No one knows the impact of COVID yet because it& #39;s unknown and unknowable.

Reading Zeckhauser and @AnnieDuke is a better preparation for investing in this scenario than the predictions of economists.

Also, focusing on analyzing a single business at a time helps a bit. https://twitter.com/AnnieDuke/status/1243216731453050880">https://twitter.com/AnnieDuke...

Reading Zeckhauser and @AnnieDuke is a better preparation for investing in this scenario than the predictions of economists.

Also, focusing on analyzing a single business at a time helps a bit. https://twitter.com/AnnieDuke/status/1243216731453050880">https://twitter.com/AnnieDuke...

" In the fog of pandemic, action must come before perfect information"

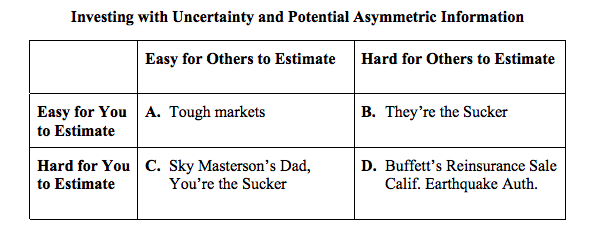

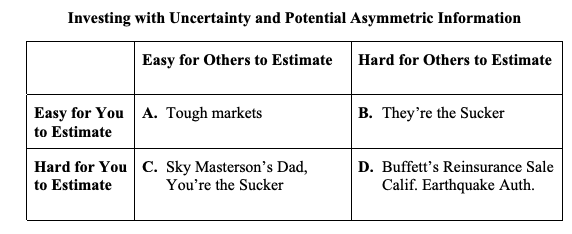

Most Buffett-fans don& #39;t talk about it, neither does Buffett talk about.

Zeckhauser does: Buffett is a master player when it comes to investing in the unknown and unknowable. One example is Earthquake reinsurance

Zeckhauser does: Buffett is a master player when it comes to investing in the unknown and unknowable. One example is Earthquake reinsurance

Another example: Buffett& #39;s 2008 Goldman Sach investment

Known: 10% dividend, GS converted to bank holding co, "GS is global franchise"

Unknown & unknowable: will $700B bailout pass? What will happen next in credit crisis?

https://money.cnn.com/2008/09/23/news/companies/goldman_berkshire/">https://money.cnn.com/2008/09/2...

Known: 10% dividend, GS converted to bank holding co, "GS is global franchise"

Unknown & unknowable: will $700B bailout pass? What will happen next in credit crisis?

https://money.cnn.com/2008/09/23/news/companies/goldman_berkshire/">https://money.cnn.com/2008/09/2...

"Warren often talks about these discounted cash flows, but I’ve never seen him do one" - Charlie Munger

This makes sense when we consider Buffett as investor in unknown and unknowable situations - DCF can& #39;t be done there! It& #39;s more like horse race handicapping or bridge

This makes sense when we consider Buffett as investor in unknown and unknowable situations - DCF can& #39;t be done there! It& #39;s more like horse race handicapping or bridge

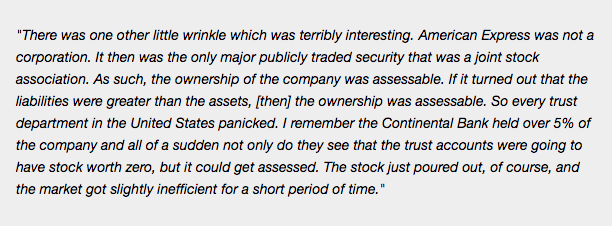

Viewing the AMEX salad oil crisis from this "unknown/unknowable lens"

Known: a sub of AMEX was on hook, balance sheet, joint stock that was assessable (i.e. holders on hook if liability > assets)

Unknown and unknowable (at least upfront): amount of liability

Known: a sub of AMEX was on hook, balance sheet, joint stock that was assessable (i.e. holders on hook if liability > assets)

Unknown and unknowable (at least upfront): amount of liability

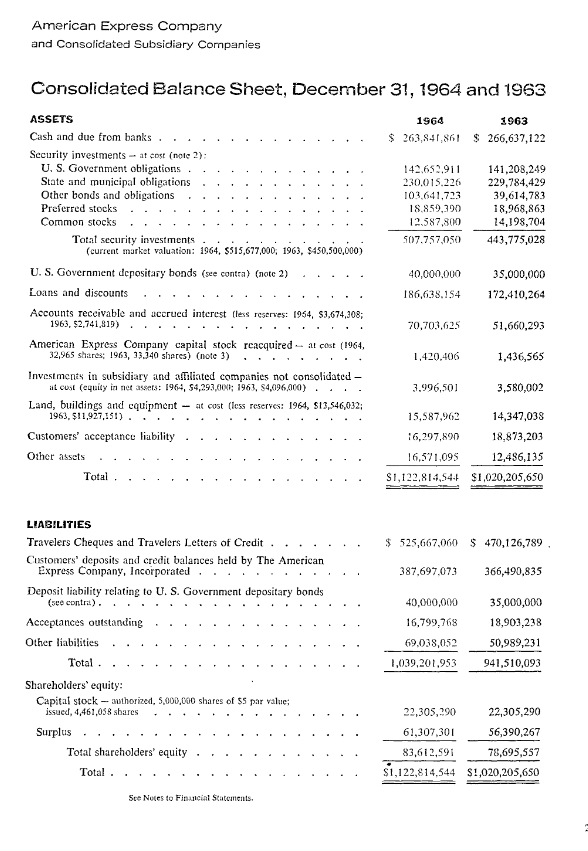

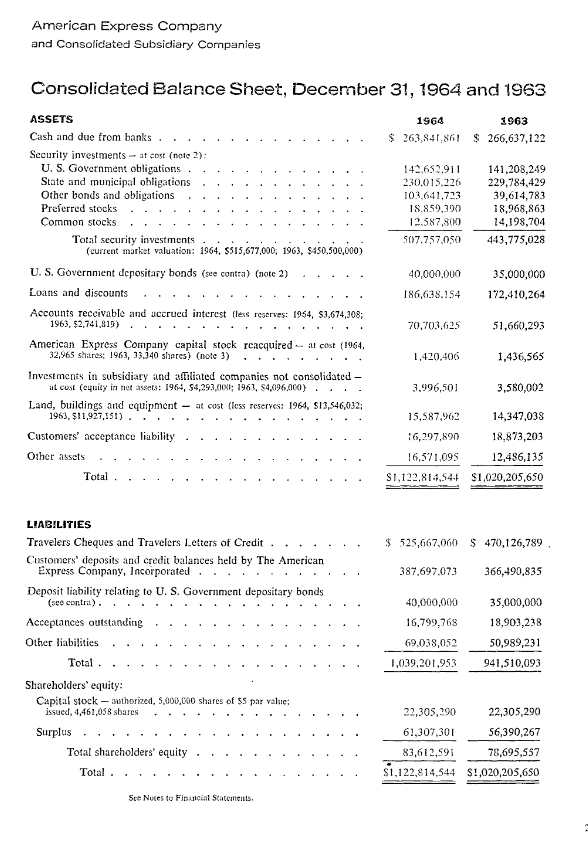

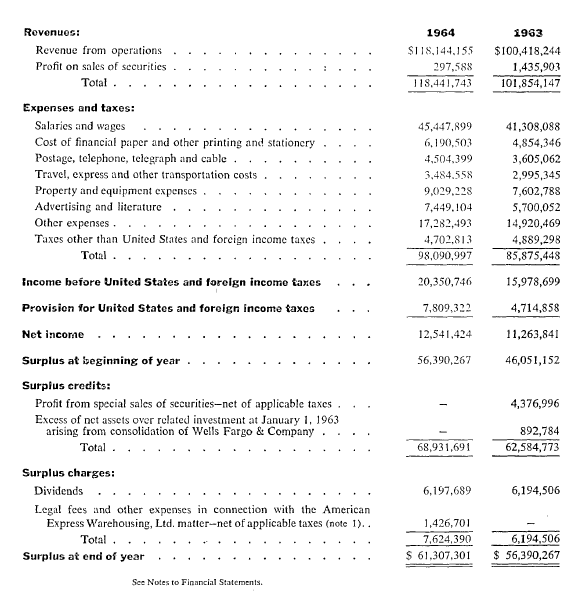

AMEX salad oil:

Knowns: Balance sheet (see pic), equity of $83M

Unknowns: liability from salad oil scandal

Buffett probably bet that deposits won& #39;t disappear overnight & salad oil liability wasn& #39;t even close to equity + deposits

Buffett bought 5% of AMEX at $150M valuation

Knowns: Balance sheet (see pic), equity of $83M

Unknowns: liability from salad oil scandal

Buffett probably bet that deposits won& #39;t disappear overnight & salad oil liability wasn& #39;t even close to equity + deposits

Buffett bought 5% of AMEX at $150M valuation

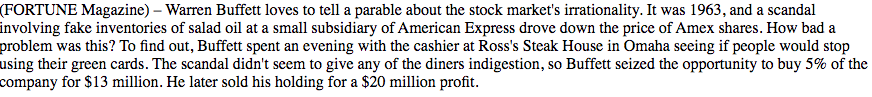

But Buffett himself does folksy rewriting of AMEX storyline.

Likely reality: betting in unknown/unknowable using Balance Sheet understanding

Folksy retelling: Buffett saw patrons in restaurant use AMEX cards

Likely reality: betting in unknown/unknowable using Balance Sheet understanding

Folksy retelling: Buffett saw patrons in restaurant use AMEX cards

Result in AMEX salad oil scandal: AMEX paid out $45M - almost half of their equity, though they were not liable for their subsidiary, to maintain "public confidence".

Buffett couldn& #39;t have known actual damage number (unknown/unknowable). But he bet big coz price was too low

Buffett couldn& #39;t have known actual damage number (unknown/unknowable). But he bet big coz price was too low

Continuing with this unknown/unknowable and low pricing thread:

Buffett talks about using initial yield when investing in farm land. This same story repeats for this investor who bought real estate on Via dei Condotti, near the Spanish steps in Rome, in 1948

Buffett talks about using initial yield when investing in farm land. This same story repeats for this investor who bought real estate on Via dei Condotti, near the Spanish steps in Rome, in 1948

Known: beautiful buildings, 15% starting yield, Rome

Unknown: when would Italy get out of post war recession, will rents go down?

Investor bought 7 buildings on Via dei Condotti in 1948, and was rich when he sold in 1960

(h/t @ThePIBnyc -

https://www.privateinvestmentbrief.com/blog/alpha-in-real-estate/">https://www.privateinvestmentbrief.com/blog/alph... )

Unknown: when would Italy get out of post war recession, will rents go down?

Investor bought 7 buildings on Via dei Condotti in 1948, and was rich when he sold in 1960

(h/t @ThePIBnyc -

https://www.privateinvestmentbrief.com/blog/alpha-in-real-estate/">https://www.privateinvestmentbrief.com/blog/alph... )

Buffett& #39;s AMEX investment from Zeckhauser unknown framework:

Known: initial yield of 8%, growing revenue, strong balance sheet with $83M equity, deposits that won& #39;t go away overnight

Unknown: salad oil scandal liability

Buffet bet that salad oil liability won& #39;t wipe out equity

Known: initial yield of 8%, growing revenue, strong balance sheet with $83M equity, deposits that won& #39;t go away overnight

Unknown: salad oil scandal liability

Buffet bet that salad oil liability won& #39;t wipe out equity

Notice how Buffett uses the term "games" (as if it was bridge) in this piece:

He says go to the games where:

1. There are few people

2. The ones who are playing have their head screwed up https://twitter.com/vetleforsland/status/1245325127832739841?s=20">https://twitter.com/vetlefors...

He says go to the games where:

1. There are few people

2. The ones who are playing have their head screwed up https://twitter.com/vetleforsland/status/1245325127832739841?s=20">https://twitter.com/vetlefors...

RTC example:

Knowns: initial yields, motivated seller, high vacancy, low rents, lease terms

Unknown: timing and extent of cash flow increase https://twitter.com/vetleforsland/status/1245325130940796928?s=20">https://twitter.com/vetlefors...

Knowns: initial yields, motivated seller, high vacancy, low rents, lease terms

Unknown: timing and extent of cash flow increase https://twitter.com/vetleforsland/status/1245325130940796928?s=20">https://twitter.com/vetlefors...

If you look at RTC example and compare to $SRG example - you can see Buffett uses the same logic. But the results for $SRG so far have been poor. Of course, we cannot be "resulting". And $SRG might well work out in the future (I don& #39;t know because I haven& #39;t followed it closely)

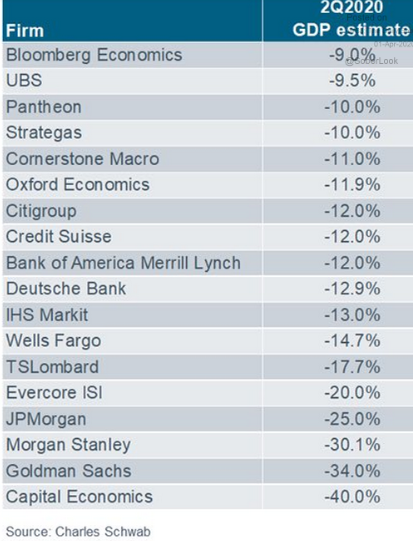

A good addition to the "No one knows" thread:

Economists have no skin in the game and they don& #39;t know. Look at the range of predictions for Q2 GDP.

Do your own (deep) research on each stock.

Economists have no skin in the game and they don& #39;t know. Look at the range of predictions for Q2 GDP.

Do your own (deep) research on each stock.

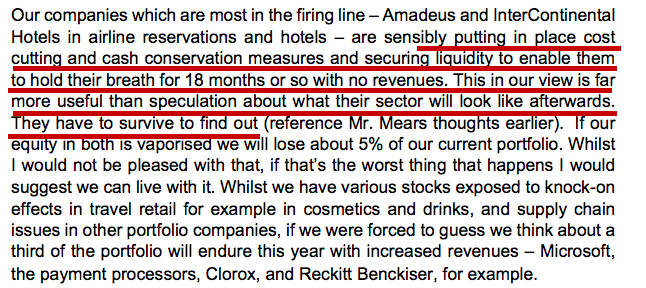

Fundsmith has some great thoughts on "unknown and unknowable" in latest letter.

It& #39;s important for companies to have financial strength to survive next 18 months to find out what unknowns lie beyond.

https://www.fundsmith.co.uk/docs/default-source/analysis---annual-letters/2020-3-fef-letter-to-shareholders.pdf?sfvrsn=2">https://www.fundsmith.co.uk/docs/defa...

It& #39;s important for companies to have financial strength to survive next 18 months to find out what unknowns lie beyond.

https://www.fundsmith.co.uk/docs/default-source/analysis---annual-letters/2020-3-fef-letter-to-shareholders.pdf?sfvrsn=2">https://www.fundsmith.co.uk/docs/defa...

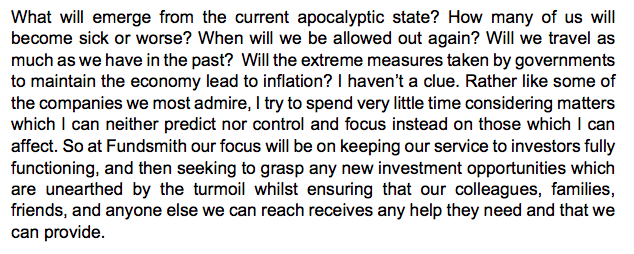

Fundsmith also acknowledge that they don& #39;t know a lot of things about COVID-19, so they focus on what they do know and look for dislocations

Another example of “No one knows” as we are in fog of epidemic. Yet, we see Wall Street reacting on every piece of positive news.

What we know: no solution other than social distancing (with varying levels of lockdown) until we get a vaccine https://twitter.com/john_hempton/status/1247532365267648512">https://twitter.com/john_hemp...

What we know: no solution other than social distancing (with varying levels of lockdown) until we get a vaccine https://twitter.com/john_hempton/status/1247532365267648512">https://twitter.com/john_hemp...

George Soros talking about his British pound bet

"chance of 15% upside, chance of 2-3% loss".

The way he talks, it& #39;s clear that that actual outcome was unknown to him, but the odds looked great.

h/t @vetleforsland https://www.youtube.com/watch?v=A0WvKEbq8v0">https://www.youtube.com/watch...

"chance of 15% upside, chance of 2-3% loss".

The way he talks, it& #39;s clear that that actual outcome was unknown to him, but the odds looked great.

h/t @vetleforsland https://www.youtube.com/watch?v=A0WvKEbq8v0">https://www.youtube.com/watch...

Add this to the pile of "unknown and unknowable" for COVID-19. I had not considered the "state" that no vaccine might come up and sure can& #39;t put any probability on it.

Listen to this "expert" (who many not know either): https://www.facebook.com/7NEWSsydney/videos/do-we-need-a-covid-19-plan-b/2456096014700876/">https://www.facebook.com/7NEWSsydn...

Listen to this "expert" (who many not know either): https://www.facebook.com/7NEWSsydney/videos/do-we-need-a-covid-19-plan-b/2456096014700876/">https://www.facebook.com/7NEWSsydn...

Even a vaccine timeline is "unknown and unknowable". So, like Fundsmith, we could check if all our investments survive for 18 months, and the vaccine *could* take 24 months to get here (or 7 months, who knows?). I feel that most stock prices aren& #39;t compensating enough for this!

Zeckhauser: "What did Buffett do when subprime crisis hit? He saw opportunity"

"Basically he is a great insurer. He wrote insurance where market has dried up"

"Went into municipal bond insurance coz leaders [Ambac, MBIA] pulled out for different reasons"

Buffet& #39;s quote below

"Basically he is a great insurer. He wrote insurance where market has dried up"

"Went into municipal bond insurance coz leaders [Ambac, MBIA] pulled out for different reasons"

Buffet& #39;s quote below

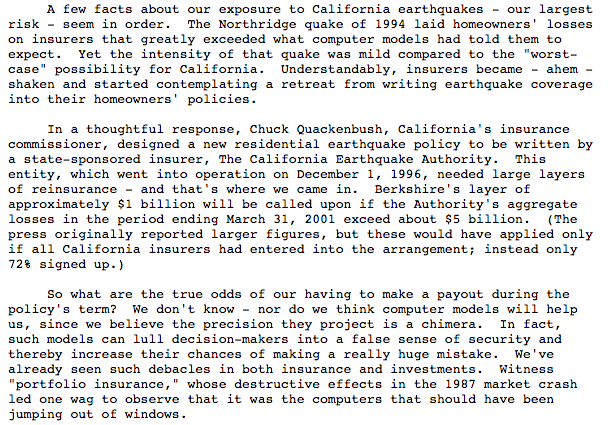

Cal Earthquake Authority reinsurance: if losses > $5B, the loss on insurance was $1B

Could find no buyers

Zeckhauser: "No one knows more than you when it comes to earthquake insurance"

"Seisomologists put probability of that range at 2%. Premium offered = 10%. Bufett took it"

Could find no buyers

Zeckhauser: "No one knows more than you when it comes to earthquake insurance"

"Seisomologists put probability of that range at 2%. Premium offered = 10%. Bufett took it"

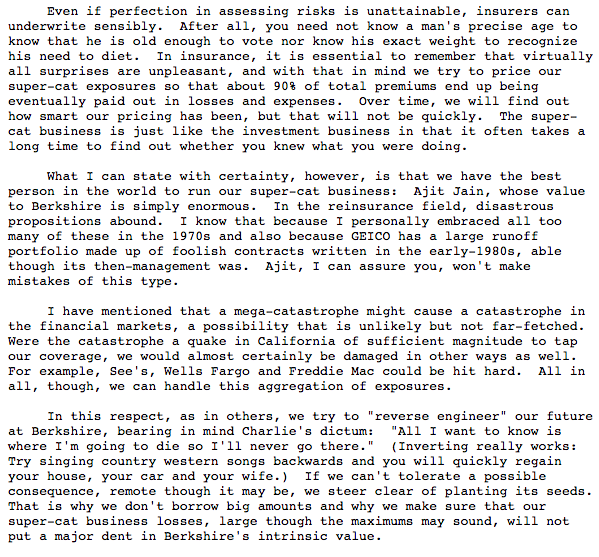

Here& #39;s Buffett himself talking in 1996 Annual letter about his unknown and unknowable reinsurance on Cal Earthquakes.

Buffett says "odds of making payments... we don& #39;t know"

"Computer models...a chimera... can lull decision-makers into making huge mistakes"

Buffett says "odds of making payments... we don& #39;t know"

"Computer models...a chimera... can lull decision-makers into making huge mistakes"

Buffett as an insurer, who deals with unknown and unknowable, explains fully why he doesn& #39;t do DCF.

For both muni bond insurance and Cal Earthquake insurance, he entered the market when others had exited. And he got good pricing for the uncertainty

For both muni bond insurance and Cal Earthquake insurance, he entered the market when others had exited. And he got good pricing for the uncertainty

Zeckhauser lecture (link below) from 2008 is worth listening for unknown and unknowable.

Key theme: world is more uncertain than you think. Unknown and unknowable situations with good odds and investing along side an expert can make all the difference https://www.youtube.com/watch?v=_7D11N6O22k">https://www.youtube.com/watch...

Key theme: world is more uncertain than you think. Unknown and unknowable situations with good odds and investing along side an expert can make all the difference https://www.youtube.com/watch?v=_7D11N6O22k">https://www.youtube.com/watch...

Barry Diller is another master of betting in unknown and unknowable. He says "we are in the middle of it" (fog of epidemic)

He points out that it& #39;s unknown as how behaviors change due to fear and when will fear go down so that business demand comes back https://www.youtube.com/watch?v=WLK-bUjLWl8">https://www.youtube.com/watch...

He points out that it& #39;s unknown as how behaviors change due to fear and when will fear go down so that business demand comes back https://www.youtube.com/watch?v=WLK-bUjLWl8">https://www.youtube.com/watch...

This example is much closer to Buffett& #39;s earthquake insurance example than one would think. Competition didn& #39;t invest because of the unknowns.

Known: near term earnings low, junk debt financing hard to get

Unknown: timing of recovery https://twitter.com/MarAzul_90/status/1254108346686361602?s=20">https://twitter.com/MarAzul_9...

Known: near term earnings low, junk debt financing hard to get

Unknown: timing of recovery https://twitter.com/MarAzul_90/status/1254108346686361602?s=20">https://twitter.com/MarAzul_9...

Read on Twitter

Read on Twitter

![Zeckhauser: "What did Buffett do when subprime crisis hit? He saw opportunity""Basically he is a great insurer. He wrote insurance where market has dried up""Went into municipal bond insurance coz leaders [Ambac, MBIA] pulled out for different reasons"Buffet& #39;s quote below Zeckhauser: "What did Buffett do when subprime crisis hit? He saw opportunity""Basically he is a great insurer. He wrote insurance where market has dried up""Went into municipal bond insurance coz leaders [Ambac, MBIA] pulled out for different reasons"Buffet& #39;s quote below](https://pbs.twimg.com/media/EVcLxcAVAAAfYgZ.png)