As many of us try to actively involve in social media and other outlets to keep us occupied in this fight between life and war, I thought let& #39;s put this time in learning and understanding some important things about a major factor which determines that same life - Money.

Funny how that piggy bank is something which existed in our childhood. If that is an example which reminds us of savings from a young age, it should also torment us in how we forgot to save money as we grew old. Okay, so why Personal Finance? Oh, wait. What is Personal Finance?

Personal Finance is an idea.... umm, chuck it. Remember your mom trying to help when your dad runs out of money? Her mystery money saving boxes in the kitchen? The chits your dad used to take to buy a small plot of land? And yeah, the budgeting discussion between your parents?

These few, simple things come under Personal finance. To understand personal finance, you need to understand 3 important parts of it.

1. Income - Monthly salary or income from business / any other sources

2. Expenditure - Basic & other expenses

3. Savings - For future purposes

1. Income - Monthly salary or income from business / any other sources

2. Expenditure - Basic & other expenses

3. Savings - For future purposes

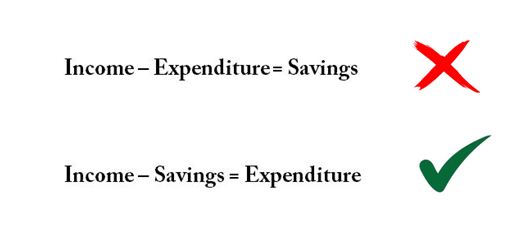

When we first learnt financial terms in our math class, we were taught that savings is something we get after we meet our expenditure from the income. In fact, even now we intend to think that we have to save whatever that is left of our income after we spend our money.

But that is not correct. We will never be able to save consistently if we ever go by the first idea. The formula has to be switched. The aim is to train ourselves to spend the money we get after we save a certain significant part of our income. We arrive at the 2nd formula.

Okay, so this is how we have to save money. Initially, as soon as we get our salary, we have to park some money as savings. When we retire or whenever we need the money, we will take a few parts of it. Okay, well done.

Oh wait, the next question, how much should we save?

Oh wait, the next question, how much should we save?

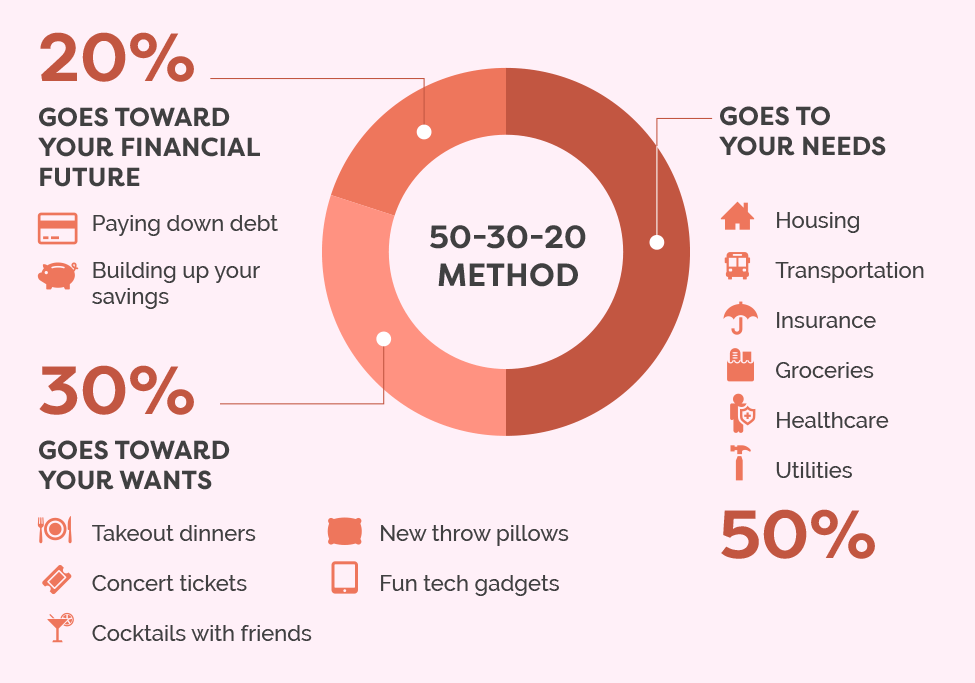

The 50-30-20 Rule (drumroll please)

Self-explanatory.

PS: Please make sure you calculate & separate 50:30:20 from income. And, the EMIs towards needs and wants such as phones, bikes, insurances etc are not savings. Don& #39;t reply LICs. (Will do a thread on why LICs are a scam)

Self-explanatory.

PS: Please make sure you calculate & separate 50:30:20 from income. And, the EMIs towards needs and wants such as phones, bikes, insurances etc are not savings. Don& #39;t reply LICs. (Will do a thread on why LICs are a scam)

Now that you know how you have to save and how much you have to save, the next baby step is to know where your savings should go. But to know where you should put your money, you should first find the answer for Newton& #39;s most important question - WHY?

The answer to the question & #39;why& #39; is nothing but your goals. Why should I save money? I should save money for my financial goals. Simple. What can my goals be? It can be anything. To buy a new car, laptop, house, marriage, child& #39;s education, etc.

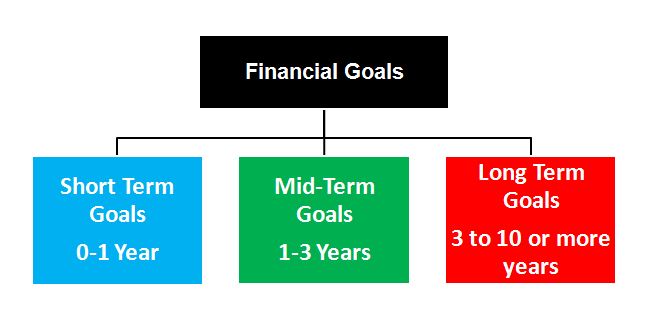

Financial goals are of 3 types.

Financial goals are of 3 types.

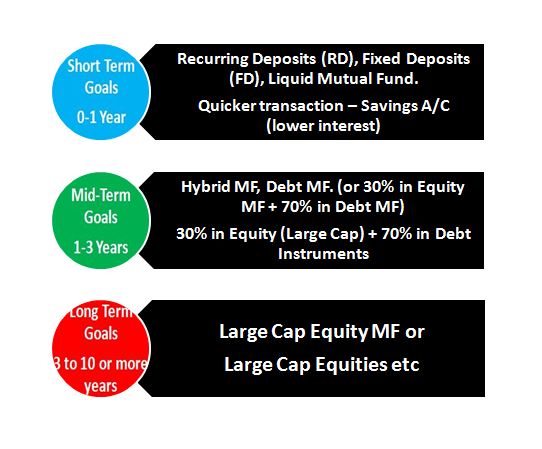

You should be able to classify your financial goal based on when you would require your money. There are many places where people park their funds. But here I will try to give you an idea to place your finds ideally, based on the three goals.

Now the next question. As you have come across what, why and where in this thread, I should also touch upon & #39;how& #39;. So how can you invest in equities and mutual funds? You should open a trading and Demat account.

If you& #39;re reading this thread and have arrived here, you also might have got the idea to start baby steps into starting or creating your personal finance plan. But the most important question comes now - & #39;WHEN& #39;. When should I start to save and follow it up? And the answer is NOW.

Main aim of this thread is that this should reach out to as many as possible, especially to the ones who are not aware of savings. Personal Finance is probably the most important topic that should be taught to an individual when he is young and it should start right at schools.

Please drop your feedbacks/suggestions/contributions to this thread. Financial Discipline is as important as the discipline to behaviour.

Read on Twitter

Read on Twitter