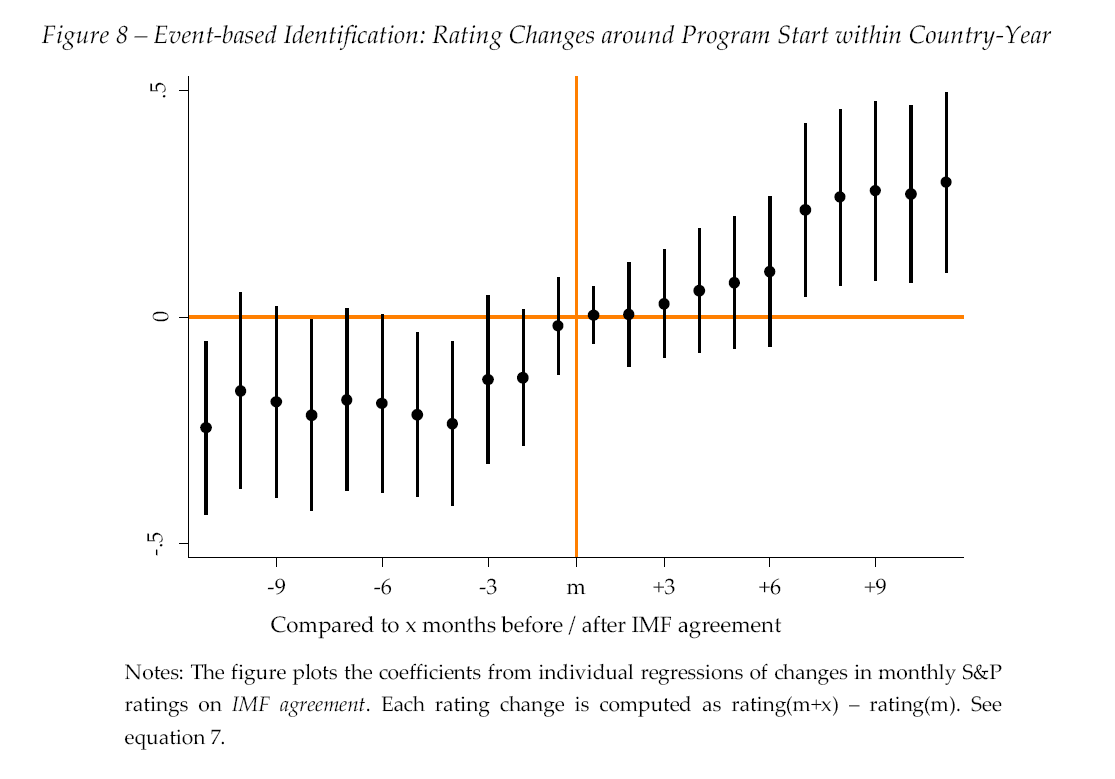

This positive effect is also visible within years. A few months after a program begins, creditors begins to improve again. All those results look similar when using bond spreads data.

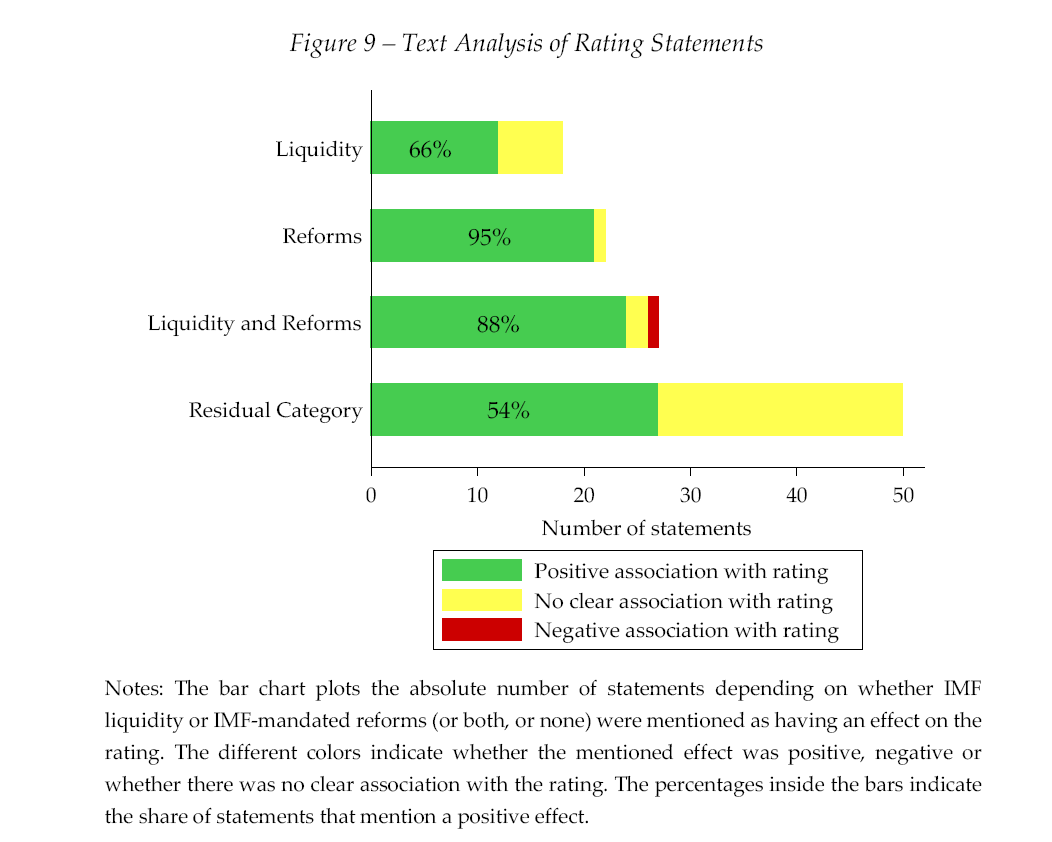

Hence, at least from an economic perspective it is not plausible that asking for a program generally conveys a negative signal to financial markets. Instead, based on a text analysis, it seems that market participants welcome conditions that include structural reforms.

All from my joint paper with @valentin_lang ,

Stigma or Cushion? IMF Programs and Sovereign Creditworthiness (Kai Gehring and Valentin Lang),

CESifo Working Paper No. 7339, Revise and Resubmit at the Journal of Development Economics (2018)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3169341">https://papers.ssrn.com/sol3/pape...

Stigma or Cushion? IMF Programs and Sovereign Creditworthiness (Kai Gehring and Valentin Lang),

CESifo Working Paper No. 7339, Revise and Resubmit at the Journal of Development Economics (2018)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3169341">https://papers.ssrn.com/sol3/pape...

This does not rule out that politicians perceive such programs to carry a stigma. Nonetheless, from a scientific perspective this does not seem warranted and we should try to communicate that it is confusing correlation with causation.

The IMF has many flaws, and for sure could be improved by reforms in many areas. But it is useful to have such organizations to act at an international level in times of crisis. And many countries outside the EU luckily can &do turn to IMF now ignoring stigma

Now ESM is not IMF, but the whole idea to create it was to have a European version of it. So if there is no financial market stigma for the IMF, and other countries are willing to use it, it seems weird to rule out using the ESM.

The IMF has many different types of programs and facilities, some with structural conditions and some purely growth oriented. Some more concessional than others. There is nothing in the statutes of the ESM that would stop it from doing the same.

I cannot see how emphasizing that stigma so often serves any other purpose than pushing for another solution that is personally preferred. As usual, all alternatives have their advantages and disadvantages. It is our role as scientists to explain both objectively.

To finish on that, delegating such tasks to international organizations has problems like potential democratic deficits. But so do bonds issued with joint liability without joint control, and political backlash in Northern countries. My tip is we end up with a hybrid solution.

Hope this is helpful and providing some background.

@MSchularick @BachmannRudi @schnellenbachj @FuestClemens @Otto_Fricke @christianbaye13 @AndrewWattEU @KeineWunder @MoritzKraemerDr @fuchs_andreas

@MSchularick @BachmannRudi @schnellenbachj @FuestClemens @Otto_Fricke @christianbaye13 @AndrewWattEU @KeineWunder @MoritzKraemerDr @fuchs_andreas

Read on Twitter

Read on Twitter