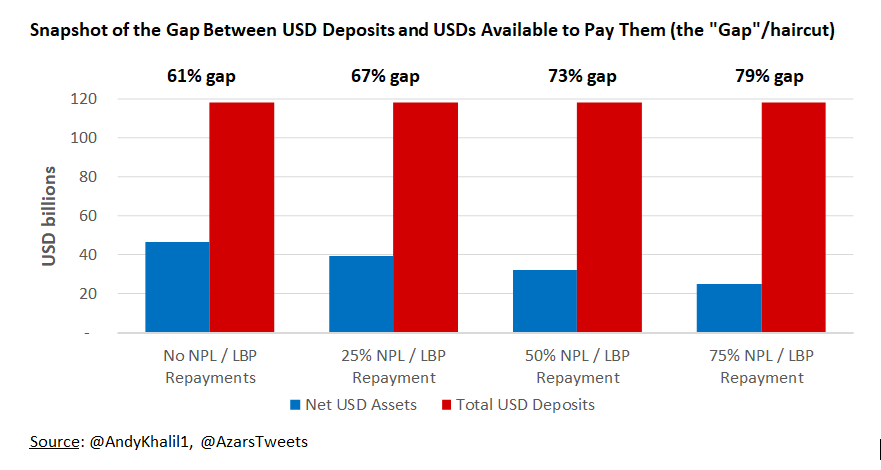

How much of your USD deposits are left? We tried to estimate. For simplicity, we took a “snapshot” of the gap between total customer deposits (USD-only) and sources of USD in the system to meet those deposits. It& #39;s a range, as explained in this thread from me and @AndyKhalil1

This “gap” is an estimate of the loss to depositors, the difference b/w deposits & USD available to meet them. Again, it& #39;s a snapshot as of today. The numbers are dynamic.

We estimate a gap/"haircut" b/w 60% & 80%. It& #39;s huge. This is what the Gov& #39;t is not being forthcoming about Actually, the first scenario in there is not realistic. The gap is actually between 67% and 79+%, and growing EVERY DAY.

There are several assumptions we had to make. Banks and BDL have USD assets. These assets and the income they generate are used to pay back depositors. We know the size of the USD deposits today (as Jan 2020). So we need to figure out how to calculate the real value of the assets

First, loans that banks made to clients (not the Govt or BDL) in USD are a potential source of USD to pay back depositors to the extent such loans are actually repaid (i.e., they are not non-performing loans/NPLs) and are repaid in USD rather than Liras, which is happening today.

If the loans are not repaid or are repaid in Lira, then this is no longer a source of USD to repay depositors. We don& #39;t know how much of these loans will not be repaid or repaid in Lira, so we calculate a range from 0% to 75% of them. This is the range in the chart.

Second, the Eurobond restructuring can have an impact on the amount of USD available for depositors. The deeper the haircut on the Eurobonds held by foreign investors, the more USD available for depositors. We assumed a 70% haircut on the bonds.

Third, we treat non-resident and resident depositors the same. Fourth, we assume the gold is not used to make up some of the loss to depositors.

Fifth, we assume that bank’s liabilities to non-resident financial institutions (basically Leb bank& #39; loans owed to foreign banks) are repaid. Similarly, we assume that Leb banks’ deposits with foreign banks and other investments abroad will be repaid.

Sixth, we assume that SGBL/GS loan to BDL is repaid in full. If you don& #39;t know what this is, BDL effectively borrowed money to boost its reserves. We assume this direct loan to BDL is repaid by BDL using its reserves.

The size of the gap will increase over time as: (i) more Bank NPLs and/or USD loans repaid in Lira, (ii) interest is earned on USD deposits, (iii) “dollarization” of deposits (conversion of Lira deposits into USD deposits), (iv) BDL’s reserves are used to pay for imports.

This is just a snapshot as of today. The longer we wait, the larger the gap will grow, unless we magically discover a new source of USD (e.g., a free check, big increase in exports, foreign investment, or remittances). None is likely.

In the end, the gap has to be closed in some way. There are only three ways. Increasing the asset side (i.e., the “sources of USD”) is not a realistic option. Therefore, we’ll have to close the gap by reducing the other side of the ledger, the amount of customer USD deposits.

This analysis makes no assumption for *how* this loss (the gap) is allocated across different depositors (i.e., how much do large depositors absorb versus smaller ones). It just aggregates all depositors into one. In theory, small depositors can be spared (90% according to PM).

You can close the gap in two ways. (1) converting those deposits into shares in the banks, or (2) converting those deposits into Liras.

We may hear proposals to “freeze” the deposits for some number of years. This won’t close the gap. It’ll just delay the time when the gap has to be closed using the same methods (1) or (2) above.

Method (1) is straightforward. Deposits are converted into shares/ownership in a bank. How much those bank shares are/will be worth? Nobody knows, but a lot less than the deposit& #39;s original value.

Under method (2), there are risks. Converting deposits into Lira (& at which USD:Lira exchange rate) would likely cause the Lira exchange rate to fall further against the USD (because you flood the system with Liras)...

...and prices will increase. Depending on how much “lirafication” is done, these effects could be severe.

Minister Wazni threw out the idea that might freeze USD deposits for six years and then allow their withdrawal in Liras. Don’t be fooled. This is the same as approach (2), it just looks nicer because you can see USD balance on your computer screen for a few more years.

In the end, we think the Gov’t will use a combination of all of these methods.

But the problem isn’t only with USD deposits...

But the problem isn’t only with USD deposits...

Lira deposits are also at risk because of the potential significant weakening of its exchange rate against the USD & loss of purchasing power (higher prices), partly driven by the lirafication of USD deposits but also b/c there already is too much Lira deposits in the system.

Bank’s Lira loans to the Government and the private sector will also lose their value because the Gov’t is broke and the economy is contracting (people can& #39;t repay their lira loans). These are the assets that Banks use to pay back Lira depositors. If those assets are impaired...

Bottom line, there’s a whole other mess for Lira deposits that can end up reducing the value of Lira accounts too (by reducing the purchasing power of the money).

Even if you don’t have a bank account, you will be affected if the Liras you have end up being worth much less than they are today. Another thread on this in the future.

Our spreadsheet is available if anyone is interested in digging in deeper...

It’s important to say again, the low end of this range is TOO low. NPLs/Lira repayments are more than 25% & gap grows daily. I think the middle of the range is likely the low end TODAY. That means LESS THAN 30% of deposits are left (again, only snapshot as of today).

And this analysis of course assumes that BDL actually has $22 billion in liquid reserves as BDL and the Ministry of Finance have stated. Until we see audited financial statements from BDL, we can’t be sure. If this number is low, it changes everything for the worst.

https://twitter.com/AzarsTweets/status/1245269734473510912?s=20">https://twitter.com/AzarsTwee...

Read on Twitter

Read on Twitter