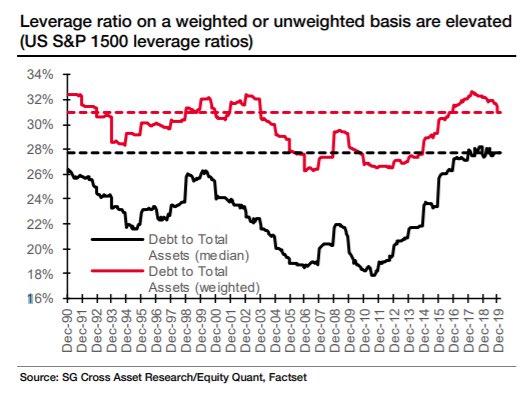

2) As of March 20th, The median company in the broader S&P 1500 now has a record debt to asset ratio.

The corporate debt bubble is real and there’s far too much leverage in the system

This is not a good sign for investment-grade bonds & not a good sign for $LQD

The corporate debt bubble is real and there’s far too much leverage in the system

This is not a good sign for investment-grade bonds & not a good sign for $LQD

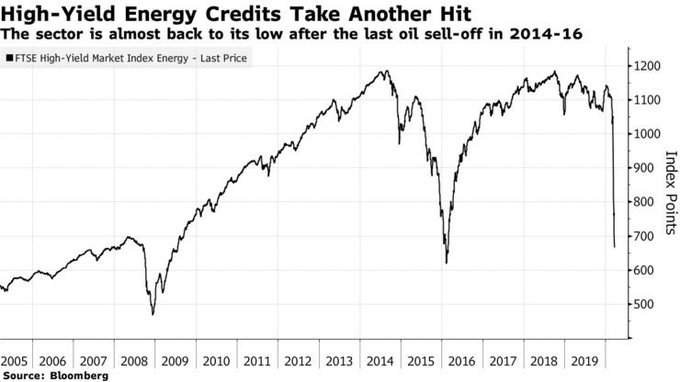

3) Collapse in price of Oil has caused high-yield energy credits to tank. According to Oaktree& #39;s most recent memo, the oil & gas industry directly provides more than 5% of American jobs

4) This isn’t confined to corporations. Total global debt exceeded $253 trillion. It’s more than 322% of global GDP

The entire global economy is like "and another one"

The entire global economy is like "and another one"

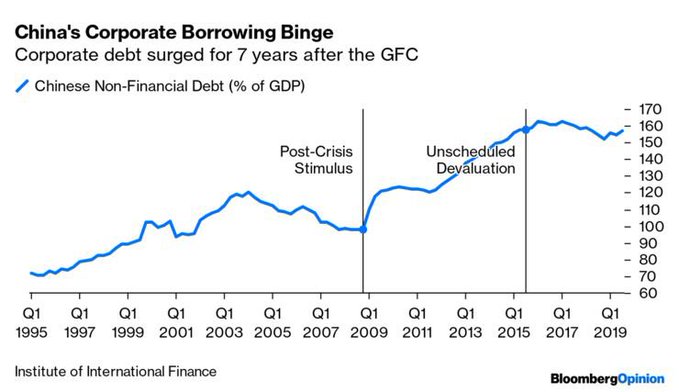

5) This is a massive issue in China. China’s nonfinancial corporate debt is 60% higher than its GDP

OH MY https://abs.twimg.com/emoji/v2/... draggable="false" alt="😱" title="Face screaming in fear" aria-label="Emoji: Face screaming in fear">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😱" title="Face screaming in fear" aria-label="Emoji: Face screaming in fear">

OH MY

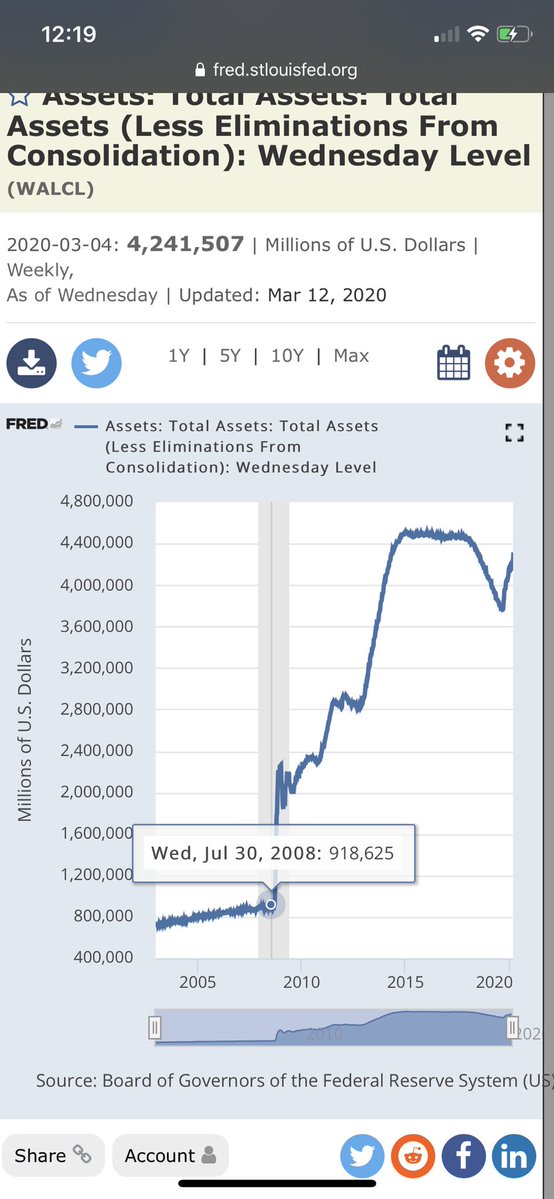

6) how much more ammo do central banks have? How much more until the Fed’s balance sheet blows up?

Well it’s the largest it has ever been. The fed’s balance sheet was $900 billion in July 2008- during the last financial crisis

As of March 20th (date of pic), it was at $4.2T

Well it’s the largest it has ever been. The fed’s balance sheet was $900 billion in July 2008- during the last financial crisis

As of March 20th (date of pic), it was at $4.2T

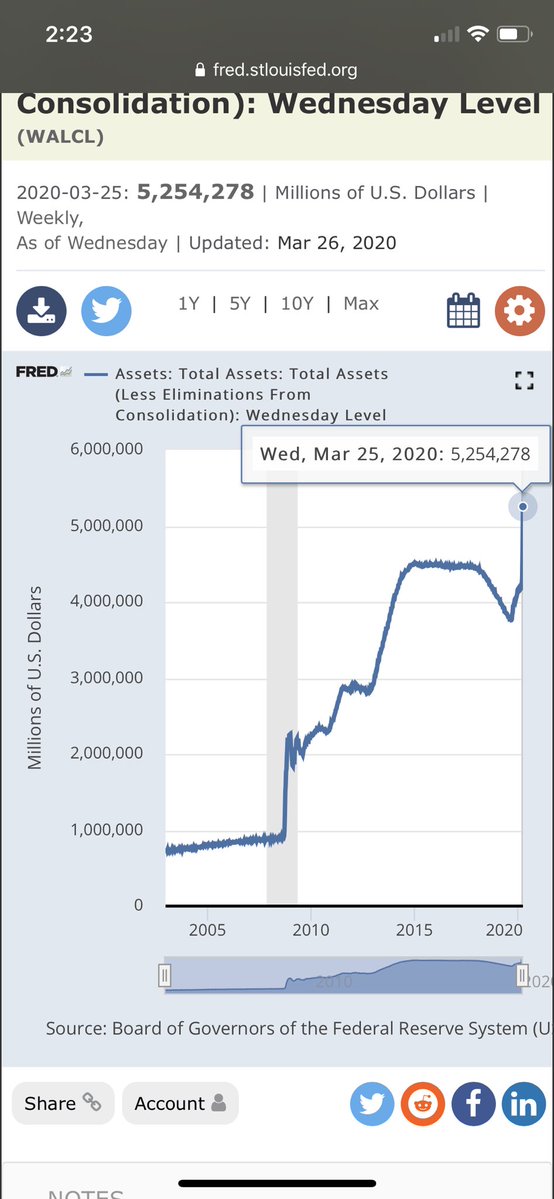

7) And as of today, the fed& #39;s balance sheet is over $5.2 trillion

8) The total debt of U.S. nonfinancial businesses has grown by about $6 trillion since 2007, while cash on hand has only grown by $1.7 trillion

source: @ScottMinerd& #39;s Global CIO Outlook

source: @ScottMinerd& #39;s Global CIO Outlook

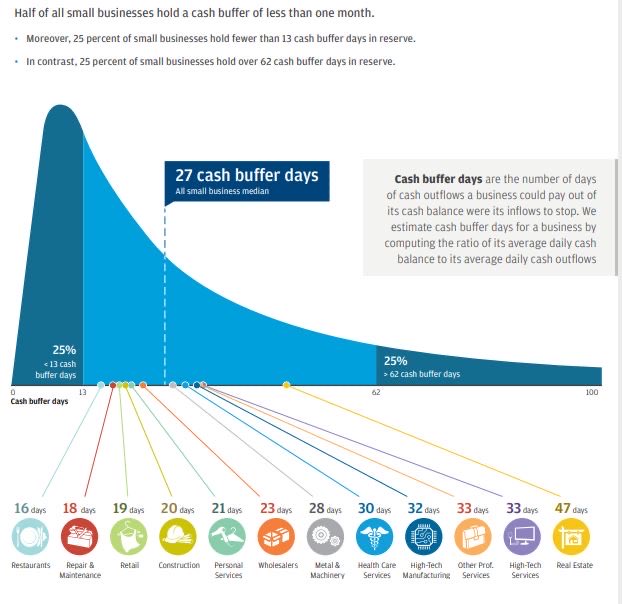

9) Half of small businesses hold a cash buffer of 27 days. 25% of small businesses hold fewer than 13 cash buffer days in reserve

(source: J.P. Morgan)

(source: J.P. Morgan)

10) Most Americans have less than $1,000 in savings, with about 40% unable to afford an unexpected $400 expense.

(Federal reserve survey)

https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf">https://www.federalreserve.gov/publicati...

(Federal reserve survey)

https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf">https://www.federalreserve.gov/publicati...

11) How do companies utilize their cash flow? S&P 500 companies spent over 50% of free cash flow on average on buybacks

Airlines spent over 90% of FCF on buybacks. Mind you, b/w the 2 of them, Warren Buffett and Primecap own 25% of every major US airline (UAL, DAL, AAL, LUV)

Airlines spent over 90% of FCF on buybacks. Mind you, b/w the 2 of them, Warren Buffett and Primecap own 25% of every major US airline (UAL, DAL, AAL, LUV)

12) The government& #39;s rescue package enabled:

49 companies to issue $107 billion of IG bonds (biggest week for issuance on record)

-part of the biggest month on record ($213B from 106 issuers)

-part of the biggest quarter on record ($473B)

(source: Howard Marks from Oaktree)

49 companies to issue $107 billion of IG bonds (biggest week for issuance on record)

-part of the biggest month on record ($213B from 106 issuers)

-part of the biggest quarter on record ($473B)

(source: Howard Marks from Oaktree)

13) Price declines + ratings downgrades will cause highly leveraged companies to default....

One would think

One would think

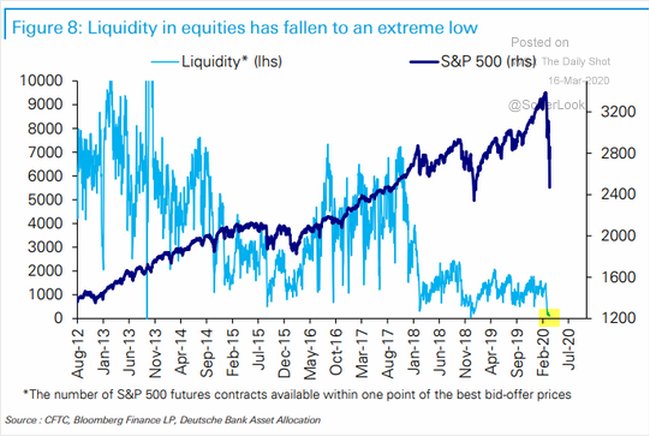

14) Not to mention the liquidity crisis on hand

In 2013, it was possible to execute 9,000 S&P futures contracts “at the front of the book” (light blue line below). In recent days, that number has fallen to only 9 contracts

source: https://www.logicafunds.com/policy-in-a-world-of-pandemics

https://www.logicafunds.com/policy-in... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimacing face" aria-label="Emoji: Grimacing face">

In 2013, it was possible to execute 9,000 S&P futures contracts “at the front of the book” (light blue line below). In recent days, that number has fallen to only 9 contracts

source: https://www.logicafunds.com/policy-in-a-world-of-pandemics

15) "In dollar terms, in 2013 it took a $750MM order to move the market… today it takes a $1MM order. Not just less liquid, order of magnitude less liquid."

source: https://www.logicafunds.com/policy-in-a-world-of-pandemics">https://www.logicafunds.com/policy-in...

source: https://www.logicafunds.com/policy-in-a-world-of-pandemics">https://www.logicafunds.com/policy-in...

16) The search for yield in a low interest rate world is what caused a lot of companies/investors/people to use abnormal & dangerous amounts of leverage.

This thread explores many of those vulnerabilities

This thread explores many of those vulnerabilities

17) Another issue with Oil & Gas industries:

“The world normally uses 100 million barrels of oil day, and traders and analysts reckon as much as a quarter of that has disappeared in just a few weeks.”

source: https://www.bloomberg.com/news/articles/2020-03-29/the-global-oil-market-is-broken-drowning-in-crude-nobody-needs

shout-out">https://www.bloomberg.com/news/arti... to @TaylorPearsonMe for sharing

“The world normally uses 100 million barrels of oil day, and traders and analysts reckon as much as a quarter of that has disappeared in just a few weeks.”

source: https://www.bloomberg.com/news/articles/2020-03-29/the-global-oil-market-is-broken-drowning-in-crude-nobody-needs

shout-out">https://www.bloomberg.com/news/arti... to @TaylorPearsonMe for sharing

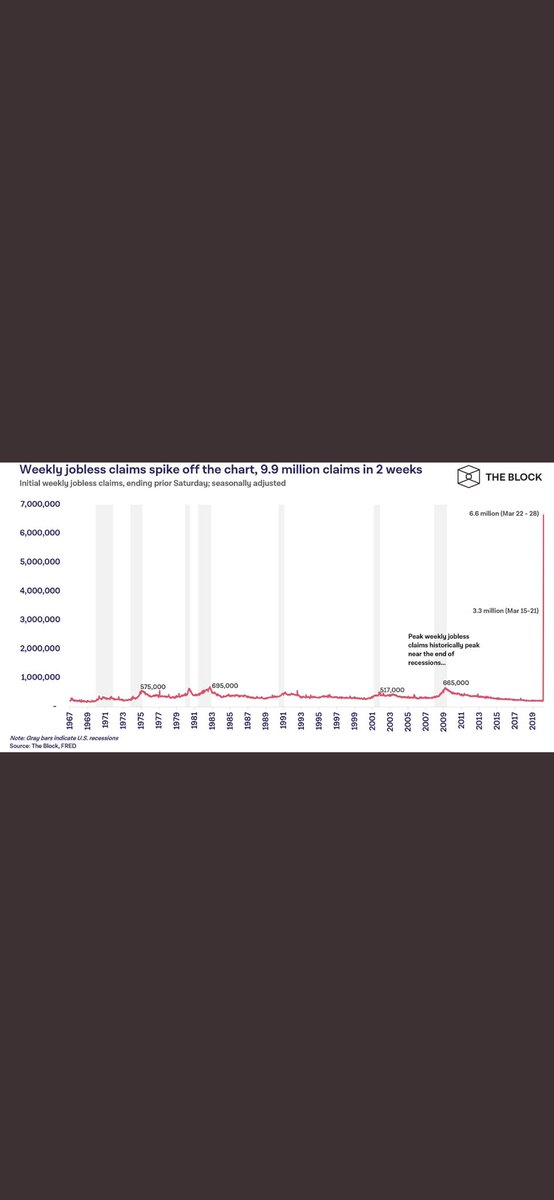

18) "The number of jobless claims in the last two weeks is close to the combined number of weekly claims over the prior 11 months."

Source: @TheBlock__

Source: @TheBlock__

Read on Twitter

Read on Twitter

" title="5) This is a massive issue in China. China’s nonfinancial corporate debt is 60% higher than its GDPOH MY https://abs.twimg.com/emoji/v2/... draggable="false" alt="😱" title="Face screaming in fear" aria-label="Emoji: Face screaming in fear">" class="img-responsive" style="max-width:100%;"/>

" title="5) This is a massive issue in China. China’s nonfinancial corporate debt is 60% higher than its GDPOH MY https://abs.twimg.com/emoji/v2/... draggable="false" alt="😱" title="Face screaming in fear" aria-label="Emoji: Face screaming in fear">" class="img-responsive" style="max-width:100%;"/>