Is now a good time to talk about the other two Cambridges controversy (MIT Sloan vs MIT Econ), the technology & growth discussion of the 1970s, and the institutional response to the Club of Rome "Limits to Growth" study? Because this.

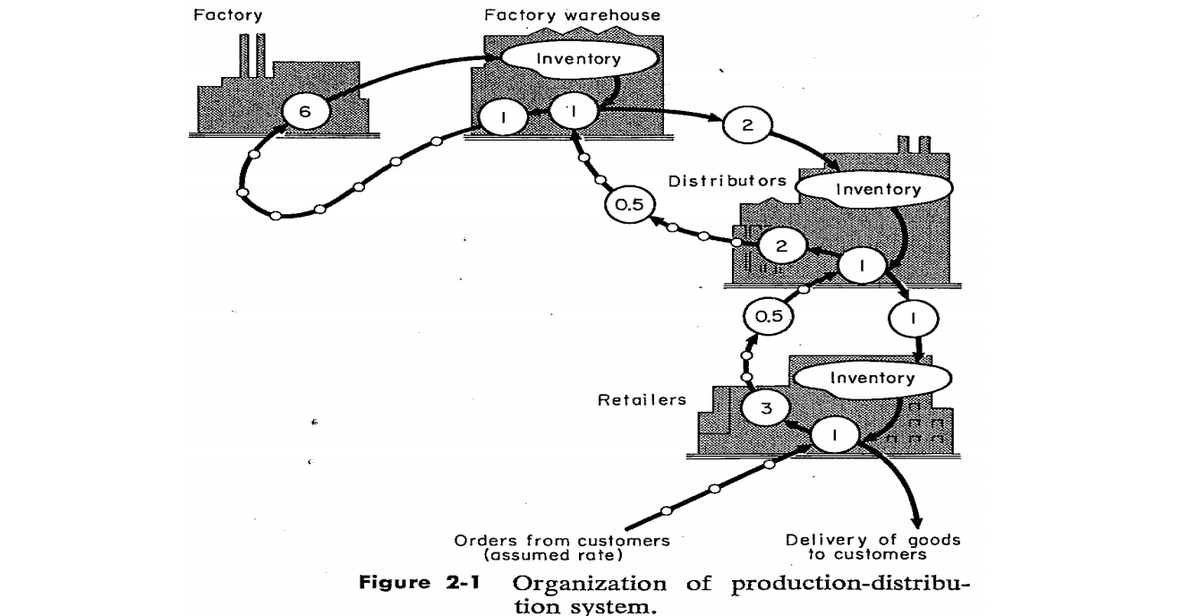

The Club of Rome study was one of two major "computer simulations" trying to predict the future quantitatively by zooming Jay Forrester& #39;s supply chain models out to the global economy. The 2nd study, commissioned 5 years later, was called Global 2000. https://twitter.com/oliverbeige/status/1088755028003819520?s=20">https://twitter.com/oliverbei...

Both studies had a huge impact, especially in Germany. And both studies were deeply, conceptually, mathematically, and empirically flawed. This is what I speak of when I call something "1970s cybernetics". https://twitter.com/oliverbeige/status/1240006859261710338?s=20">https://twitter.com/oliverbei...

Bob Solow was not impressed: "They don& #39;t merely say that the end of the world is at hand-they can show you computer output that says the same thing."

And I& #39;m with Bob here. This is "Silicon Valley data science" culture before Silicon Valley.

And I& #39;m with Bob here. This is "Silicon Valley data science" culture before Silicon Valley.

We are moving on to a subcommittee hearing by the Joint Economic Committee, 93rd Congress, on Resource Scarcity, Economic Growth, and the Environment, December 1973.

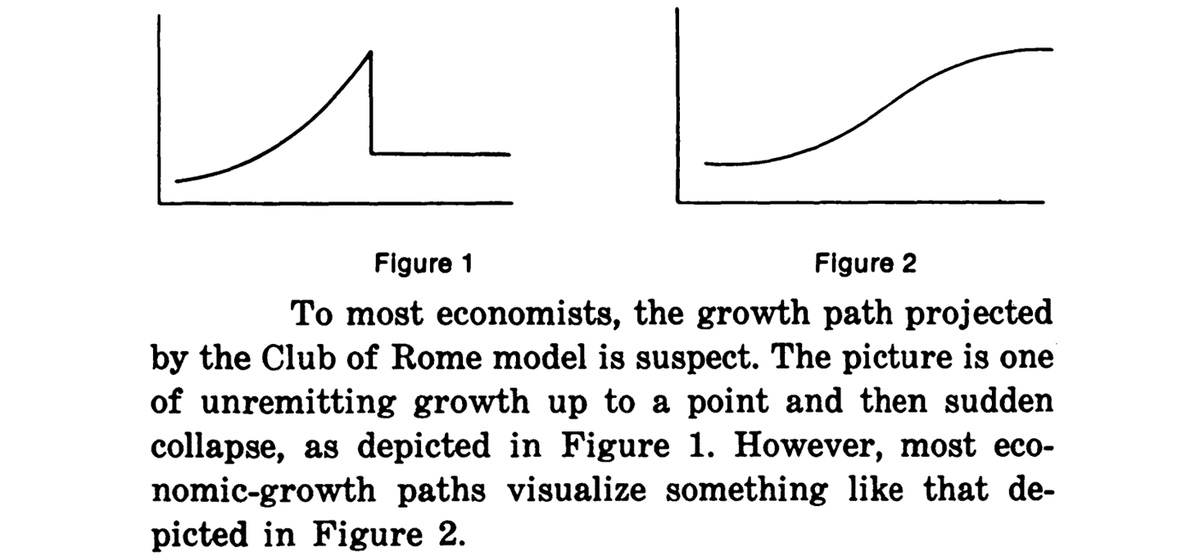

Prof. Forrester goes first and presents his model of a long-term growth trajectory for the United States. What is the difference between an exponential function and a logistic function, you asked? This is it.

"Pressures, unrest, doubts, shortages, and alienation are characteristic of transition at the end of the growth mode." -- Prof. Jay Forrester, 1973.

"Equilibrium can be at a high quality of life or low. It can be stable or with traumatic collapses and revivals. The great challenge is to choose the kind of equilibrium. The alternative is to let Nature do the choosing." -- Prof. Jay Forrester, 1973.

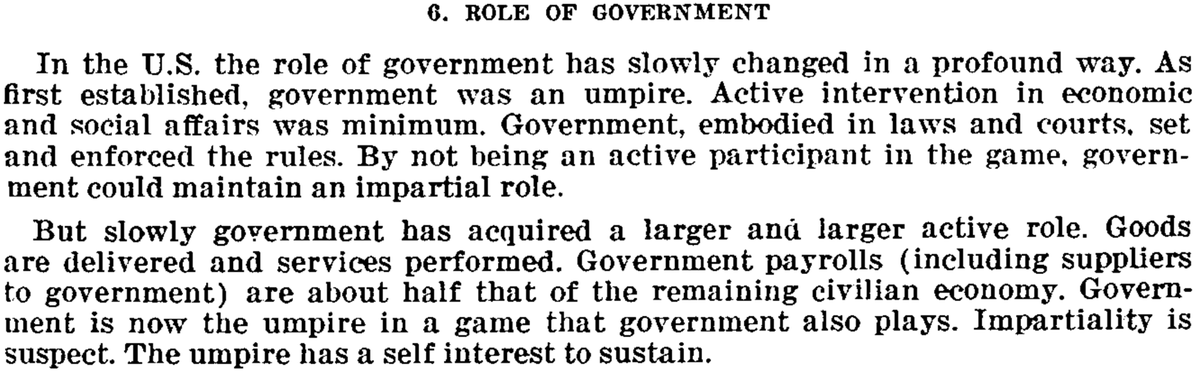

Ringfencing the sovereign obligations: The government as umpire vs the government as service provider; Jay Forrester, 1973.

One of Robert Solow& #39;s finest hours? "They may be like the Rorschach subject who asked the psychologist if he – or she – could keep the ink-blot cards because he – or she – had never seen such sexy pictures before."

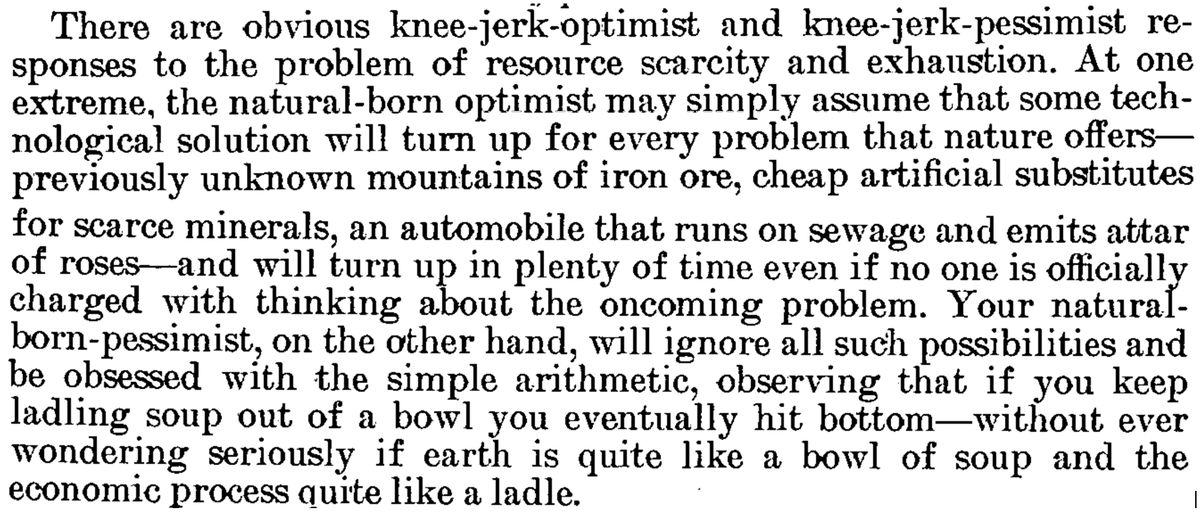

Nevermind autonomous driving, we need an automobile that runs on sewage and emits attar of roses. Prof. Robert Solow, 1973.

Prof. Solow coming down hard on 1970& #39;s cybernetic pseudoscience.

"For one thing, it is production itself, not growth of production, that uses up resources and pollutes the environment."

"For one thing, it is production itself, not growth of production, that uses up resources and pollutes the environment."

Prof. Solow destroys exponentialist bullshittery in three sentences. The first derivative of an exponential curve is still an exponential curve, and if you try to flatten an exponential curve it& #39;s also still an exponential curve. Careers should end over this.

D.C. legislators getting a free lecture on public goods and production inefficiencies in the private provision of fundamental knowledge. Srsly, this is so lucid, it should be required reading in every undergrad class. Robert Solow, 1973.

Wrapping up, the true measure of a man is to admit when one cannot see far enough into the future to make a confident prediction. Bob Solow, 1973.

In my own humble opinion Prof. Solow wins this argument hands down. This was the most lucid a defense of modern capitalism, tempered by soft-touch public intervention, I& #39;ve seen. Succinct, humorous, humanitarian. We are privileged to witness a brilliant mind at work.

And yet.

And yet.

This is a moral tale of course, a clash of two world views that reverberates until this day. Bob Solow, already a star scholar in the 1970s, would go on to receive the Econ Nobel (aka the Riksbank) in 1987, and the Samuelson-Solow legacy dominates Anglo-American economics.

It seems that Prof. Forrester& #39;s legacy is more humble, in that I find little about his later years. But indeed it is just less visible, and it lives on in tools called "Advanced Planning and Optimization" or "Integrated Business Planning". And in the German Green party.

The invisible world, the machine room of global commerce, is where prices, variants, and volumes collide, where sinkholes appear and have to be filled in real time. Compared to this, economics is a serene world of linear relationships.

Until it isn& #39;t. https://twitter.com/oliverbeige/status/1238109465846730752">https://twitter.com/oliverbei...

Until it isn& #39;t. https://twitter.com/oliverbeige/status/1238109465846730752">https://twitter.com/oliverbei...

But this is also a tale of two wrongs, and a tale of institutional forgetting. Robert Solow might have won the day during that hearing, but the Malthusian prediction of the "doomsday people" eventually came to pass, as we learned over the last days.

So what went wrong?

So what went wrong?

Read on Twitter

Read on Twitter