Treasury Bills and Treasury Bonds. You’ve heard of them. You may even have friends trying to interest you in investing in them. You probably nod approvingly, but are bewildered by the whole notion. Have no fear. Let’s try and give you a (gentle) introduction.

Ka-uzi.

1/16

Ka-uzi.

1/16

All governments (and lots of companies) borrow using bonds. For governments, the main instruments (yaani methods, to be inaccurately simple) used are Treasury Bills and Treasury Bonds.

2/16

2/16

There isn’t much difference between the two, except that T-Bills (as they are commonly known) are for a period of less than a year, and T-Bonds (ditto) are for periods longer than a year.

In Kenya, GoK offers 3 T-Bills: 91-day, 182-day and 364-day

3/16

In Kenya, GoK offers 3 T-Bills: 91-day, 182-day and 364-day

3/16

What this means is that you invest your money, and in 91 days, 182 days or 364 days, you get your money back, plus interest. Yaani unapatia gava doo na hiyo doo inazaa. Wanakurudishia, wanakwambia sand sana, na unaenda zako.

4/16

4/16

How does the gaament sell these T-Bills? The agent for selling them is the Central Bank of Kenya (where I happily sit Monday to Friday, and on the occasional weekend when the boss calls). CBK auctions the T-Bills every Thursday, and publishes the results immediately.

5/16

5/16

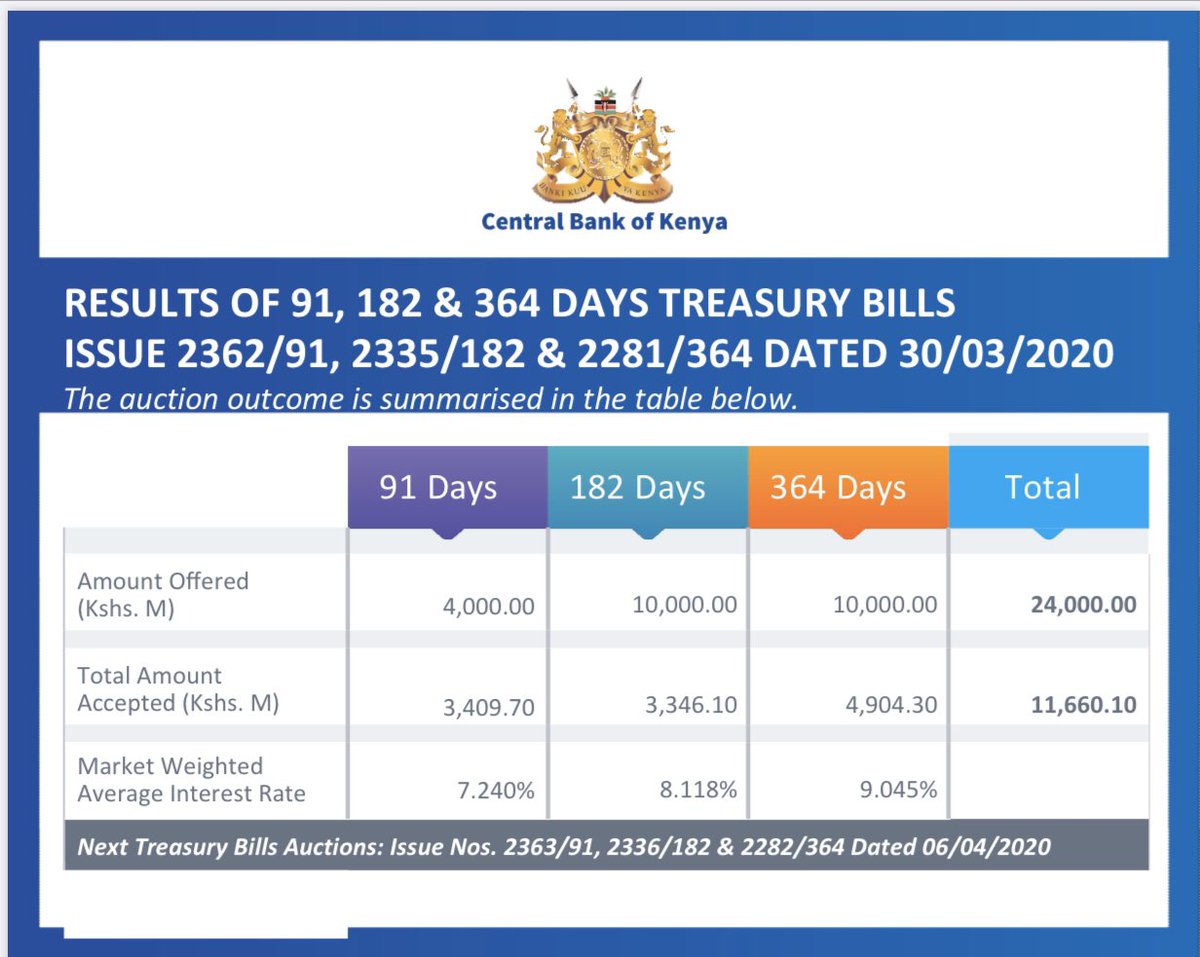

What do these results look like, and what do they mean? Look at the attached picture. It means that last Thursday, CBK auctioned KSh 24 billion of T-Bills (4b of 91d; 10b of 182d; 10b of 364d). They accepted the respective bids, at the average interest rate attached.

6/16

6/16

What does the interest rate mean? It’s important to clarify that this is an annual rate. Meaning that 91-day bill at 7.24% is (roughly) 1.8% for the 91 days. If you invested 100k in a 91-day T-Bill on 26/3/20, you’ll be paid back KSh 101,800 on 29/6/20. Same for 182 and 364

7/16

7/16

Quick note. The day that you’re supposed to be paid back, you can send instructions to CBK to ‘roll over’ the particular instrument. Yaani buy another T-Bill, instead of taking your cash. Ni kama kuenda kiosk na useme badala ya kurudisha change, nipe ugali ingine kama hiyo.

8/16

8/16

So, on to T-Bonds. Same concepts, except that this time you’re investing longer than a year. T-bills are fairly standard, and will be sold every Thursday (typically). T-Bonds, however, are unique, and each is advertised ahead of time and then auctioned.

9/16

9/16

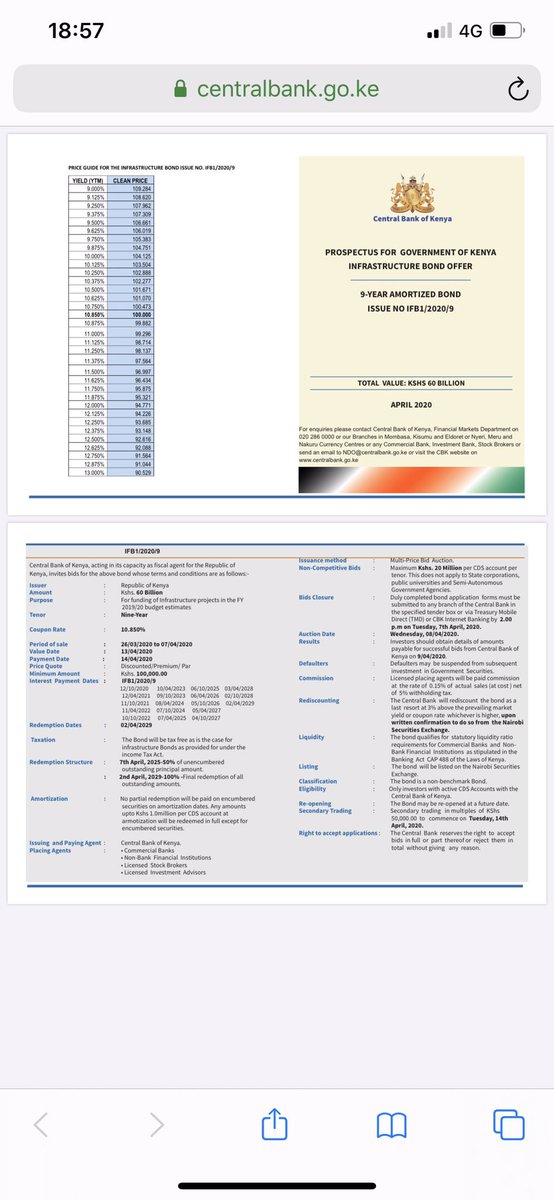

This is done through a prospectus, which tells you what the bond is for, the length of the bond, value, auction date, method of sale, coupon rate (we’ll come back to this later) and the dates you will be paid interest. There is other information, but let’s lenga for now

10/16

10/16

This is an example of the latest bond on offer. It is a 9-year infrastructure bond (IFB - investors get excited by these three letters, and I will tell you why). You can see that it is a screenshot from the CBK website, where all T-Bonds are advertised.

11/16

11/16

To note? This is a bond for KSh 60 billion, for 9 years. It will pay a coupon rate (very, very roughly speaking, its interest rate) of 10.850%, with interest payments every six months from 12/10/2020 until 4/10/2027.

12/16

12/16

To invest, same as T-Bill. You open a CDS account (a specific one with CBK, sio ile ingine ya shares), and then you can bid for whichever security (i.e. T-Bill or T-Bond). CBK can accept your entire bid, reject your entire bid, or accept it partially.

13/16

13/16

You can put in a competitive bid (kama ku-nego mtush pale Toi Market). Yaani you guess (or take an educated stab at) what interest rate CBK will accept and submit it. Or put in a non-competitive bid, yaani ulipe ile bei (interest rate) itatokezea.

14/16

14/16

Finally, Treasury Bills are usually invested with a minimum amount of KSh 100,000, and then in chunks of KSh 50,000. Treasury Bonds? The minimum amounts and other details are on the prospectus.

15/16

15/16

Oh, and why the excitement about IFBs? For other bonds, you’ll be subjected to taxes on your proceeds. IFBs are tax-free. Watu huzikimbilia kama chapo on visiting day.

I have finished. Wacha nikakule chapo madondo.

16/16

I have finished. Wacha nikakule chapo madondo.

16/16

Read on Twitter

Read on Twitter