no idea what must be done with a lot of you guys that just found this feed

how can I transport/transfer at least some of whatever tiny knowledge I have best over to you?

what format?

got many dm asking for literature atm, can produce a list later...

- knowledge

- infrastructure

how can I transport/transfer at least some of whatever tiny knowledge I have best over to you?

what format?

got many dm asking for literature atm, can produce a list later...

- knowledge

- infrastructure

problem is that successful trading/investing has its roots in correct treatment of the problem at hand ie pro style/scientific approach

pro style involves acknowledging our limitations, both in knowledge and psychologically which must be respected but can be transformed over time

pro style involves acknowledging our limitations, both in knowledge and psychologically which must be respected but can be transformed over time

despite all stuff that can be thrown at you for study, there will always be a very personal component that circles around big words like "honesty" and "confidence"

successful ppl I know have a sense for quality and are humble - know how to save energy and money

all need a mentor

successful ppl I know have a sense for quality and are humble - know how to save energy and money

all need a mentor

fine, that& #39;s stupid for I can& #39;t mentor a 1000 ppl despite the fact that all I know fits less than a page, I reckon

hm, twtr may be an ok medium for now, you can always ask and I will think about it more and try to put a plan together when done with some work, later on

hm, twtr may be an ok medium for now, you can always ask and I will think about it more and try to put a plan together when done with some work, later on

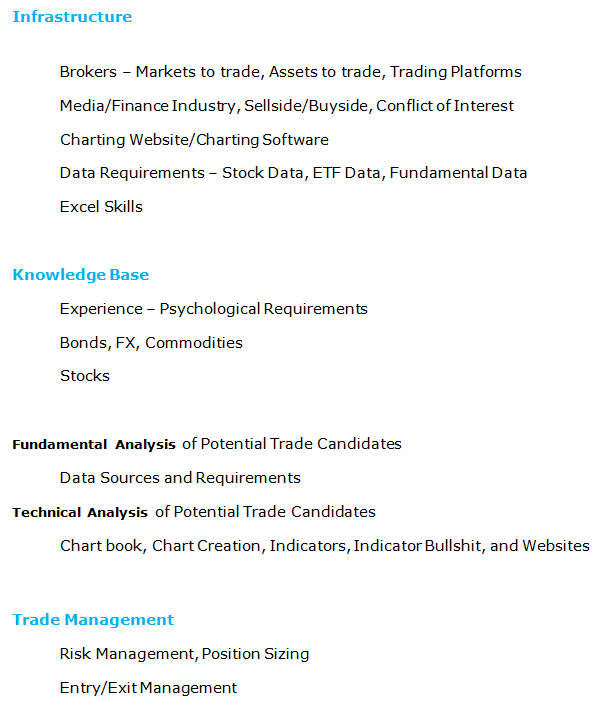

ok, am thinking of a structure like this

let& #39;s have your ideas added and then I will go about it

been sorting useful reads already, etc...

am sure I have forgotten sth, so, engage pls

l8er

let& #39;s have your ideas added and then I will go about it

been sorting useful reads already, etc...

am sure I have forgotten sth, so, engage pls

l8er

as a "foreword" I& #39;d like to draw your attention to the psychology of masses

many of the books/texts I will name can be found on the web in pdf format etc.

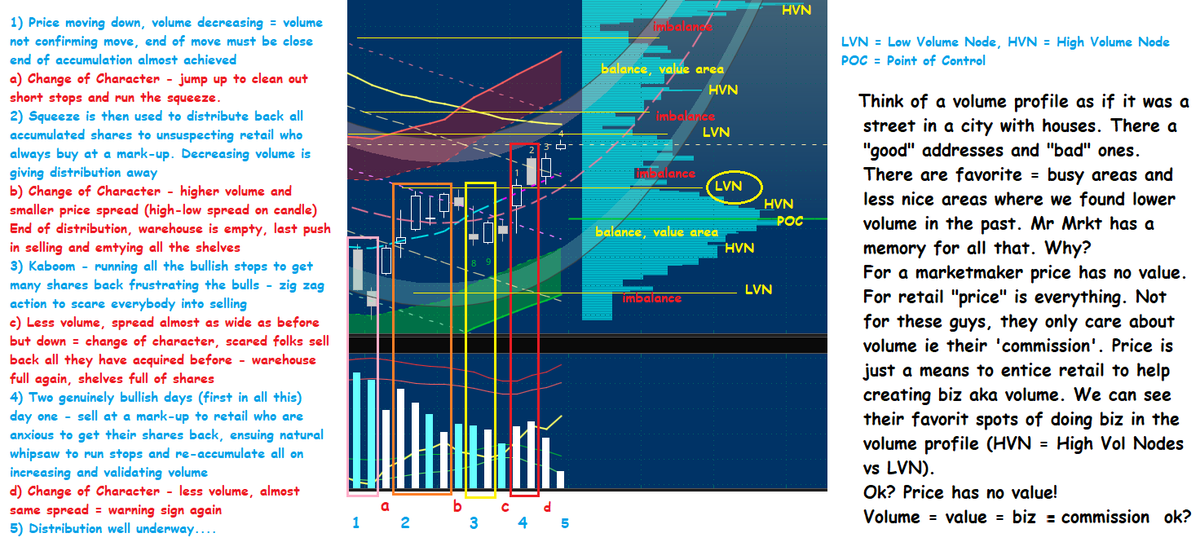

next you could watch this short and simple video about why markets move

trader Kai Whitney talks

https://www.youtube.com/watch?v=klTUBhVvlhs">https://www.youtube.com/watch...

many of the books/texts I will name can be found on the web in pdf format etc.

next you could watch this short and simple video about why markets move

trader Kai Whitney talks

https://www.youtube.com/watch?v=klTUBhVvlhs">https://www.youtube.com/watch...

still part of the Foreword

next thing everyone should do is think about personal finances, how to tie it all together and how investing/trading might finally fit into all this

next thing everyone should do is think about personal finances, how to tie it all together and how investing/trading might finally fit into all this

INFRASTRUCTURE

first thing we must understand is that NOT everybody is good at EVERYTHING, Options guys can& #39;t trade Bonds, a Futures trader may be bad at position trading etc

What vehicle is it going to be? Beginners should not touch leverage and stick to "simple" = stocks/ETF

first thing we must understand is that NOT everybody is good at EVERYTHING, Options guys can& #39;t trade Bonds, a Futures trader may be bad at position trading etc

What vehicle is it going to be? Beginners should not touch leverage and stick to "simple" = stocks/ETF

INFRASTRUCTURE

Trading platforms and brokerages should be picked according to market access we need and cost

Domestic vs The World - will you need access to trade Baht vs USD? Do you need access to Dutch stocks, etc?

Low cost vs efficiency and personal feel may be imp

Trading platforms and brokerages should be picked according to market access we need and cost

Domestic vs The World - will you need access to trade Baht vs USD? Do you need access to Dutch stocks, etc?

Low cost vs efficiency and personal feel may be imp

INFRASTRUCTURE

Interactive Brokers ie offers real bad charting only, but superior access to markets

ThinkOrSwim has all US and good charting at a discount ;-)

Ninja needs external data feeds but looks highly customizable,

CQG, Sierra charts - I did it all, try simple

Interactive Brokers ie offers real bad charting only, but superior access to markets

ThinkOrSwim has all US and good charting at a discount ;-)

Ninja needs external data feeds but looks highly customizable,

CQG, Sierra charts - I did it all, try simple

INFRASTRUCTURE

There are websites ranking brokerages and costs

- know that cost is very imp but not key

next: we don& #39;t need "n" screens - 2 screens can be efficient enough

tbc

There are websites ranking brokerages and costs

- know that cost is very imp but not key

next: we don& #39;t need "n" screens - 2 screens can be efficient enough

tbc

INFRASTRUCTURE- MEDIA/The Industry,Conflicts of Interest

Everybody is out there to get our money selling us often pretty dated and even useless stuff. Mr Market is a forward looking indicator, trying to discount an economic future 6-12months out, the Media is talking about y-day

Everybody is out there to get our money selling us often pretty dated and even useless stuff. Mr Market is a forward looking indicator, trying to discount an economic future 6-12months out, the Media is talking about y-day

INFRASTRUCTURE - Purists like Seykota don& #39;t care much about news - according to their teaching all news go straight into the bin. Try to be selective about who and what influences your process. Sell side needs to sell assets to us for a profit, like a warehouse operation.

INFRASTRUCTURE - Charting Websites/Software

Trading View

Stockcharts

We want to maintain an inventory of charts. These sites offer different ways to save our work and chart collections.

Quandl, YCharts, Koyfin etc offer useful tools to overlay price data with fundamental data.

Trading View

Stockcharts

We want to maintain an inventory of charts. These sites offer different ways to save our work and chart collections.

Quandl, YCharts, Koyfin etc offer useful tools to overlay price data with fundamental data.

INFRASTRUCTURE - DATA

Stocks and ETF come with a myriad of data points attached. Sites like Gurufocus, Zacks, YCharts, Quandl, ValueLine, Koyfin etc, offer access to that data. Sometimes we must pay to be able to download into Excel which can be a time saving thing to do.

Stocks and ETF come with a myriad of data points attached. Sites like Gurufocus, Zacks, YCharts, Quandl, ValueLine, Koyfin etc, offer access to that data. Sometimes we must pay to be able to download into Excel which can be a time saving thing to do.

INFRASTRUCTURE - those who have not built a set of Excel skill sets could try and find this on the web - else there are many vids on utube explaining things re Excel

INFRASTRUCTURE

why is this so damn important? infrastructure is at the very heart of a pro process, it is our base for a decision tree. process is all we have when things stop working.

if we don& #39;t treat this like a biz, we will never make it consistently.

its that simple

why is this so damn important? infrastructure is at the very heart of a pro process, it is our base for a decision tree. process is all we have when things stop working.

if we don& #39;t treat this like a biz, we will never make it consistently.

its that simple

KNOWLEDGE BASE

ok next comes the all important "Knowledge Base"

1...

2...

3...

aaaaand that& #39;s it...

ok next comes the all important "Knowledge Base"

1...

2...

3...

aaaaand that& #39;s it...

KNOWLEDGE BASE

I mean "F-ME" what do I know.... but ok, will try

The hardest part to talk about is "Experience" I guess, this is difficult to generalize. I found some good literature and reading Dasan& #39;s etc shows that we all face similar psychological problems. ok?

I mean "F-ME" what do I know.... but ok, will try

The hardest part to talk about is "Experience" I guess, this is difficult to generalize. I found some good literature and reading Dasan& #39;s etc shows that we all face similar psychological problems. ok?

KNOWLEDGE BASE

Trading is "blabla"

We& #39;re all doomed as long as we don& #39;t take care of risk. Taking care of risk took care of my emotions, largely, but this book is really fantastic, go read it

I will be able to show you how to take care of risk, to some extend. You will be ok

Trading is "blabla"

We& #39;re all doomed as long as we don& #39;t take care of risk. Taking care of risk took care of my emotions, largely, but this book is really fantastic, go read it

I will be able to show you how to take care of risk, to some extend. You will be ok

KNOWLEDGE BASE

Learn what style fits your personality - changing mrkts force us to learn and change along.

now, if you don& #39;t like change, if you don& #39;t like to study all day, don& #39;t even think to try your hand in this - on top, most don& #39;t want you to know a thing, its hostile

Learn what style fits your personality - changing mrkts force us to learn and change along.

now, if you don& #39;t like change, if you don& #39;t like to study all day, don& #39;t even think to try your hand in this - on top, most don& #39;t want you to know a thing, its hostile

KNOWLEDGE BASE

remember, we are supposed to "sell low & buy high" ok?

Nobody knows us, everybody is out to get our pretty $$.

To beat that we need process and force the & #39;enemy& #39; to PLAY BY OUR RULES - never seek to play on his/her terms - your process defines your field of battle

remember, we are supposed to "sell low & buy high" ok?

Nobody knows us, everybody is out to get our pretty $$.

To beat that we need process and force the & #39;enemy& #39; to PLAY BY OUR RULES - never seek to play on his/her terms - your process defines your field of battle

KNOWLEDGE BASE

the only way for me to make it is to stick to a narrow field

am on and off this since 1987 - the few things I am confident in I use, everything else I must leave to others.

I have a broad understanding of what& #39;s going on left and right, but no edge

the only way for me to make it is to stick to a narrow field

am on and off this since 1987 - the few things I am confident in I use, everything else I must leave to others.

I have a broad understanding of what& #39;s going on left and right, but no edge

KNOWLEDGE BASE

there are "world champion" bond traders on here, there are guys who trade zillions in derivatives on here, there are futures specialists and options chess players on here that know a million times more than I ever will

admiration I have, but then I turn to my turf

there are "world champion" bond traders on here, there are guys who trade zillions in derivatives on here, there are futures specialists and options chess players on here that know a million times more than I ever will

admiration I have, but then I turn to my turf

KNOWLEDGE BASE

all these markets, every market in fact, requires specialist treatment. A bond desk is different from a Options pit (no pit anymore) and its all VERY different from commodities. Often the difference is in leverage but also in the amount of rain in Brazil last week

all these markets, every market in fact, requires specialist treatment. A bond desk is different from a Options pit (no pit anymore) and its all VERY different from commodities. Often the difference is in leverage but also in the amount of rain in Brazil last week

KNOWLEDGE BASE

all of this is imp when we try and express a view in a trade

we chose a field of battle but we must still respect what& #39;s going on in all these fields.

Bonds are the boss.

Commodities are the driver.

FX is the treasurer

and stocks and ETF are for dimwits like me...

all of this is imp when we try and express a view in a trade

we chose a field of battle but we must still respect what& #39;s going on in all these fields.

Bonds are the boss.

Commodities are the driver.

FX is the treasurer

and stocks and ETF are for dimwits like me...

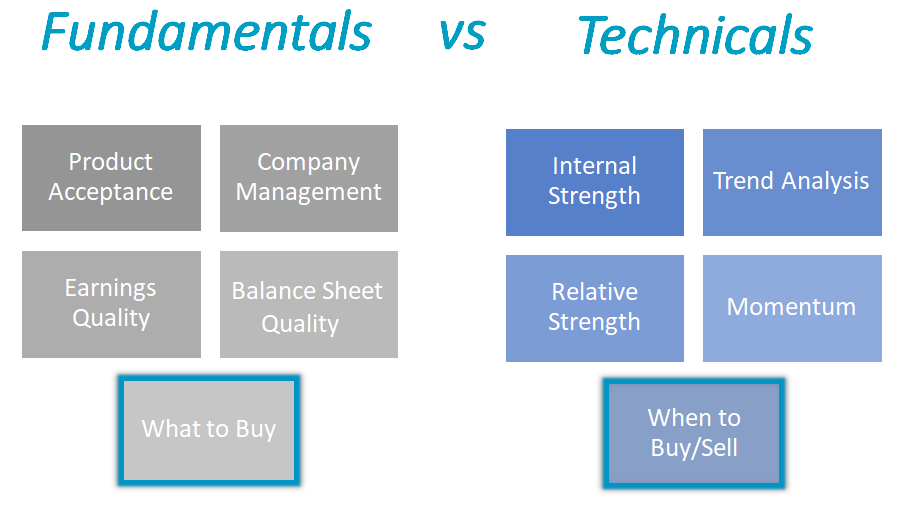

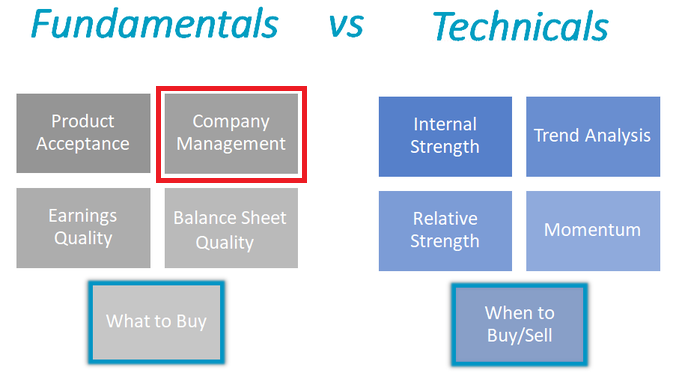

KNOWLEDGE BASE - Analysis, Fundamental & TA

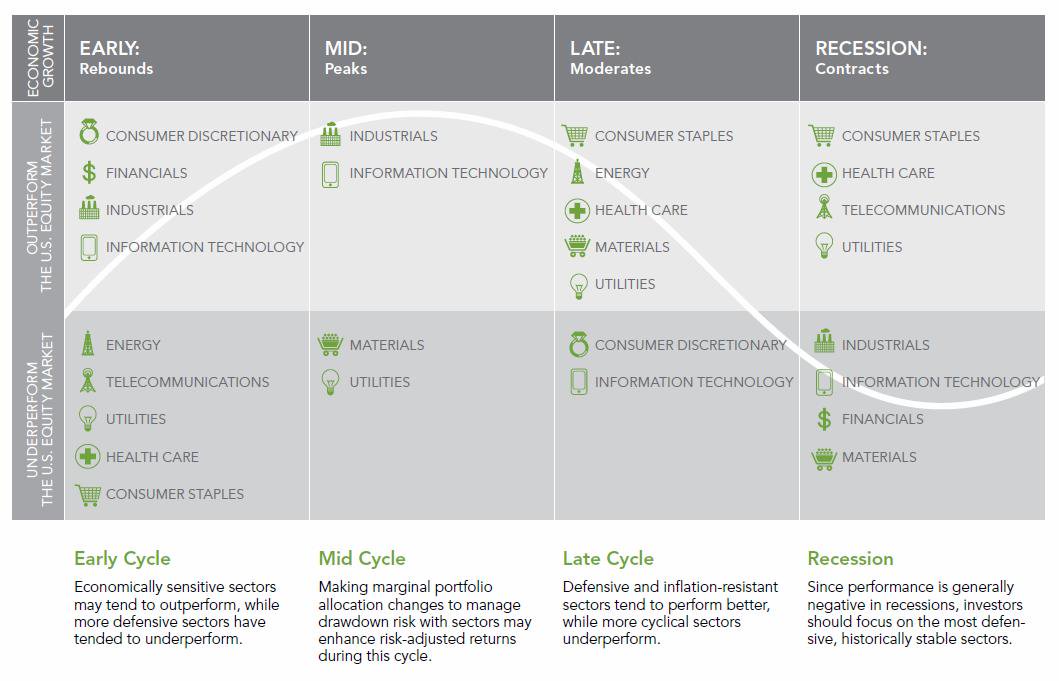

we need to respect both approaches as explained in the image. what comes first? frankly I give a damn. sometimes I get an idea from a certain sector for a TA reason, sometimes I wake up and think "coffee machines" or what have you

tbc

we need to respect both approaches as explained in the image. what comes first? frankly I give a damn. sometimes I get an idea from a certain sector for a TA reason, sometimes I wake up and think "coffee machines" or what have you

tbc

KNOWLEDGE BASE due to brevity am doing Bonds, FX and Comms massive injustice here. Rates rule the game. For many a reason I can not trade carry in FX like some leveraged "hogs" do. Look at corp borrowing rates, When they shift, equities may be in danger etc

so much to say here

so much to say here

KNOWLEDGE BASE - look at the US Yield Curve. It relates to FED policy etc. Short-Term rates are about what the FED is doing to the price of money and Long-Term rates are about inflation expectations. There are entire books written about this and when they decouple mrkts go crazy

KNOWLEDGE BASE

Bonds, FX, and commodities are largely for "Macro Traders". There are differences in FX as some currencies are pegged, some are thought to represent commodity based economies, etc... its another universe, highly political as soon as we move across jurisdictions

Bonds, FX, and commodities are largely for "Macro Traders". There are differences in FX as some currencies are pegged, some are thought to represent commodity based economies, etc... its another universe, highly political as soon as we move across jurisdictions

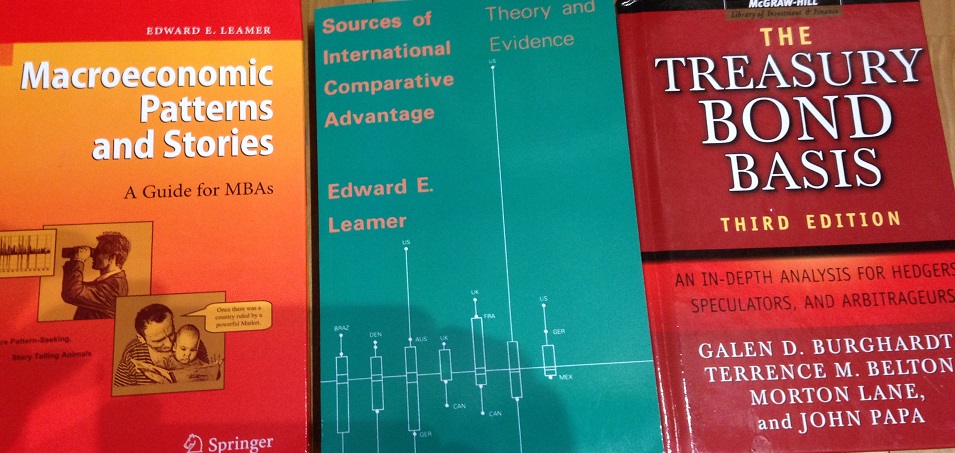

KNOWLEDGE BASE - pers remark

my 1st economics language was German, then Spanish and finally English, am a mess due to work on diff continents - needed to adjust many times, also in resources

here are some in English

read and study pls

my 1st economics language was German, then Spanish and finally English, am a mess due to work on diff continents - needed to adjust many times, also in resources

here are some in English

read and study pls

KNOWLEDGE BASE

there are websites that contain much information ie Investopedia and some are interactive like https://traderscommunity.com/index.php ">https://traderscommunity.com/index.php... where one can get in touch. Some ppl I follow may answer questions when asked politely, but keep in mind that these are pros and time is money https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Face with rolling eyes" aria-label="Emoji: Face with rolling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Face with rolling eyes" aria-label="Emoji: Face with rolling eyes">

there are websites that contain much information ie Investopedia and some are interactive like https://traderscommunity.com/index.php ">https://traderscommunity.com/index.php... where one can get in touch. Some ppl I follow may answer questions when asked politely, but keep in mind that these are pros and time is money

KNOWLEDGE BASE - Stocks Fundamental Analysis

ok guys, that was fun. Now comes the hard part: you must read up on &study quite a few concepts.

Try and find used books on amzn or other places, try and find some pdf of them on the net (often goog page 4 and up) etc, try your worst

ok guys, that was fun. Now comes the hard part: you must read up on &study quite a few concepts.

Try and find used books on amzn or other places, try and find some pdf of them on the net (often goog page 4 and up) etc, try your worst

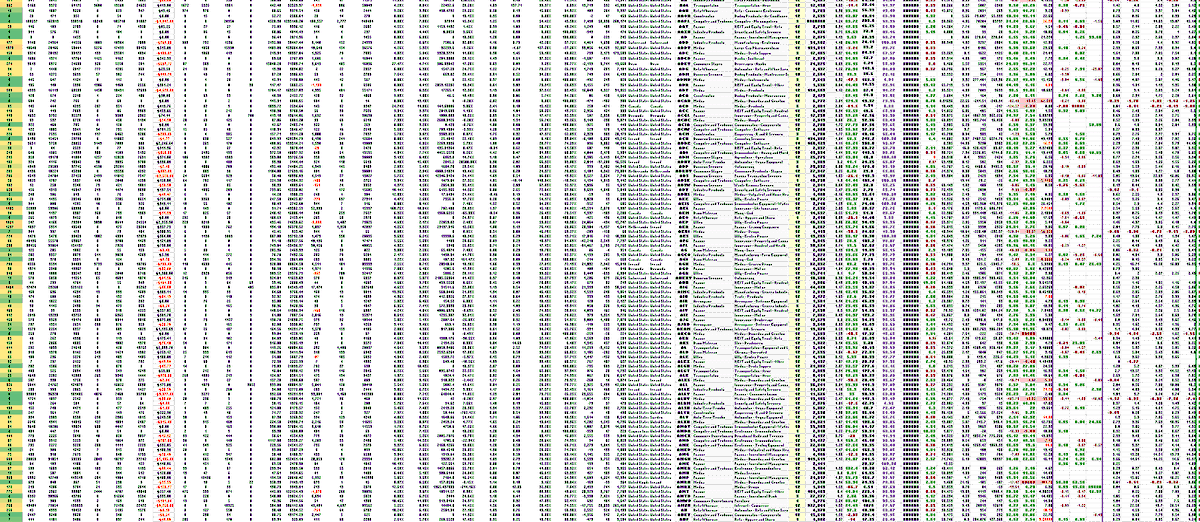

KNOWLEDGE BASE - Stocks (FA)

we need is data on them. Am not doing much fancy anymore for I have distilled it down to a narrow thing I need. Still am paying for a Zacks sub and a YCharts sub to get my hands on it for I need to custom calculate a few metrics - looking super scary

we need is data on them. Am not doing much fancy anymore for I have distilled it down to a narrow thing I need. Still am paying for a Zacks sub and a YCharts sub to get my hands on it for I need to custom calculate a few metrics - looking super scary

KNOWLEDGE BASE - Stocks (FA)

ok, b4 you start to run around like chicken its helpful to get an grip on what it is we need.

Stocks represent biz& #39; that all want to be superstars, few succeed, many just soldier on, a lot fail. We need to find out more about it before we buy/sell

ok, b4 you start to run around like chicken its helpful to get an grip on what it is we need.

Stocks represent biz& #39; that all want to be superstars, few succeed, many just soldier on, a lot fail. We need to find out more about it before we buy/sell

KNOWLEDGE BASE - (FA)

all heard about B.Graham (who almost went bankrupt, then had an epiphany) for fundamental analysis. Must try and simplify yet get deep enough to learn a few key things about debt, cash-flow, revenues, expenses and earnings etc... here are four books 4 u

all heard about B.Graham (who almost went bankrupt, then had an epiphany) for fundamental analysis. Must try and simplify yet get deep enough to learn a few key things about debt, cash-flow, revenues, expenses and earnings etc... here are four books 4 u

KNOWLEDGE BASE - (FA)

can get numbers from Gurufocus website too among others. Friendly and helpful folk they are, at Guru, been with them b4. Next come ETF, we need data on them as well which is why I am at Ycharts these days.

(if you know other, customizable sources, pls share)

can get numbers from Gurufocus website too among others. Friendly and helpful folk they are, at Guru, been with them b4. Next come ETF, we need data on them as well which is why I am at Ycharts these days.

(if you know other, customizable sources, pls share)

KNOWLEDGE BASE - (FA)

We& #39;re beginning to lean over and into tactics a little with this, but I want you to get a hold of these additional 4 reads asap to get a grip on ETF, on signals and economic indicators and initial portfolio construction problems while also using Options.

We& #39;re beginning to lean over and into tactics a little with this, but I want you to get a hold of these additional 4 reads asap to get a grip on ETF, on signals and economic indicators and initial portfolio construction problems while also using Options.

KNOWLEDGE BASE - (FA)

remember, mr & mrs mrkt are trying to discount what may come to pass 6, 8, 12 months from now

so, by checking forward looking leading indicators we can stalk around its grand intentions and maybe find some dislocation the media has not been paying attn to

remember, mr & mrs mrkt are trying to discount what may come to pass 6, 8, 12 months from now

so, by checking forward looking leading indicators we can stalk around its grand intentions and maybe find some dislocation the media has not been paying attn to

KNOWLEDGE BASE - (FA)

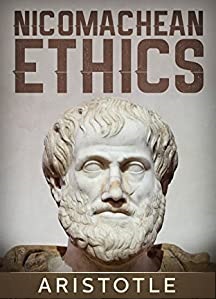

forefathers of mine & their relatives gave their life in resistance to a brutal dictatorship - what made them act were the teachings of Christ and Aristotle - they can still help us in life

Clayton Christensen was an influential economic philosopher

tbc

forefathers of mine & their relatives gave their life in resistance to a brutal dictatorship - what made them act were the teachings of Christ and Aristotle - they can still help us in life

Clayton Christensen was an influential economic philosopher

tbc

KNOWLEDGE BASE - (FA) some links

https://www.forexfactory.com/calendar

info">https://www.forexfactory.com/calendar&... on corp bonds, check entire site

http://finra-markets.morningstar.com/BondCenter/

some">https://finra-markets.morningstar.com/BondCente... on COT

https://www.ireallytrade.com/cotreport.html

Glossary

https://www.ireallytrade.com/cotreport... href=" https://ycharts.com/glossary

Excel">https://ycharts.com/glossary&... Edu - scroll down

https://people.highline.edu/mgirvin/excelisfun.htm

weird">https://people.highline.edu/mgirvin/e... activity

http://app.unusualactivity.net/default.aspx ">https://app.unusualactivity.net/default.a...

https://www.forexfactory.com/calendar

info">https://www.forexfactory.com/calendar&... on corp bonds, check entire site

http://finra-markets.morningstar.com/BondCenter/

some">https://finra-markets.morningstar.com/BondCente... on COT

https://www.ireallytrade.com/cotreport.html

Glossary

Excel">https://ycharts.com/glossary&... Edu - scroll down

https://people.highline.edu/mgirvin/excelisfun.htm

weird">https://people.highline.edu/mgirvin/e... activity

http://app.unusualactivity.net/default.aspx ">https://app.unusualactivity.net/default.a...

KNOWLEDGE BASE - (FA) some more links

a dose of opinion

https://miltonfmr.com/hedge-fund-letters/

CFT">https://miltonfmr.com/hedge-fun... on COT

https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

nerdy">https://www.cftc.gov/MarketRep... Aswath on valuation

https://www.youtube.com/watch?v=F9GfXJ-IrSA

NASDAQ">https://www.youtube.com/watch... pretty good site for many

https://www.nasdaq.com/market-activity/stocks

some">https://www.nasdaq.com/market-ac... pdf downloads

http://www.forex-warez.com/Free%20Download/">https://www.forex-warez.com/Free%20Do...

a dose of opinion

https://miltonfmr.com/hedge-fund-letters/

CFT">https://miltonfmr.com/hedge-fun... on COT

https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

nerdy">https://www.cftc.gov/MarketRep... Aswath on valuation

https://www.youtube.com/watch?v=F9GfXJ-IrSA

NASDAQ">https://www.youtube.com/watch... pretty good site for many

https://www.nasdaq.com/market-activity/stocks

some">https://www.nasdaq.com/market-ac... pdf downloads

http://www.forex-warez.com/Free%20Download/">https://www.forex-warez.com/Free%20Do...

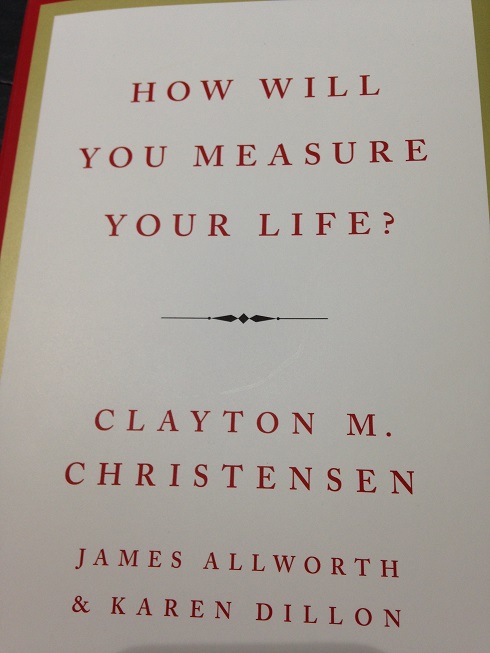

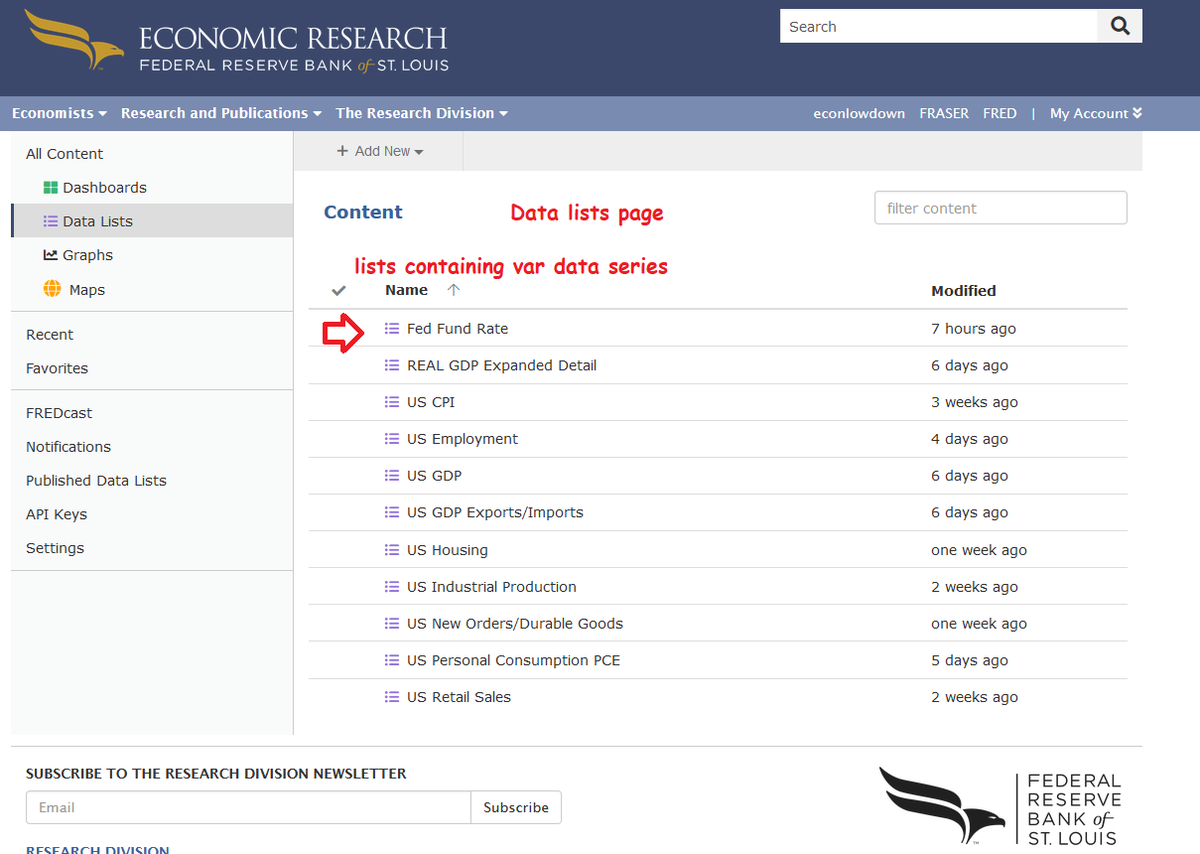

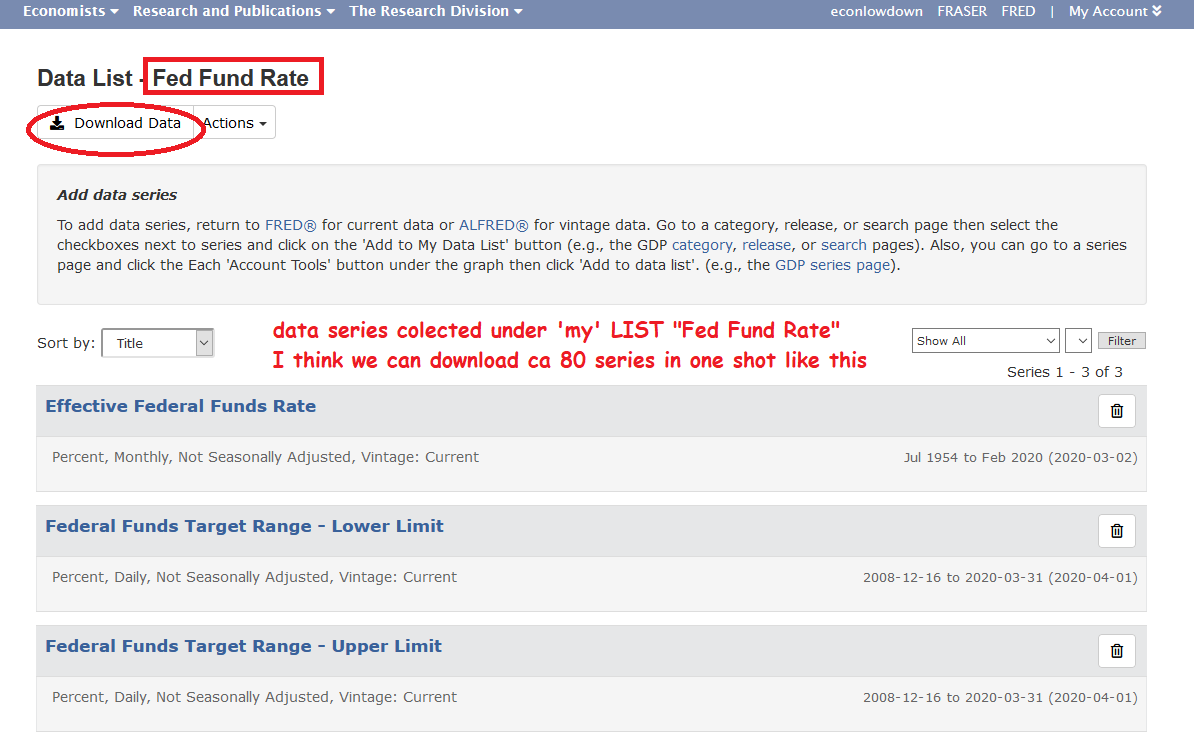

KNOWLEDGE BASE - (FA) Links

https://fred.stlouisfed.org/series/CES0500000011

https://fred.stlouisfed.org/series/CE... href=" https://research.stlouisfed.org/useraccount/

we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot

https://fred.stlouisfed.org/series/CES0500000011

we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot

KNOWLEDGE BASE - Interlude

we are here

there is a million more things to say about everything, many pros must be pretty disappointed about this tour de force, all I try to do here is draw a silhouette. More about Fundamental data must be said. Much study needed, guys

ON to TA

tbc

we are here

there is a million more things to say about everything, many pros must be pretty disappointed about this tour de force, all I try to do here is draw a silhouette. More about Fundamental data must be said. Much study needed, guys

ON to TA

tbc

KNOWLEDGE Base - Interlude2

do not think for a minute that you& #39;re a genius if a position is up 10% over night

if you do, you will invariably have to be the dumbest bum should the opposite happen and that pill will be very hard to swallow depressing you for a long time => detach

do not think for a minute that you& #39;re a genius if a position is up 10% over night

if you do, you will invariably have to be the dumbest bum should the opposite happen and that pill will be very hard to swallow depressing you for a long time => detach

KNOWLEDGE BASE - Interlude 3 (last)

before we go into TA:

a) we need a daily market wrap

check @marcmakingsense and @saxomarketcall for that

b) friends @MarkNewtonCMT @NickGiva @MarkArbeter @JLyonsFundMgmt @JulietteJDI @SamanthaLaDuc etc

offer subscriptions and edu @GregoireDup

before we go into TA:

a) we need a daily market wrap

check @marcmakingsense and @saxomarketcall for that

b) friends @MarkNewtonCMT @NickGiva @MarkArbeter @JLyonsFundMgmt @JulietteJDI @SamanthaLaDuc etc

offer subscriptions and edu @GregoireDup

KNOWLEDGE BASE - TA

guys, if you don& #39;t treat this as a biz, w/ a plan, w/ a process

mr mrkt will send his guy to collect from you.

you will be out of this game before you know it

need to read ALL literature I give you, ALL !!

NO EXCEPTION !! GO STUDY AND READ!!

ok, now onto TA

guys, if you don& #39;t treat this as a biz, w/ a plan, w/ a process

mr mrkt will send his guy to collect from you.

you will be out of this game before you know it

need to read ALL literature I give you, ALL !!

NO EXCEPTION !! GO STUDY AND READ!!

ok, now onto TA

KNOWLEDGE BASE - TA

thing in FA that& #39;s notoriously difficult to measure is management. some say its the most imp thing - been on many calls, been talking to CEOs, CIOs & CFOs until realized that many were just putting "lipstick on their pig" which is understandable but bad

thing in FA that& #39;s notoriously difficult to measure is management. some say its the most imp thing - been on many calls, been talking to CEOs, CIOs & CFOs until realized that many were just putting "lipstick on their pig" which is understandable but bad

KB - TA

There is no such problem in TA. all fields of interest can be addressed and found out about as long as we have a access to data and a calculator/computer.

You can see from this that there are 4 questions that need answering in TA

There is no such problem in TA. all fields of interest can be addressed and found out about as long as we have a access to data and a calculator/computer.

You can see from this that there are 4 questions that need answering in TA

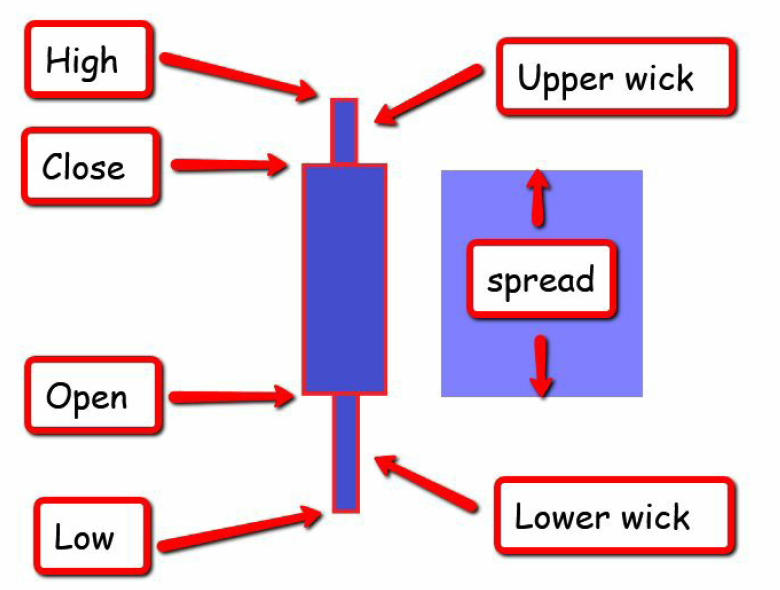

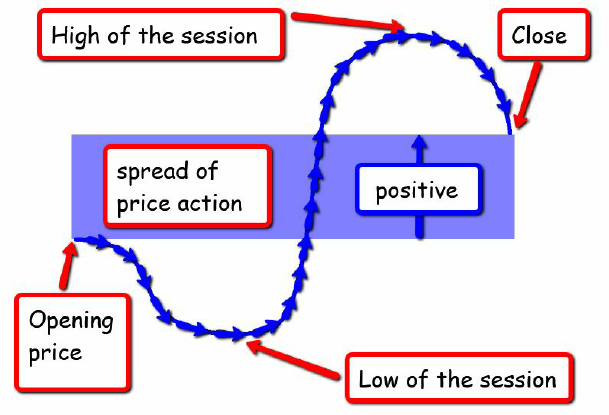

KB - TA

TA is data on price & volume

we have the open, high, low, close (OHLC) and the range of price action and we have volume.

Next come fancy derivatives of that of which many are just plain bs showered upon us from a broker whose sole intention is to take our money away asap

TA is data on price & volume

we have the open, high, low, close (OHLC) and the range of price action and we have volume.

Next come fancy derivatives of that of which many are just plain bs showered upon us from a broker whose sole intention is to take our money away asap

KB- TA

the previous image shows a bullish candle, for a bearish turn open and close around...

Every such & #39;Candle& #39; is about the & #39;tug of war& #39; between supply and demand, no exception, and it tells the story of the action within a defined time frame, be it one minute or one year

the previous image shows a bullish candle, for a bearish turn open and close around...

Every such & #39;Candle& #39; is about the & #39;tug of war& #39; between supply and demand, no exception, and it tells the story of the action within a defined time frame, be it one minute or one year

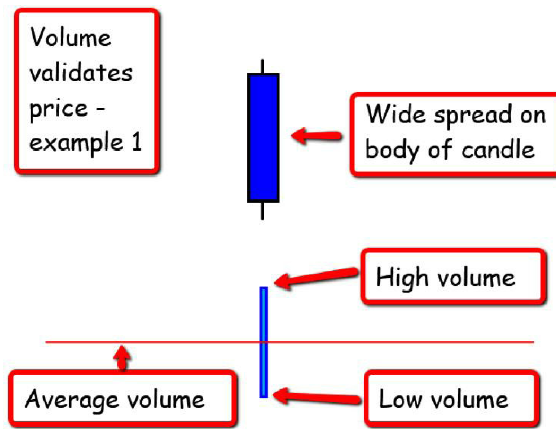

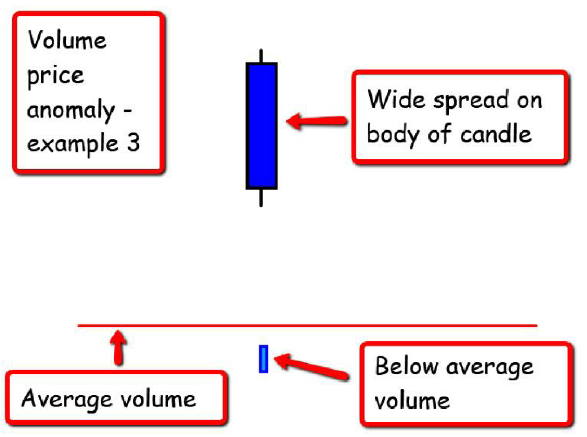

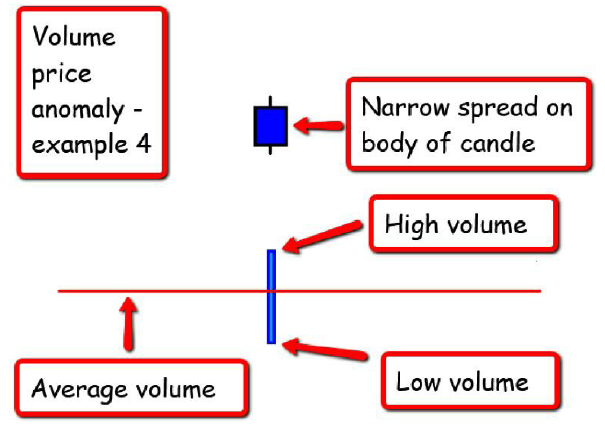

KB - TA

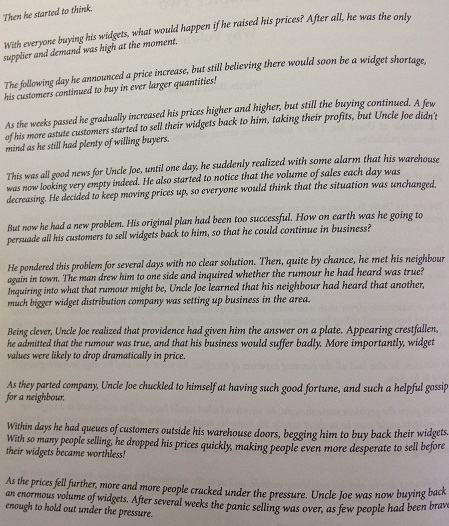

now, anybody presenting a chart of candles or bars of price action not showing volume better have a very good reason, bc otherwise its a strong sign of non-edu and BAD TA

Volume either confirms action or refutes it, volume should make us think and anomalies warn us

now, anybody presenting a chart of candles or bars of price action not showing volume better have a very good reason, bc otherwise its a strong sign of non-edu and BAD TA

Volume either confirms action or refutes it, volume should make us think and anomalies warn us

Knowledge Base - TA

ok, time for you to go to work and study

you absolutely must get a hold of this one way or another (online or amzn) and you must study every word of it

ok, time for you to go to work and study

you absolutely must get a hold of this one way or another (online or amzn) and you must study every word of it

KNOWLEDGE BASE - TA

am not very familiar with Trading View, I hear its good & perhaps should pull it up close but have a subs at Stockcharts since many years and a cpl 100 annotated charts organized over there, so, much of what I show you here will be on SC, my chart lists on SC

am not very familiar with Trading View, I hear its good & perhaps should pull it up close but have a subs at Stockcharts since many years and a cpl 100 annotated charts organized over there, so, much of what I show you here will be on SC, my chart lists on SC

KNOWLEDGE BASE - TA

some pure TA traders on here, some I have mentioned already - @Techs_Global has taken it to new frontiers as far as I can see

am mostly a lone ranger myself, don& #39;t like too much input, but I have TONS of respect!!

These 4 books are worth your time...

some pure TA traders on here, some I have mentioned already - @Techs_Global has taken it to new frontiers as far as I can see

am mostly a lone ranger myself, don& #39;t like too much input, but I have TONS of respect!!

These 4 books are worth your time...

KNOWLEDGE BASE - TA

James Dalton (Mind Over Markets) caught on a holiday

https://www.youtube.com/watch?v=YIbkSnakPXA

Hank">https://www.youtube.com/watch... Pruden on Cause and Effect

https://www.youtube.com/watch?v=0xYbwD9mSrM

Pruden">https://www.youtube.com/watch... having fun (and making fun of us) in his university office https://www.youtube.com/watch?v=Q18YSvN6xXs">https://www.youtube.com/watch...

James Dalton (Mind Over Markets) caught on a holiday

https://www.youtube.com/watch?v=YIbkSnakPXA

Hank">https://www.youtube.com/watch... Pruden on Cause and Effect

https://www.youtube.com/watch?v=0xYbwD9mSrM

Pruden">https://www.youtube.com/watch... having fun (and making fun of us) in his university office https://www.youtube.com/watch?v=Q18YSvN6xXs">https://www.youtube.com/watch...

KNOWLEDGE BASE - TA

Chimp features on all charts on ThinkOrSwim

Steidlmayer was the first to create a Volume Over Price market profile, Dalton expanded it, reading both won& #39;t hurt you...

Chimp features on all charts on ThinkOrSwim

Steidlmayer was the first to create a Volume Over Price market profile, Dalton expanded it, reading both won& #39;t hurt you...

KNOWLEDGE BASE - TA

coming up:

1 chart inventory

1a Sectors

1b Industries

2 Scans

3 Universe of Assets

4 Balance vs Imbalance

5 Signals and Switches

5a Relative Strength

5b Trends

5b Oscillators

6 More on Volume

7 On Diversification

and after this we& #39;ll go to

TRADE MANAGEMENT

coming up:

1 chart inventory

1a Sectors

1b Industries

2 Scans

3 Universe of Assets

4 Balance vs Imbalance

5 Signals and Switches

5a Relative Strength

5b Trends

5b Oscillators

6 More on Volume

7 On Diversification

and after this we& #39;ll go to

TRADE MANAGEMENT

KNOWLEDGE BASE - TA

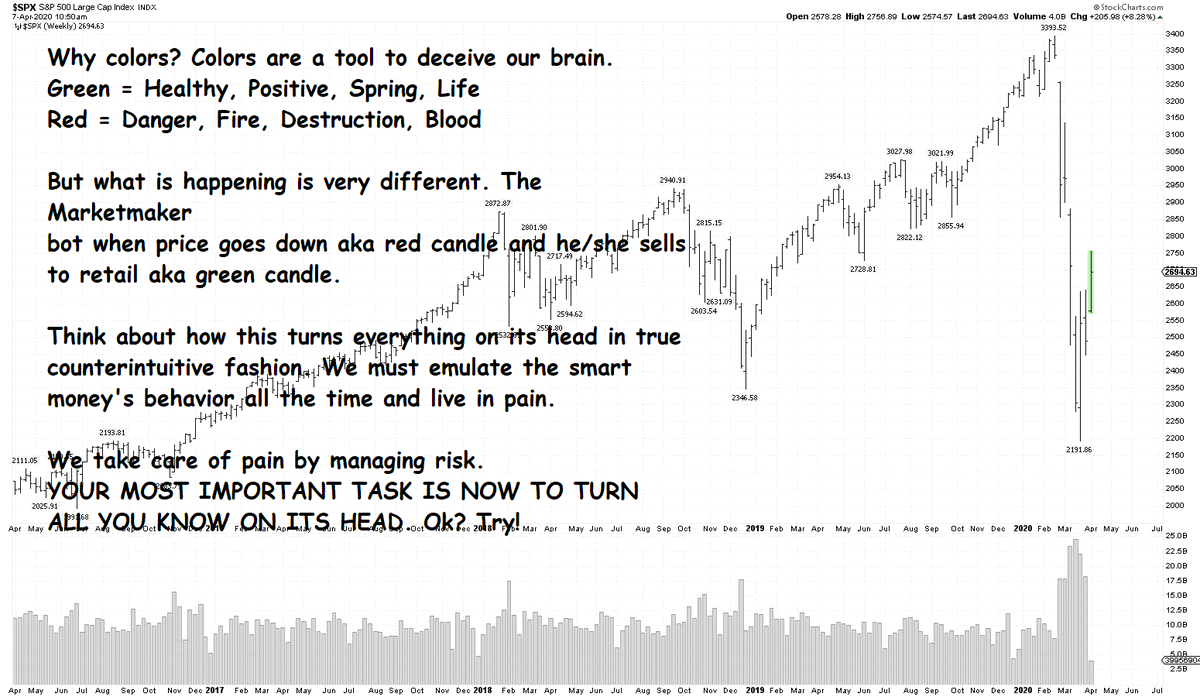

to be successful at this one has to stop "retail ways of thinking" and "retail ways of action".

Why oh why are 90% unsuccessful at this (and yes, that includes authors of many "useful" books)?

=> Simple truth: 90% of information must be wrong...! Read!

to be successful at this one has to stop "retail ways of thinking" and "retail ways of action".

Why oh why are 90% unsuccessful at this (and yes, that includes authors of many "useful" books)?

=> Simple truth: 90% of information must be wrong...! Read!

KNOWLEDGE BASE - TA

what needs to be done then..? Simple but v difficult at the same time: you have to turn EVERYTHING on its head.

1st: take a chart. The broker gives you colored bars. Green for up, red for "down". This is a pro chart, no colors. (I like to use red=down=faster)

what needs to be done then..? Simple but v difficult at the same time: you have to turn EVERYTHING on its head.

1st: take a chart. The broker gives you colored bars. Green for up, red for "down". This is a pro chart, no colors. (I like to use red=down=faster)

KNOWLEDGE BASE - TA

YOU NEED TO ABSOLUTELY HAMMER THIS INTO YOUR BRAINS. We absolutely stand no chance w/out understanding this principle: The market is a wholesale warehouse operation. Ppl buy from us to sell it back to us later and at a mark-up. Ok? We never own anything here.

YOU NEED TO ABSOLUTELY HAMMER THIS INTO YOUR BRAINS. We absolutely stand no chance w/out understanding this principle: The market is a wholesale warehouse operation. Ppl buy from us to sell it back to us later and at a mark-up. Ok? We never own anything here.

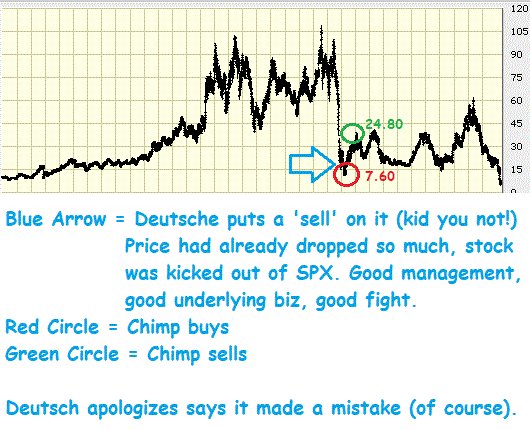

KNOWLEDGE BASE - TA

example of counterintuitive action to illustrate the points here

good risk management, good trade management

example of counterintuitive action to illustrate the points here

good risk management, good trade management

KNOWLEDGE BASE - TA

We cannot possibly work off a chart w/out understanding these key basics of market price action.

Read and try in your head to come up with an imaginary chart. Try to visualize this action in your head.

I salute you, "Uncle Joe"...

We cannot possibly work off a chart w/out understanding these key basics of market price action.

Read and try in your head to come up with an imaginary chart. Try to visualize this action in your head.

I salute you, "Uncle Joe"...

KNOWLEDGE BASE - TA

We need volume to validate price action. While this is not an exact science, its still a powerful tool when trying to understand Mr Mrkts "intentions"... S/He is a pro, s/he tries to take money away from me all the time. He/she is never my friend, never been.

We need volume to validate price action. While this is not an exact science, its still a powerful tool when trying to understand Mr Mrkts "intentions"... S/He is a pro, s/he tries to take money away from me all the time. He/she is never my friend, never been.

KNOWLEDGE BASE - TA

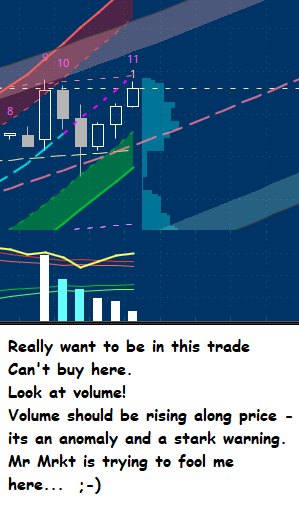

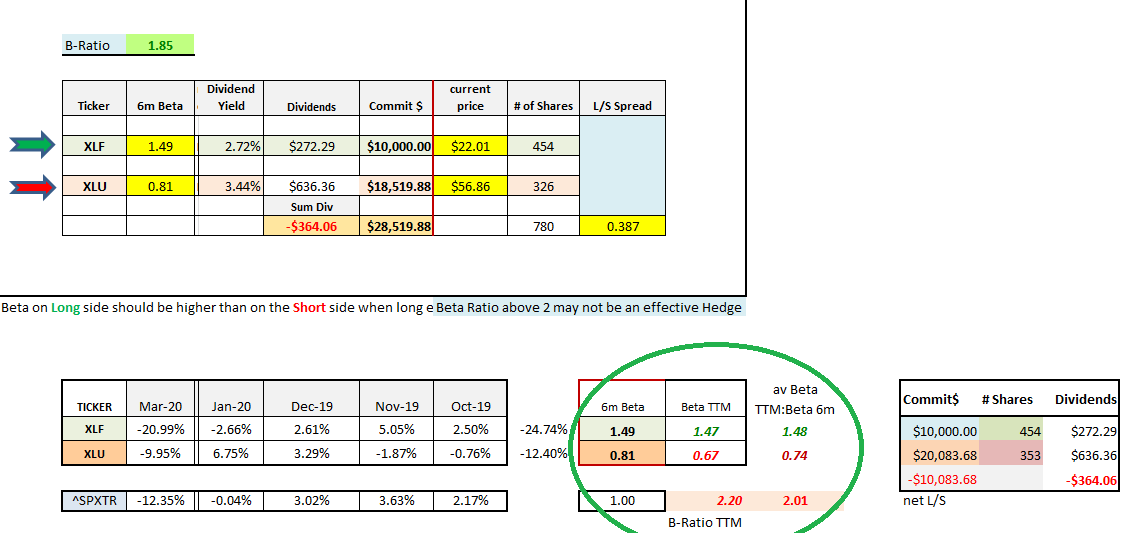

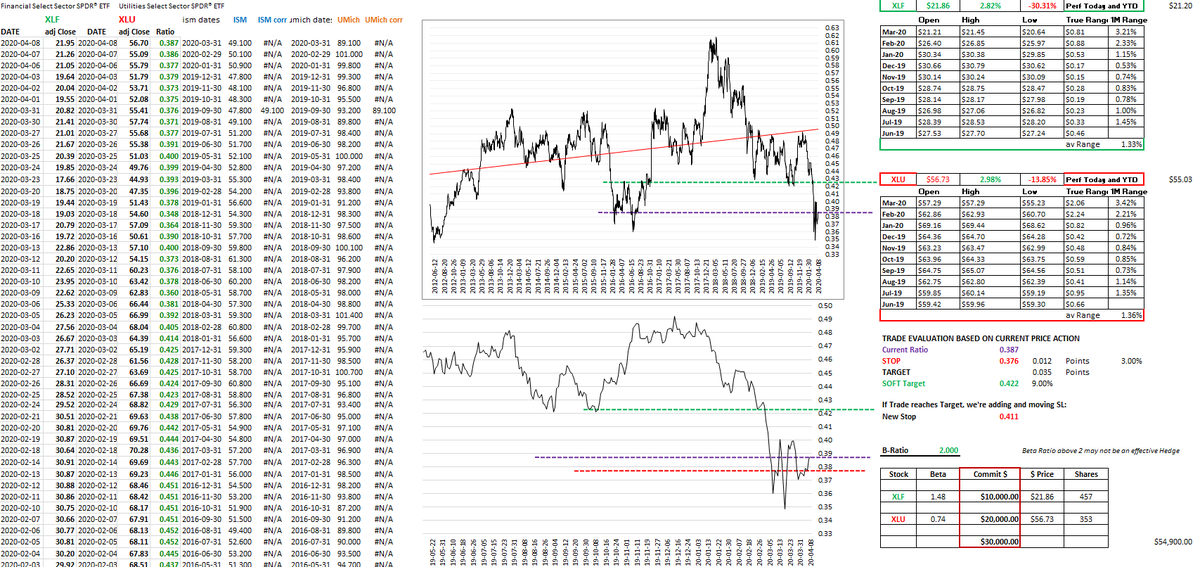

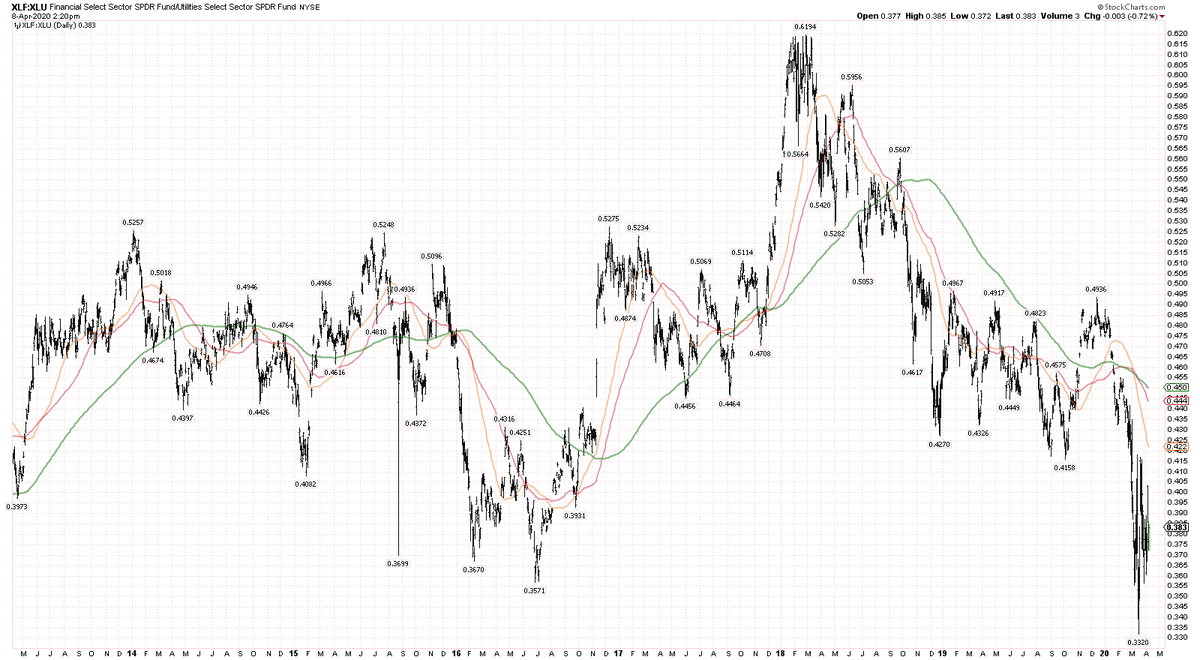

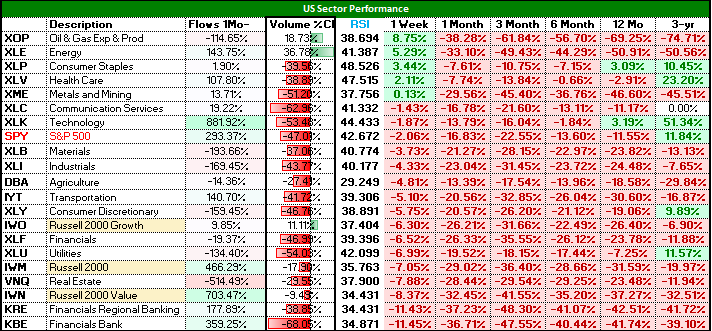

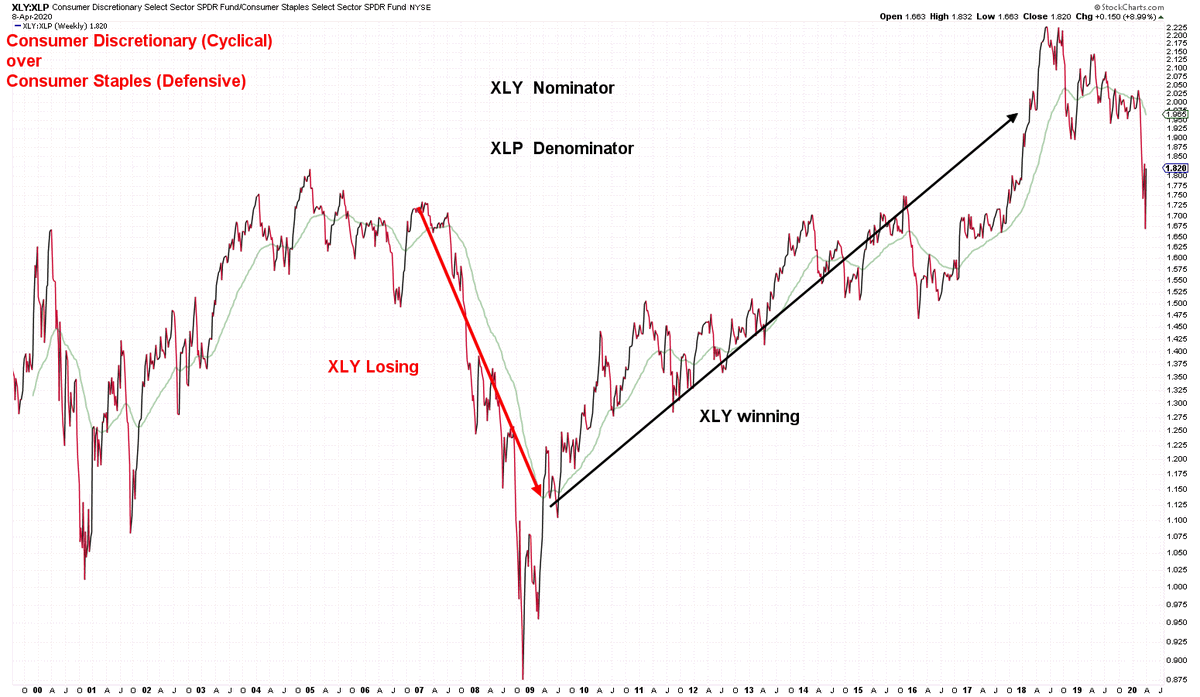

Looking at "ratio trades" this hour. These are trades that we can use to lean risk/reward against some specific characteristics ie a "mean-reverting" character or a fundamental reason such as inflationary vs deflationary etc.

Focus here is on mean reversion

Looking at "ratio trades" this hour. These are trades that we can use to lean risk/reward against some specific characteristics ie a "mean-reverting" character or a fundamental reason such as inflationary vs deflationary etc.

Focus here is on mean reversion

KNOWLEDGE BASE - TA

L XLF, S XLU - can construct this as a dollar hedge ie 10 USDlong vs 10 USDshort. In this case you have a pure directional bet. Can hedge out market risk at the same time in which case we must use Beta to inform position size. Beta of long must be > than short

L XLF, S XLU - can construct this as a dollar hedge ie 10 USDlong vs 10 USDshort. In this case you have a pure directional bet. Can hedge out market risk at the same time in which case we must use Beta to inform position size. Beta of long must be > than short

KNOWLEDGE BASE - TA

must not forget that we pay the shorts& #39; dividends & must respect stops when triggered.

A stop around 3% is the maximum risk to take. Here are calculations in all their glory. Can also inform stops via ATRs

This is not a trade advice, this is for edu only!

must not forget that we pay the shorts& #39; dividends & must respect stops when triggered.

A stop around 3% is the maximum risk to take. Here are calculations in all their glory. Can also inform stops via ATRs

This is not a trade advice, this is for edu only!

KNOWLEDGE BASE - TA

ok? A thread about TA-informed trading wouldn& #39;t be complete w/out following through on ratios & taking them L/S is TA trading on another level. Keep this in mind when we look at t/ all imp inventory of RATIO charts you need to build & maintain l8er

ok? A thread about TA-informed trading wouldn& #39;t be complete w/out following through on ratios & taking them L/S is TA trading on another level. Keep this in mind when we look at t/ all imp inventory of RATIO charts you need to build & maintain l8er

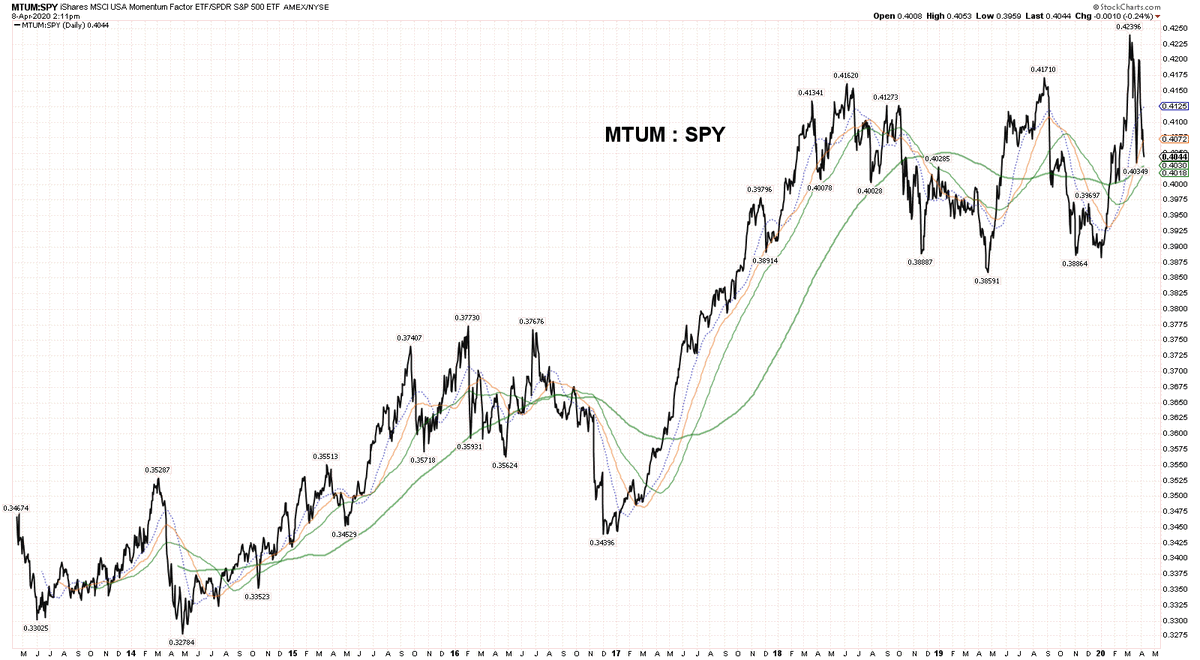

KNOWLEDGE BASE - TA

beast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

beast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable

KNOWLEDGE BASE - TA

Understand those arrows you must, understand the pattern you must and you will free yourself... Study volume!

Read the literature...

Understand those arrows you must, understand the pattern you must and you will free yourself... Study volume!

Read the literature...

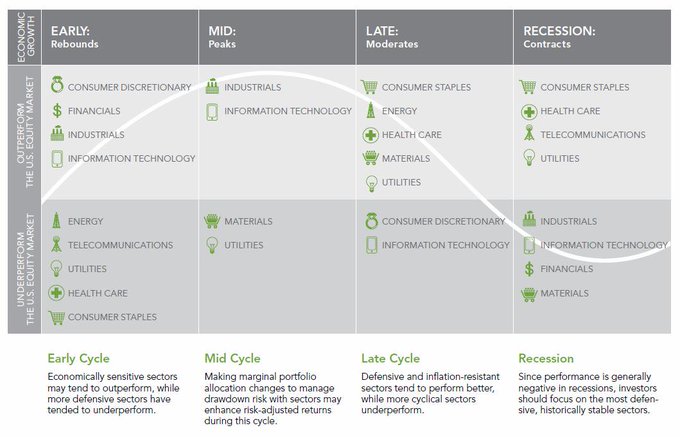

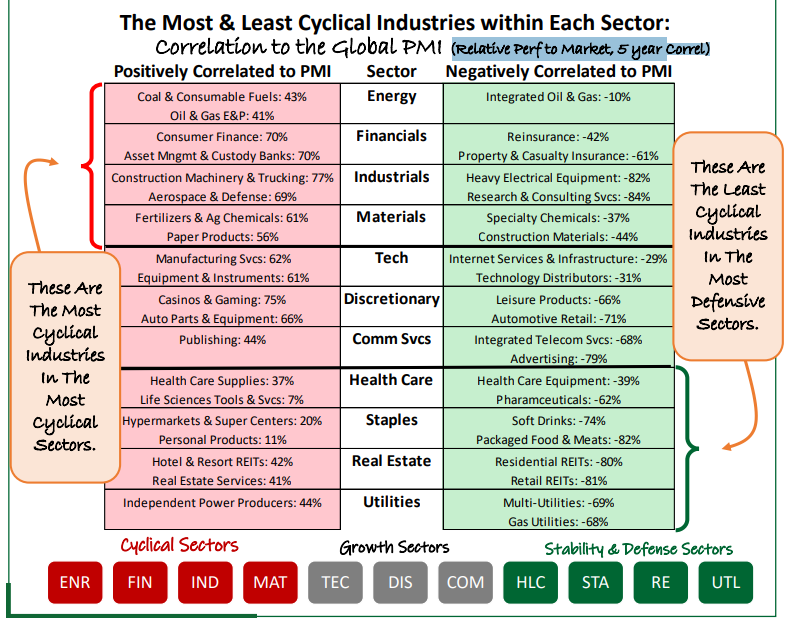

KNOWLEDGE BASE - TA

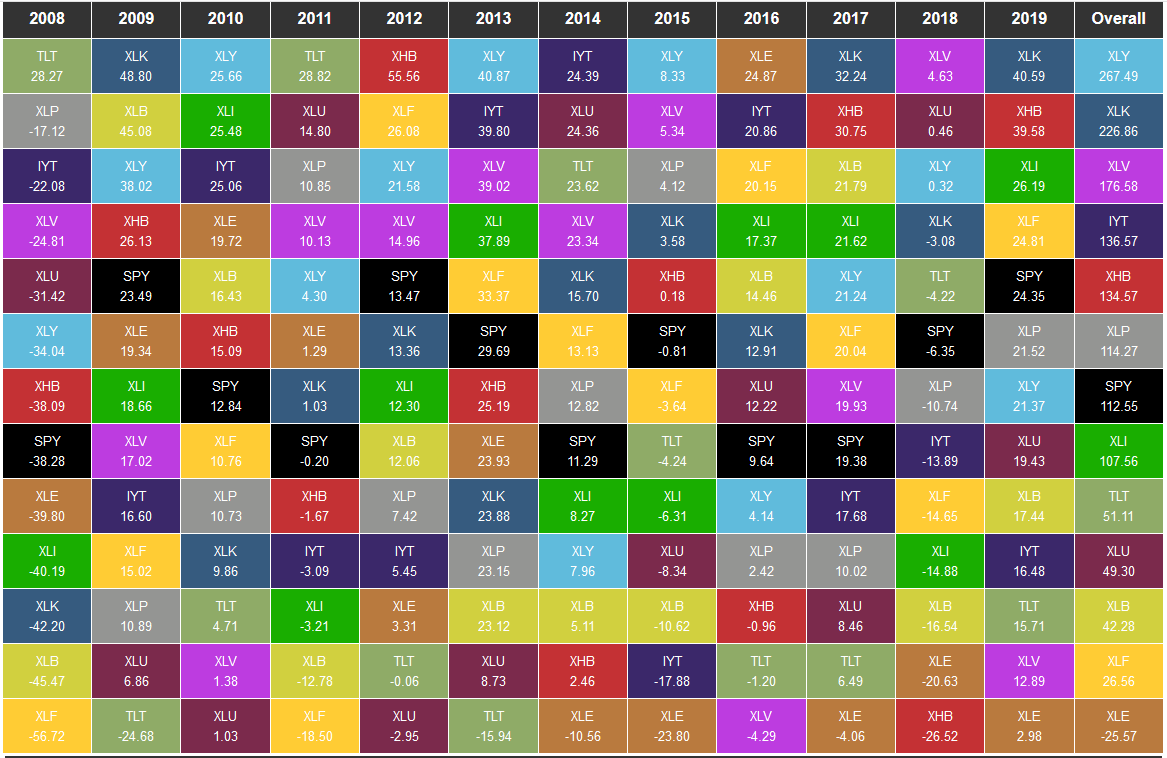

we& #39;ll talk about volume later again - we& #39;re into Ratios now

a) Cycle

b) Universe

c) Sector Assets

d) Ratio

ok, take these assets, study the cycle and their sensitivity and do ratios, then save them in a list and share them with us, ok..? Have fun!

we& #39;ll talk about volume later again - we& #39;re into Ratios now

a) Cycle

b) Universe

c) Sector Assets

d) Ratio

ok, take these assets, study the cycle and their sensitivity and do ratios, then save them in a list and share them with us, ok..? Have fun!

KNOWLEDGE BASE - TA

some more assets for Ratios - go play

after doing this we must try and establish an immediate idea about what "the casino" or the "Composite Operator" is doing and address consequences of that for us in single trade ideas

some more assets for Ratios - go play

after doing this we must try and establish an immediate idea about what "the casino" or the "Composite Operator" is doing and address consequences of that for us in single trade ideas

KNOWLEDGE BASE - TA

think about past winners and why everything may be very different (or very much the same) this time, ok...?

Do ratios and fathom and probe whats going on out there. Try and formulate a view, a thesis. write it down.

got work here

l8er https://abs.twimg.com/emoji/v2/... draggable="false" alt="😐" title="Neutral face" aria-label="Emoji: Neutral face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😐" title="Neutral face" aria-label="Emoji: Neutral face">

think about past winners and why everything may be very different (or very much the same) this time, ok...?

Do ratios and fathom and probe whats going on out there. Try and formulate a view, a thesis. write it down.

got work here

l8er

KNOWLEDGE BASE - TA

trying to explain a few key concepts again

Price has no "value" - get this straight, you silly nuts!

there is no "cheap" nor "expensive" - all there is is volume

By announcing higher price MM& #39;s try to attract biz from emotional retail, smart buys on down days

trying to explain a few key concepts again

Price has no "value" - get this straight, you silly nuts!

there is no "cheap" nor "expensive" - all there is is volume

By announcing higher price MM& #39;s try to attract biz from emotional retail, smart buys on down days

KNOWLEDGE BASE - TA

you don& #39;t have to believe a word I say (lucky you)

just listen to Kai again

now leave me alone, got work to do, you silly beans https://www.youtube.com/watch?v=klTUBhVvlhs">https://www.youtube.com/watch...

you don& #39;t have to believe a word I say (lucky you)

just listen to Kai again

now leave me alone, got work to do, you silly beans https://www.youtube.com/watch?v=klTUBhVvlhs">https://www.youtube.com/watch...

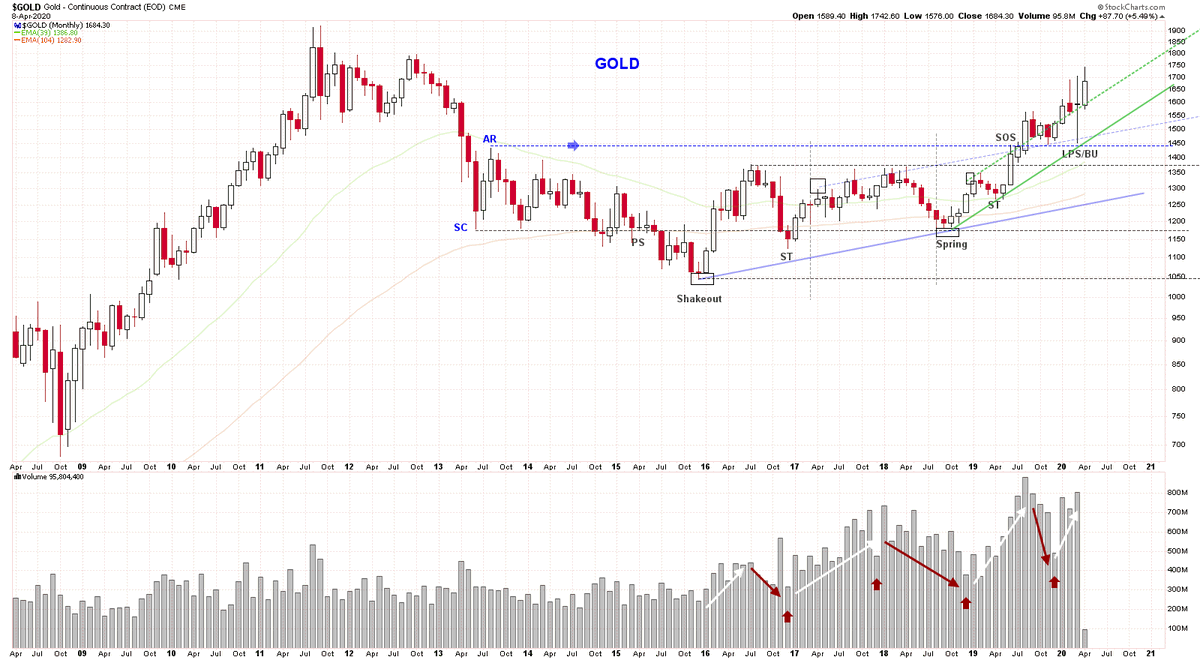

KNOWLEDGE BASE - TA

want to be in this trade, don& #39;t think I can this week, must wait...

Both Accumulation and Distribution create "Balance", see?

Re-Accumulation or "Kaboom" - that is the big Q

note the "Pareto-Nature" of the price advance...

Volume and price will tell...

want to be in this trade, don& #39;t think I can this week, must wait...

Both Accumulation and Distribution create "Balance", see?

Re-Accumulation or "Kaboom" - that is the big Q

note the "Pareto-Nature" of the price advance...

Volume and price will tell...

KNOWLEDGE BASE - TA

ok, we& #39;ll talk about scans for TA next, then single assets and how to assess smart money intentions regarding those single assets and how to read it. Then we come to indicators and some of the bs going on there etc...

how are you doing so far? Study!

ok, we& #39;ll talk about scans for TA next, then single assets and how to assess smart money intentions regarding those single assets and how to read it. Then we come to indicators and some of the bs going on there etc...

how are you doing so far? Study!

always remember

through creating our infrastructure and our process we create our field of battle. Our strategy should never change.

Our moves ON the battlefield are defined by understanding the enemy& #39;s tactics to which we have to respond with great flexibility and respect

through creating our infrastructure and our process we create our field of battle. Our strategy should never change.

Our moves ON the battlefield are defined by understanding the enemy& #39;s tactics to which we have to respond with great flexibility and respect

Read on Twitter

Read on Twitter

https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot" title="KNOWLEDGE BASE - (FA) Links https://fred.stlouisfed.org/series/CE... href=" https://research.stlouisfed.org/useraccount/ we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot">

https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot" title="KNOWLEDGE BASE - (FA) Links https://fred.stlouisfed.org/series/CE... href=" https://research.stlouisfed.org/useraccount/ we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot">

https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot" title="KNOWLEDGE BASE - (FA) Links https://fred.stlouisfed.org/series/CE... href=" https://research.stlouisfed.org/useraccount/ we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot">

https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot" title="KNOWLEDGE BASE - (FA) Links https://fred.stlouisfed.org/series/CE... href=" https://research.stlouisfed.org/useraccount/ we">https://research.stlouisfed.org/useraccou... can have a user acct at the StLouis FRED and build a deep eco data repository from data series available there and which can be downloaded into excel in one shot">

" title="KNOWLEDGE BASE - TAbeast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">">

" title="KNOWLEDGE BASE - TAbeast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">">

" title="KNOWLEDGE BASE - TAbeast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">">

" title="KNOWLEDGE BASE - TAbeast like MTUM/SPY is NOT for the faint at heart. You can see here why. Ppl drawing a nice line from close to close omit the sweat and terror. In L/S we seek much smoother rides. XLF/XLU is another such "wild bronco" - a Beta ratio below 1.5 is preferable https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">">

" title="KNOWLEDGE BASE - TAthink about past winners and why everything may be very different (or very much the same) this time, ok...? Do ratios and fathom and probe whats going on out there. Try and formulate a view, a thesis. write it down.got work here l8erhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😐" title="Neutral face" aria-label="Emoji: Neutral face">" class="img-responsive" style="max-width:100%;"/>

" title="KNOWLEDGE BASE - TAthink about past winners and why everything may be very different (or very much the same) this time, ok...? Do ratios and fathom and probe whats going on out there. Try and formulate a view, a thesis. write it down.got work here l8erhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😐" title="Neutral face" aria-label="Emoji: Neutral face">" class="img-responsive" style="max-width:100%;"/>