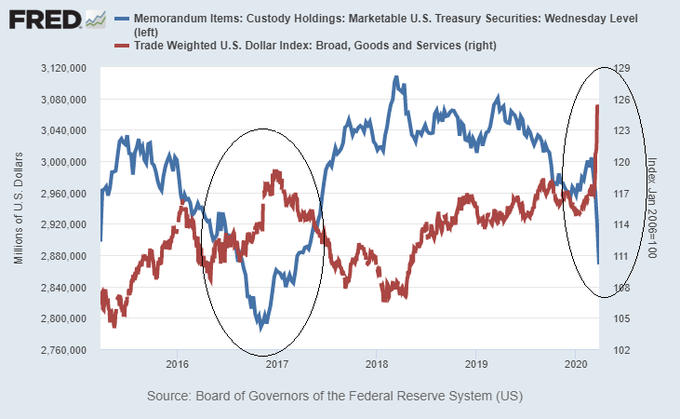

So, when foreigners are short dollars, they can sell their U.S. assets to get dollars. As a specific example, foreigners liquidate their Treasury holdings that they hold at the Fed (custodian) in response to dollar spikes:

This forced-selling applies to government bonds, corporate bonds, real estate, and stocks.

People often ask how dollars can get out of U.S. besides trade. Selling U.S. assets is how. Some of the $39 trillion that foreigners own gross, starting with about $7 trillion in UST.

People often ask how dollars can get out of U.S. besides trade. Selling U.S. assets is how. Some of the $39 trillion that foreigners own gross, starting with about $7 trillion in UST.

In other words, dollar bulls seem to underestimate how much damage a strong dollar does to U.S. asset prices in this environment.

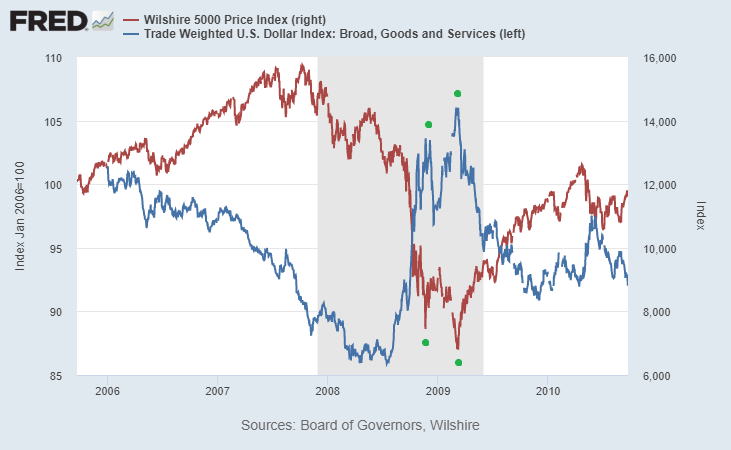

It& #39;s no surprise that in 2008, the stock market bottomed identically as the dollar topped:

It& #39;s no surprise that in 2008, the stock market bottomed identically as the dollar topped:

All of these dollar swap lines that the Fed is doing with nations is not out of the kindness of their heart. It& #39;s to avoid the prospect of foreigners selling $39 trillion in U.S. assets, including especially $7 trillion in U.S. treasuries, by biding time.

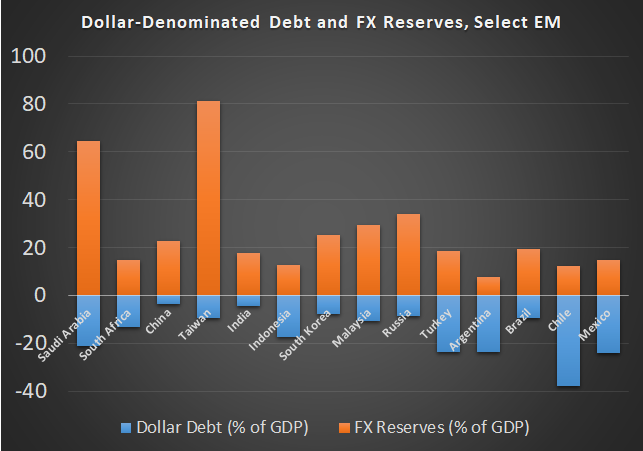

Some nations are in better shape than others, because their FX reserves (stored in dollars and other convertible currencies like euros or gold) exceed their dollar-denominated liabilities. Others are not so lucky.

Here are the major EMs FX reserves and USD debts as % of GDP:

Here are the major EMs FX reserves and USD debts as % of GDP:

For example, Korea is using a $12 billion swap to help out its banks. However, they also have $121 billion in U.S. treasuries. The swap line is there by the U.S. to avoid Korea having to sell U.S. treasuries. https://finance.yahoo.com/news/bank-korea-offer-12-bln-030000433.html">https://finance.yahoo.com/news/bank...

When analyzing who has the upper hand and how this likely plays out, consider that the U.S. is helping its creditors not do disorderly fire-sales of its assets.

The U.S. is the net debtor rather than the net creditor in this scenario. It& #39;s our stuff that they would sell.

The U.S. is the net debtor rather than the net creditor in this scenario. It& #39;s our stuff that they would sell.

A day after this thread, Fed announced intl repo:

"This facility should help support the smooth functioning of the U.S. Treasury market by providing an alternative temporary source of U.S. dollars other than sales of securities in the open market." https://www.federalreserve.gov/newsevents/pressreleases/monetary20200331a.htm">https://www.federalreserve.gov/newsevent...

"This facility should help support the smooth functioning of the U.S. Treasury market by providing an alternative temporary source of U.S. dollars other than sales of securities in the open market." https://www.federalreserve.gov/newsevents/pressreleases/monetary20200331a.htm">https://www.federalreserve.gov/newsevent...

Read on Twitter

Read on Twitter