1/ Thread on distressed asset investing. Really this should be an entire book, or at least a full chapter, but I& #39;ll try to generalize what to look for and how to feel your way through using an example. Disclosure: I trade the stuff from the examples in this thread...

2/ Starting point is a beaten down sector. For this example we look at $REM, the mortgage REIT ETF. Learn how it works: MREITs are leveraged mortgage income trusts with a tax-advantaged capital structure designed for pass-through income. Expect 90%+ of profits as dividends...

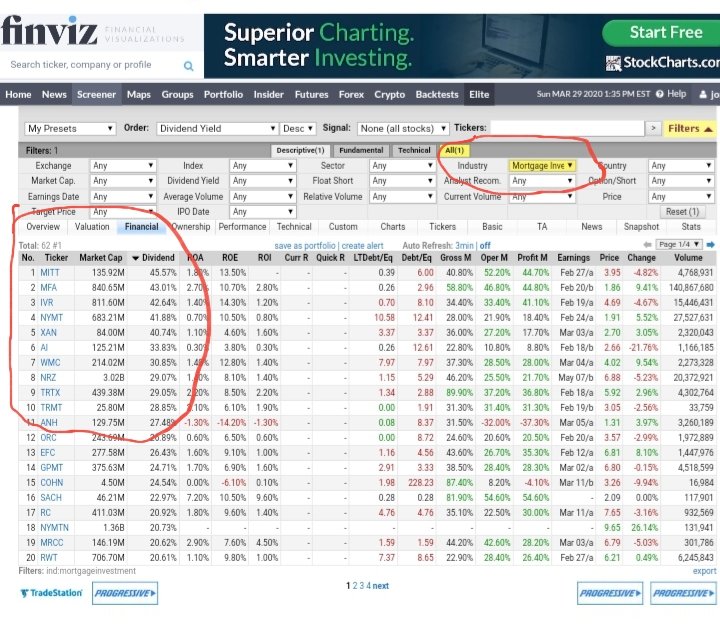

3/ The core holdings of $REM are:

$NLY (16% allocation, 15% historical yield)

$AGNC (12% allocation, 14% historical yield)

Note that there are different kinds of mortgages, some federally insured and some not. Each REIT has different specialties and different portfolios...

$NLY (16% allocation, 15% historical yield)

$AGNC (12% allocation, 14% historical yield)

Note that there are different kinds of mortgages, some federally insured and some not. Each REIT has different specialties and different portfolios...

4/ When the sector starts burning down, you will tend to see a flight to quality as pension funds and institutions dump the trash and pack into the highest quality names. $NLY / $REM ratio chart shows this very clearly, it trades at very high relative strength against the sector

5/ As a "distressed asset investor" I& #39;m not looking to buy the relatively expensive stuff, I want to diversify smartly into the names that institutions are discarding. It is important to identify that we are in a similar scenario as described so far before we go on a buying spree

6/ Let& #39;s look at $MITT since it is on top, showing a historical yield of 45%. I want to buy small amounts, usually capped to 2-5% of my net liq for each, diversified into several of these names. If they go bankrupt, I will survive. The more you learn about each, the better...

7/ The main idea is if bankruptcy doesn& #39;t happen, the shares will over time revert back to trading in line with the sector again. Look at how badly this one has gotten smashed relative to $REM. Ratio chart of $MITT / $REM

8/ For the scenario where we are correct and this does happen, we can assume that the dividend yield will revert back to normal levels for the sector. For example if $MITT reverts back to 10% yield, the shares would have to rise more than 400% from current levels...

9/ For the scenario where they don& #39;t go bankrupt but suffer a permanent impairment on their assets, consider one where the dividend distribution permanently drops by half. It will still likely normalize near 10% yield, but at prices 200% higher from current levels instead of 400%

10/ The exit strategy here is that by the time the sector normalizes, we are in long-term capital gains time frame. We have the option to use sales proceeds to "flip" from what was junk into the higher quality names like $NLY and $AGNC and still retain almost all of the income!

11/ If our timing was too soon, we will need to rely on hedging to keep our account protected from downdrafts. Put options on the sector etf (or shorting it), or buying $VXX to protect against broader market declines can be used to obtain more shares at lower prices.

12/ An alternative exit strategy: https://twitter.com/jontait/status/1246687719000027136?s=19">https://twitter.com/jontait/s...

Read on Twitter

Read on Twitter