It seems to me that a lot of the economic discussion of Covid impacts and policy response is still using the wrong metaphors and models. For example, we keep hearing about "stimulus" bills when that& #39;s not mostly what they are. So, some thoughts 1/

My stylized model of the economy right now looks like this: there are two sectors, essential (E) and nonessential (N). What& #39;s mainly happening is that we are — rightly — shutting down N to limit social interaction and flatten the curve. 2/

This isn& #39;t a conventional recession; it& #39;s more like a medically induced coma, where you temporarily shut down much of the brain& #39;s activity to give it a chance to heal. But doing this requires that we provide life support 3/

In particular, how are laid-off workers in the N sector supposed to keep buying essentials? They need aid — and when you consider how much of the economy is being shut down that aid has to be on a massive scale. $2 trillion isn& #39;t nearly enough 4/

So this is basically disaster relief, not stimulus, although there is a stimulus element. After all, without aid those unemployed N workers will cut purchases of E products, leading to a second round of job losses, which we also want to prevent 5/

You might ask, how do we pay for this massive disaster relief? The immediate answer is borrowing. But where will the borrowed funds come from? The answer, mainly, is the E sector. And why will that sector provide funds? Because it has drastically cut spending 6/

After all, it& #39;s not buying (not allowed to buy) N products; most of that foregone consumption will probably be reflected in saving, rather than increased purchases of still-available goods. Savings rates of still-employed households are surely soaring 7/

Add in slumping investment — who& #39;s going to build office parks and houses in a plague? — and you have vast savings looking for someplace to go. Real interest rate on long-term debt is -0.25: investors basically paying feds to take their money 8/ https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield">https://www.treasury.gov/resource-...

So we want massive, debt-financed disaster relief while the economy is in its medically induced coma. And while we& #39;re doing some of that — that "stimulus" bill was far better than the things Rs were talking about a week earlier — it& #39;s still not nearly enough. 9/

In particular, I& #39;ve been talking about laid-off workers, but state and local governments, which must balance their budgets, are also facing crisis and desperately need federal aid. So that& #39;s the next frontier in this policy struggle 10/

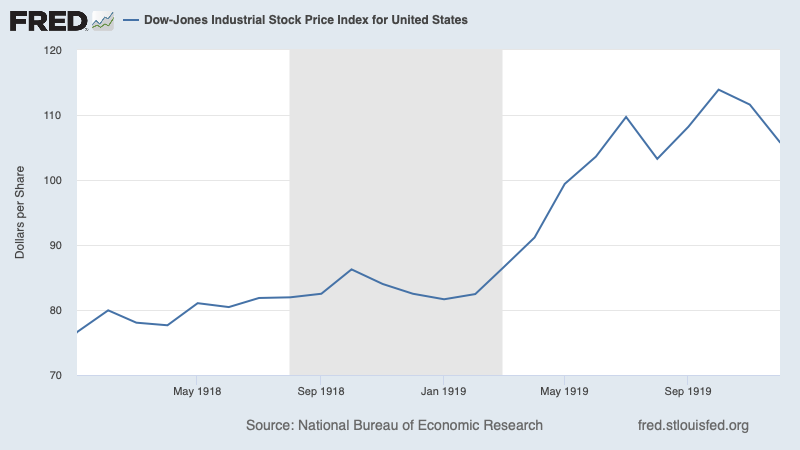

Oh, and don& #39;t tell me about the stock market. Stocks actually rose during the deadly 1919 influenza pandemic. 11/

Read on Twitter

Read on Twitter