NEW - As rescue packages rack up, tax base shrinks - deficit will spiral, poss over 10% at same time bond markets, banks, pension cos and insurers shift from Govt bonds into cash - so where is the cash going to come from?

Is it only the BoE?

BLOG: https://www.bbc.co.uk/news/business-52044374">https://www.bbc.co.uk/news/busi...

Is it only the BoE?

BLOG: https://www.bbc.co.uk/news/business-52044374">https://www.bbc.co.uk/news/busi...

Ex top Treasury official @rjdhughes floated idea in this v interesting report of central bank - (ie Bank of England) temporarily funding Government by buying bonds directly, using massive increase in Government overdraft at BoE - “ways & means account” https://twitter.com/resfoundation/status/1242753090199011329?s=21">https://twitter.com/resfounda...

This would be a really quite significant move, the BoE Governor reiterating only last week: “we& #39;re not abandoning the very clear, Central Bank philosophy in terms of monetary financing because you know history tells us where that leads”.

But there are shades of grey here.. for starters last week in its QE market notice the Bank of England said: “The MPC will keep under review the case for participating in the primary market” - ie taking part directly in the Debt Management Office auctions of Government bonds...

This could be justified on separate grounds of market functioning/ liquidity of key markets, in this case, for gilts/ Government bonds. There have been signs of a lack of demand at recent auctions...

As @rjdhughes said in his report, the traditional fears about money printing could be overcome with a credible commitment that this is a temporary measure which will be reversed - this comes from someone who ran HMT relationship with DMO and worked at IMF on cash crunch nations

Also, this is not a UK specific issue - clearly challenges in eurozone over mutualisation of debt, ECB QE. Developing countries in specific difficulty. This is not your traditional fiscal excess funded by printing presses - it’s a unique economy-stopping global pandemic...

Here @NIESRorg also expressing similar:

“more formal monetary support of the fiscal response will be required..prudent course of action is yield curve control, where Bank can create fiscal space for Chancellor although if tested this regime may mutate into monetary financing”

“more formal monetary support of the fiscal response will be required..prudent course of action is yield curve control, where Bank can create fiscal space for Chancellor although if tested this regime may mutate into monetary financing”

And, in English, the European Central Bank, analogous issue, appears to have determined that it can disproportionately target its QE where needed in pandemic - eg Italy and Spain - https://twitter.com/grundsebastian/status/1242946293401518081?s=21">https://twitter.com/grundseba... https://twitter.com/GrundSebastian/status/1242946293401518081">https://twitter.com/GrundSeba...

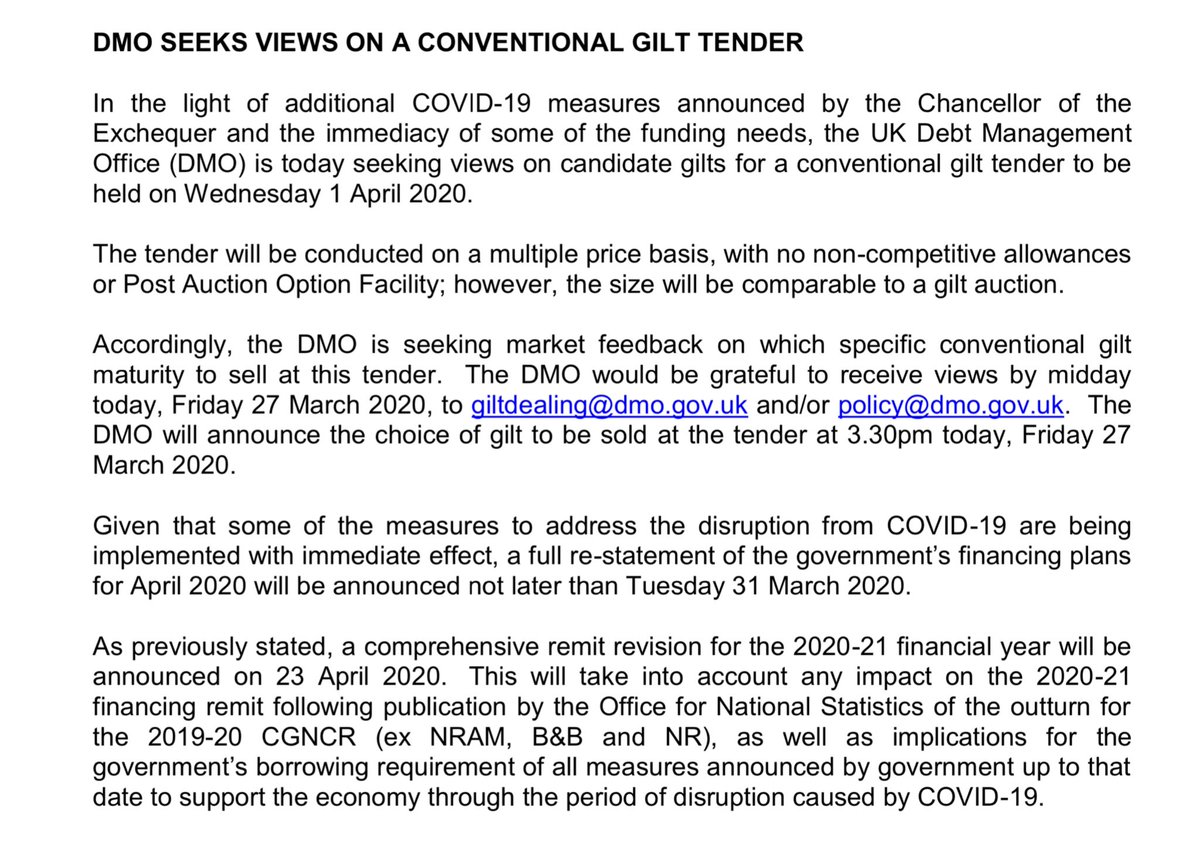

technical announcement contained something I haven’t seen before - announcement not just of an unscheduled auction of UK Government debt, to raise cash for COVID measures, but also DMO (which sells debt for Treasury) asked markets what they wanted to buy (ie for how many years)..

NEW:

Former Deputy Governor [for monetary policy] of the Bank of England Sir Charles Bean, says it would be “entirely appropriate for the Bank of England to help out by buying some [UK Govt bonds] – directly from the government in the primary market”... https://blogs.lse.ac.uk/businessreview/2020/03/30/the-economics-of-coronavirus/">https://blogs.lse.ac.uk/businessr...

Former Deputy Governor [for monetary policy] of the Bank of England Sir Charles Bean, says it would be “entirely appropriate for the Bank of England to help out by buying some [UK Govt bonds] – directly from the government in the primary market”... https://blogs.lse.ac.uk/businessreview/2020/03/30/the-economics-of-coronavirus/">https://blogs.lse.ac.uk/businessr...

Bean says worried about Weimar / Zimbabwe/ even hyperinflation were about “fundamental underlying political and structural problems” and as long as this monetary financing was explicitly understood as a “temporary expedient” to be unwound, no reason to worry “unduly” re inflation

significant backing from top former official of the Bank of England, Sir Charles, who served on the Monetary Policy Committee for 14 years of its 23 year existence, under 3 different Governors, and as a member of the OBR, knows whats coming fiscally. Piece talks of £200bn deficit

***NEW

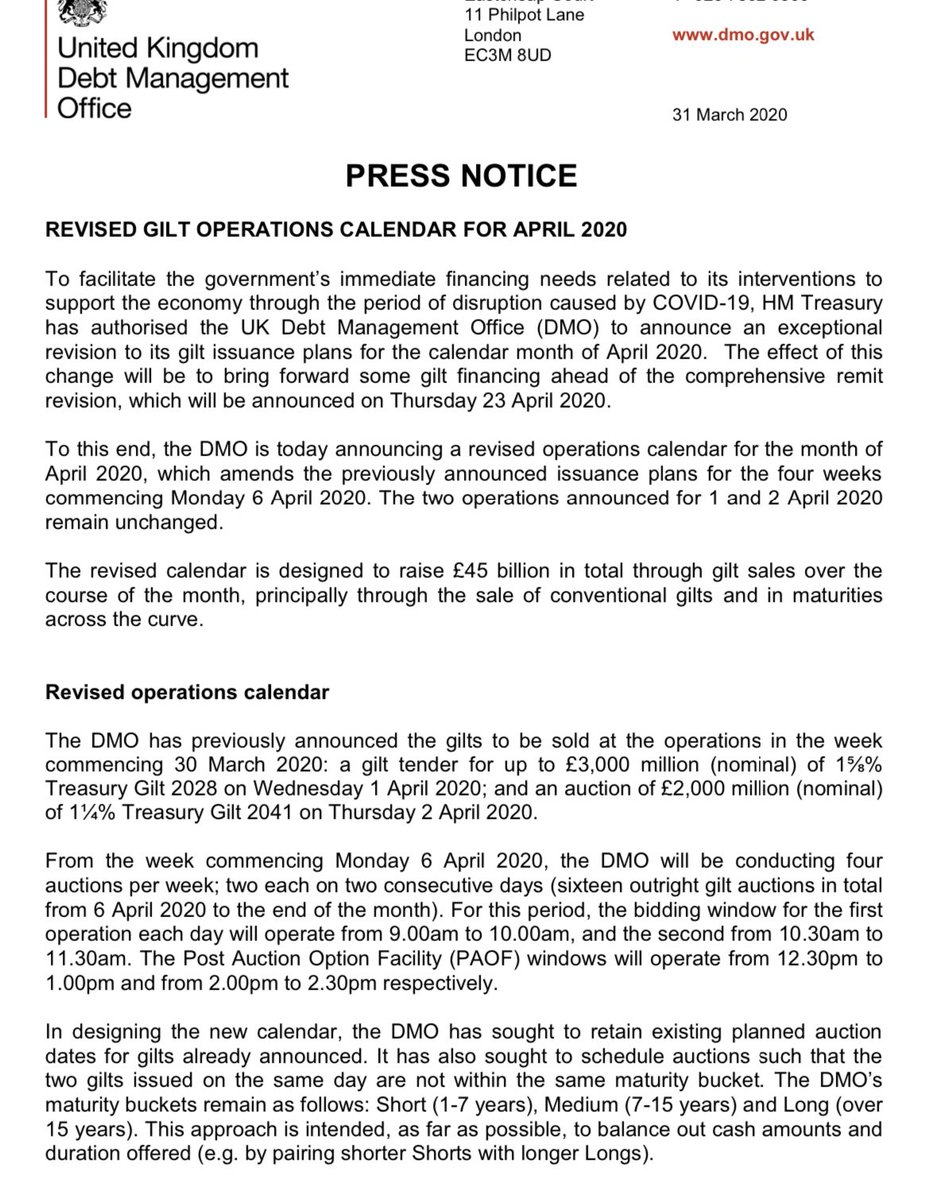

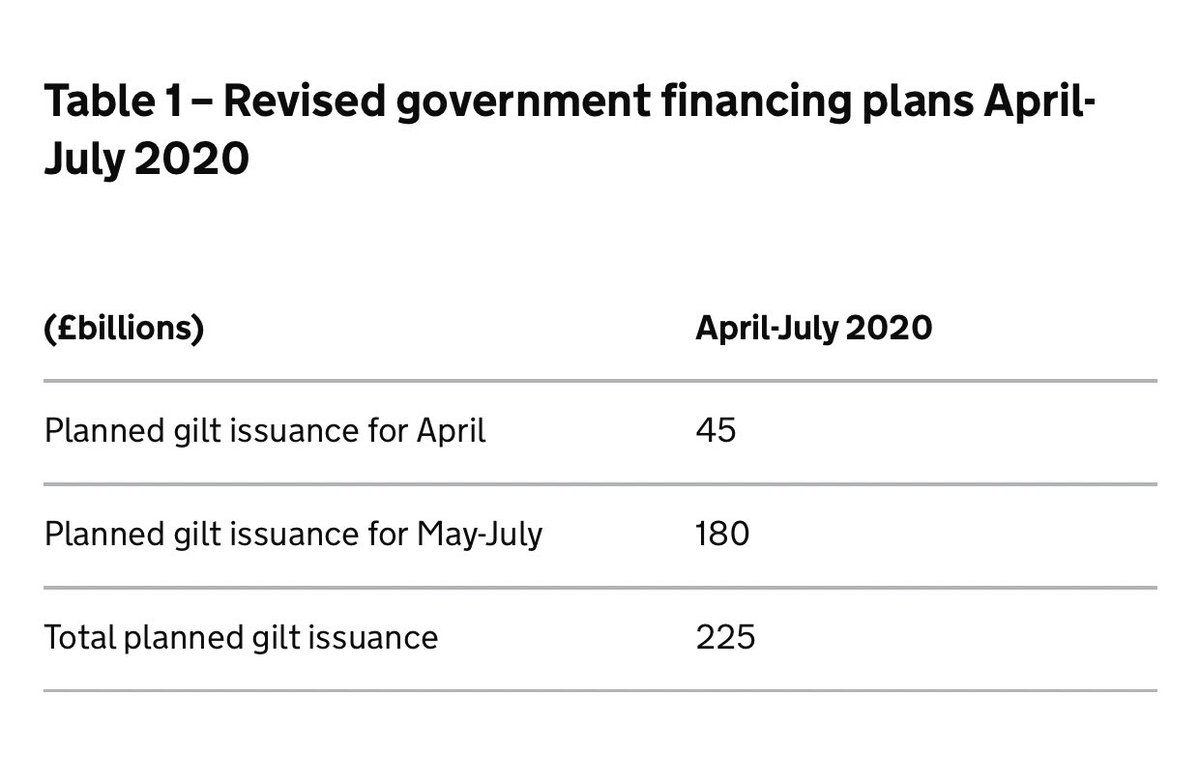

DMO announces v significant increase in “exceptional revision” to gilt issuance - seeking to raise £45 billion in April alone in four auctions a week, because of Covid rescue funding.

For ref at time of the Budget 3 weeks ago, total 20/21 issuance anticipated at £156bn

DMO announces v significant increase in “exceptional revision” to gilt issuance - seeking to raise £45 billion in April alone in four auctions a week, because of Covid rescue funding.

For ref at time of the Budget 3 weeks ago, total 20/21 issuance anticipated at £156bn

Ie Treasury is raising the Covid rescue cash up front - in time, for example, for the April pay out of the Job Retention Scheme - by the tens of billion...

£45billion the government has just announced it is going to raise in the coming month is by some distance record nominal gilt issuance (ie demand for lending to Government) according to this spreadsheet from DMO

https://www.dmo.gov.uk/media/16278/website-monthly-gross-and-net-issuance-d4f-2019-20-end-dec-19-and-jan-2020.xls">https://www.dmo.gov.uk/media/162...

https://www.dmo.gov.uk/media/16278/website-monthly-gross-and-net-issuance-d4f-2019-20-end-dec-19-and-jan-2020.xls">https://www.dmo.gov.uk/media/162...

It’s about £30bn more in April than planned at Budget earlier this month...

My reading of Governor intervention on “monetary financing” is it seeks to define it as something it won’t do (Lord Turner idea) but far from rules out what Charlie Bean suggested last week - temp expansion of Bank balance sheet, directly buying gilts https://www.ft.com/content/3a33c7fe-75a6-11ea-95fe-fcd274e920ca">https://www.ft.com/content/3...

This seems while ruling out Adair Turner’s helicopter money expressly funded by BoE printing money as “monetary financing”, to pave way for direct buying gilts, in order to keep functioning of gilt market, as an attempt to hit 2% inflation target, as long as it is temporary...

The functional difference between the former and the latter (by the way Charlie Bean referred even to his idea as “such monetary financing”) is one of motive, and the Bank being in charge of process. The action now is same, tho promise to resell gilts in future is different...

Read on Twitter

Read on Twitter